January 2024

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Contract The Business Talk Pilot Barometer<br />

NOTHING LEFT TO CHANCE<br />

Neil Cooper-Smith, Senior Analyst at Business Pilot, reflects on the ‘tough year for trading’<br />

that was 2023, but suggests that <strong>2024</strong>’s likely General Election may provide a boost...<br />

Last year was, most would agree, a tough<br />

year for trading, especially as we emerged<br />

from a significant boom following Covid, and<br />

straight into inflationary pressures brought about<br />

predominantly by global forces outside of our control.<br />

It will be four years ago in March when much<br />

of the world closed down to limit the spread of<br />

the coronavirus, so I think we can discount any<br />

residual ripple effect from that period on our<br />

market going forward.<br />

But global forces still have a disruptive effect on<br />

our economy. The wars in the Middle East and<br />

Ukraine continue to feed through to high prices<br />

on our shores, and there appears to be no end in<br />

sight in either conflict.<br />

The latest development, which sees Yemen-based<br />

Houthi forces attack freighters in the Red Sea<br />

with a link to Israel, has already driven up the<br />

price of crude oil after Iran rejected calls to end<br />

support for the attacks.<br />

This is on top of an expected increase in the price<br />

of goods after some cargo ships were diverted<br />

round the tip of Africa, rather than pass through<br />

the Suez Canal and face the extra dangers.<br />

These are unwelcome additional pressures on<br />

household finances, especially after the energy<br />

price cap increased by 5% to take into account<br />

a rise in global gas market prices at the start of<br />

the year.<br />

At home, house prices remain sluggish – as they<br />

did throughout 2023 – with Nationwide reporting<br />

that they are about 1.8% lower than they were at<br />

the start of 2023.<br />

This could have a positive impact on the window,<br />

door and glass industry, as homeowners unwilling<br />

to put their homes on the market choose to<br />

upgrade their existing properties instead. The fly<br />

in the ointment is that the number of first-time<br />

buyers dropped to its lowest level in a decade,<br />

according to the Yorkshire Building Society.<br />

This is potentially storing up problems for the<br />

future as that with less new money entering the<br />

property market, there is less money available for<br />

refurbishment projects.<br />

The shot in the arm in <strong>2024</strong> will probably come<br />

from the likely General Election. March 6 has been<br />

set for the last Budget before the country goes to<br />

the polls, and many experts believe that tax cuts<br />

will be announced in a bid to win over voters.<br />

How this will translate into better personal<br />

finances over the coming year is very difficult<br />

to predict, but if it does mean consumers ‘feel’<br />

richer, then it could have a significant impact on<br />

the sales of windows and doors.<br />

If homeowners feel confident enough to take out<br />

loans for home improvement, then we should see<br />

some of that activity return to the market this year.<br />

The Business Pilot Barometer offers a monthly analysis of the key trends defining window and door retail,<br />

drawing on real industry data collated by the Business Pilot customer relationship management system.<br />

Business Pilot uses cloud-based technologies to give installers complete visibility of every element of their<br />

operation from leads and conversions to job scheduling, cost of installation, service calls, and financial reporting.<br />

www.businesspilot.co.uk<br />

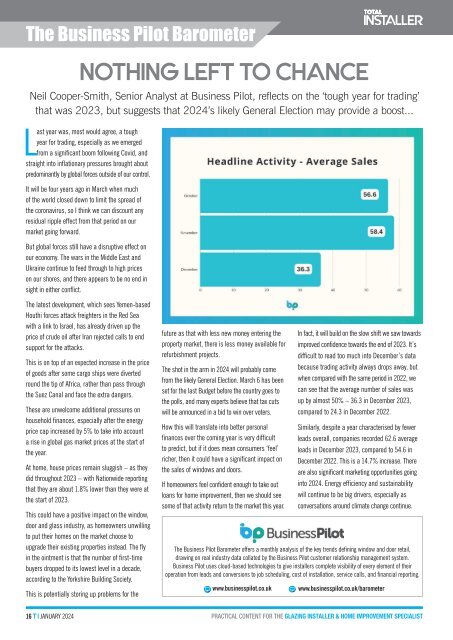

In fact, it will build on the slow shift we saw towards<br />

improved confidence towards the end of 2023. It’s<br />

difficult to read too much into December’s data<br />

because trading activity always drops away, but<br />

when compared with the same period in 2022, we<br />

can see that the average number of sales was<br />

up by almost 50% – 36.3 in December 2023,<br />

compared to 24.3 in December 2022.<br />

Similarly, despite a year characterised by fewer<br />

leads overall, companies recorded 62.6 average<br />

leads in December 2023, compared to 54.6 in<br />

December 2022. This is a 14.7% increase. There<br />

are also significant marketing opportunities going<br />

into <strong>2024</strong>. Energy efficiency and sustainability<br />

will continue to be big drivers, especially as<br />

conversations around climate change continue.<br />

www.businesspilot.co.uk/barometer<br />

16 T I JANUARY <strong>2024</strong> PRACTICAL CONTENT FOR THE GLAZING INSTALLER & HOME IMPROVEMENT SPECIALIST