CONVINUS Global Mobility Alert - Week 9.2023

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

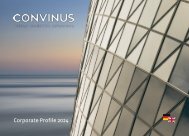

BEST PRACTICE<br />

Are there any formalities or legal requirements to be taken into account?<br />

Advice AG must consider the following issues when sending its employees to Switzerland:<br />

1.Taxes:<br />

Do employees still have to pay their income tax in Germany or can they benefit from the lower<br />

Swiss taxes?<br />

What is the case for employees from non-EU branches in the UK and the USA, for example?<br />

If the salary is taxable in Switzerland, does Advice AG, as a foreign employer, have to pay taxes<br />

for the employees in Switzerland?<br />

2. Tax Equalization:<br />

If the employees become taxable in Switzerland, can they benefit directly from this? The Tax<br />

Equalisation Guideline of Advice AG should be consulted to determine which type of tax<br />

equalization applies.<br />

3. Payroll:<br />

Does Advice AG have to keep payroll accounting in Switzerland?<br />

CONCLUSION<br />

The various issues must be viewed as a whole because depending on changes to individual aspects,<br />

this can also have an impact on other subject areas.<br />

You can find all the answers to the above questions in our March monthly special.<br />

8<br />

convinus.com