2005 Annual Report - Banque PSA Finance

2005 Annual Report - Banque PSA Finance

2005 Annual Report - Banque PSA Finance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

30 <strong>Banque</strong> <strong>PSA</strong> <strong>Finance</strong> - <strong>2005</strong> annual report<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

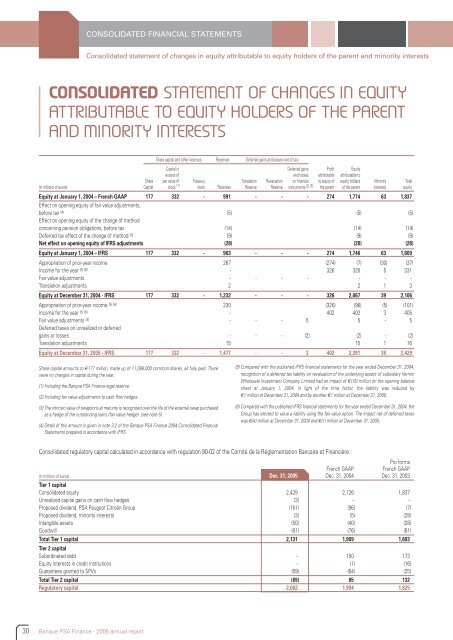

Consolidated statement of changes in equity attributable to equity holders of the parent and minority interests<br />

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY<br />

ATTRIBUTABLE TO EQUITY HOLDERS OF THE PARENT<br />

AND MINORITY INTERESTS<br />

Share capital and other reserves Reserves Deferred gains and losses (net of tax)<br />

Capital in Deferred gains Profit Equity<br />

excess of and losses attributable attributable to<br />

Share par value of Treasury Translation Revaluation on financial to equity of equity holders Minority Total<br />

(in millions of euros) Capital stock (1)<br />

stock Reserves Reserve Reserve instruments (2) (3) the parent of the parent interests equity<br />

Equity at January 1, 2004 – French GAAP<br />

Effect on opening equity of fair value adjustments,<br />

177 332 - 991 - - - 274 1,774 63 1,837<br />

before tax (4) Effect on opening equity of the change of method<br />

(5) (5) (5)<br />

concerning pension obligations, before tax (14) (14) (14)<br />

Deferred tax effect of the change of method (5) (9) (9) (9)<br />

Net effect on opening equity of IFRS adjustments (28) (28) (28)<br />

Equity at January 1, 2004 – IFRS 177 332 - 963 - - - 274 1,746 63 1,809<br />

Appropriation of prior-year income 267 (274) (7) (30) (37)<br />

Income for the year (5) (6) - 326 326 5 331<br />

Fair value adjustments - - - - - - -<br />

Translation adjustments 2 2 1 3<br />

Equity at December 31, 2004 - IFRS 177 332 - 1,232 - - - 326 2,067 39 2,106<br />

Appropriation of prior-year income (5) (6) 230 (326) (96) (5) (101)<br />

Income for the year (5) (6) - 402 402 3 405<br />

Fair value adjustments (3) Deferred taxes on unrealized or deferred<br />

- - - 5 5 - 5<br />

gains or losses - - - (2) (2) - (2)<br />

Translation adjustments 15 15 1 16<br />

Equity at December 31, <strong>2005</strong> - IFRS 177 332 - 1,477 - - 3 402 2,391 38 2,429<br />

Share capital amounts to €177 million, made up of 11,088,000 common shares, all fully paid. There<br />

were no changes in capital during the year.<br />

(1) Including the <strong>Banque</strong> <strong>PSA</strong> <strong>Finance</strong> legal reserve.<br />

(2) Including fair value adjustments to cash flow hedges.<br />

(3) The intrinsic value of swaptions at maturity is recognized over the life of the external swap purchased<br />

as a hedge of the outstanding loans (fair value hedge) (see note 5).<br />

(4) Detail of this amount is given in note 3.2 of the <strong>Banque</strong> <strong>PSA</strong> <strong>Finance</strong> 2004 Consolidated Financial<br />

Statements prepared in accordance with IFRS.<br />

(5) Compared with the published IFRS financial statements for the year ended December 31, 2004,<br />

recognition of a deferred tax liability on revaluation of the underlying assets of subsidiary Vernon<br />

Wholesale Investment Company Limited had an impact of €(15) million on the opening balance<br />

sheet at January 1, 2004. In light of the time factor, the liability was reduced by<br />

€1 million at December 31, 2004 and by another €1 million at December 31, <strong>2005</strong>.<br />

(6) Compared with the published IFRS financial statements for the year ended December 31, 2004, the<br />

Group has elected to value a liability using the fair value option. The impact net of deferred taxes<br />

was €(4) million at December 31, 2004 and €(1) million at December 31, <strong>2005</strong>.<br />

Consolidated regulatory capital calculated in accordance with regulation 90-02 of the Comité de la Réglementation Bancaire et Financière :<br />

French GAAP<br />

Pro forma<br />

French GAAP<br />

(in millions of euros)<br />

Tier 1 capital<br />

Dec. 31, <strong>2005</strong> Dec. 31, 2004 Dec. 31, 2003<br />

Consolidated equity 2,429 2,126 1,837<br />

Unrealized capital gains on cash flow hedges (3) - -<br />

Proposed dividend, <strong>PSA</strong> Peugeot Citroën Group (161) (96) (7)<br />

Proposed dividend, minority interests (3) (5) (28)<br />

Intangible assets (50) (40) (28)<br />

Goodwill (81) (76) (81)<br />

Total Tier 1 capital 2,131 1,909 1,693<br />

Tier 2 capital<br />

Subordinated debt - 150 173<br />

Equity interests in credit institutions - (1) (16)<br />

Guarantees granted to SPVs (69) (64) (25)<br />

Total Tier 2 capital (69) 85 132<br />

Regulatory capital 2,062 1,994 1,825