2005 Annual Report - Banque PSA Finance

2005 Annual Report - Banque PSA Finance

2005 Annual Report - Banque PSA Finance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

(3) The <strong>Banque</strong> <strong>PSA</strong> <strong>Finance</strong> group implemented three securitization programs through the Auto ABS special purpose entity, created in June<br />

2001.<br />

- On June 28, 2001, two Crédipar subsidiaries, Din and Sofi, merged with Crédipar since January 2002, sold €1 billion worth of automobile loans<br />

to the 2001-1 fund of the Auto ABS securitization vehicle. The Auto ABS 2001-1 fund issued €950 million worth of AAA/Aaa rated preferred<br />

asset-backed securities and €50 million worth of A/A2 rated subordinated asset-backed securities. Crédipar's retained interest amounts to<br />

€10,000.<br />

- On July 11, 2002, Crédipar sold €550 million worth of automobile loans and the Spanish branch of <strong>Banque</strong> <strong>PSA</strong> <strong>Finance</strong> sold<br />

€950 million worth of automobile loans to the Auto ABS 2002-1 fund. The Auto ABS 2002-1 fund issued €1,440 million worth of AAA/Aaa<br />

rated preferred asset-backed securities and €60 million worth of A/A2 rated subordinated asset-backed securities. <strong>Banque</strong> <strong>PSA</strong> <strong>Finance</strong><br />

group's retained interest amounts to €30,000.<br />

- On February 25, 2004, the German <strong>Banque</strong> <strong>PSA</strong> <strong>Finance</strong> subsidiary <strong>PSA</strong> <strong>Finance</strong> Deutschland GmbH sold €1 billion worth of automobile<br />

loans to the Auto ABS 2004-1 fund. The Auto ABS 2004-1 fund issued €970 million worth of AAA/Aaa rated preferred asset-backed securities<br />

and €30 million worth of A/A2 rated subordinated asset-backed securities. <strong>PSA</strong> <strong>Finance</strong> Deutschland GmbH's retained interest amounts to<br />

€10,000.<br />

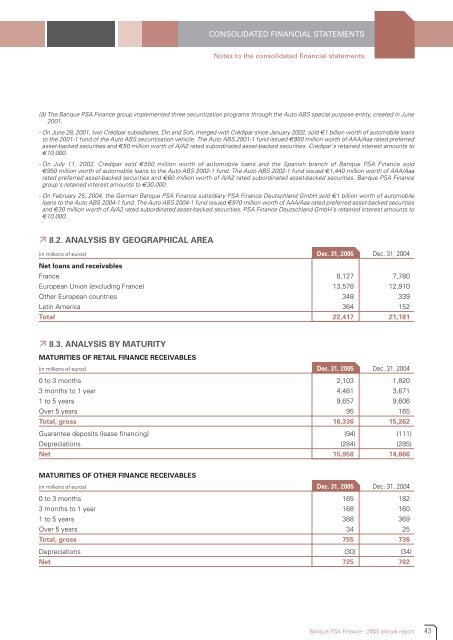

� 8.2. ANALYSIS BY GEOGRAPHICAL AREA<br />

(in millions of euros) 31/12/<strong>2005</strong> Dec. 31, <strong>2005</strong> Dec. 31, 2004<br />

Net loans and receivables<br />

France 8,127 7,780<br />

European Union (excluding France) 13,578 12,910<br />

Other European countries 348 339<br />

Latin America 364 152<br />

Total 22,417 21,181<br />

� 8.3. ANALYSIS BY MATURITY<br />

MATURITIES OF RETAIL FINANCE RECEIVABLES<br />

(in millions of euros) 31/12/<strong>2005</strong> Dec. 31, <strong>2005</strong> Dec. 31, 2004<br />

0 to 3 months 2,103 1,820<br />

3 months to 1 year 4,481 3,671<br />

1 to 5 years 9,657 9,606<br />

Over 5 years 95 165<br />

Total, gross 16,336 15,262<br />

Guarantee deposits (lease financing) (94) (111)<br />

Depreciations (284) (285)<br />

Net 15,958 14,866<br />

MATURITIES OF OTHER FINANCE RECEIVABLES<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

Notes to the consolidated financial statements<br />

(in millions of euros) 31/12/<strong>2005</strong> Dec. 31, <strong>2005</strong> Dec. 31, 2004<br />

0 to 3 months 165 182<br />

3 months to 1 year 168 160<br />

1 to 5 years 388 369<br />

Over 5 years 34 25<br />

Total, gross 755 736<br />

Depreciations (30) (34)<br />

Net 725 702<br />

<strong>Banque</strong> <strong>PSA</strong> <strong>Finance</strong> - <strong>2005</strong> annual report<br />

43