2005 Annual Report - Banque PSA Finance

2005 Annual Report - Banque PSA Finance

2005 Annual Report - Banque PSA Finance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

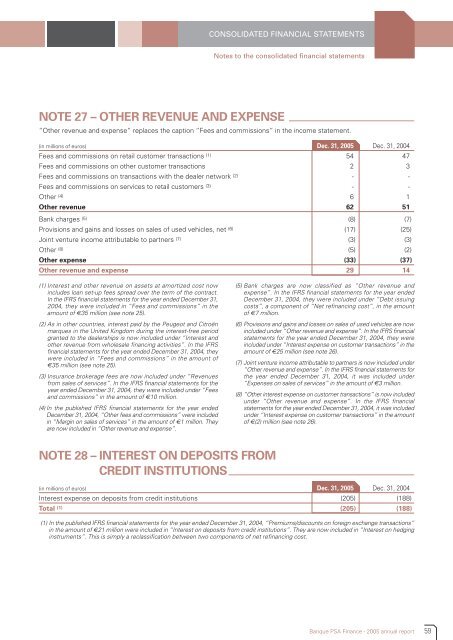

NOTE 27 – OTHER REVENUE AND EXPENSE<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

Notes to the consolidated financial statements<br />

“Other revenue and expense” replaces the caption “Fees and commissions” in the income statement.<br />

(in millions of euros)31/12/<strong>2005</strong> Dec. 31, <strong>2005</strong> Dec. 31, 2004<br />

Fees and commissions on retail customer transactions (1) 54 47<br />

Fees and commissions on other customer transactions 2 3<br />

Fees and commissions on transactions with the dealer network (2) - -<br />

Fees and commissions on services to retail customers (3) - -<br />

Other (4) 6 1<br />

Other revenue 62 51<br />

Bank charges (5) (8) (7)<br />

Provisions and gains and losses on sales of used vehicles, net (6) (17) (25)<br />

Joint venture income attributable to partners (7) (3) (3)<br />

Other (8) (5) (2)<br />

Other expense (33) (37)<br />

Other revenue and expense 29 14<br />

(1) Interest and other revenue on assets at amortized cost now<br />

includes loan set-up fees spread over the term of the contract.<br />

In the IFRS financial statements for the year ended December 31,<br />

2004, they were included in “Fees and commissions” in the<br />

amount of €35 million (see note 25).<br />

(2) As in other countries, interest paid by the Peugeot and Citroën<br />

marques in the United Kingdom during the interest-free period<br />

granted to the dealerships is now included under “Interest and<br />

other revenue from wholesale financing activities”. In the IFRS<br />

financial statements for the year ended December 31, 2004, they<br />

were included in “Fees and commissions” in the amount of<br />

€35 million (see note 25).<br />

(3) Insurance brokerage fees are now included under “Revenues<br />

from sales of services”. In the IFRS financial statements for the<br />

year ended December 31, 2004, they were included under “Fees<br />

and commissions” in the amount of €10 million.<br />

(4) In the published IFRS financial statements for the year ended<br />

December 31, 2004, “Other fees and commissions” were included<br />

in “Margin on sales of services” in the amount of €1 million. They<br />

are now included in “Other revenue and expense”.<br />

NOTE 28 – INTEREST ON DEPOSITS FROM<br />

CREDIT INSTITUTIONS<br />

(5) Bank charges are now classified as “Other revenue and<br />

expense”. In the IFRS financial statements for the year ended<br />

December 31, 2004, they were included under “Debt issuing<br />

costs”, a component of “Net refinancing cost”, in the amount<br />

of €7 million.<br />

(6) Provisions and gains and losses on sales of used vehicles are now<br />

included under “Other revenue and expense”. In the IFRS financial<br />

statements for the year ended December 31, 2004, they were<br />

included under “Interest expense on customer transactions” in the<br />

amount of €25 million (see note 26).<br />

(7) Joint venture income attributable to partners is now included under<br />

“Other revenue and expense”. In the IFRS financial statements for<br />

the year ended December 31, 2004, it was included under<br />

“Expenses on sales of services” in the amount of €3 million.<br />

(8) “Other interest expense on customer transactions” is now included<br />

under “Other revenue and expense”. In the IFRS financial<br />

statements for the year ended December 31, 2004, it was included<br />

under “Interest expense on customer transactions” in the amount<br />

of €(2) million (see note 26).<br />

(in millions of euros)31/12/<strong>2005</strong> Dec. 31, <strong>2005</strong> Dec. 31, 2004<br />

Interest expense on deposits from credit institutions (205) (188)<br />

Total (1) (205) (188)<br />

(1) In the published IFRS financial statements for the year ended December 31, 2004, “Premiums/discounts on foreign exchange transactions”<br />

in the amount of €21 million were included in “Interest on deposits from credit institutions”. They are now included in “Interest on hedging<br />

instruments”. This is simply a reclassification between two components of net refinancing cost.<br />

<strong>Banque</strong> <strong>PSA</strong> <strong>Finance</strong> - <strong>2005</strong> annual report<br />

59