2005 Annual Report - Banque PSA Finance

2005 Annual Report - Banque PSA Finance

2005 Annual Report - Banque PSA Finance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

46 <strong>Banque</strong> <strong>PSA</strong> <strong>Finance</strong> - <strong>2005</strong> annual report<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

Notes to the consolidated financial statements<br />

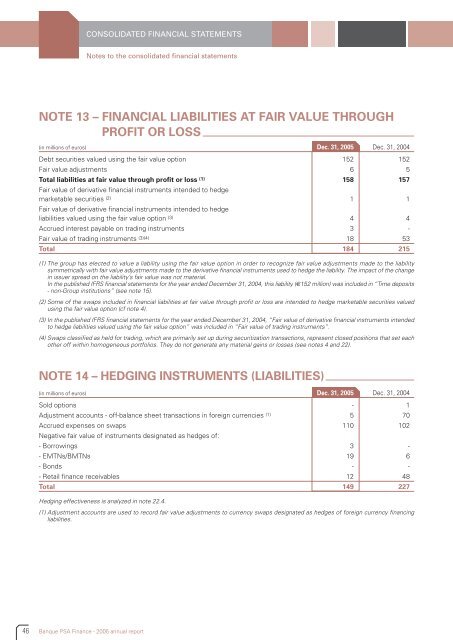

NOTE 13 – FINANCIAL LIABILITIES AT FAIR VALUE THROUGH<br />

PROFIT OR LOSS<br />

(in millions of euros) 31/12/<strong>2005</strong> Dec. 31, <strong>2005</strong> Dec. 31, 2004<br />

Debt securities valued using the fair value option 152 152<br />

Fair value adjustments 6 5<br />

Total liabilities at fair value through profit or loss (1) Fair value of derivative financial instruments intended to hedge<br />

158 157<br />

marketable securities (2) Fair value of derivative financial instruments intended to hedge<br />

1 1<br />

liabilities valued using the fair value option (3) 4 4<br />

Accrued interest payable on trading instruments 3 -<br />

Fair value of trading instruments (3)(4) 18 53<br />

Total 184 215<br />

(1) The group has elected to value a liability using the fair value option in order to recognize fair value adjustments made to the liability<br />

symmetrically with fair value adjustments made to the derivative financial instruments used to hedge the liability. The impact of the change<br />

in issuer spread on the liability’s fair value was not material.<br />

In the published IFRS financial statements for the year ended December 31, 2004, this liability (€152 million) was included in “Time deposits<br />

- non-Group institutions” (see note 15).<br />

(2) Some of the swaps included in financial liabilities at fair value through profit or loss are intended to hedge marketable securities valued<br />

using the fair value option (cf note 4).<br />

(3) In the published IFRS financial statements for the year ended December 31, 2004, “Fair value of derivative financial instruments intended<br />

to hedge liabilities valued using the fair value option” was included in “Fair value of trading instruments”.<br />

(4) Swaps classified as held for trading, which are primarily set up during securitization transactions, represent closed positions that set each<br />

other off within homogeneous portfolios. They do not generate any material gains or losses (see notes 4 and 22).<br />

NOTE 14 – HEDGING INSTRUMENTS (LIABILITIES)<br />

(in millions of euros) 31/12/<strong>2005</strong> Dec. 31, <strong>2005</strong> Dec. 31, 2004<br />

Sold options - 1<br />

Adjustment accounts - off-balance sheet transactions in foreign currencies (1) 5 70<br />

Accrued expenses on swaps<br />

Negative fair value of instruments designated as hedges of:<br />

110 102<br />

- Borrowings 3 -<br />

- EMTNs/BMTNs 19 6<br />

- Bonds - -<br />

- Retail finance receivables 12 48<br />

Total 149 227<br />

Hedging effectiveness is analyzed in note 22.4.<br />

(1) Adjustment accounts are used to record fair value adjustments to currency swaps designated as hedges of foreign currency financing<br />

liabilities.