2005 Annual Report - Banque PSA Finance

2005 Annual Report - Banque PSA Finance

2005 Annual Report - Banque PSA Finance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Changes in actuarial assumptions and experience adjustments<br />

– corresponding to the effects of differences between the<br />

previous actuarial assumptions and what has actually occurred –<br />

give rise to actuarial gains and losses. These gains and losses<br />

are recognized in the income statement by the corridor<br />

method, which consists of recognizing a specified portion of<br />

the net cumulative actuarial gains and losses that exceed the<br />

greater of 10% of the present value of the defined benefit<br />

obligation (before deducting plan assets) and 10% of the fair<br />

value of any plan assets.<br />

In accordance with IFRS 1 – First-time Adoption of<br />

International Financial <strong>Report</strong>ing Standards, all cumulative<br />

actuarial gains and losses at January 1, 2004 have been<br />

recognized in the balance sheet and the corresponding<br />

adjustment has been recorded in equity.<br />

The total projected benefit obligation, including the portion<br />

not recognized due to the deferral of actuarial gains and losses,<br />

is covered by external funds. Because of the deferral of<br />

actuarial gains and losses, in some cases the amount of these<br />

external funds exceeds the recognized projected benefit<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

Notes to the consolidated financial statements<br />

obligation, leading to the recognition of an asset in “Other<br />

non-current assets” in an amount not exceeding the sum of<br />

net actuarial losses and unrecognized past service costs.<br />

Other employee benefits covered by provisions concern, for<br />

the French subsidiaries:<br />

- long-service awards,<br />

- the remaining liability towards the “Caisse de Retraite du<br />

Personnel Bancaire”, pension fund for banking sector<br />

employees.<br />

� E. OTHER COMMITMENTS<br />

In accordance with IAS 39, irrevocable commitments given or<br />

received by Group companies are recognized in the balance<br />

sheet at their historical fair value (option premiums, cash<br />

balances on swaps, mostly at par). Provisions are taken for<br />

impairment of financing or guarantee commitments in<br />

accordance with IAS 37 – Provisions, Contingent Liabilities and<br />

Contigent Assets. Other commitments comprise derivative<br />

financial instruments (see C.1.).<br />

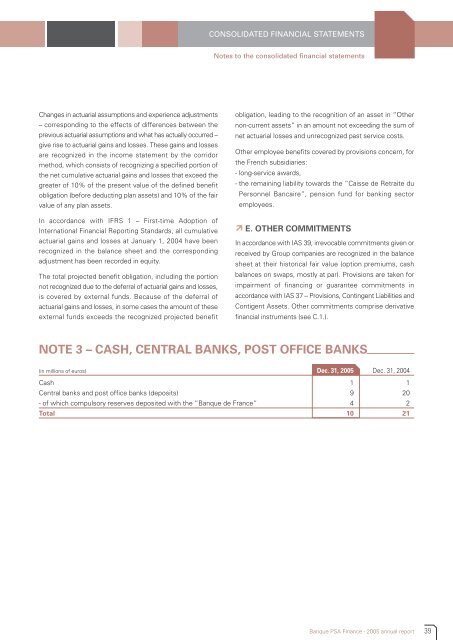

NOTE 3 – CASH, CENTRAL BANKS, POST OFFICE BANKS<br />

(in millions of euros) 31/12/<strong>2005</strong> Dec. 31, <strong>2005</strong> Dec. 31, 2004<br />

Cash 1 1<br />

Central banks and post office banks (deposits) 9 20<br />

- of which compulsory reserves deposited with the “<strong>Banque</strong> de France” 4 2<br />

Total 10 21<br />

<strong>Banque</strong> <strong>PSA</strong> <strong>Finance</strong> - <strong>2005</strong> annual report<br />

39