Download PDF (1.3MB) - J Sainsbury plc

Download PDF (1.3MB) - J Sainsbury plc

Download PDF (1.3MB) - J Sainsbury plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the accounts<br />

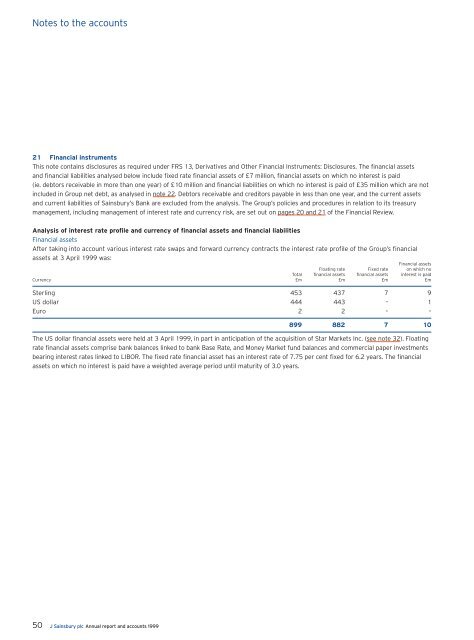

21 Financial instruments<br />

This note contains disclosures as required under FRS 13, Derivatives and Other Financial Instruments: Disclosures. The financial assets<br />

and financial liabilities analysed below include fixed rate financial assets of £7 million, financial assets on which no interest is paid<br />

(ie. debtors receivable in more than one year) of £10 million and financial liabilities on which no interest is paid of £35 million which are not<br />

included in Group net debt, as analysed in note 22. Debtors receivable and creditors payable in less than one year, and the current assets<br />

and current liabilities of <strong>Sainsbury</strong>’s Bank are excluded from the analysis. The Group’s policies and procedures in relation to its treasury<br />

management, including management of interest rate and currency risk, are set out on pages 20 and 21 of the Financial Review.<br />

Analysis of interest rate profile and currency of financial assets and financial liabilities<br />

Financial assets<br />

After taking into account various interest rate swaps and forward currency contracts the interest rate profile of the Group’s financial<br />

assets at 3 April 1999 was:<br />

Financial assets<br />

Floating rate Fixed rate on which no<br />

Total financial assets financial assets interest is paid<br />

Currency £m £m £m £m<br />

Sterling 453 437 7 9<br />

US dollar 444 443 – 1<br />

Euro 2 2 – –<br />

50 J <strong>Sainsbury</strong> <strong>plc</strong> Annual report and accounts 1999<br />

899 882 7 10<br />

The US dollar financial assets were held at 3 April 1999, in part in anticipation of the acquisition of Star Markets Inc. (see note 32). Floating<br />

rate financial assets comprise bank balances linked to bank Base Rate, and Money Market fund balances and commercial paper investments<br />

bearing interest rates linked to LIBOR. The fixed rate financial asset has an interest rate of 7.75 per cent fixed for 6.2 years. The financial<br />

assets on which no interest is paid have a weighted average period until maturity of 3.0 years.