NATIONAL INDUSTRIALIZATION CO. (TASNEE) - Bank Audi

NATIONAL INDUSTRIALIZATION CO. (TASNEE) - Bank Audi

NATIONAL INDUSTRIALIZATION CO. (TASNEE) - Bank Audi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ENTITY OF AUDI SARADAR GROUP<br />

CURRENT PRICE SAR 24.8<br />

FAIR VALUE SAR 33.2<br />

RATING BUY<br />

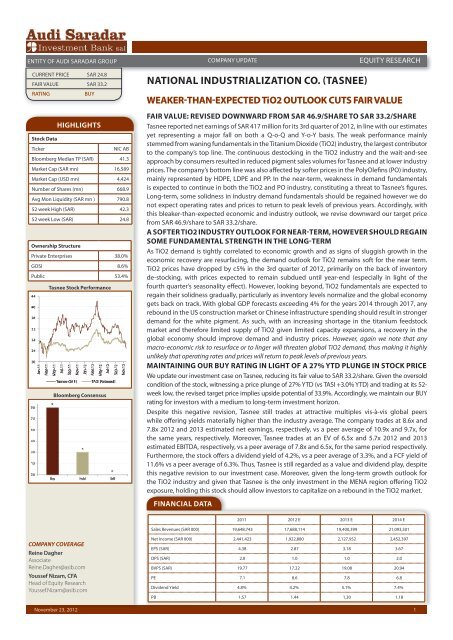

Stock Data<br />

November 23, 2012<br />

HIGHLIGHTS<br />

Ticker NIC AB<br />

Bloomberg Median TP (SAR) 41.3<br />

Market Cap (SAR mn) 16,589<br />

Market Cap (USD mn) 4,424<br />

Number of Shares (mn) 668.9<br />

Avg Mon Liquidity (SAR mn ) 790.8<br />

52 week High (SAR) 42.3<br />

52 week Low (SAR) 24.8<br />

Ownership Structure<br />

Private Enterprises 38.0%<br />

GOSI 8.6%<br />

Public 53.4%<br />

Tasnee Stock Performance<br />

Bloomberg Consensus<br />

<strong>CO</strong>MPANY <strong>CO</strong>VERAGE<br />

Reine Dagher<br />

Associate<br />

Reine.Dagher@asib.com<br />

Youssef Nizam, CFA<br />

Head of Equity Research<br />

Youssef.Nizam@asib.com<br />

EQUITY RESEARCH<br />

WEAKER-THAN-EXPECTED TiO2 OUTLOOK CUTS FAIR VALUE<br />

FAIR VALUE: REVISED DOWNWARD FROM SAR 46.9/SHARE TO SAR 33.2/SHARE<br />

Tasnee reported net earnings of SAR 417 million for its 3rd quarter of 2012, in line with our estimates<br />

yet representing a major fall on both a Q-o-Q and Y-o-Y basis. The weak performance mainly<br />

stemmed from waning fundamentals in the Titanium Dioxide (TiO2) industry, the largest contributor<br />

to the company’s top line. The continuous destocking in the TiO2 industry and the wait-and-see<br />

approach by consumers resulted in reduced pigment sales volumes for Tasnee and at lower industry<br />

prices. The company’s bottom line was also affected by softer prices in the PolyOlefins (PO) industry,<br />

mainly represented by HDPE, LDPE and PP. In the near-term, weakness in demand fundamentals<br />

is expected to continue in both the TiO2 and PO industry, constituting a threat to Tasnee’s figures.<br />

Long-term, some solidness in industry demand fundamentals should be regained however we do<br />

not expect operating rates and prices to return to peak levels of previous years. Accordingly, with<br />

this bleaker-than-expected economic and industry outlook, we revise downward our target price<br />

from SAR 46.9/share to SAR 33.2/share.<br />

A SOFTER TIO2 INDUSTRY OUTLOOK FOR NEAR-TERM, HOWEVER SHOULD REGAIN<br />

SOME FUNDAMENTAL STRENGTH IN THE LONG-TERM<br />

As TiO2 demand is tightly correlated to economic growth and as signs of sluggish growth in the<br />

economic recovery are resurfacing, the demand outlook for TiO2 remains soft for the near term.<br />

TiO2 prices have dropped by c5% in the 3rd quarter of 2012, primarily on the back of inventory<br />

de-stocking, with prices expected to remain subdued until year-end (especially in light of the<br />

fourth quarter’s seasonality effect). However, looking beyond, TiO2 fundamentals are expected to<br />

regain their solidness gradually, particularly as inventory levels normalize and the global economy<br />

gets back on track. With global GDP forecasts exceeding 4% for the years 2014 through 2017, any<br />

rebound in the US construction market or Chinese infrastructure spending should result in stronger<br />

demand for the white pigment. As such, with an increasing shortage in the titanium feedstock<br />

market and therefore limited supply of TiO2 given limited capacity expansions, a recovery in the<br />

global economy should improve demand and industry prices. However, again we note that any<br />

macro-economic risk to resurface or to linger will threaten global TiO2 demand, thus making it highly<br />

unlikely that operating rates and prices will return to peak levels of previous years.<br />

MAINTAINING OUR BUY RATING IN LIGHT OF A 27% YTD PLUNGE IN STOCK PRICE<br />

We update our investment case on Tasnee, reducing its fair value to SAR 33.2/share. Given the oversold<br />

condition of the stock, witnessing a price plunge of 27% YTD (vs TASI +3.0% YTD) and trading at its 52week<br />

low, the revised target price implies upside potential of 33.9%. Accordingly, we maintain our BUY<br />

rating for investors with a medium to long-term investment horizon.<br />

Despite this negative revision, Tasnee still trades at attractive multiples vis-à-vis global peers<br />

while offering yields materially higher than the industry average. The company trades at 8.6x and<br />

7.8x 2012 and 2013 estimated net earnings, respectively, vs a peer average of 10.9x and 9.7x, for<br />

the same years, respectively. Moreover, Tasnee trades at an EV of 6.5x and 5.7x 2012 and 2013<br />

estimated EBITDA, respectively, vs a peer average of 7.8x and 6.5x, for the same period respectively.<br />

Furthermore, the stock offers a dividend yield of 4.2%, vs a peer average of 3.3%, and a FCF yield of<br />

11.6% vs a peer average of 6.3%. Thus, Tasnee is still regarded as a value and dividend play, despite<br />

this negative revision to our investment case. Moreover, given the long-term growth outlook for<br />

the TiO2 industry and given that Tasnee is the only investment in the MENA region offering TiO2<br />

exposure, holding this stock should allow investors to capitalize on a rebound in the TiO2 market.<br />

FINANCIAL DATA<br />

<strong>CO</strong>MPANY UPDATE<br />

<strong>NATIONAL</strong> <strong>INDUSTRIALIZATION</strong> <strong>CO</strong>. (<strong>TASNEE</strong>)<br />

2011 2012 E 2013 E 2014 E<br />

Sales Revenues (SAR 000) 19,648,743 17,688,114 19,400,399 21,093,501<br />

Net Income (SAR 000) 2,441,423 1,922,880 2,127,952 2,452,397<br />

EPS (SAR) 4.38 2.87 3.18 3.67<br />

DPS (SAR) 2.0 1.0 1.0 2.0<br />

BVPS (SAR) 19.77 17.22 19.08 20.94<br />

PE 7.1 8.6 7.8 6.8<br />

Dividend Yield 4.8% 4.2% 5.1% 7.4%<br />

PB 1.57 1.44 1.30 1.18<br />

1

SAF<strong>CO</strong> <strong>CO</strong>MPANY UPDATE<br />

EQUITY RESEARCH<br />

November 23, 2012<br />

VALUATION<br />

FCFF VALUATION<br />

We revisited our FCFF model incorporating the weaker-than-expected global economic and<br />

industry growth. We reviewed mainly our price projections for TiO2, noting that the latest Cristal<br />

announcement of a TiO2 price increase dated all way back in December 2011. In addition, we<br />

reviewed downward our price projections for HDPE, LDPE and PP. We adjusted our discount rate to<br />

9.0%, from a previous 10.4%, and the growth rate to 2.1%, from a previous 2.4%, to reflect the latest<br />

macro-developments and the latest changes in the company’s financial position. Accordingly, a fair<br />

value of SAR 32.9/share was obtained.<br />

(SAR 000) 2012 E 2013 E 2014 E<br />

Net Income 1,922,880 2,127,952 2,452,397<br />

Change in Working Capital 413,915 (513,935) 834,347<br />

Non-Cash Charges 1,305,363 1,431,728 1,556,677<br />

Capex 1,173,880 1,157,358 1,258,362<br />

Interest Expense 661,848 648,009 577,627<br />

Free Cash Flow to the Firm (FCFF) 2,302,296 3,564,267 2,493,992<br />

Present Value of FCFF 2,302,296 2,997,948 1,923,871<br />

Present Value of Terminal Value 28,517,658<br />

Intrinsic Value of the Firm 35,741,774<br />

Net Debt 13,731,348<br />

Intrinsic Value of Equity 22,010,426<br />

WACC 9.0%<br />

Terminal Growth Rate 2.1%<br />

Shares Outstanding (000) 668,914<br />

NAV per share (SAR) 32.9<br />

SENSITIVITY ANALYSIS<br />

Below is a data table presenting a sensitivity analysis to our price target valuation, assuming various<br />

growth and discount rates.<br />

Terminal Growth Rate<br />

WACC<br />

8.0% 8.5% 9.0% 9.5% 10.0% 10.5% 11.0% 11.5% 12.0%<br />

1.0% 32.8 29.3 26.3 23.6 21.2 19.0 17.1 15.4 13.8<br />

1.25% 34.5 30.8 27.5 24.7 22.2 19.9 17.9 16.0 14.4<br />

1.5% 36.3 32.3 28.9 25.9 23.2 20.8 18.7 16.8 15.0<br />

1.75% 38.3 34.0 30.3 27.1 24.3 21.8 19.6 17.5 15.7<br />

2.0% 40.4 35.8 31.9 28.4 25.4 22.8 20.5 18.4 16.5<br />

2.25% 42.7 37.8 33.5 29.9 26.7 23.9 21.4 19.2 17.2<br />

2.5% 45.2 39.9 35.3 31.4 28.0 25.0 22.4 20.1 18.0<br />

2.75% 48.0 42.1 37.2 33.0 29.4 26.3 23.5 21.1 18.9<br />

3.0% 51.0 44.6 39.3 34.8 30.9 27.6 24.7 22.1 19.8<br />

2

<strong>TASNEE</strong><br />

November 23, 2012<br />

RELATIVE VALUATION<br />

<strong>CO</strong>MPANY UPDATE EQUITY RESEARCH<br />

Using two different earnings multiples, we valued Tasnee on an equal basis with comparable peers<br />

region-wide and world-wide. Tasnee should be trading at a premium to regional counterparts given<br />

mainly its exclusive and significant exposure to TiO2, in addition to its largely diversified income<br />

stream, an advantage shared by very few counterparts in the region. Furthermore, Tasnee should<br />

be trading at a premium to global peers given that the company benefits from a notable feedstock<br />

advantage in the production of polyolefins.<br />

P/E MULTIPLE<br />

Tasnee’s counterparts trade at an average of 10.9x estimated 2012 earnings, opposed to Tasnee trading<br />

at 8.6x its estimated 2012 earnings, implying an unjustified discount to its peers. Based on our 2012<br />

earnings per share (EPS) estimate of SAR 2.87, a fair value of SAR 31.4/share was derived, thus offering<br />

an upside potential of 26.4% for the company’s stock.<br />

EV/EBITDA MULTIPLE<br />

On a forward basis (2012E), Tasnee’s peer group trades at an average EV/EBITDA of 7.8x opposed to<br />

Tasnee’s EV/EBITDA of 6.5x. Accordingly, a fair value of SAR 36.0/share was obtained, resulting in an<br />

upside potential of 45.0%.<br />

(SAR 000)<br />

EBITDA 2012E 5,742,171<br />

Enterprise Value 44,788,933<br />

Net Debt as of YE12 E 13,980,539<br />

Minority Interest as of YE12 E 6,758,963<br />

Market Capitalization 24,049,431<br />

Shares Outstanding (000) 668,914<br />

NAV per Share (SAR) 36.0<br />

FINAL VALUATION<br />

Attributing a 60% weight to the FCFF valuation and the remaining weight to the comparative<br />

valuation, a final fair value of SAR 33.2/share was derived for Tasnee, offering an upside potential of<br />

33.9% (based on the closing price of SAR 24.8/share).<br />

Fair Value (SAR) Weight<br />

FCFF Valuation 32.9 60%<br />

Relative Valuation<br />

P/E 31.4 20%<br />

EV/EBITDA 36.0 20%<br />

Final Fair Value per Share (SAR) 33.2<br />

3

<strong>TASNEE</strong><br />

November 23, 2012<br />

<strong>CO</strong>MPANY UPDATE EQUITY RESEARCH<br />

APPENDIX A: PRO-FORMA IN<strong>CO</strong>ME STATEMENT<br />

(SAR 000) 2011 2012E 2013E 2014E<br />

Sales 19,648,743 17,688,114 19,400,399 21,093,501<br />

Cost of Sales (12,657,082) (11,915,594) (12,784,863) (13,816,243)<br />

Gross Profit 6,991,661 5,772,520 6,615,536 7,277,258<br />

S,G&A expenses (1,597,396) (1,512,215) (1,642,126) (1,785,436)<br />

Share in net income of associates 12,703 16,780 18,952 17,866<br />

Income from operations 5,406,968 4,277,085 4,992,362 5,509,687<br />

Investment income and other 80 159,722 164,481 180,880<br />

Financing charges (692,656) (661,848) (648,009) (577,627)<br />

Income before zakat, income tax and MI 4,713,634 3,774,959 4,508,834 5,112,940<br />

Zakat and income tax on subsidiaries (539,393) (418,342) (527,459) (598,130)<br />

Minority interest (1,725,751) (1,414,213) (1,669,764) (1,893,484)<br />

Income before zakat 2,448,490 1,942,404 2,311,610 2,621,326<br />

Zakat (7,067) (19,524) (183,658) (168,929)<br />

Net Income 2,441,423 1,922,880 2,127,952 2,452,397<br />

APPENDIX B: PRO-FORMA BALANCE SHEET (SUMMARIZED)<br />

(SAR 000) 2011 2012E 2013E 2014E<br />

Cash and cash equivalents 4,636,675 5,140,859 6,349,548 5,285,079<br />

Accounts receivables 4,140,326 3,572,098 3,917,892 4,259,812<br />

Inventories 3,692,544 4,345,280 3,729,822 4,030,715<br />

Prepaid expenses and other assets 391,013 728,451 559,732 540,699<br />

Total current assets 12,860,558 13,786,688 14,556,994 14,116,305<br />

Investments in associated companies and other 471,622 458,969 474,029 489,089<br />

PPE, net 17,830,489 18,388,339 21,415,348 22,193,886<br />

Intangible assets, net 3,569,127 3,390,671 3,212,214 3,033,758<br />

Projects under progress 4,105,038 5,423,000 1,963,000 1,613,000<br />

Other non-current assets 753,256 720,220 746,521 733,370<br />

Total non-current assets 27,067,021 28,929,497 28,405,655 28,634,524<br />

Total Assets 39,927,579 42,716,184 42,962,649 42,750,828<br />

Short-term facilities and Murabaha 3,387,118 1,831,181 2,049,658 2,268,136<br />

Current portion of long-term loans 1,586,773 2,091,846 2,091,846 2,091,846<br />

Accounts payable 1,027,614 1,035,644 1,111,196 900,629<br />

Accrued expenses and other liabilities 1,953,075 1,839,538 1,957,984 2,098,519<br />

Total current liabilities 7,954,580 6,798,210 7,210,685 7,359,130<br />

Long-term loans 11,363,330 15,198,371 13,106,524 11,014,678<br />

Other non-current liabilities 2,833,232 2,441,979 2,391,568 2,152,580<br />

Total non-current liabilities 14,196,562 17,640,350 15,498,092 13,167,258<br />

Total shareholders’ equity 11,022,826 11,518,662 12,764,104 14,005,967<br />

Minority interests 6,753,611 6,758,963 7,489,768 8,218,473<br />

Total Equity 17,776,437 18,277,625 20,253,872 22,224,440<br />

Total Liabilities and Equity 39,927,579 42,716,184 42,962,649 42,750,828<br />

4

<strong>TASNEE</strong><br />

FAIR VALUE DEFINITION<br />

November 23, 2012<br />

RATING GUIDE<br />

ISSUER<br />

<strong>CO</strong>MPANY UPDATE EQUITY RESEARCH<br />

It is an unbiased estimate of the 12-month potential market price of the stock<br />

SELL REDUCE HOLD ACCUMULATE BUY<br />

Downside -30% -10% +10% +30% Upside<br />

BUY: Upside potential in share price is more than 30%<br />

ACCUMULATE: Upside potential in share price is between 10 and 30%<br />

HOLD: Upside or downside potential in share price less than 10%<br />

REDUCE: Downside potential in share price is between 10 and 30%<br />

SELL: Downside potential in share price is more than 30%<br />

<strong>Audi</strong> Saradar Investment <strong>Bank</strong><br />

<strong>Audi</strong> Saradar Investment <strong>Bank</strong> SAL • Lebanese joint stock company with a registered capital of<br />

10,000,000,000 Lebanese Pounds • Commercial Registrar in Beirut: 30812 • Holding number 33 on<br />

the Central <strong>Bank</strong>’s <strong>Bank</strong>s List.<br />

Address: <strong>Bank</strong> <strong>Audi</strong> Plaza • Bab Idriss • Beirut 2021 8102 Lebanon • P.O. Box 11-2560 • Beirut 1107<br />

2808 • Lebanon. Phone: +961 1 964072 • Fax: +961 1 970403 • Email: contactus@asib.com<br />

5

<strong>TASNEE</strong><br />

November 23, 2012<br />

DISCLAIMER<br />

<strong>CO</strong>MPANY UPDATE EQUITY RESEARCH<br />

“All rights reserved. This research document (the “Document”) is prepared by <strong>Audi</strong> Saradar Investment <strong>Bank</strong> SAL (“ASIB”),<br />

being an entity of <strong>Audi</strong> Saradar Group, for the use of the clients of ASIB and/or the clients of any entity within the <strong>Audi</strong><br />

Saradar Group.<br />

This Document is disclosed to you on a confidential basis. Receipt and/or review of this Document constitute your agreement<br />

not to copy, modify, redistribute, retransmit, or disclose to others the contents, opinions, conclusion, or information<br />

contained in this Document prior to public disclosure of the same by ASIB or the <strong>Audi</strong> Saradar Group or without the express<br />

prior written consent of ASIB.<br />

This Document is not intended for dissemination, distribution to, or use by, any person or entity in any country or jurisdiction<br />

which would subject ASIB or any entity within the <strong>Audi</strong> Saradar Group, to any registration or licensing requirements within<br />

these jurisdictions or where it might be considered as unlawful. Accordingly, this Document is for distribution solely in<br />

jurisdictions where permitted and to persons who may receive it without breaching any applicable legal or regulatory<br />

requirements. In any case, this Document shall not be distributed in the Republic of Egypt.<br />

Your attention is drawn to the fact that you should not access this Document if the regulations of your country of citizenship<br />

and/or residency or any applicable regulations prohibit it. In any case, persons who are subject to any restrictions in any<br />

country, such as US persons are not permitted to access information contained herein.<br />

Neither the information, nor any opinion expressed herein constitutes an offer or an invitation or a recommendation to<br />

make an offer, to buy or sell any security or other investment product related to such security or investment. This Document<br />

provides general information only, is not intended to provide personal investment advice or recommendation and does not<br />

take into account the specific investment objectives, financial situation and the particular needs of any specific person who<br />

may receive it. You should seek financial, legal or tax advice regarding the appropriateness and suitability in investing in any<br />

security, other investment or investment strategy discussed or forecasted in this Document.<br />

You should carefully read the definitions of the Rating Guide provided in this Document. In addition you should read this<br />

Document in its entirety and not conclude its contents from the ratings solely.<br />

The information herein was obtained from various public sources believed in good faith to be reliable. Neither ASIB nor any<br />

entity within the <strong>Audi</strong> Saradar Group represents that the information contained in this Document is complete, accurate<br />

or free from any error and makes no representations or warranties whatsoever as to the data, information and opinions<br />

provided herein.<br />

This Document and any information, opinion and prospect contained herein reflect a judgment at its original date<br />

of publication by ASIB and are subject to change without notice. ASIB and/or any entity within the <strong>Audi</strong> Saradar Group<br />

may have issued, and may in the future issue, other research documents that are inconsistent with, and reach different<br />

conclusions from, the information, opinions and prospects presented in this Document.<br />

This Document reflects the different assumptions, views and analytical methods of the analysts who prepared them; ASIB,<br />

and the <strong>Audi</strong> Saradar Group are under no obligation to ensure that such other research documents are brought to the<br />

attention of any recipient of this Document.<br />

ASIB, any entity within the <strong>Audi</strong> Saradar Group, one or more of their affiliates and/or their officers (including but not limited<br />

to their strategists, analysts and sales staff) may have a financial interest in securities of the issuer(s) or related investments,<br />

may engage in securities transactions, on a proprietary basis or otherwise, in a manner inconsistent with the view taken in<br />

this Document and may take a view that is inconsistent with that taken herein.<br />

The price, value of and income from any of the securities or financial instruments mentioned in this Document can fall as well<br />

as rise. The value of securities and financial instruments is subject to market conditions, volatility, exchange rate fluctuation<br />

and credit quality of any issuer that may have a positive or adverse effect on the price or income of such securities or<br />

financial instruments. Any forecasts on the economy, stock market, bond market or the economic trends of the markets are<br />

not necessarily a guide to future returns. You should understand that statements regarding future prospects may not be<br />

realized. Past performance should not be taken as an indication or guarantee of future performance, and no representation<br />

or warranty, express or implied, is made regarding future returns. As a result of the preceding, you may lose, as the case may<br />

be, the amount originally invested.<br />

None of ASIB, any entity within the <strong>Audi</strong> Saradar Group, any of their affiliates and/or their officers (including but not limited<br />

to their strategists, analysts and sales staff) shall be held liable for any loss or damage that may arise, directly or indirectly,<br />

from any use of the information contained in this Document nor for any decision or investment made on the basis of<br />

information contained herein.”<br />

6