financials - Bank Audi

financials - Bank Audi

financials - Bank Audi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

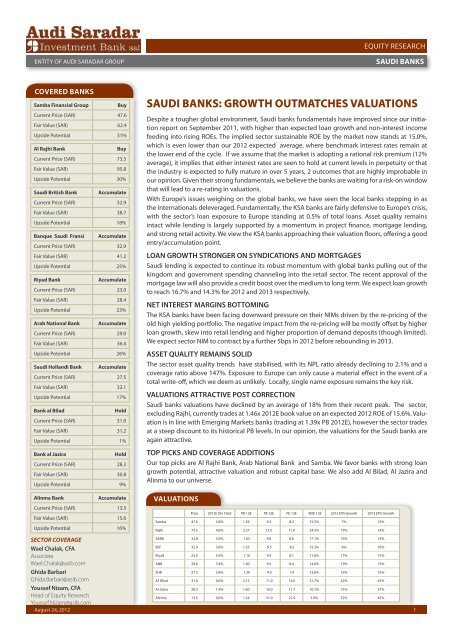

COVERED BANKS<br />

Samba Financial Group Buy<br />

Current Price (SAR) 47.6<br />

Fair Value (SAR) 62.4<br />

Upside Potential 31%<br />

Al Rajhi <strong>Bank</strong> Buy<br />

Current Price (SAR) 73.5<br />

Fair Value (SAR) 95.8<br />

Upside Potential 30%<br />

Saudi British <strong>Bank</strong> Accumulate<br />

Current Price (SAR) 32.9<br />

Fair Value (SAR) 38.7<br />

Upside Potential 18%<br />

Banque Saudi Fransi Accumulate<br />

Current Price (SAR) 32.9<br />

Fair Value (SAR) 41.2<br />

Upside Potential 25%<br />

Riyad <strong>Bank</strong> Accumulate<br />

Current Price (SAR) 23.0<br />

Fair Value (SAR) 28.4<br />

Upside Potential 23%<br />

Arab National <strong>Bank</strong> Accumulate<br />

Current Price (SAR) 29.0<br />

Fair Value (SAR) 36.4<br />

Upside Potential 26%<br />

Saudi Hollandi <strong>Bank</strong> Accumulate<br />

Current Price (SAR) 27.5<br />

Fair Value (SAR) 32.1<br />

Upside Potential 17%<br />

<strong>Bank</strong> al Bilad Hold<br />

Current Price (SAR) 31.0<br />

Fair Value (SAR) 31.2<br />

Upside Potential 1%<br />

<strong>Bank</strong> al Jazira Hold<br />

Current Price (SAR) 28.3<br />

Fair Value (SAR) 30.8<br />

Upside Potential 9%<br />

Alinma <strong>Bank</strong> Accumulate<br />

Current Price (SAR) 13.5<br />

Fair Value (SAR) 15.6<br />

Upside Potential 16%<br />

SECTOR COVERAGE<br />

Wael Chalak, CFA<br />

Associate<br />

Wael.Chalak@asib.com<br />

Ghida Barbari<br />

Ghida.Barbari@asib.com<br />

Youssef Nizam, CFA<br />

Head of Equity Research<br />

Youssef.Nizam@asib.com<br />

August 24, 2012<br />

EQUITY RESEARCH<br />

ENTITY OF AUDI SARADAR GROUP SAUDI BANKS<br />

SAUDI BANKS: GROWTH OUTMATCHES VALUATIONS<br />

Despite a tougher global environment, Saudi banks fundamentals have improved since our initiation<br />

report on September 2011, with higher than expected loan growth and non-interest income<br />

feeding into rising ROEs. The implied sector sustainable ROE by the market now stands at 15.0%,<br />

which is even lower than our 2012 expected average, where benchmark interest rates remain at<br />

the lower end of the cycle. If we assume that the market is adopting a rational risk premium (12%<br />

average), it implies that either interest rates are seen to hold at current levels in perpetuity or that<br />

the industry is expected to fully mature in over 5 years, 2 outcomes that are highly improbable in<br />

our opinion. Given their strong fundamentals, we believe the banks are waiting for a risk-on window<br />

that will lead to a re-rating in valuations.<br />

With Europe’s issues weighing on the global banks, we have seen the local banks stepping in as<br />

the internationals deleveraged. Fundamentally, the KSA banks are fairly defensive to Europe’s crisis,<br />

with the sector’s loan exposure to Europe standing at 0.5% of total loans. Asset quality remains<br />

intact while lending is largely supported by a momentum in project finance, mortgage lending,<br />

and strong retail activity. We view the KSA banks approaching their valuation floors, offering a good<br />

entry/accumulation point.<br />

LOAN GROWTH STRONGER ON SYNDICATIONS AND MORTGAGES<br />

Saudi lending is expected to continue its robust momentum with global banks pulling out of the<br />

kingdom and government spending channeling into the retail sector. The recent approval of the<br />

mortgage law will also provide a credit boost over the medium to long term. We expect loan growth<br />

to reach 16.7% and 14.3% for 2012 and 2013 respectively.<br />

NET INTEREST MARGINS BOTTOMING<br />

The KSA banks have been facing downward pressure on their NIMs driven by the re-pricing of the<br />

old high yielding portfolio. The negative impact from the re-pricing will be mostly offset by higher<br />

loan growth, skew into retail lending and higher proportion of demand deposits (though limited).<br />

We expect sector NIM to contract by a further 5bps in 2012 before rebounding in 2013.<br />

ASSET QUALITY REMAINS SOLID<br />

The sector asset quality trends have stabilised, with its NPL ratio already declining to 2.1% and a<br />

coverage ratio above 147%. Exposure to Europe can only cause a material effect in the event of a<br />

total write-off, which we deem as unlikely. Locally, single name exposure remains the key risk.<br />

VALUATIONS ATTRACTIVE POST CORRECTION<br />

Saudi banks valuations have declined by an average of 18% from their recent peak. The sector,<br />

excluding Rajhi, currently trades at 1.46x 2012E book value on an expected 2012 ROE of 15.6%. Valuation<br />

is in line with Emerging Markets banks (trading at 1.39x PB 2012E), however the sector trades<br />

at a steep discount to its historical PB levels. In our opinion, the valuations for the Saudi banks are<br />

again attractive.<br />

TOP PICKS AND COVERAGE ADDITIONS<br />

Our top picks are Al Rajhi <strong>Bank</strong>, Arab National <strong>Bank</strong> and Samba. We favor banks with strong loan<br />

growth potential, attractive valuation and robust capital base. We also add Al Bilad, Al Jazira and<br />

Alinma to our universe.<br />

VALUATIONS<br />

Price 2012E Div Yield PB 12E PE 12E PE 13E ROE 12E 2012 EPS Growth 2013 EPS Growth<br />

Samba 47.6 3.8% 1.39 9.3 8.2 15.5% 7% 14%<br />

Rajhi 73.5 4.8% 3.27 13.5 11.9 24.5% 19% 14%<br />

SABB 32.9 3.0% 1.63 9.8 8.6 17.1% 16% 14%<br />

BSF 32.9 3.6% 1.33 9.5 8.2 15.3% 6% 16%<br />

Riyad 23.0 5.0% 1.10 9.4 8.1 11.6% 17% 15%<br />

ANB 29.0 3.4% 1.40 9.5 8.4 14.6% 19% 13%<br />

SHB 27.5 3.6% 1.36 9.0 7.9 13.6% 16% 15%<br />

Al Bilad 31.0 0.0% 2.15 11.0 14.0 21.7% 42% 42%<br />

Al Jazira 28.3 1.9% 1.60 16.0 11.7 10.1% 75% 37%<br />

Alinma 13.5 0.0% 1.24 31.0 21.9 3.9% 52% 42%<br />

1

August 24, 2012<br />

TABLE OF CONTENTS<br />

INVESTMENT CASE<br />

EQUITY RESEARCH<br />

SAUDI BANKS<br />

Improved Fundamentals on Low Valuations 3<br />

Retail Oriented Market Could Cap Short Term Upside 4<br />

Summary of Fair Value Changes and Coverage Additions 4<br />

Relative Valuations 4<br />

Valuation Catalysts 5<br />

Valuation Methodology 6<br />

Valuation Key Risks 6<br />

How We Differ from Consensus 6<br />

Top Picks 6<br />

SECTOR OUTLOOK<br />

Exposure to Europe : How Immune are the KSA <strong>Bank</strong>s ? 8<br />

Loan Growth Benefits From Global Deleveraging 9<br />

Mortgage Law Approval Boosts The Longer Term Outlook 10<br />

Retail Lending Still Gaining Pace 13<br />

Favorable Liquidity Adds Support to Lending Momentum 14<br />

Loan Growth Projections 14<br />

The Effect of Brokerage and Proprietary Trading 15<br />

Net Interest Margins Bottoming 17<br />

Asset Quality Stays Solid 18<br />

BANKS SECTION<br />

Samba Financial Group 19<br />

Al Rajhi <strong>Bank</strong> 22<br />

Saudi Arabian British <strong>Bank</strong> 25<br />

Banque Saudi Fransi 28<br />

Riyad <strong>Bank</strong> 31<br />

Arab National <strong>Bank</strong> 34<br />

Saudi Hollandi <strong>Bank</strong> 37<br />

<strong>Bank</strong> Al Bilad 40<br />

<strong>Bank</strong> Al Jazira 43<br />

Alinma <strong>Bank</strong> 46<br />

2

August 24, 2012<br />

INVESTMENT CASE<br />

IMPROVED FUNDAMENTALS ON LOW VALUATIONS<br />

EQUITY RESEARCH<br />

SAUDI BANKS<br />

Over the last 4 months, the Tadawul <strong>Bank</strong>ing Index PE multiple declined by 18% from its recent peak<br />

on Europe’s economic concerns. At the same time, sector fundamentals have in fact improved with<br />

banks ROEs lifted by a rising lending momentum and stronger non-interest income.<br />

Chart 1: Tadawul <strong>Bank</strong>ing Index P/E<br />

Source: Bloomberg<br />

Sector fundamentals have re-rated as lending picked up, asset quality stabilized and NIMs approached<br />

their floors. Saudi banks are now replacing the international banks in the project finance<br />

space, as global banks face pressure on their capital ratios in the midst of concerns over a European<br />

crisis. Government spending and the recent approval of the mortgage law are also backing up retail<br />

lending as consumers capacity to borrow increases. As of Q1-12, the sector NPL has reached 2.1%<br />

with an NPL coverage ratio of 147%, reaffirming the sector’s solid asset quality. Pressure on NIMs has<br />

also eased, with most of the high yield investment portfolio already re-priced on new terms. We do<br />

not expect major pressure from loan re-pricing as corporate lending in KSA is 80% driven by working<br />

capital needs and project finance share of total lending is only starting to become significant.<br />

In our view, a widening gap between valuations and ROE coupled with a sounder sector outlook<br />

creates an opportunity for entry /accumulation point. We note that the gap between the sector’s<br />

price to book and its ROE is the largest since March 2009 lows.<br />

Chart 2: Saudi <strong>Bank</strong>ing Sector PB - ROE<br />

Source: Bloomberg, ASIB research<br />

3

August 24, 2012<br />

RETAIL ORIENTED MARKET COULD CAP SHORT TERM UPSIDE<br />

EQUITY RESEARCH<br />

SAUDI BANKS<br />

During the first half of 2012, the risk-on trade has pushed the Tadawul volumes into levels not seen<br />

since 2007, with many investors accessing sizeable leverage positions. Heavy buying has certainly<br />

supported the market on the upside with a 25% rise in the first 3 months of the year. On the flip side,<br />

leverage has also triggered heavy selling on the correction, leaving speculators and short term<br />

traders financially scarred. This recent experience could cap the upside for the banks over the short<br />

term; however with robust fundamentals in place, Saudi banks are well placed for an upturn.<br />

SUMMARY OF FAIR VALUE CHANGES AND COVERAGE ADDITIONS<br />

In general fair values have been adjusted upwards on higher growth and better ROEs (with the<br />

exception of Riyad <strong>Bank</strong> and Banque Saudi Fransi). Saudi Hollandi <strong>Bank</strong> has witnessed a major rerating<br />

since last year, mainly on improved asset quality and better NIMs. We add 3 banks to our<br />

coverage universe, being <strong>Bank</strong> Al Bilad , <strong>Bank</strong> Al Jazira and Alinma <strong>Bank</strong>.<br />

• We initiate on Al Bilad with a Hold rating. Al Bilad has shown superior strength in retail growth<br />

and in the remittance business. However trading at 2.15x PB 2012E, we believe the bank’s<br />

upside is capped relative to peers.<br />

• <strong>Bank</strong> al Jazira is skewed to investment banking activities, with Al Jazira Capital holding the 3rd<br />

largest brokerage market share in KSA and making a significant contribution to the bank’s<br />

earnings. Al Jazira is well positioned to outperform in a risk-on environment. However given<br />

current market uncertainty and the fact that it trades at 1.60 times 2012E book value, we<br />

initiate on Al Jazira with a Hold rating.<br />

• Alinma <strong>Bank</strong> is an upcoming Islamic bank that managed to capture 3.1% lending market share<br />

since it started operating. In a similar way to Al Rajhi, the bank enjoys a cheaper than peers cost<br />

of funds, allowing it to price competitively. The bank is trading at 1.24x 2012E book value and<br />

PE13E of 21.9x, which in our view is partially capturing its upside; hence our Accumulate rating.<br />

Table 1: Fair Value Changes and Earnings Comparison to Consensus<br />

Old Fair<br />

Value<br />

New Fair<br />

Value<br />

% Change Upside/<br />

Downside<br />

ASIB 12E<br />

EPS<br />

ASIB 13E<br />

EPS<br />

ASIB 14E<br />

EPS<br />

Cons. 12E<br />

EPS<br />

Cons. 13E<br />

EPS<br />

Cons. 14E<br />

Samba 59.8 62.4 4% 31% 5.09 5.80 6.56 5.00 5.70 6.70<br />

Rajhi 91.2 95.8 4% 30% 5.46 6.20 7.08 5.30 6.24 7.12<br />

SABB 36.8 38.7 5% 18% 3.36 3.83 4.45 3.13 3.66 4.26<br />

BSF 42.2 41.2 -2% 25% 3.44 3.99 4.57 3.30 3.95 4.41<br />

Riyad 29.3 28.4 -3% 23% 2.45 2.83 3.27 2.30 2.70 3.20<br />

ANB 35 36.4 4% 26% 3.03 3.43 3.88 2.80 3.50 4.00<br />

SHB 25.1 32.1 28% 17% 3.15 3.56 4.03 3.00 3.30 3.70<br />

Bilad na 31.2 na 1% 2.80 2.21 2.52 3.03 2.31 2.72<br />

Jazira na 30.8 na 9% 1.77 2.42 3.00 1.62 2.11 2.68<br />

Alinma na 15.6 na 16% 0.43 0.62 0.94 0.42 0.68 1.07<br />

Source: Bloomberg, ASIB estimates<br />

RELATIVE VALUATIONS<br />

Excluding Al Rajhi <strong>Bank</strong>, the Saudi banks currently trade at a PB 2012E of 1.46x, PE 2012E of 9.8x and<br />

PE 2013E of 8.5x with a sector ROE of 15.6%. If we were to include Al Rajhi bank, sector valuation<br />

reaches a PB 2012E of 2.25x, PE 2012E of 11.6 x and PE 2013E of 10.8x with a sector ROE rising to<br />

19.1%.<br />

We are of the opinion that current valuations for the Saudi banks do not reflect their robust<br />

fundamentals. We acknowledge the rationale behind the recent de-rating for KSA banks as risk<br />

premiums have increased on global concerns. However, we believe the KSA banks ROEs have<br />

achieved stability and we are witnessing a widening gap between valuation and profitability that<br />

creates buying opportunities.<br />

EPS<br />

4

August 24, 2012<br />

EQUITY RESEARCH<br />

SAUDI BANKS<br />

Due to stronger capital adequacy and higher operational profitability, the Saudi banks have traded<br />

at a premium to their emerging markets counterparts in the past. However, valuation differentials<br />

have narrowed recently.<br />

Chart 3: Relative <strong>Bank</strong>ing Sector Valuations<br />

Source: Bloomberg, ASIB estimates<br />

The Saudi banks are now trading at a steep price to book discount to their 5 year historical average of<br />

3.4x, which in our opinion is not justified, notwithstanding a recent increase in global risk premium.<br />

We note that Saudi banks ROEs have turned the corner with fees and commissions rising on surging<br />

lending and trading volumes, while net interest margins seem to have stabilised.<br />

Table 2: Saudi <strong>Bank</strong>s Valuation Summary<br />

Price Fair<br />

Value<br />

Upside<br />

Potential<br />

2011 Div.<br />

Yield<br />

PB 12E PE 12E PE 13E ROAE<br />

12E<br />

2012 E EPS<br />

Growth<br />

2013 E EPS<br />

Growth<br />

Samba 47.6 62.4 31% 3.8% 1.39 9.3 8.2 15.5% 7% 11%<br />

Al Rajhi 73.5 95. 30% 4.8% 3.27 13.5 11.9 24.5% 19% 12%<br />

SABB 32.9 38.7 18% 3.6% 1.63 9.8 8.6 17.4% 16% 14%<br />

BSF 32.9 41.2 25% 3.6% 1.33 9.6 8.2 15.3% 6% 16%<br />

Riyad 23.0 28.4 23% 5.0% 1.10 9.4 8.1 11.6% 16% 15%<br />

ANB 29.0 36.4 26% 3.4% 1.40 9.6 8.5 14.3% 19% 13%<br />

SHB 27.5 32.1 17% 3.6% 1.36 9.1 7.9 13.6% 16% 15%<br />

Al Bilad 31.0 31.2 1% 0.0% 2.15 19.9 14.0 12.1% 42% 42%<br />

Al Jazira 28.3 30.8 9% 1.9% 1.72 16.0 11.7 10.1% 75% 37%<br />

Alinma 13.5 15.6 16% 0.0% 1.24 31.0 21.9 2.7% 52% 42%<br />

Source: Bloomberg, ASIB estimates<br />

VALUATION CATALYSTS<br />

Going forward, the key catalysts in our opinion will be:<br />

• Return to risk-on environment triggered by a better outlook on global markets. This will lower<br />

the market’s implied discount rate and improve KSA banks profitability through brokerage<br />

income and profits on equity investments.<br />

• Saudi banks accelerating their pace in the syndications space. KSA banks have largely replaced<br />

international banks in financing projects since the beginning of the year. We believe a stronger<br />

foothold in this domain will push loan growth above our base case scenario.<br />

• An increase in the access to long term funding markets, allowing banks to be well placed from<br />

an asset-liability management perspective for project finance and mortgage lending.<br />

5

August 24, 2012<br />

EQUITY RESEARCH<br />

SAUDI BANKS<br />

VALUATION METHODOLOGY<br />

We value the Saudi banks using the sustainable ROE approach cross-checked with the dividend<br />

discount model with the exception of Alinma <strong>Bank</strong>, where we rely solely on the sustainable ROE<br />

model. Our estimates have a five year forecast period with a terminal value in the fifth year. We<br />

derive the cost of equity by using the capital asset pricing model while taking into account the<br />

political and socio-economic environment. Our discount rate of 12% takes into account the current<br />

state of global markets, leading to a higher investor risk premium . We apply a perpetual growth rate<br />

of 5% on the terminal value.<br />

VALUATION KEY RISKS<br />

Key risks to our fair value estimations for the covered banks are:<br />

• Further deterioration in Europe’s debt crisis. The direct impact on the KSA banks is limited given<br />

the modest exposure on the books, however the indirect repercussions will result in heavier<br />

consequences.<br />

• Slower than foreseen global growth from the rest of the world (mainly US and BRICS), hence<br />

causing a slowdown in commodities demand (including oil).<br />

• A blow up in any large single name exposure.<br />

• A faster than expected mortgage penetration is an upside risk to our valuations.<br />

HOW WE DIFFER FROM CONSENSUS<br />

Our earnings estimates are relatively in line with consensus. In terms of loan growth we are less<br />

bullish on growth emerging from the mortgage law. Our NIM estimates are slightly more bullish,<br />

however our ROEs are at the low end of consensus as we assign higher capital ratios in general.<br />

TOP PICKS: AL RAJHI, ANB AND SAMBA<br />

Al Rajhi: superior profitability more than justifies premium valuation<br />

Al Rajhi <strong>Bank</strong> is the most profitable bank within KSA with a 2012E ROE of 24.5%, well above the<br />

average ROE of 15.6% for the rest of the Saudi peers. Al Rajhi enjoys a cheap funding base with short<br />

term deposits constituting about 90% of its total deposit base. With 2 thirds of its total loans in retail,<br />

Al Rajhi’s yield on assets is evidently higher than the rest of the Saudi banks, which carry a more<br />

corporate skewed loan book. We expect the recent strength in retail lending to continue to support<br />

Al Rajhi’s profitability. Over the last 2 years, Al Rajhi’s liquidity remained adequate with its current<br />

loan to deposit ratio reaching 85%, providing itself with a strong platform for future growth. Al Rajhi<br />

trades at a PB 2012E of 3.27x, a premium of 42% to the Saudi market weighted average PB 2012E of<br />

2.25x. Al Rajhi’s premium valuation, in our opinion, is more than justified by its superior profitability<br />

and strong growth outlook.<br />

Arab National <strong>Bank</strong>: attractive valuation / growth profile<br />

ANB is within top players in the retail Saudi market which has supported its NIM over the years. The<br />

bank has largely addressed its previous asset quality concerns with its NPL now declining to 2.13%<br />

on an NPL coverage of 159%. The bank is well established to grow in both the retail and corporate<br />

space, now that asset quality concerns have been dealt with. Y-o-Y the corporate book has grown<br />

by12% while the retail book has grown by 20%. We forecast earnings growth for ANB of 19% and<br />

13% for 2012 and 2013 respectively. The bank trades at a PB2012E of 1.40x, 10% below its 2 year<br />

average. On a PE basis, the bank is valued at 9.6x 2012E a 6% discount to peers. We raise ANB’s fair<br />

value to SAR 36.4 given its improved fundamentals.<br />

6

August 24, 2012<br />

EQUITY RESEARCH<br />

SAUDI BANKS<br />

Samba: widening valuation discount<br />

In our opinion, Samba’s valuation remains discounted. The stock underperformed its local peers<br />

mainly due to weak loan growth. Samba’s results revealed solid strength on many aspects however,<br />

the bank is leading on asset quality improvement with its NPL ratio dropping from 3.70% to 2.45%.<br />

Growth is below sector average, nonetheless the bank managed to deliver a 6.8% increase in gross<br />

loans and advances over the last 6 months. The liquidity profile has certainly improved with the loan<br />

to deposit ratio increasing from 59% to 68% Y-o-Y. Samba’s loan exposure to Europe is not higher<br />

than its peers (at 0.5% of total assets), however the bank holds 2.8% of total assets under European<br />

investments. The bank’s discount to the sector has recently widened with the bank trading at a PB<br />

2012E of 1.39x, a 7% discount to the comparable Saudi banks despite comparable ROEs.<br />

7

August 24, 2012<br />

EQUITY RESEARCH<br />

SAUDI BANKS<br />

EXPOSURE TO EUROPE : HOW IMMUNE ARE THE SAUDI BANKS?<br />

KSA lending exposure to Europe accounts for 0.5% of system total lending. The majority of these<br />

loans were granted to established corporates with solid financial health. According to the pillar 3<br />

disclosure, the Saudi banks are also exposed to Europe through the investment portfolio with Riyad<br />

bank, Samba and Arab National <strong>Bank</strong> being the most exposed. While the combination of the above<br />

is less than 3% of system’s total assets, the KSA banks may need to raise capital in the event of heavy<br />

write-downs on European exposures.<br />

Table 3: <strong>Bank</strong>s Portfolios Exposure to Europe (% of Total Assets)<br />

Loans Investments Total<br />

BSF 0.5% 0.5% 1.0%<br />

Samba 0.5% 2.8% 3.3%<br />

SABB 0.0% 0.3% 0.3%<br />

SHB 0.0% 0.2% 0.2%<br />

ANB 0.3% 3.0% 3.3%<br />

Riyad 0.5% 5.3% 5.8%<br />

Jazira 0.0% 0.3% 0.3%<br />

Source: Saudi <strong>Bank</strong>s 2011 Financial Reports (Pillar III)<br />

We analyze below the percentage of equity needed to be raised on 10%, 20% and 30% write-downs<br />

of European exposure. We have excluded Al Rajhi, Al Bilad and Alinma from the analysis below as<br />

there are no direct European exposure on their lending or investment books.<br />

Chart 4: Percentage of reduction in equity to be on write down of European Exposure<br />

Source: Bloomberg, ASIB estimates<br />

We note that the latest disclosures available on this topic are as of 31 December 2011. Since then,<br />

exposures may have changed, especially when considering that certain banks have reduced their<br />

investments.<br />

8

August 24, 2012<br />

EQUITY RESEARCH<br />

SAUDI BANKS<br />

LOAN GROWTH BENEFITS FROM GLOBAL DELEVERAGING<br />

In spite of global economic concerns, net loan growth in KSA has accelerated from an annual<br />

10.4% in 2011 to 16.4% in June 2012. The pick up in lending was driven by a step-in from the KSA<br />

banks to replace internationals as deleveraging persists. The share of KSA banks of total project<br />

finance has increased from a 5th of the pie to almost a third. Data from the <strong>Bank</strong> of International<br />

Settlements (BIS) reveals that there remains $44bn of lending in KSA by European banks, equating<br />

to approximately 18% of KSA banks lending, hence providing a sizeable opportunity in the event<br />

of further deleveraging. The banks in KSA were the biggest loan arrangers in the MENA region<br />

accounting for approximately 45% of total loans.<br />

Subsidized loans are also retracting, lending by the kingdom’s Public Investment Fund and the<br />

Saudi Industrial Development Fund dropped 16% and 40% respectively in 2011, according to data<br />

published by SAMA.<br />

The projects portion financed by KSA banks in 2012 and 2013 is estimated at 4.5% of current Saudi<br />

banks lending. We note below the list of upcoming projects which the Saudi banks will be partially<br />

financing:<br />

Table 4: List of Upcoming Saudi Projects for 2012 and 2013<br />

Project Owner Expected Financing Value ($bn) Amount Financed By Local <strong>Bank</strong>s<br />

Sadara Aramco 2012 20 2.7<br />

Yanbu Refinery Aramco 2012-2013 10 2.1<br />

Al khabra Phosphates Maaden 2013 6 1.1<br />

Elastomers Project SABIC 2012-2013 5 1.1<br />

KAEC Heavy Steel Complex Al Rajhi Steel 2012 4 0.9<br />

Medina Airport GACA Jun-12 1.5 0.15<br />

Clean Fuels Project Aramco - Mobil 2012-2013 na na<br />

Lube Oil Refinery Luberef 2nd Half 2012 na na<br />

Mecca Hotels and Shops Jabal Omar 2012-2013 1.3 1.3<br />

Source: MEED, Bloomberg, ASIB Analysis<br />

We apply below some sensitivities revealing the potential growth for KSA banks stemming from<br />

market share gains in the project finance market.<br />

Chart 5: Loan Growth Sensitivity to Project Finance Share<br />

Source: Bloomberg, ASIB estimates<br />

9

August 24, 2012<br />

EQUITY RESEARCH<br />

SAUDI BANKS<br />

MORTGAGE LAW APPROVAL BOOSTS THE LONGER TERM OUTLOOK<br />

Specifics in regards to the mortgage law are yet to come, nevertheless the recent approval paves<br />

the way for banks to diversify their lending over the long term. We are not expecting a rush from<br />

the banks into mortgages, as many obstacles remain in place for a robust framework to formulate.<br />

We note the below factors that are likely to delay a major short term jump in mortgage lending:<br />

• Most real estate developers currently target high end customers that are not dependent on<br />

mortgages. Moving to a lower tier will require a new construction cycle which will take time.<br />

• The new demand will cause a lift in property prices, hence capping affordability.<br />

• <strong>Bank</strong>s funding is short term while mortgage lending is long term, hence creating an assetliability<br />

mismatch. A solution would be the creation of a real estate SPV structured by the banks.<br />

• The banks will need some time to test the new model on the ground.<br />

• KSA home buyers targeting home purchases beyond their affordability.<br />

Currently, mortgage loans only equate to approximately 3.5% of total loans and 12.5% of retail<br />

loans, nevertheless the banks have witnessed decent growth levels in housing loans post the Global<br />

Financial Crisis ( 20% CAGR from 2008 to 2011).<br />

The opportunity in mortgage lending remains sizeable for the Saudi banks with penetration levels<br />

deemed largely low in a global context.<br />

Chart 6: Mortgages to GDP<br />

Source: Central <strong>Bank</strong>s, ASIB estimates<br />

Currently Al Rajhi <strong>Bank</strong> and SABB dominate the current mortgage lending market, while Arab<br />

National <strong>Bank</strong> and Saudi Hollandi <strong>Bank</strong> can largely improve their market shares.<br />

Table 5: Saudi <strong>Bank</strong>s - Mortgage Market Share (2011)<br />

<strong>Bank</strong> Mortgage Market Share<br />

Al Rajhi 30.1%<br />

SABB 16.8%<br />

Riyad 12.9%<br />

Samba 11.4%<br />

Al Jazira 8.1%<br />

BSF 7.2%<br />

Al Bilad 4.9%<br />

ANB 2.7%<br />

SHB 0.8%<br />

Alinma 0.0%<br />

Source: Financial Reports, ASIB estimates<br />

10

August 24, 2012<br />

EQUITY RESEARCH<br />

SAUDI BANKS<br />

With mortgages making a small portion of total loans, growth in mortgages will need to be sizeable<br />

in order to have a material effect on the banks total loan growth, as seen below at different scenarios:<br />

Table 6 : Total Loan Growth Sensitivity to Mortgage Growth<br />

At 20% growth At 50% growth At 100% growth<br />

Al Bilad 1.92% 4.81% 9.61%<br />

Al Jazira 1.89% 4.73% 9.46%<br />

Al Rajhi 1.16% 2.91% 5.82%<br />

SABB 1.08% 2.70% 5.40%<br />

Samba 0.72% 1.81% 3.61%<br />

Riyad 0.66% 1.66% 3.32%<br />

BSF 0.43% 1.09% 2.17%<br />

ANB 0.21% 0.52% 1.05%<br />

NCB 0.19% 0.46% 0.93%<br />

SHB 0.11% 0.29% 0.57%<br />

Total 0.70% 1.71% 3.51%<br />

Source: Financial Reports, ASIB estimates<br />

The sensitivities above demonstrate that the Islamic banks benefit more than the conventional<br />

banks from every 1% rise in their mortgage portfolios more, with Al Bilad and Al Jazira leading due<br />

to their mortgage skewed loan book.<br />

ASSESSING THE LIKELY IMPACT ON LOAN GROWTH AND PROFITABILITY<br />

While the impact of the mortgage law will take time to become fully effective, we provide a base<br />

case scenario on the incremental lending and profitability emerging from the law’s approval. Our<br />

core assumptions for this base case scenario are:<br />

• 175 thousand units built each year.<br />

• Average unit value of SAR 750k.<br />

• Two from every 3 units will require finance from the banks.<br />

• Average loan to value ratio of 80%.<br />

• An average NIM of 2.5%.<br />

• Cost of Risk of 30bps.<br />

Should such a scenario materialise, our analysis shows that system lending could increase by an<br />

incremental 7.9%, while earnings will be lifted by an additional 3.9%. We note that as non-mortgage<br />

loans grow, the effect of the mortgage law on total loan growth becomes of decreasing scale.<br />

On the individual level, we assess the incremental earnings growth under 2 scenarios:<br />

• Scenario 1: If new loans emerging from the mortgage law are shared across all banks according<br />

to their current mortgage lending market shares.<br />

Chart 7: Incremental EPS Growth Based on Maintaining Mortgage Market Share<br />

Source: Bloomberg, ASIB estimates<br />

11

August 24, 2012<br />

EQUITY RESEARCH<br />

SAUDI BANKS<br />

• Scenario 2: If new loans emerging from the mortgage law are shared across all banks according<br />

to their current total lending market shares.<br />

Chart 8: Incremental EPS Growth Based on Gaining Market Share Proportionate to Total Book<br />

Source: Bloomberg, ASIB estimates<br />

We believe that banks with strong retail franchise will also hold a comparative advantage in<br />

mortgage lending. We compare the retail scale and efficiency of the Saudi banks:<br />

Table 7: Saudi <strong>Bank</strong>s Retail Efficiency Comparison<br />

Number of<br />

Branches<br />

Retail Portfolio<br />

(SAR mn)<br />

Retail Loans /<br />

Branch<br />

Retail /<br />

Total loans<br />

Al Rajhi 454 85,327 188 60%<br />

NCB 295 39,623 134 28%<br />

Riyad 248 26,295 106 23%<br />

ANB 142 20,451 144 28%<br />

BSF 83 10,399 125 11%<br />

Al Bilad 82 5,515 67 40%<br />

SABB 80 16,051 201 19%<br />

Samba 69 17,188 249 19%<br />

Al Jazira 51 7,261 142 31%<br />

SHB 44 4,128 94 11%<br />

Alinma 37 4,270 115 17%<br />

Source: SAMA<br />

In reality, none of the scenarios above is likely to materialise exactly, but we believe that banks with<br />

scale, high existent mortgage market share and strong retail franchise are likely to build most on the<br />

new law. We highlight Al Rajhi, Al Jazira, Al Bilad from the islamic banks, SABB and Riyad <strong>Bank</strong> from<br />

the conventional banks.<br />

12

August 24, 2012<br />

RETAIL LENDING STILL GAINING PACE<br />

EQUITY RESEARCH<br />

SAUDI BANKS<br />

Retail credit growth has been gradually recovering since the second half of 2009, post heavy<br />

deleveraging caused by the Global Financial Crisis. The government spending measures taken in<br />

2011 have boosted retail growth from 11% to nearly 20% in less than a year. This was due to increased<br />

salaries, higher borrowing capacity and ability to spend, lower rates as well as more Saudisation.<br />

The banks appetite for credit risk is also naturally increasing as NPLs decline and provision coverage<br />

ratios rise.<br />

Chart 9: Retail Loan Growth Has Outpaced Corporate Growth<br />

Source: Bloomberg, ASIB estimates<br />

Chart 10: KSA Retail Loans to GDP vs Other Countries<br />

Source: Financial Reports, ASIB Estimates<br />

We believe that government spending, the potential approval of the mortgage law and improved<br />

lending appetite pave the way for retail credit to grow at higher than historical rates. We also see<br />

the retail window as an opportunity for banks to improve their NIMs in a period of sustained low<br />

benchmark rates. It’s worth noting that so far retail competition in KSA has capped this opportunity<br />

to a certain extent, with many banks pricing their new retail loans on low margins.<br />

13

August 24, 2012<br />

FAVORABLE LIQUIDITY ADDS SUPPORT TO LENDING<br />

MOMENTUM<br />

EQUITY RESEARCH<br />

SAUDI BANKS<br />

Sector loan to deposit ratios (LDRs) remain low in a global context, leaving large room for Saudi<br />

banks to increase lending, with minimal need to access the wholesale markets or securitisation.<br />

LDRs in Saudi Arabia are lower than average LDRs in the UAE and Europe and well below the levels<br />

attained in the UK and Qatar.<br />

Chart 11: MENA and DM LDRs<br />

Source: Financial Reports, ASIB Estimates<br />

LOAN GROWTH PROJECTIONS<br />

We forecast a loan growth of 16.7% in 2012 declining to 10.0% by 2016. While new loans are expected<br />

to remain solid, we expect the percentage Y-o-Y growth to decline gradually as we do not factor<br />

sharp rises in new loans at this stage. Further deleveraging from the global banks and strong intake<br />

of mortgage lending are upside risks to our loan projections. On the other side, a deterioration in<br />

asset quality on any single name exposure would cause a drag on lending.<br />

Chart 12: Loan Growth Projection<br />

Source: Financial Reports, ASIB Estimates<br />

14

August 24, 2012<br />

EQUITY RESEARCH<br />

SAUDI BANKS<br />

THE EFFECT OF BROKERAGE AND PROPRIETARY TRADING<br />

Rising volumes and rallying equity prices in Q1-12 raised the question of the impact of brokerage<br />

and proprietary trading on KSA banks profitability. Saudi banks dominate the local brokerage<br />

market, offering low commission rates in return for strong banking relationships. The biggest<br />

players are Al Rajhi Capital, NCB Capital and AL Jazira Capital.<br />

Chart 13: Brokerage Market Shares<br />

Source: SAMA, Tadawul , ASIB Estimates<br />

As at 31 December 2011, brokerage contributed to 2.75% of total operating income on average for<br />

the KSA banks , however for Al Jazira the contribution is substantially higher at 11.89%. We note that<br />

we expect the contribution of brokerage income to be higher going forward, given the volumes<br />

that we have witnessed so far in 2012.<br />

Table 8: Brokerage Income % of Total Operating Income<br />

<strong>Bank</strong> %<br />

Al Jazira 11.89%<br />

Samba 5.89%<br />

BSF 4.25%<br />

SHB 2.59%<br />

SABB 2.37%<br />

ANB 2.24%<br />

NCB 2.14%<br />

Al Rajhi 2.01%<br />

Al Bilad 1.68%<br />

Riyad 0.23%<br />

System 2.75%<br />

Source: Financial Reports<br />

Besides brokerage, the banks hold equity positions under their available-for-sale and held for<br />

trading portfolios. Changes in available-for-sale investments are recorded under equity unless<br />

realised, where they hit the income statement. Changes in held for trading investments feed directly<br />

into the P&L.<br />

15

August 24, 2012<br />

EQUITY RESEARCH<br />

SAUDI BANKS<br />

We analyse below the effect on the banks earnings emerging from a 10% rise in the TASI as well as<br />

10% rise in traded volumes.<br />

Table 9: Effect on Earnings Assuming 10% Rise in Volumes and Prices<br />

Brokerage HFT investments Realisation of 10% AVS Securities Combined<br />

Al Jazira 9.96% 9.67% 9.83% 29.46%<br />

Al Bilad 1.47% 0.00% 8.25% 9.72%<br />

Samba 1.89% 0.23% 7.02% 9.13%<br />

ANB 0.98% 0.00% 4.00% 4.99%<br />

SABB 0.84% 0.00% 3.60% 4.44%<br />

BSF 1.34% 0.00% 2.64% 3.98%<br />

Riyad 0.10% 0.00% 3.78% 3.88%<br />

Al Rajhi 0.71% 1.07% 0.00% 1.78%<br />

SHB 1.06% 0.00% 0.39% 1.44%<br />

Alinma 0.00% 0.08% 0.74% 0.83%<br />

Source: ASIB Analysis, Financial Reports<br />

Al Jazira is the most correlated to equity markets, where a 10% rise in market prices and volumes<br />

adds on about 20% of EPS accretion (excluding any realisation on AVS securities).<br />

16

August 24, 2012<br />

NET INTEREST MARGINS BOTTOMING<br />

EQUITY RESEARCH<br />

SAUDI BANKS<br />

Saudi banks yields continue to face downward pressure, but reduced cost of funds has minimized the<br />

impact on NIMs, as banks continue to shed their excess liquidity and increase the proportion of demand<br />

deposits. With most of the re-pricing already done, we believe NIMs have reached a stage of stability.<br />

Chart 14: Demand Deposits Proportion of Total Deposits<br />

Source: ASIB Analysis; Financial Reports<br />

While re-pricing of asset yields is unlikely to have a negative effect on NIMs going forward, KSA banks<br />

now have little room to witness a margin uptick coming from lower cost of funds. Most banks used their<br />

cheap sources of funding with demand deposits jumping from 47% of total funding in 2010 to 60%<br />

in June 2012. We also view the increased penetration in syndications as a negative catalyst on NIMs<br />

(syndications typically carry lower yields). Nevertheless, with change in the balance sheet mix into more<br />

lending and retail momentum still occurring, we expect NIMs to be supported from further contraction.<br />

Chart 15: Historical NIM<br />

Source: ASIB Analysis; Financial Reports<br />

Saudi <strong>Bank</strong>s margins can be supported on the upside should lending keep on exceeding deposit<br />

accumulation. With sector’s loan to deposit ratios at 82% and liquid assets to total assets for most<br />

banks below 15%, we believe higher lending provides support for net interest margins.<br />

Table 10: Saudi <strong>Bank</strong>s Liquidity Metrics<br />

LDR Cash & Net interbank to Total Assets<br />

Al Rajhi 82% 12%<br />

BSF 87% 12%<br />

Samba 66% 11%<br />

SABB 82% 14%<br />

SHB 84% 8%<br />

ANB 83% 1%<br />

Riyad 81% 7%<br />

Inma 129% 14%<br />

Al Jazira 72% 16%<br />

Al Bilad 66% 40%<br />

Source: ASIB Analysis; Financial Reports<br />

17

August 24, 2012<br />

EQUITY RESEARCH<br />

SAUDI BANKS<br />

ASSET QUALITY STAYS SOLID<br />

The banks in KSA enjoy one of the best asset quality metrics regionally and globally with the<br />

sector average NPL ratio at 2.1% and the NPL coverage ratio at 147%. The majority of the decline<br />

in provisions has already occurred, paralleled with a sharp drop in past due loans. We believe asset<br />

quality has little room for improvement and is unlikely to be a major catalyst. Risk of asset quality<br />

deterioration is minimal, however there is a possibility of a rise in retail NPLs post the recent high<br />

growth period.<br />

Chart 16: Sector NPL and NPL Coverage<br />

Source: Financial Reports, ASIB Estimates<br />

We compare below the Saudi banks NPL ratios and NPL coverage ratios.<br />

Chart 17: NPL and NPL Coverage ratios<br />

Source: ASIB Analysis; Financial Reports<br />

We forecast the average Saudi banking sector NPL to decline to 1.9% in 2012 and 1.8% in 2013. A<br />

key risk to our projections is a deterioration in cash flow metrics in any high single name exposure.<br />

The current lending limit to a single party is at 25% of invested capital and reserves (previously at<br />

50%), which remains high in global standards and could cause a material effect in the event of any<br />

default.<br />

18

CURRENT PRICE SAR 47.6<br />

FAIR VALUE SAR 62.4<br />

RATING BUY<br />

Stock Data<br />

Ticker SAMBA AB<br />

Price 47.6<br />

Consensus Median Target<br />

Price (SAR)<br />

64.0<br />

Fair Value 62.4<br />

Upside Potential 31%<br />

Market Cap (SAR m) 42,840<br />

Market Cap (USD m) 11,328<br />

Number of Shares (m) 900<br />

August 24, 2012<br />

HIGHLIGHTS<br />

Free Float 51%<br />

Av Monthly Liquidity (SARm) 228<br />

52 week High (SAR) 57.0<br />

Major Shareholders<br />

Name Holding<br />

Public Investment Fund 22.9%<br />

Public Pension Agency 15.0%<br />

GOSI 11.4%<br />

Public<br />

Source: Zawya<br />

50.7%<br />

Relative Share Price Performance<br />

EQUITY RESEARCH<br />

SAUDI BANKS SAMBA<br />

SAMBA: MARKET VALUATION IMPLYING LOWER THAN FORESEEN ROE<br />

Samba’s valuation discount appears excessive if we take into account the recent recovery in loans. We<br />

believe that the share price did not fully reflect the loan growth recovery, nor the upcoming potential.<br />

LOAN GROWTH LAGS THE SECTOR BUT REMAINS STRONG<br />

Samba’s loan growth for the first 6 months of 2012 stood at 7.7% against an average of 10% for the<br />

Saudi peers. Samba has lost market share of new loans over the last 6 months, mainly to NCB, SABB<br />

and Arab National <strong>Bank</strong>. Y-o-Y however, the bank recorded a loan growth of 16.6% in line with peers<br />

average of 16.4%. We expect the bank’s focus on big ticket transactions to keep it among the main<br />

beneficiaries from the improved banking intermediation, especially in the building and construction<br />

sector. Samba can take advantage from its strong corporate relationships, with global banks leaving<br />

a lending supply gap in KSA. With 11% of current mortgages, the bank can also strengthen its growth<br />

with the latest approval of the mortgage law. We expect Samba to grow near the sector average at<br />

15.2% for 2012 and 13.3% for 2013.<br />

EASING PRESSURE ON NIM<br />

Samba’s re-pricing of its investment book has been a major drag in the past on its net interest margin.<br />

NIMs have recently stabilized now that most re-pricing has already occurred. We believe this provides<br />

Samba with an opportunity to generate strong EPS growth as lending picks up and margins bottom.<br />

STRONG FOOTHOLD IN BROKERAGE AND INVESTMENT BANKING<br />

Tadawul’s value traded has fallen by 20% in Q2-12 compared to Q1-12, nevertheless it remains 103%<br />

higher than average levels achieved in 2011. Samba Capital has a strong foothold in brokerage with<br />

9.7% market share. The investment banking arm is also very robust and has competed with global<br />

banks in M&A and ECM transactions.<br />

PROGRESS ON ASSET QUALITY<br />

Recent disclosures have shown an improving asset quality picture. Samba lifted its coverage ratio from<br />

121% in Q2-11 to 130% in Q2-12. The bank’s NPL has been showing improving trend since Q2-11, It<br />

decreased from 3.7% in Q2-11 to 2.4% in Q2-12. Despite this progress, the bank’s NPL is still above the<br />

sector’s average of 2.2%.This said, we believe that asset quality trends are broadly positive.<br />

OPTIMIZED LIQUIDITY/ LENDING MIX<br />

Samba is one of the most liquid banks in the MENA region, with a loan to deposit ratio at 68%. The<br />

bank is being active on optimizing its asset-liability structure. We note that the LTD ratio has moved<br />

from 59% to 68% in one year by mid 2012. Investments as % of total assets decreased from a high of<br />

37% to 28% between Q2-11 and Q2-12.<br />

VALUATION REMAINS CHEAP; REITERATE BUY<br />

In our view, Samba’s valuation gap to the sector average is overdone. The bank now trades at a PB2012E<br />

1.39x and a PE 2012E of 9.3x while generating a return on equity of 15.5%. The market has been harsh<br />

on Samba over the last year and a half, as management’s conservatism has led to lower than peers<br />

loan growth. With this issue now addressed to a certain extent, we believe the bank offers an attractive<br />

risk-reward profile. We re-iterate our buy rating on Samba, and revise our fair value upward from<br />

SAR 59.8 to SAR 62.4.<br />

FINANCIAL DATA<br />

2011 2012e 2013e 2014e<br />

Net Income 4,303 4,583 5,223 5,903<br />

EPS 4.78 5.09 5.80 6.56<br />

P/B (x) 1.52 1.39 1.23 1.13<br />

P/E (x) 9.96 9.35 8.20 7.26<br />

Dividend Yield 3.5% 3.8% 4.0% 4.6%<br />

ROAE 16.1% 15.5% 16.3% 16.9%<br />

NPL Ratio 3.0% 2.4% 2.3% 2.2%<br />

NPL Coverage 124% 132% 138% 142%<br />

19

August 24, 2012<br />

FINANCIALS<br />

EQUITY RESEARCH<br />

SAMBA<br />

Income Statement 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

Net Special Commission Income 4,536 4,376 4,368 4,936 5,553 6,275 7,592<br />

Fee and <strong>Bank</strong>ing Income 1,258 1,399 1,742 1,916 2,089 2,277 2,482<br />

Exchange Income 314 309 344 354 365 376 387<br />

Trading Income 690 355 479 499 519 539 561<br />

Other Income 102 123 133 141 149 158 168<br />

Non Special Commission Income 2,364 2,186 2,698 2,910 3,122 3,350 3,597<br />

Total <strong>Bank</strong>ing Income 6,901 6,562 7,066 7,846 8,674 9,625 11,190<br />

Operating Expenses (1,910) (1,957) (2,087) (2,191) (2,301) (2,416) (2,537)<br />

Operating profit before provisions 4,991 4,605 4,979 5,655 6,373 7,209 8,653<br />

Provision losses on loans& investments (559) (301) (399) (435) (474) (517) (563)<br />

Minority Interest - (1) 3 3 4 4 5<br />

Net Income 4,432 4,303 4,583 5,223 5,903 6,697 8,095<br />

Balance Sheet Summary 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

Cash and due from banks 35,072 36,240 34,061 37,812 43,066 51,138 58,587<br />

Loans and Advances (Net) 80,251 89,111 102,656 116,309 129,452 142,786 156,493<br />

Investments 64,882 60,175 62,582 65,085 67,689 70,396 73,212<br />

Prorperty Plant and Equipment 970 1,169 1,227 1,289 1,353 1,421 1,492<br />

Other Assets 6,240 6,078 6,851 7,366 7,920 8,517 9,160<br />

Total Assets 187,416 192,773 207,377 227,861 249,480 274,259 298,944<br />

Deposits 133,463 137,257 148,238 163,803 180,183 199,102 218,017<br />

Due to <strong>Bank</strong>s 19,801 20,628 21,659 23,392 25,264 27,285 29,467<br />

Debt securities 1,875 - - - - - -<br />

Other liabilities 6,675 6,631 6,963 7,311 7,676 8,060 8,463<br />

Total Liabilities 161,813 164,516 176,860 194,505 213,122 234,447 255,947<br />

Shareholder Equity 25,603 28,257 30,518 33,356 36,358 39,812 42,997<br />

Total Liabilities and Shareholders Equity 187,416 192,773 207,377 227,861 249,480 274,259 298,944<br />

Per Share Data 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

EPS 4.92 4.78 5.09 5.80 6.56 7.44 8.99<br />

DPS 1.65 1.65 1.80 1.90 2.20 2.40 2.90<br />

Growth 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

Total Assets Growth 3.7% 2.9% 7.6% 9.9% 9.5% 9.9% 9.0%<br />

Loans Growth -14.3% 11.0% 15.2% 13.3% 11.3% 10.3% 9.6%<br />

Deposits Growth 9.6% 2.8% 8.0% 10.5% 10.0% 10.5% 9.5%<br />

EPS Growth 2.4% -2.9% 6.5% 14.0% 13.0% 13.4% 20.9%<br />

20

August 24, 2012<br />

FINANCIALS<br />

EQUITY RESEARCH<br />

SAMBA<br />

Balance Sheet Mix 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

Loans to Deposits 60% 65% 69% 71% 72% 72% 72%<br />

Loans/ Assets 43% 46% 50% 51% 52% 52% 52%<br />

Assets/Equity 7.32 6.82 6.80 6.83 6.86 6.89 6.95<br />

(Cash + Interbank) /Assets 19% 19% 16% 17% 17% 19% 20%<br />

Deposits/ Total Funding 82% 83% 84% 84% 85% 85% 85%<br />

Asset Quality 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

NPL Ratio 3.7% 3.0% 2.4% 2.3% 2.2% 2.1% 2.1%<br />

NPL Coverage Ratio 118% 124% 132% 138% 142% 148% 157%<br />

Cost of Risk (% of Gross Loans) 0.65% 0.34% 0.40% 0.37% 0.36% 0.35% 0.34%<br />

Capital Adequacy 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

Tier 1 17.8% 18.0% 18.1% 18.0% 18.1% 18.2% 18.0%<br />

CAR 18.9% 19.0% 19.1% 19.2% 19.3% 19.2% 19.1%<br />

Profitability 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

ROAE 18.5% 16.1% 15.5% 16.3% 16.9% 17.5% 19.6%<br />

ROAA 2.3% 2.3% 2.2% 2.3% 2.4% 2.5% 2.7%<br />

NIM 2.60% 2.61% 2.64% 2.68% 2.71% 2.73% 3.03%<br />

Cost to Income 29.9% 29.8% 29.5% 27.9% 26.5% 25.1% 22.7%<br />

Operating Income Attribution 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

Net Interest Income 66% 67% 62% 63% 64% 65% 68%<br />

Fee Income 18% 21% 25% 24% 24% 24% 22%<br />

Other Income 16% 12% 14% 13% 12% 11% 10%<br />

21

CURRENT PRICE SAR 73.5<br />

FAIR VALUE SAR 95.8<br />

RATING BUY<br />

August 24, 2012<br />

HIGHLIGHTS<br />

Stock Data<br />

Ticker RJHI AB<br />

Price 73.5<br />

Consensus Median Target<br />

Price (SAR)<br />

87.4<br />

Fair Value 95.8<br />

Upside Potential 30%<br />

Market Cap (SAR m) 110,250<br />

Market Cap (USD m) 29,400<br />

Number of Shares (m) 1,500<br />

Free Float 49%<br />

Av Monthly Liquidity (SAR) 1,918<br />

52 week High (SAR) 83.3<br />

Major Shareholders<br />

Name Holding<br />

Suleiman Al Rajhi 19.9%<br />

Saleh Al Rajhi 15.1%<br />

GOSI 9.9%<br />

Abdullah al Rajhi 5.9%<br />

Public 49.2%<br />

Source: Zawya<br />

Relative Share Price Performance<br />

AL RAJHI: VALUATION PREMIUM IS MORE THAN JUSTIFIED<br />

EQUITY RESEARCH<br />

In addition to being the largest Islamic bank in Saudi Arabia and MENA region, Al Rajhi is by far<br />

the most profitable bank in the region, holding the highest ROE within the Saudi <strong>Bank</strong>s. With its<br />

dominant position in the retail market, the bank is consistently delivering strong results. Al Rajhi is<br />

also the best positioned to benefit from interest rates rises.<br />

STRONG GROWTH SUPPORTED BY DUAL NETWORK<br />

As of June 2012, Al Rajhi recorded the highest Y-o-Y and YTD loan growth within the top 7 banks,<br />

coming at 24% and 12.5% respectively. The bank’s strong retail network (more than a third of<br />

Saudi retail market share) has positioned him well to benefit from government spending. On the<br />

corporate and project finance space, the bank has been involved in several syndications such as<br />

Jabal Omar Mecca’s Project, Maaden and potentially a portion of Sadara project financing. On the<br />

downside, competition on retail lending between the banks could slowdown loan growth over the<br />

coming periods or reduce profitability. We forecast a loan growth of 19.3% and 14.2% for 2012 and<br />

2013 respectively.<br />

MARGINS TO REMAIN RELATIVELY STABLE<br />

Q2-12 results showed stable to increasing margins for the Saudi banks. We believe the exit of<br />

foreign banks and increased demand for retail credit has eased the downward pressure on NIMs.<br />

Nevertheless, retail competition remains in place and corporate syndications are in general low<br />

yielding. Furthermore, the loan book will witness further downward re-pricing though the majority<br />

is now re-priced on the new lower yields. We expect a relatively stable NIM for Al Rajhi in the absence<br />

of benchmark rates rises.<br />

FEE GENERATION WELL MANAGED<br />

Al Rajhi’s retail strength has led to solid fee generation. In addition to traditional banking services,<br />

the bank has obtained a niche position in the brokerage and remittance businesses. We believe that<br />

Al Rajhi can sustain strong fee income growth on strong consumer lending growth momentum, as<br />

well as corporate banking related fee income. This said, we expect Al Rajhi’s fees and commissions<br />

yield to remain above sector average.<br />

VALUATION PREMIUM LARGELY REASONABLE<br />

Al Rajhi’s valuation is at a PE 2013E of 11.9x and PB 2012E of 3.27x. While the valuation is at a large<br />

premium to the sector, the bank is trading at an 20% discount to its 5 year average. Driven by its<br />

cheap access to funding, Al Rajh’s ROE is by far the highest in the sector at 24.5% against 15.6% for<br />

the sector. With demand deposits forming 90% of total, the bank is well positioned in later years for<br />

higher ROEs driven by a widening net interest margin. The bank has no material exposure to Europe<br />

or the wholesale markets, hence minimizing contagion risk. In our view, given Al Rajhi’s profile, its<br />

valuation remains attractive, hence we reiterate our Buy rating and revise our fair value upward<br />

from SAR 91.2 to SAR 95.8. Key downside risks to our fair value are the extension of low interest rate<br />

environment and a dimmer global picture weighing on local credit demand.<br />

FINANCIAL DATA<br />

AL RAJHI BANK<br />

2011 2012e 2013e 2014e<br />

Net Income 7,378 8,187 9,297 10,623<br />

EPS 4.29 5.46 6.20 7.08<br />

P/B (x) 3.36 3.27 2.98 2.70<br />

P/E (x) 17.1 13.5 11.9 10.4<br />

Dividend Yield 4.4% 4.8% 5.1% 5.4%<br />

ROAE 23.2% 24.5% 25.6% 26.7%<br />

NPL Ratio 1.7% 1.8% 1.8% 1.8%<br />

NPL Coverage 148% 155% 158% 160%<br />

22

August 24, 2012<br />

FINANCIALS<br />

EQUITY RESEARCH<br />

AL RAJHI BANK<br />

Income Statement 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

Net Special Commission Income 8,861 9,070 9,437 10,475 11,627 12,831 15,461<br />

Fee and <strong>Bank</strong>ing Income 1,634 2,298 2,989 3,288 3,650 4,051 4,659<br />

Exchange Income 637 799 840 890 944 1,000 1,060<br />

Trading Income 250 - - - - - -<br />

Other Income 279 335 398 412 478 512 590<br />

Non Special Commission Income 2,800 3,432 4,227 4,590 5,071 5,563 6,309<br />

Total <strong>Bank</strong>ing Income 11,661 12,502 13,664 15,065 16,699 18,394 21,770<br />

Operating Expenses (2,981) (3,479) (3,704) (3,889) (4,084) (4,288) (4,502)<br />

Operating profit before provisions 8,680 9,023 9,960 11,176 12,615 14,106 17,268<br />

Provision losses on loans& investments (1,909) (1,645) (1,773) (1,879) (1,992) (2,112) (2,238)<br />

Net Income 6,771 7,378 8,187 9,297 10,623 11,995 15,030<br />

Balance Sheet Summary 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

Cash and due from banks 30,593 35,019 32,815 33,489 35,424 38,414 43,405<br />

Loans and Advances (Net) 120,065 140,395 167,491 191,275 216,332 241,859 267,254<br />

Investments 28,887 38,802 37,455 40,451 43,688 47,183 50,957<br />

Prorperty Plant and Equipment 3,395 3,624 3,805 3,995 4,195 4,405 4,625<br />

Other Assets 1,901 2,973 3,152 3,341 3,541 3,754 3,979<br />

Total Assets 184,842 220,813 244,718 272,551 303,180 335,614 370,220<br />

Deposits 143,064 173,429 193,894 217,161 242,786 269,735 298,327<br />

Due to <strong>Bank</strong>s 5,414 7,021 7,442 7,889 8,362 8,864 9,396<br />

Debt securities - - - - - - -<br />

Other liabilities 6,046 7,542 7,919 8,315 8,731 9,167 9,626<br />

Total Liabilities 154,524 187,992 209,255 233,365 259,879 287,766 317,348<br />

Shareholder Equity 30,318 32,821 35,463 39,187 43,301 47,848 52,872<br />

Total Liabilities and Shareholders Equity 184,842 220,813 244,718 272,551 303,180 335,614 370,220<br />

Per Share Data 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

EPS 4.51 4.60 5.46 6.20 7.08 8.00 10.02<br />

DPS 2.75 3.25 3.50 3.75 4.00 4.50 5.00<br />

Growth 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

Total Assets Growth 8.0% 19.5% 10.8% 11.4% 11.2% 10.7% 10.3%<br />

Loans Growth 7.0% 16.9% 19.3% 14.2% 13.1% 11.8% 10.5%<br />

Deposits Growth 16.0% 21.2% 11.8% 12.0% 11.8% 11.1% 10.6%<br />

EPS Growth 0.0% 2.0% 18.7% 13.6% 14.3% 12.9% 25.3%<br />

23

August 24, 2012<br />

FINANCIALS<br />

EQUITY RESEARCH<br />

AL RAJHI BANK<br />

Balance Sheet Mix 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

Loans to Deposits 84% 81% 86% 88% 89% 90% 90%<br />

Loans/ Assets 65% 64% 68% 70% 71% 72% 72%<br />

Assets/Equity 6.8 7.6 7.8 7.9 8.0 8.0 8.2<br />

(Cash + Net Interbank) /Assets 14% 13% 10% 9% 9% 9% 9%<br />

Deposits/ Total Funding 77% 79% 79% 80% 80% 80% 81%<br />

Asset Quality 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

NPL Ratio 2.2% 1.7% 1.8% 1.8% 1.8% 1.7% 1.7%<br />

NPL Coverage Ratio 135.8% 148.0% 155.0% 158.0% 160.0% 163.0% 166.0%<br />

Cost of Risk (% of Gross Loans) 1.59% 1.10% 1.05% 1.00% 0.90% 0.91% 0.90%<br />

Capital Adequacy 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

Tier 1 15.2% 16.3% 15.3% 15.2% 15.2% 15.2% 15.2%<br />

CAR 20.5% 20.5% 19.5% 19.0% 19.1% 19.4% 19.5%<br />

Profitability 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

ROAE 22.5% 23.2% 24.5% 25.6% 26.7% 27.4% 31.9%<br />

ROAA 3.3% 3.2% 3.2% 3.3% 3.4% 3.4% 3.9%<br />

NIM 4.76% 4.63% 4.49% 4.45% 4.43% 4.44% 4.89%<br />

Cost to Income 25.6% 27.8% 27.1% 25.8% 24.5% 23.3% 20.7%<br />

Operating Income Attribution 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

Net Interest Income 76% 73% 69% 70% 70% 70% 71%<br />

Fee Income 14% 18% 22% 22% 22% 22% 21%<br />

Other Income 10% 9% 9% 9% 9% 8% 8%<br />

24

CURRENT PRICE SAR 32.9<br />

FAIR VALUE SAR 38.7<br />

RATING ACCUMULATE<br />

Stock Data<br />

Ticker SABB AB<br />

Price 32.9<br />

Consensus Median Target<br />

Price (SAR)<br />

38.7<br />

Fair Value 38.7<br />

Upside Potential 18%<br />

Market Cap (SAR m) 32,899<br />

August 24, 2012<br />

HIGHLIGHTS<br />

Market Cap (USD m) 8,773<br />

Number of Shares (m) 1,000<br />

Free Float 45%<br />

Av Monthly Liquidity (SAR) 113<br />

52 week High (SAR) 37.2<br />

Major Shareholders<br />

Name Holding<br />

HSBC Holdings 40.0%<br />

Olayan Saudi Investment 16.9%<br />

Company<br />

GOSI 9.5%<br />

Muhaidib and Sons 4.5%<br />

Public<br />

Source: Zawya<br />

29.1%<br />

Relative Share Price Performance<br />

SABB: RAISING FAIR VALUE ON HIGHER PROFITABILITY<br />

EQUITY RESEARCH<br />

After experiencing a sharp deterioration in asset quality in 2009, SABB’s ROE has bounced back on<br />

lower provisioning as well as stronger lending momentum. Moreover, we are witnessing signs of<br />

stabilizaton in the bank’s NIM. Based on the latter, we raise our fair value on SABB from SAR 36.8 to SAR<br />

38.7 and keep an accumulate rating.<br />

ROE TURNS UPWARDS ON BETTER ASSET QUALITY<br />

Pressure on asset quality has eased with the NPL ratio now declining to 1.78% after it reached 4.5%<br />

in 2009. The bank has managed to build solid NPL coverage, rising from 100% in 2009 to 126%<br />

currently. We forecast an NPL ratio of 1.75% for 2013 with an 32 bps cost of risk.<br />

GROWTH ADDS SUPPORT TO THE TOP LINE<br />

SABB is amongst the best positioned to grow in KSA with its strong corporate franchise and solid mortgage<br />

book. Loan growth ended at 11.7% for the first 6 months of 2012 and 18.6%. Y-o-Y, corporate loans account<br />

for 82% of the total loans. Growth in the corporate book has exceeded the sector average recording 16%<br />

over the last 12 months to June 2012. The bank’s solid corporate franchise enables it to be a key player in<br />

the project finance area, where direct government financing is slowing while global banks are reducing<br />

their presence in the local market. SABB was involved in many major syndications recently (eg Maaden,<br />

Tasnee). We forecast a loan growth of 17.4% and 14.2% for 2012 and 2013 respectively.<br />

NIM HAS BOTTOMED<br />

Net interest margin for SABB is starting to improve (5bps Q-o-Q in Q2-12). Y-o-Y Net interest income<br />

has risen by 6.5%. The bank has targeted to contain its cost of funds by increasing its proportion of<br />

demand deposits from 42% as at the end of 2009 to 50% as of June 2012. Re-pricing of the long term<br />

corporate book is mostly done, while retail momentum will help improve asset yields.<br />

STRENGTH IN NON-INTEREST INCOME MAINTAINED<br />

Non-interest income rose by 28% over the past 12 months. SABB is benefiting from a rise in borrowing<br />

appetite and a strong corporate lending foothold. SABB also delivered strong brokerage income,<br />

benefiting from HSBC strong brand name and its track record to in the brokerage business. We note<br />

that previously HSBC plc merged its brokerage business HSBC Saudi Arabia with SABB’s brokerage<br />

arm.<br />

COMFORTABLE LIQUIDITY<br />

With a loan to deposit ratio of almost 80%, relatively in line with sector average, SABB’s balance<br />

sheet remains comfortable. The bank’s liquidity is sufficient to allow the bank to sustain loan growth<br />

momentum, on the corporate as well as on the retail side.<br />

VALUATION PARTIALLY REFLECTS IMPROVED FUNDAMENTALS, MAINTAIN ACCUMULATE<br />

Currently SABB trades at a PE 2013E of 8.6x and PB 2012E of 1.63x. SABB’s valuation is at a premium of<br />

12% to the sector reflecting its improved fundamentals (SABB’s ROE is at 17.1% against 15.6% for its<br />

peers). We keep our Accumulate rating on SABB and revise our fair value upward from SAR 36.8 to<br />

SAR 38.7.<br />

FINANCIAL DATA<br />

SAUDI BRITISH BANK<br />

2011 2012e 2013e 2014e<br />

Net Income 2,888 3,361 3,833 4,454<br />

EPS 2.42 3.36 3.83 4.45<br />

P/B (x) 1.91 1.63 1.45 1.30<br />

P/E (x) 13.6 9.8 8.6 7.4<br />

Dividend Yield 2.1% 3.0% 3.6% 4.6%<br />

ROAE 16.8% 17.1% 17.4% 18.3%<br />

NPL Ratio 1.9% 1.7% 1.7% 1.6%<br />

NPL Coverage 123% 131% 138% 149%<br />

25

August 24, 2012<br />

FINANCIALS<br />

EQUITY RESEARCH<br />

SAUDI BRITISH BANK<br />

Income Statement 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

Net Special Commission Income 3,244 3,022 3,202 3,650 4,107 4,579 5,540<br />

Fee and <strong>Bank</strong>ing Income 1,181 1,215 1,308 1,439 1,696 1,916 2,165<br />

Exchange Income 127 265 244 251 259 267 275<br />

Trading Income 258 308 327 364 383 402 422<br />

Other Income 30 88 55 57 59 62 64<br />

Non Special Commission Income 1,596 1,876 1,934 2,112 2,397 2,646 2,926<br />

Total <strong>Bank</strong>ing Income 4,840 4,898 5,136 5,762 6,503 7,225 8,466<br />

Operating Expenses (1,754) (1,605) (1,590) (1,670) (1,753) (1,841) (1,933)<br />

Operating profit before provisions 3,086 3,293 3,546 4,092 4,750 5,385 6,534<br />

Provision losses on loans& investments (1,243) (469) (295) (330) (370) (397) (448)<br />

Profit/Loss from Associates 41 64 110 71 74 78 82<br />

Net Income 1,884 2,888 3,361 3,833 4,454 5,066 6,167<br />

Balance Sheet Summary 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

Cash and due from banks 22,186 26,728 25,340 26,892 28,733 29,918 31,082<br />

Loans and Advances (Net) 74,248 84,811 99,568 113,707 127,693 141,611 154,923<br />

Investments 24,972 22,200 26,800 29,587 32,664 36,061 39,812<br />

Prorperty Plant and Equipment 559 537 580 609 639 671 705<br />

Other Assets 3,406 4,381 4,294 4,671 5,243 5,883 6,582<br />

Total Assets 125,371 138,657 156,583 175,466 194,972 214,145 233,103<br />

Deposits 94,673 105,577 120,675 136,604 152,996 169,061 184,952<br />

Due to <strong>Bank</strong>s 4,661 5,894 6,189 6,498 6,823 7,164 7,522<br />

Debt securities 5,663 4,150 4,159 4,168 4,177 4,187 4,198<br />

Other liabilities 5,204 5,870 6,164 6,472 6,795 7,135 7,492<br />

Total Liabilities 110,201 121,491 137,185 153,741 170,791 187,547 204,164<br />

Shareholder Equity 15,171 17,166 19,398 21,725 24,180 26,598 28,939<br />

Total Liabilities and Shareholders Equity 125,371 138,657 156,583 175,466 194,972 214,145 233,103<br />

Per Share Data 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

EPS 1.88 2.89 3.36 3.83 4.45 5.07 6.17<br />

DPS - 0.70 1.00 1.20 1.50 1.80 2.25<br />

Growth 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

Total Assets Growth -3.7% 10.6% 12.9% 12.1% 11.1% 9.8% 8.9%<br />

Loans Growth -4.8% 14.2% 17.4% 14.2% 12.3% 10.9% 9.4%<br />

Deposits Growth -3.8% 11.5% 14.3% 13.2% 12.0% 10.5% 9.4%<br />

EPS Growth -30.5% 53.3% 16.4% 14.0% 16.2% 13.7% 21.7%<br />

26

August 24, 2012<br />

FINANCIALS<br />

EQUITY RESEARCH<br />

SAUDI BRITISH BANK<br />

Balance Sheet Mix 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

Loans to Deposits 78% 80% 83% 83% 83% 84% 84%<br />

Loans/ Assets 59% 61% 64% 65% 65% 66% 66%<br />

Assets/Equity 8.58 8.35 8.35 8.35 8.34 8.32 8.33<br />

(Cash + Net Interbank) /Assets 14% 15% 12% 12% 11% 11% 10%<br />

Deposits/ Total Funding 76% 76% 77% 78% 78% 79% 79%<br />

Asset Quality 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

NPL Ratio 3.4% 1.9% 1.7% 1.7% 1.6% 1.5% 1.4%<br />

NPL Coverage Ratio 100.0% 123.0% 131.0% 138.0% 149.0% 155.0% 163.0%<br />

Cost of Risk (% of Gross Loans) 1.58% 0.58% 0.33% 0.32% 0.32% 0.30% 0.30%<br />

Capital Adequacy 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

Tier 1 12.5% 11.8% 12.1% 12.2% 12.3% 12.3% 12.3%<br />

CAR 14.7% 14.7% 15.0% 15.1% 15.2% 15.4% 15.5%<br />

Profitability 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

ROAE 12.3% 16.8% 17.1% 17.4% 18.3% 18.8% 21.2%<br />

ROAA 1.3% 1.9% 2.1% 2.1% 2.2% 2.3% 2.5%<br />

NIM 2.6% 2.5% 2.5% 2.6% 2.7% 2.8% 3.1%<br />

Cost to Income 36.2% 32.8% 31.0% 29.0% 27.0% 25.5% 22.8%<br />

Operating Income Attribution 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

Net Interest Income 67% 62% 62% 63% 63% 63% 65%<br />

Fee Income 24% 25% 25% 25% 26% 27% 26%<br />

Other Income 9% 13% 12% 12% 11% 10% 9%<br />

27

CURRENT PRICE SAR 32.9<br />

FAIR VALUE SAR 41.2<br />

RATING ACCUMULATE<br />

Stock Data<br />

Ticker BSFR AB<br />

Price 32.9<br />

Consensus Median Target<br />

Price (SAR)<br />

41.1<br />

Fair Value 41.2<br />

Upside Potential 25%<br />

Market Cap (SAR m) 29,742<br />

Market Cap (USD m) 7,931<br />

Number of Shares (m) 904<br />

Free Float 45%<br />

Av Monthly Liquidity (SAR) 113<br />

52 week High (SAR) 40.6<br />

August 24, 2012<br />

HIGHLIGHTS<br />

Major Shareholders<br />

Name Holding<br />

Credit Agricole 31.1%<br />

GOSI 12.8%<br />

Rashed Al Rashed 9.8%<br />

Mohamed Issa 5.0%<br />

Public<br />

Source: Zawya<br />

30.4%<br />

Relative Share Price Performance<br />

BSF: ATTRACTIVE RETAIL - CORPORATE MIX<br />

EQUITY RESEARCH<br />

With its strong corporate franchise and growing retail market share, BSF is well placed to benefit for<br />

the recovery in the corporate credit demand, as well as from the growing retail lending.<br />

FOCUS BACK ON CORPORATE LENDING<br />

Aside from its recent expansion in retail, BSF has managed to obtain a sizeable market share in<br />

corporate lending 14% of total corporate loans. The bank’s corporate loan book grew by 1% over<br />

the last 6 months and 10% over the last year. On the other hand, the retail book grew by 18% Y-o-Y.<br />

The retail loan book contribution to the total loan book (at 10%) remains well below the sector average.<br />

Saudi Fransi managed to ride the lending wave, growing by 9.4% over the last 6 months and<br />

18.5% Y-o-Y. We believe BSF will continue to leverage on its corporate franchise and benefit from<br />

the gradual pull-out of global banks from the Saudi market. Recently, BSF has been active in several<br />

major syndications with Marafiq Company, Zain KSA and potentially a portion of the Sadara Project<br />

financing. We forecast a loan growth of 15.4% and 13.7% for BSF for 2012 and 2013 respectively.<br />

SUKUK ISSUE IMPROVES FUNDING STRUCTURE<br />

In April 2012, BSF launched a $2 billion Sukuk program, the first program to be established by a<br />

Saudi bank, listed on the London Stock Exchange. Under the program, the bank launched its first<br />

issue of $750mn at a spread of 185 basis points over midswaps. The issuance attracted orders worth<br />

$4 billion. We view this as a welcomed diversification of funding, where the bank’s reliance on short<br />

term deposits will be reduced. The longer term nature of this funding will also serve BSF to target<br />

the mortgage market more aggressively, with the legal aspects of home lending now on the path<br />

of being resolved.<br />

BROKERAGE ADDS SUPPORT TO ROE<br />

Fransi Tadawul has 9% market share of the Saudi brokerage market. Q1-12 non interest income rose<br />

by 29% Q-o-Q partially due to higher brokerage fees. We believe BSF strong position in the brokerage<br />

market could help it improve its ROE in times of rising trading volumes.<br />

ASSET QUALITY REMAINS ROBUST<br />

The bank’s asset quality remains among the best in the sector. Provisions for Q2-12 stayed<br />

consistently low at SAR 23m. The NPL ratio remains the lowest in the sector at 1.23% against sector<br />

average NPL of 2.2%. We estimate the bank’s NPL to remain at such levels over the short to medium<br />

term. BSF’s NPL coverage stayed solid at 129% though lower than peers average at 133%. We believe<br />

BSF’s superior asset quality remains a core differentiating factor to its peers. At the same time, we<br />

acknowledge the fact that there’s little room for BSF to witness a major improvement in its bottom<br />

line from further drops in provisioning, as the bank already maintains one of the cleanest balance<br />

sheets in the sector.<br />

NON-DEMANDING VALUATION<br />

The bank trades at PE 2013E of 8.2x PB 2012E of 1.33x, we believe that the valuation is certainly<br />

tempting at this point with an 14% discount to MENA peers and 9% discount to Saudi peers. Our fair<br />

value on BSF to SAR 41.2 and assign an Accumulate rating.<br />

FINANCIAL DATA<br />

BANQUE SAUDI FRANSI<br />

2011 2012e 2013e 2014e<br />

Net Income (SAR million) 2,927 3,111 3,607 4,128<br />

EPS (SAR) 3.24 3.44 3.99 4.57<br />

P/B (X) 1.51 1.33 1.19 1.08<br />

P/E (X) 10.1 9.5 8.2 7.2<br />

Dividend Yield 3.0% 3.6% 4.1% 4.6%<br />

ROAE (%) 14.9% 15.3% 15.7% 15.8%<br />

NPL Ratio 1.1% 1.2% 1.3% 1.2%<br />

NPL Coverage 147% 136% 143% 148%<br />

28

August 24, 2012<br />

FINANCIALS<br />

EQUITY RESEARCH<br />

BANQUE SAUDI FRANSI<br />

Income Statement 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

Net Special Commission Income 3,066 3,137 3,303 3,759 4,210 4,698 5,567<br />

Fee and <strong>Bank</strong>ing Income 887 1,050 1,233 1,470 1,646 1,841 2,053<br />

Exchange Income 200 220 225 220 220 220 220<br />

Trading Income 221 147 179 184 190 196 201<br />

Other Income 20 30 35 39 44 54 65<br />

Non Special Commission Income 1,328 1,447 1,672 1,913 2,100 2,310 2,540<br />

Total <strong>Bank</strong>ing Income 4,394 4,584 4,975 5,672 6,310 7,009 8,108<br />

Operating Expenses (1,259) (1,499) (1,551) (1,729) (1,816) (1,906) (2,002)<br />

Operating profit before provisions 3,135 3,085 3,424 3,943 4,494 5,102 6,106<br />

Provision losses on loans& investments (339) (158) (297) (324) (353) (385) (419)<br />

Profit/Loss from Associates 4 - (5) - - - -<br />

Minority Interest - - (10) (12) (13) (17) (21)<br />

Net Income 2,800 2,927 3,111 3,607 4,128 4,701 5,666<br />

Balance Sheet Summary 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

Cash and due from banks 16,056 25,125 13,883 15,133 17,874 21,529 25,978<br />

Loans and Advances (Net) 80,976 92,325 106,543 121,139 135,434 150,332 164,312<br />

Investments 19,841 16,669 21,670 22,970 24,348 25,809 27,357<br />

Prorperty Plant and Equipment 586 581 610 641 673 706 742<br />

Other Assets 5,757 5,780 6,069 6,372 6,691 7,026 7,377<br />

Total Assets 123,218 140,480 148,774 166,255 185,019 205,401 225,767<br />

Deposits 93,529 109,963 115,461 129,894 145,481 162,211 178,433<br />

Due to <strong>Bank</strong>s 2,313 2,064 2,167 2,297 2,435 2,581 2,736<br />

Debt securities 4,894 4,230 4,318 4,411 4,509 4,611 4,718<br />

Other liabilities 4,459 4,567 4,841 5,131 5,439 5,766 6,112<br />

Total Liabilities 105,195 120,824 126,788 141,734 157,864 175,169 191,998<br />

Shareholder Equity 18,023 19,655 21,987 24,522 27,155 30,232 33,768<br />

Total Liabilities and Shareholders Equity 123,218 140,480 148,774 166,255 185,019 205,401 225,767<br />

Per Share Data 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

EPS 3.10 3.24 3.44 3.99 4.57 5.20 6.27<br />

DPS 1.10 1.00 1.20 1.35 1.50 1.85 2.25<br />

Growth 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

Total Assets Growth 2.0% 14.0% 5.9% 11.7% 11.3% 11.0% 9.9%<br />

Loans Growth 3.0% 14.0% 15.4% 13.7% 11.8% 11.0% 9.3%<br />

Deposits Growth 3.0% 17.6% 5.0% 12.5% 12.0% 11.5% 10.0%<br />

EPS Growth 13.0% 4.5% 6.3% 15.9% 14.4% 13.9% 20.5%<br />

29

August 24, 2012<br />

FINANCIALS<br />

EQUITY RESEARCH<br />

BANQUE SAUDI FRANSI<br />

Balance Sheet Mix 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

Loans to Deposits 87% 84% 92% 93% 93% 93% 92%<br />

Loans/ Assets 66% 66% 72% 73% 73% 73% 73%<br />

Assets/Equity 6.84 7.15 6.77 6.78 6.81 6.79 6.69<br />

(Cash + Net Interbank) /Assets 11% 16% 8% 8% 8% 9% 10%<br />

Deposits/ Total Funding 76% 78% 78% 78% 79% 79% 79%<br />

Asset Quality 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

NPL Ratio 1.27% 1.10% 1.18% 1.25% 1.24% 1.25% 1.21%<br />

NPL Coverage Ratio 126% 147% 136% 143% 148% 151% 155%<br />

Cost of Risk (% of Gross Loans) 0.71% 0.18% 0.21% 0.21% 0.22% 0.25% 0.25%<br />

Capital Adequacy 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

Tier 1 13.9% 13.9% 14.0% 14.2% 14.4% 14.4% 14.4%<br />

CAR 13.7% 14.5% 14.7% 15.1% 15.2% 15.2% 15.2%<br />

Profitability 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

ROAE 15.1% 14.9% 15.3% 15.7% 15.8% 16.5% 18.6%<br />

ROAA 1.7% 2.0% 2.0% 2.1% 2.2% 2.2% 2.5%<br />

NIM 2.65% 2.61% 2.64% 2.63% 2.65% 2.73% 3.01%<br />

Cost to Income 27.0% 28.4% 31.9% 30.1% 28.3% 25.0% 22.2%<br />

Operating Income Attribution 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

Net Interest Income 70% 68% 66% 66% 67% 67% 69%<br />

Fee Income 20% 23% 25% 26% 26% 26% 25%<br />

Other Income 10% 9% 9% 8% 7% 7% 6%<br />

30

CURRENT PRICE SAR 23.0<br />

FAIR VALUE SAR 28.4<br />

RATING ACCUMULATE<br />

Stock Data<br />

Ticker RIBL AB<br />

Price 23.0<br />

Consensus Median Target<br />

Price (SAR)<br />

28.8<br />

Fair Value 28.4<br />

Upside Potential 23%<br />

Market Cap (SAR m) 34,500<br />

August 24, 2012<br />

HIGHLIGHTS<br />

Market Cap (USD m) 9,200<br />

Number of Shares (m) 1,500<br />

Free Float 48%<br />

Av Monthly Liquidity (SAR) 380<br />