adopting a mature growth strategy almarai company - Search Center ...

adopting a mature growth strategy almarai company - Search Center ...

adopting a mature growth strategy almarai company - Search Center ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ENTITY OF AUDI SARADAR GROUP<br />

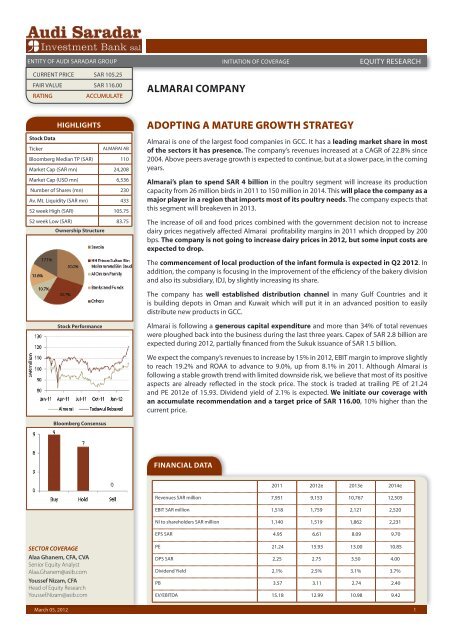

CURRENT PRICE SAR 105.25<br />

FAIR VALUE SAR 116.00<br />

RATING ACCUMULATE<br />

Stock Data<br />

March 05, 2012<br />

HIGHLIGHTS ADOPTING A MATURE GROWTH STRATEGY<br />

Ticker ALMARAI AB<br />

Bloomberg Median TP (SAR) 110<br />

Market Cap (SAR mn) 24,208<br />

Market Cap (USD mn) 6,536<br />

Number of Shares (mn) 230<br />

Av. Mt. Liquidity (SAR mn) 433<br />

52 week High (SAR) 105.75<br />

52 week Low (SAR) 83.75<br />

Ownership Structure<br />

Stock Performance<br />

Bloomberg Consensus<br />

SECTOR COVERAGE<br />

Alaa Ghanem, CFA, CVA<br />

Senior Equity Analyst<br />

Alaa.Ghanem@asib.com<br />

Youssef Nizam, CFA<br />

Head of Equity Research<br />

Youssef.Nizam@asib.com<br />

ALMARAI COMPANY<br />

EQUITY RESEARCH<br />

Almarai is one of the largest food companies in GCC. It has a leading market share in most<br />

of the sectors it has presence. The <strong>company</strong>’s revenues increased at a CAGR of 22.8% since<br />

2004. Above peers average <strong>growth</strong> is expected to continue, but at a slower pace, in the coming<br />

years.<br />

Almarai’s plan to spend SAR 4 billion in the poultry segment will increase its production<br />

capacity from 26 million birds in 2011 to 150 million in 2014. This will place the <strong>company</strong> as a<br />

major player in a region that imports most of its poultry needs. The <strong>company</strong> expects that<br />

this segment will breakeven in 2013.<br />

The increase of oil and food prices combined with the government decision not to increase<br />

dairy prices negatively affected Almarai profitability margins in 2011 which dropped by 200<br />

bps. The <strong>company</strong> is not going to increase dairy prices in 2012, but some input costs are<br />

expected to drop.<br />

The commencement of local production of the infant formula is expected in Q2 2012. In<br />

addition, the <strong>company</strong> is focusing in the improvement of the efficiency of the bakery division<br />

and also its subsidiary, IDJ, by slightly increasing its share.<br />

The <strong>company</strong> has well established distribution channel in many Gulf Countries and it<br />

is building depots in Oman and Kuwait which will put it in an advanced position to easily<br />

distribute new products in GCC.<br />

Almarai is following a generous capital expenditure and more than 34% of total revenues<br />

were ploughed back into the business during the last three years. Capex of SAR 2.8 billion are<br />

expected during 2012, partially financed from the Sukuk issuance of SAR 1.5 billion.<br />

We expect the <strong>company</strong>’s revenues to increase by 15% in 2012, EBIT margin to improve slightly<br />

to reach 19.2% and ROAA to advance to 9.0%, up from 8.1% in 2011. Although Almarai is<br />

following a stable <strong>growth</strong> trend with limited downside risk, we believe that most of its positive<br />

aspects are already reflected in the stock price. The stock is traded at trailing PE of 21.24<br />

and PE 2012e of 15.93. Dividend yield of 2.1% is expected. We initiate our coverage with<br />

an accumulate recommendation and a target price of SAR 116.00, 10% higher than the<br />

current price.<br />

FINANCIAL DATA<br />

INITIATION OF COVERAGE<br />

2011 2012e 2013e 2014e<br />

Revenues SAR million 7,951 9,153 10,767 12,505<br />

EBIT SAR million 1,518 1,759 2,121 2,520<br />

NI to shareholders SAR million 1,140 1,519 1,862 2,231<br />

EPS SAR 4.95 6.61 8.09 9.70<br />

PE 21.24 15.93 13.00 10.85<br />

DPS SAR 2.25 2.75 3.50 4.00<br />

Dividend Yield 2.1% 2.5% 3.1% 3.7%<br />

PB 3.57 3.11 2.74 2.40<br />

EV/EBITDA 15.18 12.99 10.98 9.42<br />

1

ALMARAI INITIATION OF COVERAGE<br />

EQUITY RESEARCH<br />

TABLE OF CONTENTS<br />

Company Overview 2<br />

Investment Case 3<br />

Dairy 4<br />

Cheese 6<br />

Fruit Juice 7<br />

Bakery 7<br />

Poultry 8<br />

Baby Food 10<br />

IDJ 11<br />

SWOT Analysis 14<br />

Valuation 15<br />

Pro Forma Financials 17<br />

March 05, 2012<br />

COMPANY OVERVIEW<br />

Almarai was established in 1976 in order to transform the traditional dairy farming in KSA to meet<br />

the needs of a growing domestic market. In early 90s, the <strong>company</strong> entered into a restructuring and<br />

reinvestment phase moving away from a decentralized to a centralized structure in order to reduce<br />

cost. The <strong>company</strong> continued to invest heavily in technologically advanced production facilities. In<br />

2005, Almarai moved from being a privately owned <strong>company</strong> to a publicly listed one with more than<br />

60,000 shareholders currently have stakes in the <strong>company</strong>. Today, Almarai is capable of serving high<br />

quality products, diversified into 7 main business lines, to more than 43,000 customers on a daily<br />

basis, not only inside KSA but in other neighbor countries.<br />

Chart 1: 2011 Sales by Product<br />

Source: Almarai Presentation, 2011<br />

Chart 2: 2011 Sales by Country<br />

Source: Almarai Presentation, 2011<br />

During the past 3 years, more than 34% of Almarai’s sales revenues have been ploughed back into<br />

business development, infrastructure and technology. In 2007, Almarai acquired the Jeddah based<br />

Western Bakeries. In 2009, Almarai acquired Hail Agricultural Development Company (HADCO)<br />

in order to expand in the poultry segment. Also in 2009, Almarai formed a 48:52 JV with PepsiCo<br />

pooling respective expertise in dairy and juice to enable geographical expansion outside GCC.<br />

In the same year, Almarai made a commitment to enter the infant nutrition formula market by<br />

establishing a 50:50 JV (named the International Pediatric Nutrition Company, IPNC) with Mead<br />

Johnson Nutrition, and commenced the construction of the region’s first plant in AlKharj in 2010.<br />

Also in 2010, the <strong>company</strong> started the construction of a new bakery facility in AlKharj.<br />

2

ALMARAI<br />

The food retail sector in KSA is<br />

projected to double in size<br />

March 05, 2012<br />

INVESTMENT CASE<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

The food sector is a defensive sector that shows relative stability in demand compared to other<br />

sectors. The food retail industry in KSA increased at a CAGR of 15.5% between 2005 and 2010 to<br />

reach USD 42 billion in 2010. While the overall food sector is expected to grow at CAGR of 4.2%<br />

between 2011 and 2015, the food retail industry is projected to double in size. Many factors were<br />

behind this supernormal <strong>growth</strong>, including:<br />

1 Above average population <strong>growth</strong>: averaged 3% per year between 2001 and 2010, compared<br />

to 1.4% globally.<br />

1 Increase in the per capita income: annual increase is expected by 3.5% in the coming 5 years,<br />

according to IMF.<br />

1 Changing of life style: increasing urbanization and popularity of high valued processed foods.<br />

1 Growing demand for ready-to-eat products during the Hajj: 2008 pilgrims’ number is expected<br />

to double by 2020.<br />

Based in KSA, Almarai is one of the biggest food companies in GCC. The <strong>company</strong> is well<br />

positioned to benefit from the <strong>growth</strong> in the food sector. This is reflected in high increase of<br />

Almarai revenues during the last years.<br />

Chart 3: Almarai Revenues<br />

Source: Company Financials<br />

Important to note that demand for food in Muslim countries increases during the Holy month of<br />

Ramadan. Demand for juice in KSA, for example, rises by 20%. In addition, demand for food in KSA<br />

increases during the Haj season, which occurs 2 months after the end of Ramadan.<br />

In addition, food companies usually have to keep a 2-4 months inventory in order to assure the<br />

continuity of running their business. When food prices start to increase, the <strong>company</strong> may increase<br />

its sale prices while the cost of sale remains low for few weeks and so the <strong>company</strong> can benefit<br />

from higher profitability margins, and vice versa.<br />

3

ALMARAI<br />

GCC dairy market is expected to grow<br />

at CAGR of 9.5%<br />

March 05, 2012<br />

DAIRY MARKET<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

GCC demand for dairy products reached 1.9 billion liters in 2011, 23.1% out of them are fresh milk.<br />

Chart 4: GCC Dairy Market by Products<br />

Source: Nielsen Company, 2011<br />

Reflecting its demography, KSA represents around 63% of total GCC demand, followed by UAE<br />

(17.5%) and Kuwait (6.9%).<br />

Chart 5: GCC Dairy Market Breakdown<br />

Source: Nielsen Company, 2011<br />

The GCC dairy market was valued at USD 3.2 billion in 2011, and it is expected to grow at a CAGR of<br />

9.5% in the coming 3 years. Overall, Almarai has the leading market share with 35.3%, followed by<br />

Nestle (7.5%) and Alsafi (7.3%). This market share changes from one product to another.<br />

Chart 6: GCC Top 3 Players by Products<br />

Source: Nielsen Company, 2011<br />

4

ALMARAI<br />

Lack of pricing flexibility negatively<br />

affects Almarai 2011 performance<br />

Backward integration in Argentina<br />

March 05, 2012<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

The dairy food business operates under Almarai brand name. Almarai has 7 dairy farms and 2<br />

manufacturing facilities located in KSA. It produced 867 million liters of milk in 2011. The dairy<br />

segment is divided into 2 main sub-segments:<br />

1 Fresh dairy products: including fresh milk, laban, zabadi, yogurt, cream and dairy desserts.<br />

Almarai successfully introduced to the market a range of new products as flavored milk and<br />

fruit yogurts. 2011 sales increased 9.7%, y-o-y basis, to reach SAR 3,475 million.<br />

1 Long life dairy: comprising of evaporated and UHT milk and whipping, cooking and sterilized<br />

cream. Sales grew by 15.5% in 2011 to reach SAR 761 million, due to improving marketing and<br />

focused distribution, in addition to product development.<br />

During 2011, the Saudi government introduced several regulations that highly impacted the food<br />

sector:<br />

1 Fixing the selling prices of the main food products including dairy products.<br />

1 Increase (almost double) the feed subsidies.<br />

1 Import the alfalfa feed requirements for the export of dairy products.<br />

Negatively affected by the global inflation of food prices which increases the <strong>company</strong>’s cost of<br />

sale, Almarai increased the prices of some products including fresh dairy in early July 2011. Few<br />

days later, the Saudi Ministry of Commerce and Industry interfered to fix the price. Accordingly,<br />

Almarai was obliged to drop the fresh milk and laban prices back and so it failed to pass the<br />

increase of input cost to consumers. In late July, however, the government almost doubled the<br />

feed subsidies, an action that helped the <strong>company</strong> to partially improve its profitability margins.<br />

This lack of pricing flexibility, combined with food inflation, negatively impacted Almarai which<br />

return on sales for the Dairy and Juice segment dropped from 20.4% in 2010 to 18.3% in 2011.<br />

The <strong>company</strong> is in talk with the government but it does not plan to increase prices in 2012. On the<br />

other hand, IMF forecasts that food prices are expected to drop by an average of 5% in 2012. In<br />

addition, fresh milk subsidies will double in 2012. Such drop in input cost will help the <strong>company</strong> to<br />

improve its profitability margins.<br />

Also in 2011, the Council of Ministers decided to import 40% and 80% the alfalfa feed requirements<br />

for the export of dairy products in 2011 and 2012, respectively. Almarai, which is importing 100% of<br />

alfalfa feed requirements, declared that it fully endorsed this decision. In this context, the <strong>company</strong><br />

acquired, in December 2011, 100% of Fondomonte S.A., a <strong>company</strong> that owns and operates 3<br />

farms in Argentina totaling 13,306 hectares dedicated to the production of corn and soybean. This<br />

backward integration will help the <strong>company</strong> to:<br />

1 Assure 25% of its corn needs,<br />

1 Better control the quality and the time of supply,<br />

1 Be less affected by commodity inflation.<br />

The payback period of this SAR 312 million investment is expected in 3 to 4 years. Almarai is<br />

acquiring a team of professional farmers in order to build a platform to acquire additional lands in<br />

the mid term.<br />

5

ALMARAI<br />

Capex of SAR 600 million to develop Al<br />

Kharj cheese plant in 2012<br />

March 05, 2012<br />

CHEESE MARKET<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

Demand for cheese in GCC reached 87.7 million kg in 2011, 68.3% are consumed by KSA.<br />

Chart 7: Cheese Demand by Country<br />

Source: Nielsen Company, 2011<br />

The GCC cheese market was valued at USD 1.1 billion in 2011, and it is expected to increase at a<br />

CAGR of 10.9% in the coming 3 years.<br />

The cheese market in GCC is very concentrated with 4 players dominating 85% of total market.<br />

Chart 8: GCC Market Share<br />

Source: Nielsen Company, 2011<br />

Almarai sales increased 12.8% in 2011 to reach SAR 1.4 billion. On a close look to the cheese market,<br />

it appears that Almarai has a leading market share in 2 segments (jars and slices) out of 5 segments<br />

it has presence. Almarai ranks second after La Vache Qui Rit in the triangles market, but with close<br />

market share, representing high competition between the 2 names. It also ranks second after Kraft<br />

in the square portions but with low market share of 14.4% compared to 84.5% to Kraft which also<br />

dominates the cheese tins market with 57.5% share, followed by Almarai with 32.9%. As such, it<br />

seems that Almarai can improve its presence in the cheese market by developing new products and<br />

improving its marketing <strong>strategy</strong> in segments other than jars and slices. Almarai plans to spend SAR<br />

600 million to develop AlKharj cheese plant in 2012.<br />

6

ALMARAI<br />

Almarai is well positioned to gain<br />

from the changes in the consumption<br />

patterns in the Juice sector<br />

March 05, 2012<br />

FRUIT JUICE MARKET<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

KSA is the largest juice consumer in GCC with a market share of 67%. Demand for fruit juice in KSA<br />

grew at a CAGR of 5.8% between 2004 and 2010 to reach 983 million liters. Consumption is positively<br />

affected by rising health awareness, and hot weather. KSA possesses 38 factories producing all types<br />

of juices in various sizes, and this scale of production represents more than 90% of the domestic<br />

needs. Going forward, yearly consumption is expected to exceed 1.3 billion liters in 2014, with a<br />

market value of SAR 7.5 billion.<br />

Chart 9: KSA Juice Market million liters<br />

Source: Department of Agriculture, Forestry and Fisheries, Euromonitor<br />

The juice market in GCC is highly fragmented due to low barriers of entry. Almarai ranks first with<br />

14.3% market share, followed by Rani (13.3%), Al Rabie (11.2%) and Suntop at 6.6%.<br />

As consumers have become more conscious of the nutritional value of products, they have started<br />

to switch from nectars (25-99% juice), various products in which contain preservatives and high<br />

sugar content, to 100% juice. This has encouraged companies to enhance their product offerings<br />

in 100% juice by launching new variants, such as 100% Orange Juice with Pulp from Almarai, which<br />

was launched in 2010. Product innovation, in addition to focused distribution positively affects the<br />

<strong>company</strong>’s revenues which are increasing at a faster rate than the market. Revenues grew by 20.2%<br />

and 19.2% in 2010 and 2011, respectively.<br />

BAKERY MARKET<br />

The bakery industry in KSA is witnessing a tremendous <strong>growth</strong> and representing a major share in<br />

the domestic food and beverage market. Demand increased by more than 70% during the last 5<br />

years to reach more than 250 million kg in 2011. The supernormal <strong>growth</strong> is expected to continue<br />

during the coming 3 years, and demand is expected to reach 309 million kg in 2014.<br />

Chart 10: Bakery Products in KSA<br />

Source: Euromonitor<br />

7

ALMARAI<br />

Almarai, by far, has a leading market<br />

share in the bakery segment<br />

March 05, 2012<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

Almarai bakery products are manufactured and traded by Western Bakeries Company Limited<br />

and Modern Food Industries Limited under the brand names L’usine and 7 Days respectively.<br />

International Baking Services Company Limited, 100% owned by Almarai, trades bakery products.<br />

The <strong>company</strong> bakery sales grew at a faster rate than the industry during the last years.<br />

Chart 11: Almarai vs. Industry Sale Growth<br />

Source: Euromonitor, Almarai Financials<br />

Apart from L’usine which has a leading market share of 21%, the bakery industry in KSA is highly<br />

fragmented. Pain Dor ranks second followed by Almarai 7 Days with market share of 6.2% and 6.1%,<br />

respectively. L’usine dominates all segments it has presence except maamoul, in which it ranked<br />

second (22.9%) after HB (24.6%), and croissant in which it ranks second also (26.9%) after its sister<br />

<strong>company</strong> 7 Days (57.7%). In addition, Almarai is faced by a strong competition in the waffles market<br />

from Ghandour, and both of them have a combined market share of 99.5%, as of November 2011,<br />

according to Nielsen.<br />

During 2011, the <strong>company</strong> introduced new products such as mini croissant from 7 Days. Both<br />

L’usine and 7 Days products are now distributed throughout the entire GCC. Impacted by higher<br />

depreciation and distribution expenses, in addition to the inflation of food prices globally, the return<br />

on sale for this sector decreased from 14.2% in 2010 to 12.2% in 2011. During 2012, the <strong>company</strong><br />

plans to improve efficiency of this sector and also increase the capacity of some business lines in<br />

order to be able to export 10% of total production. Alkharj plant will be expanded in 2012 and 2013<br />

and distribution channels will be opened to other GCC markets. Almarai plans to invest SAR 300-500<br />

million in this business during 2012.<br />

POULTRY MARKET<br />

KSA poultry consumption increased by more than 75% during the last decade to reach 1.4 million<br />

tons in 2011, valued at USD 3.6 billion. The increasing demand for poultry is part of the changes in<br />

the consumption patterns in KSA and other GCC markets, as people are changing their diet from a<br />

carbohydrate based to a protein based diet. Having 59% of its needs imported, KSA is the 3 rd largest<br />

chicken importer after Russia and Japan. Frozen products account for 72% of total consumption,<br />

while the fresh products account for the rest.<br />

8

ALMARAI<br />

High expenditure in the poultry<br />

segment<br />

March 05, 2012<br />

Profitability to start in 2013<br />

Chart 12: KSA Poultry Market<br />

Source: US Department of Agriculture<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

Almarai intends to benefit from the increasing demand of chicken and the limited domestic supply,<br />

by investing SAR 4 billion in this segment to increase its annual production capacity to reach 150<br />

million birds in 2014. Important to note that poultry products are manufactured and traded by Hail<br />

Agricultural Development Company (HADCO) under the Alyoum brand.<br />

Chart 13: Birds Capacity million<br />

Source: Company Presentation, 2011<br />

The <strong>company</strong> will also improve the distribution channel related to the poultry segment and 20% of<br />

its production will be exported to other gulf countries, mainly UAE and Qatar, where average prices<br />

are 20% higher than that in KSA. By 2014, the <strong>company</strong> plans to export 25% of its production.<br />

The poultry contribution to total revenues increased from 2.5% in 2010 to 4.0% in 2011. Despite that<br />

this segment is the fastest growing sector for the <strong>company</strong>, it reported losses before minorities of<br />

SAR 33.5 million in 2011 because of the increase in depreciation and marketing activities. Breakeven<br />

is expected in 2013.<br />

ARABLE & HORTICULTURE<br />

Just 1.7% of the Saudi land space is arable and main products are wheat, barley, tomatoes, melons,<br />

dates, and citrus. The Kingdom is faced with a serious water shortage and has decided to place<br />

more emphasis on sustainable production of horticultural crops. The Ministry of Agriculture and<br />

the Agricultural Development Fund plan to guide the horticultural sector towards more sustainable<br />

production methods. One of the strategies is to stimulate production of vegetables in greenhouses<br />

rather than in the field since the latter requires much more water per unit of product. A policy group<br />

has been formed in KSA with the task to guide the horticultural sector and stimulate sustainable<br />

production methods. Almarai 3 rd party sales increased 52% to reach SAR 72.6 million in 2011,<br />

representing only 0.9% of total revenues.<br />

9

ALMARAI<br />

March 05, 2012<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

Table 1 summarizes the performance of each sector during 2011.<br />

Table 1: Almarai Performance by Sector<br />

SAR million<br />

Dairy<br />

&Juice<br />

Bakery Poultry Arable and<br />

Horticulture<br />

Others Total<br />

3 rd Party Sales 6,593 966 319 73 0 7,951<br />

Net Depreciation (331) (90) (39) (59) 0 (519)<br />

Income before Minorities 1,205 118 (34) 53 (35) 1,307<br />

Assets 9,065 1,920 1,938 1,967 1,034 15,924<br />

Return on sales (%) 18.3% 12.2% -10.5% 72.6% NA 16.4%<br />

ROA (%) 13.3% 6.1% -1.7% 2.7% -3.4% 8.2%<br />

Source: Company Financials, 2011<br />

Overall, the <strong>company</strong>’s sales grew by 14.7% in 2011 to reach SAR 7.95 billion. The poultry segment<br />

showed the biggest increase of more than 81% - a trend that it is expected to continue in the<br />

coming years and which will increase the contribution of this sector to the <strong>company</strong>’s total<br />

revenues. In addition, Almarai is trying to improve the efficiency of the bakery segment in 2012, the<br />

one that reported below <strong>company</strong> average profitability margins in 2011. The fresh dairy segment,<br />

the most <strong>mature</strong> one, reports the lowest <strong>growth</strong> but the highest profitability margins, despite the<br />

government interaction. Even though the <strong>company</strong> is expanding in other GCC markets outside the<br />

Kingdom, the KSA contribution slightly dropped in 2011 but remained high at 71.1% compared to<br />

71.2% in 2010. Any expansion outside Saudi Arabia can give the <strong>company</strong> more flexibility to price<br />

its products, will offer the necessary diversification and most importantly will open a door to grow<br />

for its <strong>mature</strong> business lines.<br />

As of June 2011, about SAR 3.5 billion of the <strong>company</strong> assets did not contribute to the bottom line.<br />

During 2012, the <strong>company</strong> does not have plans to do any acquisition, instead it plans to improve<br />

efficiency and synergy in order to optimize its benefits from the current portfolio.<br />

BABY FOOD MARKET<br />

Demand for the baby food in KSA reached 19.5 million kg in 2011 and it is expected to increase at<br />

a CAGR rate of 12.5% in the coming 3 years due to population <strong>growth</strong> and changes in consumer<br />

trends. The milk formula market value represents 79% of the total baby food market value in KSA.<br />

Chart 14: Baby Food Market by Subsector, 2010<br />

Source: Agriculture and Agri-Food Canada<br />

Supply in this sector is highly concentrated and just 4 players dominate 70% of the market, and all<br />

the supply is imported.<br />

10

ALMARAI<br />

IPNC is going to be the first infant<br />

formula producer in the region<br />

IDJ is still not performing as expected<br />

March 05, 2012<br />

Table 2: Main Players in KSA<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

Producer Volume Share<br />

Abbott 24%<br />

Wyeth 20%<br />

Nestle 15%<br />

Saudi <strong>Center</strong> for Pharmaceuticals 11%<br />

The baby food price has showed high increase in the Kingdom during the last months. Hence, the<br />

Ministry of Commerce and Industry has intervened to contain the unreasonable hike of baby milk<br />

prices. According to the ministry, importers should take only a marginal profit especially that the<br />

government announced a subsidy of SAR 12/kg.<br />

Almarai, which approved in 2009 a plan to invest SAR 650 million in this sector (current investment<br />

reached SAR 800 million), formed a 50:50 JV with Mead Johnson Nutrition, International Pediatric<br />

Nutrition Company (IPNC). IPNC currently imports infant nutrition products produced in USA and<br />

Netherlands. This will continue up to the commencement of local production, expected to start in<br />

Q2 2012. Locally produced products will be introduced to the market only after full compliance is<br />

achieved with all required quality standards and metrics, according to the <strong>company</strong>. IPNC plans to<br />

not only serve the Saudi market but also other GCC and MENA markets currently valued at USD 560<br />

million.<br />

Pharmacies dominate the distribution channel in KSA with a market share of 78%, followed by<br />

supermarkets at 18%. Almarai is establishing its distribution channels with hospitals, pharmacies and<br />

doctors. In addition, Almarai has the opportunity to distribute the infant products in supermarkets<br />

through PANDA, which is owned by Savola, a major shareholder in Almarai.<br />

INTERNATIONAL DAIRY AND JUICE LIMITED (IDJ)<br />

In 2009, Almarai formed a 48:52 JV with PepsiCo in order to catch new business opportunities in dairy<br />

and juice products in Southeast Asia, Africa and the Middle East excluding the GCC market. IDJ will<br />

benefit from the good reputation for Almarai to enter markets that share close characteristics to that<br />

of KSA, especially MENA and Muslim countries, which will benefit PepsiCo. On the other hand, this JV<br />

will benefit from the well established distribution chain of Pepsi in these countries, which will save<br />

cost for Almarai. IDJ owns 100% of the Egyptian Beyti Company and also 75% of the Jordanian Teeba.<br />

IDJ reported first quarter profit in Q3 11, however the <strong>company</strong> reported losses again in Q4 11 because<br />

of one time provision of SAR 12 million in Jordan to clean the balance sheet, as declared by Almarai.<br />

The unrest in Egypt and also in Jordan negatively affected the <strong>company</strong>, especially in November and<br />

December 2011. Despite that the export did well, it did not compensate for the negative performance<br />

in these countries. IDJ is looking to buy a farm in Egypt to provide good quality milk supply, as the case<br />

in Jordan. Almarai and Pepsi Tropicana are the main players in both countries.<br />

Almarai lately declared that it will slightly increase its investment in IDJ in order to be involved more in<br />

the management of this <strong>company</strong>. Details will be released later this month.<br />

11

ALMARAI<br />

Capex of SAR 6.5 billion expected in 3<br />

years<br />

March 05, 2012<br />

GENEROUS CAPITAL EXPENDITURE<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

For the past 3 years, more than 34% of Almarai’s sales revenues have been ploughed back into<br />

business development, infrastructure and technology. The <strong>company</strong> capex totaled SAR 3.2 billion<br />

in 2011, including:<br />

1 Poultry expansion.<br />

1 Development in the infant nutrition facility.<br />

1 Establishment of the dairy and food polytechnic in Al Kharj.<br />

1 Improvement of the <strong>company</strong>’s distribution capabilities.<br />

1 Backward integration with the acquisition of Blue Yulan and Fondomonte<br />

Almarai plans to spend SAR 2.8 billion in 2012. No acquisition are expected, rather the <strong>company</strong> will<br />

focus on improving efficiency.<br />

ESTABLISHED DISTRIBUTION CHANNELS<br />

Almarai fleet comprises of more than 800 trailers and 66 tankers that transport products from the<br />

manufacturing facilities to the 90 sales depots in the GCC. The <strong>company</strong> is also establishing depots<br />

in Oman and Kuwait. It has about 3,000 vans serving 50,000 retail outlets on a daily basis. This large<br />

distribution channel puts the <strong>company</strong> is an advanced position compared to its peers in GCC,<br />

allowing it to easily distribute new products in the GCC market.<br />

CHANGES IN THE WORK ENVIRONMENT<br />

Material costs consumed 43.2% of total 2011 revenues for Almarai, compared to 41.5% in 2010. Both<br />

ingredients and feed costs form 76% of total material cost, and they were negatively affected by<br />

high inflation during 2011. Packaging costs form 24% of material cost and they were hit by increased<br />

crude oil prices which also impacted distribution cost. Labor and overhead cost consumed 37.7% of<br />

the <strong>company</strong>’s 2011 total revenues. Almarai workforce enlarged from 17 thousand workers in 2010<br />

to 22 thousands in 2011, and a similar number is expected to be added during 2012. These factors,<br />

combined with unpleased performance from IDJ and most significantly the inability to pass the<br />

increase in raw material costs, negatively affected the EBIT margin which dropped by 200 bps to<br />

stabilize at 19.1% in 2011, first time below the targeted 20% since 2006.<br />

DEBT IS INCREASING<br />

Almarai paid more than SAR 3.2 billion capex and SAR 0.5 billion cash dividend in 2011, and it<br />

generated only SAR 1.9 billion cash flow from operating activities. As such, the <strong>company</strong>’s net debt<br />

increased by more than SAR 2 billion in 2011 to reach SAR 6.7 billion. On the other hand, average<br />

cost of borrowing dropped from 3.19% in 2010 to 2.15% in 2011. Net debt to equity ratio increased<br />

from 75.6% in 2010 to 99.6% in 2011. While Almarai targets 1:1 ratio on the medium term, it is<br />

expected that 2012 ratio may be slightly higher because of the high capex of SAR 2.8 billion. The<br />

<strong>company</strong> plans to diversify its sources of fund by issuing Sukuk. The first tranche of SAR 1.5 billion<br />

to be offered in a private placement this month, arranged by HSBC. About SAR 800 million are for<br />

refinancing purposes and the remaining amount is to partially finance the <strong>company</strong> 2012 capex.<br />

While a tenor of 6 months is expected for the SAR 500 million tranche, tenor of 5 to 7 years is<br />

expected for the other SAR 1 billion.<br />

12

ALMARAI<br />

March 05, 2012<br />

DIVIDEND AND BONUS SHARE<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

In compliance with the <strong>company</strong> <strong>strategy</strong> to distribute 40% of the net profits to shareholders,<br />

Almarai’s board recommended to pay total dividend of SAR 517.5 million (DPS =SAR 2.25) for the<br />

financial year 2011. In addition, the board recommended to increase its share capital from SAR 2.3<br />

billion to SAR 4.0 billion by distributing 1 bonus share for every 1.35 existing share. Such increase will<br />

be paid by transferring an amount of SAR (1,600,500,000) from share premium and SAR (99,500,000)<br />

from retained earnings to the <strong>company</strong>’s capital.<br />

ZAIN WRITE OFF<br />

Almarai has 35 million shares bought at par of SAR 10/share in Zain KSA <strong>company</strong>. The market<br />

value of Zain share has been significantly below cost for a prolonged period of time and so Almarai<br />

management took the decision to impair this investment resulting in an impairment loss of SAR<br />

160.2 million in the full year 2011 income statement.<br />

13

ALMARAI<br />

March 05, 2012<br />

SWOT ANALYSIS<br />

STRENGTHS<br />

1 Diversified business<br />

1 Well recognized brand<br />

1 Leading market share<br />

1 Extensive distribution coverage<br />

WEAKNESSES<br />

1 High crude oil price<br />

1 Some assets are still non profitable<br />

1 Lack of pricing flexibility<br />

1 Increase in labor cost<br />

OPPORTUNITIES<br />

1 Domestic production of the infant food<br />

1 Expanding in the poultry segment<br />

1 Expanding regionally<br />

1 Drop of the input cost<br />

THREATS<br />

1 Increasing debt level<br />

1 Intensive capital expenditure<br />

1 Competition from local and global players<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

1 Political instability threats regional expansion<br />

14

ALMARAI<br />

March 05, 2012<br />

VALUATION<br />

DIVIDEND DISCOUNT MODEL (DDM)<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

A risk-free rate of 2.02% and an expected market return of 14.25% were used in our model. In<br />

addition, a beta of 0.79 was considered, representing the low correlation with Tadawul. A terminal<br />

<strong>growth</strong> rate of 5.0% was used considering above global average population <strong>growth</strong> and inflation. A<br />

fair value of SAR 118.32 was obtained.<br />

Table 3: DDM<br />

2012e 2013e 2014e 2015e<br />

EPS SAR 6.61 8.09 9.70 10.71<br />

DPS SAR 2.75 3.50 4.00 9.50<br />

PV of DPS SAR 2.51 2.91 3.03 6.57<br />

PV of TV SAR 103.30<br />

Cost of Equity 11.68%<br />

Current Shares Outstanding million 230<br />

Terminal Growth Rate 5.00%<br />

Fair Value SAR 118.32<br />

FREE CASH FLOW TO EQUITY (FCFE) MODEL<br />

Same assumptions as DDM were used. A fair value of SAR 113.92 was derived.<br />

Table 4: FCFE Model<br />

2012e 2013e 2014e 2015e<br />

NI SAR million 1,519 1,862 2,231 2,464<br />

NCC SAR million 622 694 762 816<br />

Capex SAR million 2,800 2,450 2,250 2,000<br />

Change in WC SAR million 227 254 427 81<br />

Change in Debt SAR million 1,425 1,000 650 900<br />

FCFE SAR million 539 852 965 2,099<br />

PV of FCFE SAR million 491 709 732 1,452<br />

PV of TV SAR million 22,818<br />

Cost of Equity 11.68%<br />

Current Shares Outstanding million 230<br />

Fair Value SAR 113.92<br />

15

ALMARAI<br />

March 05, 2012<br />

RELATIVE VALUATION<br />

Table 5: Relative Valuation<br />

Company PE 11 PE<br />

12e<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

EPS G PEG ROA DVD<br />

11<br />

DVD<br />

12e<br />

PB EV/<br />

EBITDA<br />

EV/EBITDA<br />

12e<br />

Debt/<br />

Equity<br />

Saputo inc 18.26 16.54 10.0% 1.65 13.0% 1.6% 1.8% 3.71 10.82 10.35 25%<br />

Danone SA 18.84 15.45 9.5% 1.63 7.1% 2.6% 3.0% 2.64 11.65 10.68 88%<br />

Morinaga 13.86 15.84 -25.4% NA 1.8% 2.4% 2.4% 0.67 5.28 4.55 86%<br />

China<br />

Mengniu<br />

18.19 19.30 24.7% 0.78 7.9% 1.1% 1.3% 2.48 13.60 9.12 6%<br />

Nestlé 18.24 16.64 8.0% 2.09 8.4% 3.3% 3.8% 3.02 12.15 11.61 38%<br />

Unilever 16.99 15.18 6.3% 2.42 9.6% 3.5% 3.9% 5.06 10.39 10.07 92%<br />

Parmalat 9.81 17.73 -1.2% NA 6.1% 2.1% 2.7% 0.65 8.80 4.47 1%<br />

Kraft 17.14 16.71 15.6% 1.07 5.1% 3.1% 3.0% 2.04 11.82 10.58 79%<br />

Normalized<br />

Average<br />

16.42 16.67 12.3% 1.61 7.4% 2.5% 2.7% 2.53 11.32 9.55 52%<br />

Almarai 18.62 15.93 16.9% 0.94 8.1% 2.1% 2.5% 3.57 15.18 12.99 102%<br />

* NI excluding impairment loss is used for Almarai Fair Value<br />

Source: Bloomberg, ASIB<br />

Almarai is expected to report above average <strong>growth</strong> in earnings in 2012 and so one of the lowest<br />

PEG ratio among peers. In addition, it reports one of the highest ROA margin and average dividend<br />

yield. However, the stock is traded at a discount of 5%. We believe that the <strong>company</strong> should be<br />

traded at a premium compared to peers.<br />

On the other hand, Almarai EV/EBITDA is higher than its peers reflecting the fact that some of the<br />

<strong>company</strong>’s assets are still not contributing to the bottom line and because Almarai has higher debt<br />

ratio than peers and also because of higher <strong>growth</strong>.<br />

FAIR VALUE AND RECOMMENDATION<br />

Almarai delivered stable <strong>growth</strong> over the last years thanks to the long term vision the management<br />

has. Since the introduction of the 5 year plan which is revised annually, the <strong>company</strong> succeeded in<br />

developing new products in existing business lines (dairy, juice and bakery), entering new segments<br />

(poultry and infant formula) and penetrating new markets (outside KSA). Despite that some of the<br />

assets are not contributing to the bottom line yet, Almarai is focusing on improving efficiency<br />

in the coming years. The dairy and juice sector will assure the needed stability to the <strong>company</strong>’s<br />

performance in 2012. We expect the infant formula to perform well in 2012 and the poultry business<br />

to move gradually to be a profitable unit in the coming15 to 18 months. On the other hand, the<br />

<strong>company</strong>’s main risk remains the lack of pricing flexibility inside KSA. Almarai regional expansion<br />

through IDJ is facing difficulties which management related them to political instability. We believe<br />

other unmentioned factors are behind this performance which will require from Almarai to be more<br />

involved in the management of IDJ.<br />

However, we believe that most of the positive aspects for the <strong>company</strong> are already reflected in the<br />

market valuation. Downside risk is limited but the <strong>company</strong> does not offer high upside potential<br />

considering the current conditions, especially that Almarai does not plan to increase prices at the<br />

time when the <strong>company</strong> expects that most the 2011 costs are going to remain in 2012.<br />

Our fair value is purely derived from fundamental valuation. An equal weight was assigned to each<br />

method and a fair value of SAR 116 was derived, reflecting an upside potential of 13% over the<br />

current price. Therefore, we initiate our coverage with an accumulate recommendation.<br />

16

ALMARAI<br />

March 05, 2012<br />

FINANCIAL ANALYSIS<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

SAR millions 2011 2012e 2013e 2014e 2015e<br />

Sales 7,951 9,153 10,767 12,505 13,438<br />

Sales Growth 14.7% 15.1% 17.6% 16.1% 7.5%<br />

COGS (4,954) (5,682) (6,638) (7,666) (8,170)<br />

Gross Profit 2,997 3,471 4,129 4,839 5,268<br />

Gross Margin 37.7% 37.9% 38.4% 38.7% 39.2%<br />

Selling & Distribution Expenses (1,213) (1,400) (1,647) (1,901) (2,043)<br />

G&A Expenses (266) (311) (361) (419) (443)<br />

Share of Loss from Associates (42) (30) 0 20 50<br />

EBIT 1,518 1,759 2,121 2,520 2,782<br />

EBIT Margin 19.1% 19.2% 19.7% 20.2% 20.7%<br />

Bank Charges (135) (164) (204) (242) (295)<br />

Zakat (33) (39) (48) (57) (63)<br />

Impairment of Investments (160) 0 0 0 0<br />

Income before Minority Interest 1,147 1,526 1,870 2,241 2,474<br />

Minority Interest (7) (7) (8) (10) (10)<br />

Net Income 1,140 1,519 1,862 2,231 2,464<br />

NI Growth -11.4% 33.3% 22.5% 19.8% 10.4%<br />

Net Margin 14.3% 16.6% 17.3% 17.8% 18.3%<br />

SAR million 2011 2012e 2013e 2014e 2015e<br />

Cash & Equivalents 272 277 300 328 373<br />

Inventories 1,697 1,932 2,191 2,530 2,696<br />

Others 618 618 620 630 600<br />

Total Current Assets 2,586 2,827 3,111 3,488 3,669<br />

PPE net 10,508 12,529 14,159 15,539 16,638<br />

Biological Assets 818 975 1,102 1,209 1,295<br />

Goodwill 827 840 860 870 870<br />

Others 915 920 954 912 861<br />

Total Non Current Assets 13,068 15,264 17,074 18,530 19,664<br />

Total Assets 15,654 18,091 20,185 22,019 23,333<br />

Short Term Loans 1,209 1,253 1,309 1,400 1,526<br />

Payables & Accruals 1,513 1,517 1,531 1,450 1,500<br />

Others 96 101 94 97 103<br />

Total Current Liabilities 2,818 2,871 2,934 2,947 3,129<br />

Long Term Loans 5,717 7,098 8,041 8,600 9,374<br />

Employees' Termination Benefits 243 276 292 301 309<br />

Total Non Current Liabilities 6,058 7,446 8,418 8,974 9,774<br />

Total Liabilities 8,876 10,316 11,352 11,921 12,903<br />

Total Shareholders Equity 6,718 7,708 8,765 10,026 10,354<br />

Minority Interest 59 67 68 72 76<br />

Total Equity 6,778 7,775 8,833 10,098 10,430<br />

17

ALMARAI<br />

March 05, 2012<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

2011 2012e 2013e 2014e 2015e<br />

ROAA 8.1% 9.0% 9.7% 10.6% 10.9%<br />

ROAE 17.7% 21.1% 22.6% 23.7% 24.2%<br />

Net Debt to Equity 0.98 1.04 1.02 0.96 1.01<br />

Interest Coverage Ratio 11.24 10.74 10.42 10.42 9.44<br />

Capex/Sales 41% 31% 23% 18% 15%<br />

Depreciation/Capex 16% 22% 28% 34% 41%<br />

PE 21.24 15.93 13.00 10.85 9.83<br />

PB 3.57 3.11 2.74 2.40 2.32<br />

Dividend Yield 2.1% 2.5% 3.1% 3.7% 8.7%<br />

EV/EBITDA 15.18 12.99 10.98 9.42 8.60<br />

18

ALMARAI<br />

FAIR VALUE DEFINITION<br />

March 05, 2012<br />

RATING GUIDE<br />

ISSUER<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

It is an unbiased estimate of the 12-month potential market price of the stock<br />

SELL REDUCE HOLD ACCUMULATE BUY<br />

Downside -30% -10% +10% +30% Upside<br />

BUY: Upside potential in share price is more than 30%<br />

ACCUMULATE: Upside potential in share price is between 10 and 30%<br />

HOLD: Upside or downside potential in share price less than 10%<br />

REDUCE: Downside potential in share price is between 10 and 30%<br />

SELL: Downside potential in share price is more than 30%<br />

Audi Saradar Investment Bank<br />

Audi Saradar Investment Bank SAL • Lebanese joint stock <strong>company</strong> with a registered capital of<br />

10,000,000,000 Lebanese Pounds • Commercial Registrar in Beirut: 30812 • Holding number 33 on<br />

the Central Bank’s Banks List.<br />

Bank Audi Plaza • Bab Idriss • Beirut 2021 8102 Lebanon • P.O. Box 11-2560 • Beirut 1107 2808 •<br />

Lebanon. Phone: +961 1 964072 • Fax: +961 1 970403 • Email: contactus@asib.com<br />

19

ALMARAI<br />

March 05, 2012<br />

DISCLAIMER<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

“All rights reserved. This research document (the “Document”) is prepared by Audi Saradar Investment Bank SAL (“ASIB”),<br />

being an entity of Audi Saradar Group, for the use of the clients of ASIB and/or the clients of any entity within the Audi<br />

Saradar Group.<br />

This Document is disclosed to you on a confidential basis. Receipt and/or review of this Document constitute your agreement<br />

not to copy, modify, redistribute, retransmit, or disclose to others the contents, opinions, conclusion, or information<br />

contained in this Document prior to public disclosure of the same by ASIB or the Audi Saradar Group or without the express<br />

prior written consent of ASIB.<br />

This Document is not intended for dissemination, distribution to, or use by, any person or entity in any country or jurisdiction<br />

which would subject ASIB or any entity within the Audi Saradar Group, to any registration or licensing requirements within<br />

these jurisdictions or where it might be considered as unlawful. Accordingly, this Document is for distribution solely in<br />

jurisdictions where permitted and to persons who may receive it without breaching any applicable legal or regulatory<br />

requirements. In any case, this Document shall not be distributed in the Republic of Egypt.<br />

Your attention is drawn to the fact that you should not access this Document if the regulations of your country of citizenship<br />

and/or residency or any applicable regulations prohibit it. In any case, persons who are subject to any restrictions in any<br />

country, such as US persons are not permitted to access information contained herein.<br />

Neither the information, nor any opinion expressed herein constitutes an offer or an invitation or a recommendation to<br />

make an offer, to buy or sell any security or other investment product related to such security or investment. This Document<br />

provides general information only, is not intended to provide personal investment advice or recommendation and does not<br />

take into account the specific investment objectives, financial situation and the particular needs of any specific person who<br />

may receive it. You should seek financial, legal or tax advice regarding the appropriateness and suitability in investing in any<br />

security, other investment or investment <strong>strategy</strong> discussed or forecasted in this Document.<br />

You should carefully read the definitions of the Rating Guide provided in this Document. In addition you should read this<br />

Document in its entirety and not conclude its contents from the ratings solely.<br />

The information herein was obtained from various public sources believed in good faith to be reliable. Neither ASIB nor any<br />

entity within the Audi Saradar Group represents that the information contained in this Document is complete, accurate<br />

or free from any error and makes no representations or warranties whatsoever as to the data, information and opinions<br />

provided herein.<br />

This Document and any information, opinion and prospect contained herein reflect a judgment at its original date<br />

of publication by ASIB and are subject to change without notice. ASIB and/or any entity within the Audi Saradar Group<br />

may have issued, and may in the future issue, other research documents that are inconsistent with, and reach different<br />

conclusions from, the information, opinions and prospects presented in this Document.<br />

This Document reflects the different assumptions, views and analytical methods of the analysts who prepared them; ASIB,<br />

and the Audi Saradar Group are under no obligation to ensure that such other research documents are brought to the<br />

attention of any recipient of this Document.<br />

ASIB, any entity within the Audi Saradar Group, one or more of their affiliates and/or their officers (including but not limited<br />

to their strategists, analysts and sales staff) may have a financial interest in securities of the issuer(s) or related investments,<br />

may engage in securities transactions, on a proprietary basis or otherwise, in a manner inconsistent with the view taken in<br />

this Document and may take a view that is inconsistent with that taken herein.<br />

The price, value of and income from any of the securities or financial instruments mentioned in this Document can fall as well<br />

as rise. The value of securities and financial instruments is subject to market conditions, volatility, exchange rate fluctuation<br />

and credit quality of any issuer that may have a positive or adverse effect on the price or income of such securities or<br />

financial instruments. Any forecasts on the economy, stock market, bond market or the economic trends of the markets are<br />

not necessarily a guide to future returns. You should understand that statements regarding future prospects may not be<br />

realized. Past performance should not be taken as an indication or guarantee of future performance, and no representation<br />

or warranty, express or implied, is made regarding future returns. As a result of the preceding, you may lose, as the case may<br />

be, the amount originally invested.<br />

None of ASIB, any entity within the Audi Saradar Group, any of their affiliates and/or their officers (including but not limited<br />

to their strategists, analysts and sales staff) shall be held liable for any loss or damage that may arise, directly or indirectly,<br />

from any use of the information contained in this Document nor for any decision or investment made on the basis of<br />

information contained herein.”<br />

20