sabic - Search Center - Bank Audi

sabic - Search Center - Bank Audi

sabic - Search Center - Bank Audi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

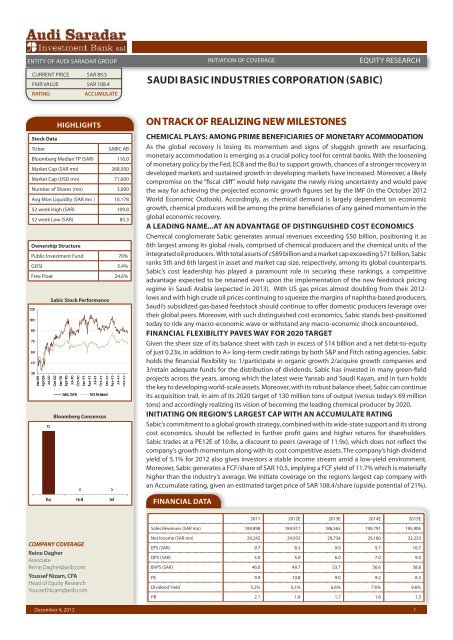

ENTITY OF AUDI SARADAR GROUP<br />

CURRENT PRICE SAR 89.5<br />

FAIR VALUE SAR 108.4<br />

RATING ACCUMULATE<br />

Stock Data<br />

December 4, 2012<br />

HIGHLIGHTS<br />

Ticker SABIC AB<br />

Bloomberg Median TP (SAR) 116.0<br />

Market Cap (SAR mn) 268,500<br />

Market Cap (USD mn) 71,600<br />

Number of Shares (mn) 3,000<br />

Avg Mon Liquidity (SAR mn ) 10,178<br />

52 week High (SAR) 109.8<br />

52 week Low (SAR) 85.3<br />

Ownership Structure<br />

Public Investment Fund 70%<br />

GOSI 5.4%<br />

Free Float 24.6%<br />

Sabic Stock Performance<br />

Bloomberg Consensus<br />

COMPANY COVERAGE<br />

Reine Dagher<br />

Associate<br />

Reine.Dagher@asib.com<br />

Youssef Nizam, CFA<br />

Head of Equity Research<br />

Youssef.Nizam@asib.com<br />

SAUDI BASIC INDUSTRIES CORPORATION (SABIC)<br />

ON TRACK OF REALIZING NEW MILESTONES<br />

EQUITY RESEARCH<br />

CHEMICAL PLAYS: AMONG PRIME BENEFICIARIES OF MONETARY ACOMMODATION<br />

As the global recovery is losing its momentum and signs of sluggish growth are resurfacing,<br />

monetary accommodation is emerging as a crucial policy tool for central banks. With the loosening<br />

of monetary policy by the Fed, ECB and the BoJ to support growth, chances of a stronger recovery in<br />

developed markets and sustained growth in developing markets have increased. Moreover, a likely<br />

compromise on the “fiscal cliff” would help navigate the newly rising uncertainty and would pave<br />

the way for achieving the projected economic growth figures set by the IMF (in the October 2012<br />

World Economic Outlook). Accordingly, as chemical demand is largely dependent on economic<br />

growth, chemical producers will be among the prime beneficiaries of any gained momentum in the<br />

global economic recovery.<br />

A LEADING NAME...AT AN ADVANTAGE OF DISTINGUISHED COST ECONOMICS<br />

Chemical conglomerate Sabic generates annual revenues exceeding $50 billion, positioning it as<br />

6th largest among its global rivals, comprised of chemical producers and the chemical units of the<br />

integrated oil producers. With total assets of c$89 billion and a market cap exceeding $71 billion, Sabic<br />

ranks 5th and 6th largest in asset and market cap size, respectively, among its global counterparts.<br />

Sabic’s cost leadership has played a paramount role in securing these rankings, a competitive<br />

advantage expected to be retained even upon the implementation of the new feedstock pricing<br />

regime in Saudi Arabia (expected in 2013). With US gas prices almost doubling from their 2012lows<br />

and with high crude oil prices continuing to squeeze the margins of naphtha-based producers,<br />

Saudi’s subsidized gas-based feedstock should continue to offer domestic producers leverage over<br />

their global peers. Moreover, with such distinguished cost economics, Sabic stands best-positioned<br />

today to ride any macro-economic wave or withstand any macro-economic shock encountered.<br />

FINANCIAL FLEXIBILITY PAVES WAY FOR 2020 TARGET<br />

Given the sheer size of its balance sheet with cash in excess of $14 billion and a net debt-to-equity<br />

of just 0.23x, in addition to A+ long-term credit ratings by both S&P and Fitch rating agencies, Sabic<br />

holds the financial flexibility to: 1/participate in organic growth 2/acquire growth companies and<br />

3/retain adequate funds for the distribution of dividends. Sabic has invested in many green-field<br />

projects across the years, among which the latest were Yansab and Saudi Kayan, and in turn holds<br />

the key to developing world-scale assets. Moreover, with its robust balance sheet, Sabic can continue<br />

its acquisition trail, in aim of its 2020 target of 130 million tons of output (versus today’s 69 million<br />

tons) and accordingly realizing its vision of becoming the leading chemical producer by 2020.<br />

INITIATING ON REGION’S LARGEST CAP WITH AN ACCUMULATE RATING<br />

Sabic’s commitment to a global growth strategy, combined with its wide-state support and its strong<br />

cost economics, should be reflected in further profit gains and higher returns for shareholders.<br />

Sabic trades at a PE12E of 10.8x, a discount to peers (average of 11.9x), which does not reflect the<br />

company’s growth momentum along with its cost competitive assets. The company’s high dividend<br />

yield of 5.1% for 2012 also gives investors a stable income stream amid a low-yield environment.<br />

Moreover, Sabic generates a FCF/share of SAR 10.5, implying a FCF yield of 11.7% which is materially<br />

higher than the industry’s average. We initiate coverage on the region’s largest cap company with<br />

an Accumulate rating, given an estimated target price of SAR 108.4/share (upside potential of 21%).<br />

FINANCIAL DATA<br />

INITIATION OF COVERAGE<br />

2011 2012E 2013E 2014E 2015E<br />

Sales Revenues (SAR mn) 189,898 184,917 186,565 190,791 195,906<br />

Net Income (SAR mn) 29,242 24,933 29,734 29,180 32,233<br />

EPS (SAR) 9.7 8.3 9.9 9.7 10.7<br />

DPS (SAR) 5.0 5.0 6.0 7.0 9.0<br />

BVPS (SAR) 46.0 49.7 53.7 56.6 58.8<br />

PE 9.9 10.8 9.0 9.2 8.3<br />

Dividend Yield 5.2% 5.1% 6.6% 7.6% 9.6%<br />

PB 2.1 1.8 1.7 1.6 1.5<br />

1

SABIC INITIATION OF COVERAGE<br />

EQUITY RESEARCH<br />

December 4, 2012<br />

FOOTNOTES<br />

INVESTMENT CASE<br />

CHEMICAL PLAYS: AMONG PRIME BENEFICIARIES OF MONETARY ACOMMODATION<br />

As the global recovery is losing its momentum and signs of sluggish growth are resurfacing, monetary<br />

accommodation is emerging as a crucial policy tool for central banks. Quantitative easing measures<br />

are already underway given: the unlimited bond-purchase program announced by the European<br />

Central <strong>Bank</strong> on September 6, the third round of bond-buying by the US Federal Reserve announced<br />

on September 13th, and the <strong>Bank</strong> of Japan following suit by expanding its asset-purchase fund by<br />

$264 billion. Positive stimulus signals have also extended from China with an infrastructure package<br />

of $158 billion approved in early September. As such, with the loosening of monetary policy by<br />

the Fed, ECB and the BoJ to support growth, chances of a stronger recovery in developed markets<br />

and sustained growth in developing markets have increased. Moreover, a likely compromise on the<br />

“fiscal cliff” would help navigate the newly rising uncertainty and would pave the way for achieving<br />

the projected economic growth figures set by the IMF (in the October 2012 World Economic<br />

Outlook). Accordingly, as chemical demand is largely dependent on economic growth and as<br />

earnings of chemical companies closely track the global manufacturing and industrial activities,<br />

chemical producers will be among the first and the largest to build on any gained momentum in the<br />

global economic recovery. Accordingly, the improvement in real demand for chemicals, combined<br />

with the well-paced capacity expansions, should elevate the global chemical utilization rate from its<br />

33-month low of 84.8%.<br />

Table 1: Projected Growth Rates of Key Economies<br />

Real GDP % 2011 2012E 2013E<br />

World 3.8% 3.3% 3.6%<br />

Advanced Economies 1.6% 1.3% 1.5%<br />

US 1.7% 2.2% 2.1%<br />

Euro Area 1.4% -0.4% 0.2%<br />

Emerging Economies 6.2% 5.3% 5.6%<br />

China 9.2% 7.8% 8.2%<br />

India 7.1% 4.9% 6.0%<br />

Source: IMF World Economic Outlook, October 2012<br />

KEY CHEMICAL MARKETS EXPECTED TO TIGHTEN<br />

Despite a bearish demand environment for crude oil, prices are not expected to subdue in the<br />

medium-term with projections signaling a c$110/bbl floor for Brent. The support for crude oil prices<br />

should stem from: 1/geo-political risks in the region 2/ stimulus effect of QE3 by the US Fed and<br />

3/ further stimulus measures by other key central banks. Not to mention that the first two factors<br />

are expected to linger for an undefined period of time, as geo-political tensions are escalating and<br />

the quantitative easing of the US Federal Reserve is widely expected to be the open-ended type of<br />

bond-buying.<br />

On another front, the oversupplied global chemical markets are expected to tighten over next 4-5<br />

years on the back of stronger chemical demand, as a recovery in developed markets and strong<br />

growth in emerging markets lead to additional demand. Global demand for ethylene, the most<br />

common basic chemical in the industry, is projected to grow at a CAGR of 4.53% for the period 2011<br />

till 2016. Global capacity for ethylene, on the other hand, is projected to grow at a CAGR of 3.05%<br />

for the same period given limited capacity additions across the globe. The excess oversupply of<br />

ethylene is expected to fall from an estimated 23 million tons in 2011 to an estimated 16 million tons<br />

in 2016. Accordingly, the share of the ethylene surplus of global supply will contract from 15.5% to<br />

9.3% for the same period 1 .<br />

1 Source: Braskem Investor Relations presentation, citing IHS<br />

2

SABIC<br />

December 4, 2012<br />

FOOTNOTES<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

As a result, with a strong crude oil environment 2 and a tighter global chemical market, downside<br />

risk to chemical prices is limited, providing opportunities of wider margins for fixed-cost producers<br />

such as Sabic.<br />

Chart 1: Brent Price Forecasts ($/bbl) Chart 2: Global Ethylene Market<br />

Source: Bloomberg Commodity Price Forecasts Source: Braskem Investor Relations presentation, citing IHS<br />

On a further note, the global industry cost curve is being reshaped with the boom in shale gas<br />

development in the US and the coal-to-chemical technologies in China. The US, which historically<br />

dominated the production landscape, is regaining ground with a wave of new petrochemical<br />

investments estimated at $25 billion 3 . The boost in North American ethylene capacity, estimated at<br />

10 million tons through 2017 or 6.5% of global ethylene capacity 4 , is taking place as the country’s<br />

ethane is resurfacing as a globally competitive feedstock. China, already a leading producer<br />

of petrochemicals, is boosting its share as it is tapping into coal as a new feedstock (given its<br />

massive coal reserves and low prices of coal in the inland West of the country). Yet even with these<br />

developments, the Middle East and particularly Saudi Arabia will remain positioned at the bottom<br />

of the industry cost curve and will accordingly retain its cost leadership (for further details, please<br />

refer to p.13).<br />

Chart 3: Market Shares of Top Producers Chart 4: 2011 Chemical Output of GCC (mn MT)<br />

Source: KPMG, cited by Sixth Annual GPCA Forum Source: MEED<br />

2 Petrochemical prices have a propensity to trail crude oil prices, as the marginal cost of petrochemical production<br />

is determined by naphtha-based producers (mainly European producers)<br />

3 Source: American Chemistry Council, cited by Bloomberg<br />

4 Source: Nexant, cited by Bloomberg<br />

3

SABIC<br />

December 4, 2012<br />

FOOTNOTES<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

FERTILIZER INDUSTRY FUNDAMENTALS STILL FIRM<br />

Agricultural market conditions have remained tight. Global grain stocks are still at a historical low,<br />

with the stocks-to-use ratio falling significantly over the past ten years. Corn, the most traded<br />

grain in the global coarse grain trade, is witnessing falling stock-to-consumption levels for the crop<br />

calendar year 2012/13, reaching historical lows again.<br />

Chart 5: Global Stocks-to-Use % of Corn<br />

Source: Bloomberg<br />

Moreover, the world population is progressively increasing and eating habits, especially in<br />

developing countries, are improving. In turn, and amid such low stock levels, there is a need for an<br />

increase in global grain production to counter the continuing growth in demand for food, feed and<br />

fuel. Strong grain prices in the markets today should also incentivize farmers to increase agricultural<br />

activity. With global grain production supported across the years, fertilizer demand should also<br />

remain strong. Global demand for nitrogen fertilizers is projected to grow at a CAGR of 1.5% for the<br />

period 2012-2016, with global demand for urea specifically projected to grow at a CAGR 2.1% for<br />

the same period. Global supply of nitrogen fertilizers is also expected to largely increase in parallel,<br />

particularly with the emergence of new capacity in China, with figures pointing to a CAGR 12-16 of<br />

3.6%. Global supply of urea is projected to grow at a CAGR of 4.1% for the period 2012-2016 5 .<br />

Although the growing surplus in the nitrogen fertilizer markets threatens the long-term outlook<br />

of the industry, this threat should be mitigated given that the fertilizer industry today is demanddriven.<br />

Moreover, support for the industry, particularly pricing support, should stem from:<br />

1 Limited export volumes from China, given its strict urea export policy, keeping global markets<br />

somewhat immune from its massive capacity additions<br />

1 Continued project delays slowing down projected capacity growth<br />

1 A tight global grain outlook keeping prices at historical highs<br />

1 Attractive grain prices incentivizing farmers<br />

1 Swing producers’ production cost remaining relatively high<br />

5 Fertilizer Outlook 2012-2016, IFA<br />

4

SABIC<br />

December 4, 2012<br />

FOOTNOTES<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

These factors should continue supporting fertilizer prices, offsetting any downside risks originating<br />

from supply and demand imbalances in the market. In turn, fertilizer producers with both a cash<br />

cost advantage and a strong market presence, such as Sabic’s fertilizer SBU 6 , should stand best<br />

to capitalize on this stable industry environment and earn a stable income amidst such a volatile<br />

macro-economic environment.<br />

GCC STEEL MARKET STILL EXHIBITING BUOYANT FACTORS<br />

The global steel capacity utilization continues to be around 80%, reflecting weak demand and<br />

major overcapacity. These factors have exerted downward pressure on steel prices, reflected<br />

through a plunge of c14% over the course of the year. Iron ore prices have also fallen by c16% this<br />

year, with the industry expecting continued pricing weakness in the medium-term on the back of 1/<br />

an anemic global economic recovery and 2/ rising output for iron ore. As such, with iron ore prices<br />

continuing to decline in the medium term 7 , the iron ore industry is expected to face the longest bear<br />

market in two decades. The plunging raw material prices should drag steel prices further, given that<br />

the recovery in global steel demand seems distant especially with the faltering economic growth in<br />

China, the world’s largest steelmaker. Nevertheless, the long-term demand outlook for steel remains<br />

positive.<br />

The medium-term market dynamics of the GCC region differ somewhat from those abroad, given<br />

strong regional demand stemming from 1/ high oil prices 2/ government infrastructure projects<br />

and 3/ World Cup 2022 in Qatar, all coupled with a steel shortage in the region 8 . As such, steel<br />

demand in the region is projected to remain buoyant with this healthy pace of infrastructure, real<br />

estate and industrial investments (especially in Saudi Arabia and Qatar). Forecasted growth for<br />

rebar demand in the region is at 10%-15% over the next 5 years 9 . Moreover, the region’s significant<br />

growth potential for steel is reflected by the numerous steel projects on track, estimated at more<br />

than $18 billion worth of investments 10 (For a detailed list of the steel projects in the region, please<br />

refer to Appendix H). Accordingly, the region’s firm steel drive should somewhat support prices, over<br />

the next few years, despite the weaker global market picture. More specifically, in Saudi Arabia,<br />

Sabic’s Hadeed is the main provider of steel rebars, dictating the steel prices in the Kingdom and<br />

accordingly largely benefiting from this pricing power during weak global trends (especially when<br />

the Kingdom imposes import tariffs on steel rebars originating from outside the GCC). Furthermore,<br />

with iron ore as the primary raw material for region’s steelmakers and with the region holding little<br />

iron ore of its own, any decrease in the commodity’s price should result in wider margins for Sabic’s<br />

Hadeed and other steel manufacturers in the GCC.<br />

6 Sabic’s Fertilizer SBU represents 8% of Sabic›s total sales output<br />

7 Bloomberg commodity price forecasts point to a median of $137.5/mt, $130/mt and $115/mt for the years<br />

2013, 2014 and 2015 versus $179/ton average for 2012<br />

8 GCC’s annual steel production is c10 million tons vs annual consumption of c25 million tons (Source: MEED)<br />

9 Source: MEED 2012<br />

10 Source: MEED 2012<br />

5

SABIC<br />

December 4, 2012<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

SABIC: POSITIONED AMONG LEADING NAMES OF THE INDUSTRY<br />

Sabic is one of the world’s leading diversified chemical companies. It generates annual revenues<br />

exceeding $50 billion, securing a position among the world’s largest chemical firms. The company<br />

ranks 6th largest in revenues against its global rivals, comprised of chemical producers and the<br />

chemical units of the integrated oil producers. Sabic is among the top producers of polyethylene,<br />

polypropylene, advanced thermoplastics, glycols, methanol and fertilizers.<br />

Chart 6: Top Companies by Chemical Sales (USD mn)<br />

Source: ICIS, Bloomberg<br />

With total assets of c$89 billion, Sabic ranks 5th largest amongst these firms. In terms of market cap,<br />

Sabic’s value exceeds $71 billion, which also makes it the 6th largest company in the industry. As a<br />

regional player, Sabic has grown, organically and via acquisitions, to reach the top ranks within its<br />

league. With a committed growth strategy in place, expansions underway and massive financial<br />

flexibility, Sabic is poised to retain its leading spot in the industry.<br />

Chart 7: Market Cap of Peers (USD mn)<br />

Source: Bloomberg<br />

6

SABIC<br />

December 4, 2012<br />

FOOTNOTES<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

In terms of production volumes, Sabic is the world’s fifth largest producer of polyolefins, producing<br />

over 8 million tons of polyethylene and polypropylene. However, the bulk of Sabic’s polyolefins<br />

output is polyethylene, with output near 6 million tons.<br />

Chart 8: Approximate Production Capacities of Leading 5 Polyolefin Producers (mn tons)<br />

Source: Borealis Facts and Figures 2011/12<br />

Sabic’s product rankings are as follows:<br />

1 Sabic ranks as world’s largest producer of Ethylene glycol 11 , MTBE, Granular Urea, Polyphenylene<br />

and Polyether Imide 12 .<br />

1 Sabic ranks as world’s 2nd largest producer of Methanol and Polycarbonate 13 .<br />

1 Sabic ranks as world’s 3rd largest producer of Polyethylene, Polybutylene Terephtalate and<br />

Engineering plastics 14 .<br />

In regards to its steel business, Sabic owns one of the largest steel manufacturers in the MENA<br />

region. It has an annual production capacity of more than 5.2 million tons, whereby steel rebars<br />

make up c75% of total steel output. Moreover, Hadeed enjoys a market share of over 25% in the<br />

GCC rebar market 15 .<br />

With such rankings among its industry peers, Sabic is best-positioned to capitalize on any upturn in<br />

the global markets.<br />

11 Ethylene glycol output amounted to 6.7 million tons for 2011 or 9.7% of Sabic’s total output (Source: Sabic)<br />

12 Source: Sabic<br />

13 Source: Sabic<br />

14 Source: Sabic<br />

15 Source: MEED<br />

7

SABIC<br />

December 4, 2012<br />

FOOTNOTES<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

FINANCIAL FLEXIBILITY PAVES WAY FOR 2020 TARGET<br />

Sabic’s balance sheet is fairly robust with cash exceeding $14 billion and a net debt-to-equity of<br />

just 0.23x vis-à-vis a peer average of 0.58x. The company’s Debt-to-Ebitda of 1.7x is also below<br />

the industry average of 2.2x, while enjoying double-digit interest coverage for over ten quarters.<br />

Moreover, Sabic’s interest coverage of 18.1x well exceeds its peer average of 8.8x. In parallel, Sabic<br />

enjoys A+ long-term credit ratings by both S&P and Fitch rating agencies. Given its strong financial<br />

position and favorable credit ratings, Sabic holds the financial flexibility to: 1/participate in organic<br />

growth 2/acquire growth companies 3/ invest in its innovation capability and 4/retain adequate<br />

funds for the distribution of dividends. It is noteworthy highlighting that Sabic has announced<br />

previously this year that it intends to repay $7 billion of debt in 2012. In turn, the significant<br />

deleveraging in 2012 and the years to come should increase notably its cash dividend pay-outs.<br />

Chart 9: Projected Gearing Level Chart 10: Projected Dividend Stream<br />

Source: ASIB Estimates Source: ASIB Estimates<br />

Sabic has invested in many green-field projects across the years, among which the latest were<br />

Yansab and Saudi Kayan, and in turn has the expertise of developing world-scale assets. Moreover,<br />

with its robust balance sheet, Sabic can continue its acquisition trail, in aim of its 2020 target of<br />

130 million tons of output (versus today’s 69 million tons) and accordingly realizing its vision of<br />

becoming the leading chemical producer by 2020. It is noteworthy to mention that Sabic is aiming<br />

to launch over 30 new performance chemicals and polymers in the coming several years, part of<br />

its 2020 vision where this new product line will represent 10% of the company’s revenues by that<br />

year 16 . Thus, the Performance Chemicals SBU will be one of the core drivers of growth.<br />

AN INDUSTRY LEADER WITH CONTINUOUS ACQUISITION APPETITE<br />

Sabic is one of the world’s largest and fastest-growing petrochemical producers, with its 2011<br />

production volume exceeding 69 million tons. With a global growth strategy intact, the company<br />

has been on an acquisition mode for years, making investments around the world. Through these<br />

acquisitions, Sabic has expanded its product portfolio, acquired world-class technology and<br />

boosted its market presence.<br />

16 Saudi Kayan was one of Sabic’s first projects in the performance chemicals arena. It represented the first company<br />

within the Middle East to produce and sell these specialty chemicals. The first shipment of ethanolamines<br />

and ethoxylates was made in June 2012.<br />

8

SABIC<br />

December 4, 2012<br />

FOOTNOTES<br />

Sabic’s most known for its acquisitions of:<br />

1 GE Plastics, US, in 2007 for $11.6 billion<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

1 Huntsman Petrochemicals’ UK operations in 2006 for $685 million<br />

1DSM’s petrochemical unit, Europe, in 2002 for $2.1 billion<br />

Currently market sources are pointing out to another potential acquisition eyed by Sabic, most likely<br />

a company “with a large amount of its own licensed technology, especially in the specialty plastics<br />

sector” (MEED, August 2012). This will fasten Sabic’s path to securing the top spot in the industry, as<br />

it will obtain the technology expertise it misses across the chemical value chain 17 .<br />

NEW EXPANSIONS TAKING SABIC DOWNSTREAM<br />

Sabic has gone through three stages of major expansion since 1976. The company is operationally<br />

present in more than 40 countries, owning about 60 production plants across the globe The<br />

company’s fast expansion has allowed it to reach production volumes of c69 million tons for 2011.<br />

This compares with c47 million tons for 2005 and 6.3 million tons in 1983, when the first plant went<br />

onstream.<br />

Chart 11: Track Record of Events<br />

30% IPO<br />

1984<br />

Source: Sabic Capital<br />

DSM<br />

Petrochemicals<br />

2002<br />

Huntsman UK<br />

Petrochemicals<br />

2006<br />

The latest expansions to go online have been:<br />

GE Plastics<br />

2007<br />

Sinopec Sabic<br />

Tianjin<br />

Petrochemical Co.<br />

Yansab and<br />

Sharq<br />

2010 2010<br />

Saudi<br />

Kayan<br />

1 The integrated phosphate complex of Maaden Phosphate Company, a 70:30 joint venture<br />

between Maaden and Sabic (October 2011). The complex has an annual production capacity<br />

of 2.9 million tons of phosphate fertilizers and 1.1 million tons of ammonia. Investment cost<br />

of this project was $5.5 billion.<br />

1 Cracker of Saudi Kayan, the region’s first producer of polycarbonates (October 2011), followed<br />

by the downstream units. The project, a partnership between Sabic and Al Kayan Petrochemical<br />

Co., has an annual production capacity of 6 million tons of petrochemicals. Investment cost of<br />

this project was $10.8 billion.<br />

1 Phase I of Sinopec Sabic Tianjin Petrochemical Co., a 50-50 joint venture with Sinopec 18 (May<br />

2010). The Tianjin-based plant has an annual production capacity of 3.2 million tons of<br />

petrochemicals, comprised of a one-million ton ethylene cracker and eight downstream units.<br />

Investment cost of this project was $2.7 billion.<br />

1 Phase III of Sharq, a 50-50 joint venture with a group of Japanese companies (April 2010).<br />

This expansion added close to 3 million tons of various petrochemicals, mainly ethylene (1.3<br />

million tons), HDPE (400 thousand tons), LDPE (400 thousand tons) and ethylene glycol (700<br />

thousand tons). Sharq’s production capacity increased to 5 million tons/annum, confirming its<br />

status as the world’s largest producer of ethylene glycol.<br />

17 Sabic has already accelerated its quest for more technology licenses, signing licensing deals lately with technology<br />

providers, such as Mitsui and Linde, for the production of toluene diisocyanate (TDI) and methylene<br />

diphenyl diisocyanate (MDI).<br />

18 China Petroleum and Chemical Corporation<br />

2011<br />

9

SABIC<br />

December 4, 2012<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

1 Yansab, another Sabic landmark project, with an annual production capacity of 4 million<br />

tons (March 1 2010). Key products are polyethylene (800 thousand tons), ethylene glycol (700<br />

thousand tons) and polypropylene (400 thousand tons). Investment cost for this project was<br />

$5.6 billion.<br />

Sales volumes have amounted to 54 million tons for 2011, versus 37 million tons for 2005. This<br />

growth translates into a CAGR of 6.7% and 6.8%, in production and sales volumes respectively,<br />

for the period 2005-11. Looking beyond, with the diverse expansions going online, Sabic should<br />

witness an estimated CAGR of 4.1% and 3.1% in production and sales volumes, respectively, for the<br />

period 2011-2015.<br />

A large part of the company’s production takes place in Saudi Arabia, with European operations<br />

contributing c20% to the total polymers output and c11% to total chemicals output. On a further<br />

note, European-produced basic chemicals account for 7% of Sabic’s total selling volumes, where as<br />

European-produced polymers account for 4% of Sabic’s total selling volumes.<br />

Chart 12: Production and Sales Volumes (million mt)<br />

Source: Company Reports<br />

Expansions coming onstream in the near-term include:<br />

1 Phase VIII of Gas is expected to begin production by year-end 2012. The expansion has a<br />

production capacity of 1.2 million tons of oxygen gas and 1 million tons of nitrogen gas.<br />

1 Hadeed new steel plant, with an annual production capacity of 1 million tons of steel billets and<br />

500 thousand of long steel products, is expected to be completed in September 2013. Once<br />

operational, Hadeed’s annual production capacity will rise to over 6 million tons, whereby<br />

long products will represent 4 million tons or a 67% share. According to Sabic, ‘the new plant<br />

will make Hadeed self-sufficient in feedstock, intermediate and finished products” and will<br />

therefore protect it to some extent from the fluctuations in the international steel market. The<br />

plant’s estimated investment cost is $630 million.<br />

1 A $400 million plant, for the production of purified terephthalic acid (PTA), is scheduled to<br />

begin production in early 2013. The plant, owned by Ibn Rushd, will have an annual production<br />

capacity of 350 thousand tons of PTA which will be used as feedstock for the production of<br />

polyethylene terepthalate (PET).<br />

1 A polyacetal production plant, in partnership with Celanese Corp., is expected to go onstream<br />

in 2013. The Jubail-based plant, with an annual production capacity of 50 thousand tons, will<br />

use in-house methanol as feedstock for the production of polyacetal. The plant is part of the<br />

National Methanol Co. (Ibn Sina) complex, which is 50% owned by Sabic and the remainder<br />

equally owned by Celanese Corp. and an affiliate of Duke Energy Corp. Total investment cost<br />

for this project is estimated at $400 million.<br />

10

SABIC<br />

December 4, 2012<br />

FOOTNOTES<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

1 Safco V, a urea plant with an annual production capacity of 1.1 million tons, expected in the<br />

third quarter of 2014. Total investment cost of this expansion is estimated at USD 534 million.<br />

1 A methyl-methacrylate (MMA) and poly-methyl-methacrylate (PMMA) plant in Jubail, a 50-<br />

50 joint venture with Mitsubishi Rayon Company, is scheduled to go on-stream in 2013. The<br />

annual production capacity of the MMA plant will be 250 thousand tons, where as the PMMA<br />

plant will produce 40 thousand tons/annum. These products will be produced for the first time<br />

in the Middle East. The project’s estimated investment cost is $1 billion.<br />

1 A N-Butanol production facility, in equal partnership with Saudi Aramco, Dow Chemical and<br />

Tasnee, is scheduled to go online in late 2014. The plant, of an annual production capacity of<br />

330 thousand tons of N-Butanol, will be part of Saudi Kayan’s acrylic complex. The project’s<br />

investment cost is $500 million.<br />

1 A joint venture with Asahi Kasei and Mitsubishi Corp. to develop world-scale plants in Jubail<br />

Industrial City for the production of acrylonitrile and sodium cyanide. The new company will<br />

be named Saudi Japanese Acrylonitrile Co. (Shrouq). The annual production capacities will be<br />

200 thousand tons of acrylonitrile and 40 thousand tons of sodium cyanide. Total investment<br />

cost of this project is estimated at $561 million. Production is scheduled to start during the<br />

final quarter of 2014.<br />

1 Phase II of Sinopec Sabic Tianjin Petrochemical Co. , with an annual production capacity of<br />

260 thousand tons of polycarbonates, is expected to go fully onstream by 2015. Its investment<br />

cost is estimated at $1.7 billion. The Tianjin-based plant, once operational, will position Sabic<br />

among the world’s leading producers of polycarbonates.<br />

1 A world-scale elastomers project, a 50-50 joint venture with Exxon Chemical Arabia (an affiliate<br />

of ExxonMobil Chemical Co.), is scheduled to go online in 2H 2015. The plant is part of the<br />

Al-Jubail Petrochemical Co. (Kemya) complex. The project will have an annual production<br />

capacity of 400 thousand tons of specialty elastomers (poly-butadiene rubber, ethylene<br />

propylene diene monomer rubber, thermoplastic elastomer and MTBE). Total investment cost<br />

for this project is estimated at $3.4 billion.<br />

1 A joint-venture with Saudi Aramco to construct an aromatics plant near Aramco’s present<br />

Yanbu refinery. Tenders have not yet been made, with market expectations pointing to early<br />

2013 for the submission of the tenders. No additional details regarding this project have been<br />

released yet.<br />

Although the expansions that went online in 2010 and 2011 were larger in production scale than<br />

the upcoming ones, the new expansions will nevertheless give Sabic an additional competitive<br />

edge. These additions will be increasing the company’s footprint in the high-growth markets 19 of<br />

specialized chemicals, bringing it closer to the downstream industries such as the automotive and<br />

construction industries. The global markets for the above performance chemicals are exhibiting fast<br />

growth, as new uses for these high-value products are unfolding, thereby increasing their demand.<br />

As such, serving this high growth market will allow Sabic to 1/ largely diversify its income stream<br />

2/ reach its 2020 aim of specialized chemicals constituting 10% of the company’s revenues and 3/<br />

contribute to the Kingdom’s industrial diversification program and job creation.<br />

19 As an example of the high-growth markets for such products, polycarbonate demand in China is expected to<br />

grow annually by c 10%, reaching 1.78 million tons by 2015. Polycarbonate is China’s most imported engineering<br />

plastic, by volume, given domestic production of just 220 thousand tons. (Sabic)<br />

11

SABIC<br />

December 4, 2012<br />

FOOTNOTES<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

IN CONTINUAL MODE OF SIGNING NEW DEALS<br />

Sabic has always been on the look-out for new investments and partnerships, however over the<br />

recent years has been focusing on performance chemicals, a new product line which will boost its<br />

competitive edge and take it closer to its 2020 objectives. As observed from the above expansions,<br />

the company has been eyeing several new projects in this specialty chemicals industry and boosting<br />

its dealmaking presence in such markets.<br />

DOMINATING THE DOMESTIC PRODUCTION LANDSCAPE<br />

The growing importance of the Middle East region was evident in its increasing share of global<br />

production over the past decade. From 2001 till 2010, the region’s share of global chemical output<br />

has increased from 10% to 20%, while the US and European share of global output has shrunk from<br />

36% to 24% and from 32% to 21%, respectively. The region’s expanding influence on the industry<br />

should continue in the medium term, as it is projected that the region’s production capacity of<br />

chemicals and petrochemicals will grow at annual rate of 6.6% up until 2016 20 .<br />

Chart 13: Country/Region’s Share of Global Chemical Production (Basic Chemicals)<br />

Source: Petrochemical Industry Overview, SRI Consulting, April 2011, cited by GPCA Sixth Annual Forum<br />

Sabic’s growth has originated from this region and has been a key contributor to the region’s<br />

petrochemical boom, while leading its own country Saudi Arabia’s diversification scheme away from<br />

crude oil. The company today has 15 petrochemical subsidiaries operating in Saudi Arabia, out of<br />

the country’s 42 existing ones (see Appendix G) 21 . Sabic has built chemical clusters in the Kingdom,<br />

with the output of its group representing 95% of the domestic petrochemical production 22 .<br />

Moreover, Saudi Arabia’s production capacity of downstream plastics constitutes c62% of the<br />

GCC’s total capacity. As such, Sabic dominates also the regional production landscape. With the<br />

Saudi government’s firm commitment to moving and expanding downstream (projects tendered<br />

in excess of $20 billion 23 ) and with Sabic’s growing participation in the Kingdom’s downstream<br />

projects, becoming the world’s leading producer of petrochemicals would not be far from reality.<br />

20 GPCA Sixth Annual Forum<br />

21 Source: MEED<br />

22 Source: US Saudi Arabian Business Council<br />

23 Source: MEED, May 2011<br />

12

SABIC<br />

December 4, 2012<br />

FOOTNOTES<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

STRATEGIC PARTNERSHIPS WITH INDUSTRY LEADERS<br />

Sabic’s growth has leveraged on long-term strategic partnerships with industry leaders. Investing in<br />

joint ventures, Sabic has established companies in the MENA region, Asia, US and Europe. Sabic has<br />

projects in partnership with companies such as Shell, Exxonmobil Chemical, Mitsubishi Chemicals<br />

and Sinopec. Partnering with such names has boosted its competitiveness and strengthened its<br />

market presence, allowing it to reach the ranks it has reached today. Lately, the company announced<br />

its intention to invest further in the US, this time in the country’s shale gas projects. This strategic<br />

aim will give Sabic the opportunity to partner again with leading energy firms and to be part of the<br />

US shale gas epoch.<br />

COMPETITIVELY POSITIONED REGIONALLY AND GLOBALLY<br />

As raw materials and utilities are the largest component of production costs in the petrochemical<br />

industry, with capital and labor playing a minor role, a producer’s competitiveness is then mainly<br />

determined by the type of hydrocarbon feedstock it uses and its pricing structure.<br />

Chart 14: Global Ethylene Production by Feedstock<br />

Source: IHS, Global Olefins Update, 6th Annual GPCA Forum<br />

Saudi producers’ access to subsidized gas-based feedstock, has positioned them at the low-end<br />

of the production cost curve, as the bulk of the country’s petrochemical output is produced from<br />

ethane and methane feedstock. According to our estimates, Sabic’s domestic operations account<br />

for c80% of total output, hence a large portion of its total feedstock cost is relatively fixed, leaving<br />

only its European, US and Asian operations 24 , with a variable cost structure. As such, for the bulk of<br />

its operations, its domestic production, Sabic obtains its ethane and methane feedstock at a set<br />

price of $0.75/mmbtu, at the lowest price worldwide 25 , fixed until 2012-2015 depending on the<br />

project. The heavier feedstocks propane and butane are supplied at a 30% discount to C&F Japan<br />

Naphtha price. This vast cost advantage has allowed Sabic during cycles to maintain operating rates<br />

above 90% at its production plants in Saudi Arabia 26 .<br />

24 Output from European plants, which are Sabic’s only pure naphtha-based facilities, represent around 11% of<br />

the company’s total output. US operations represent around 2% and Asian operations represent around 7%.<br />

25 Its GCC neighbors obtain ethane feedstock at a cost ranging between $1.25/mmbtu-$2.50/mmbtu (MEED)<br />

26 Source: Sabic Capital Presentation, 2010<br />

13

SABIC<br />

December 4, 2012<br />

FOOTNOTES<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

Further to Saudi Arabia holding one-fifth of the world’s proven oil reserves 27 , with Saudi Aramco<br />

producing c12% of the world’s crude oil 28 , the Kingdom holds the world’s fourth largest proven<br />

gas reserves. As such, the government is largely committed to growing its gas infrastructure,<br />

which should in turn reduce the gas shortage risk constraining the ethane supply for domestic<br />

petrochemical producers. This sustained competiveness, accordingly, will allow key players such as<br />

Sabic to withstand any global oversupply threats and to remain best positioned to capitalize on any<br />

upturn in the global economy.<br />

On a further note, worries around the price increase of ethane in the Kingdom are exaggerated.<br />

Despite the increase of ethane prices most likely to $1.5/mmbtu, from the current $0.75/mmbtu,<br />

there will remain a price advantage over US gas-based feedstocks and the naphtha-based<br />

feedstocks used by its European peers (which are highly correlated to crude oil prices). Based on<br />

an ethane price of $0.75/mmbtu, the production cost of one ton of ethylene would amount to $90-<br />

$100, whereas if the ethane price jumps to $1.5/mmbtu, ethylene production cost would only rise<br />

to $160/mt. These numbers compare very favorably with average production costs of $700-$800/mt<br />

for naphtha-based operators in Europe and $600/mt for gas-based operators in the US 29 .<br />

In turn, Saudi producers will retain the cost leadership advantage over rivals even upon the<br />

implementation of the new pricing regime (expected in 2013). Moreover, with naphtha-based<br />

producers expected to remain price-setters, profit margins for ethane-based producers such as<br />

Sabic should remain supported across time.<br />

Chart 15: Feedstock Cost Advantage (Ethylene Production Cost)<br />

Source: Bloomberg Commodity Price Forecasts, ASIB estimates Source: MEED, ASIB estimates<br />

LEADING ITS COUNTERPARTS WITH SUPERIOR MARGINS<br />

Generating an operating margin close to 30%, Sabic stands apart from major counterparts who<br />

generate an average operating margin of 11%. With an Ebitda margin of over 30%, Sabic also leads<br />

its peer group who hold an average Ebitda margin of 15%. This wide gap between Sabic and its<br />

global counterparts is in large due to: 1/ the competitive feedstock cost structure 2/ economies of<br />

scale 3/ logistics advantage and 4/ the integrated facilities employing world-scale plants it operates<br />

within Saudi Arabia, which account for the bulk of the company’s total production (17 out of the 23<br />

manufacturing affiliates are based in the KSA). As Sabic is expected to retain this competitiveness,<br />

mainly feedstock competitiveness, the impact on profitability from threats such as cyclical<br />

downturns and increasing competition should be contained.<br />

27 Source: US Energy Information Administration<br />

28 Source: Energy Intelligence, cited by US Energy Information Administration<br />

29 Source: MEED, February 2012<br />

14

SABIC<br />

December 4, 2012<br />

FOOTNOTES<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

Chart 16: Peer EBIT Margins (%) Chart 17: Peer EBITDA Margins (%)<br />

Source: Bloomberg Source: Bloomberg<br />

EXPOSED TO OVER 10 INDUSTRIES<br />

Sabic’s product portfolio ranges from chemicals (basic and performance chemicals) to plastics<br />

(polymers and innovative plastics) to fertilizers to steel, whereby an entire range of sub-products<br />

fall under these categories.<br />

The largest strategic business unit (SBU) is the Chemicals SBU, whereby it represents 64% of<br />

production volumes and 58% of sales volumes. This SBU includes performance chemicals or<br />

specialty chemicals, which were first introduced by Saudi Kayan. Having these products in Sabic’s<br />

portfolio will assist in mitigating the company’s exposure to price swings, as specialty chemicals are<br />

less cyclical than traditional or commodity petrochemicals. Moreover, the market for specialized<br />

chemicals does not face an excess oversupply risk, a threat faced by the basic or traditional<br />

petrochemical producers. Finally, specialized chemicals are produced in much smaller volumes,<br />

owing to their specialized structure & functions and are of higher value, with their demand linked<br />

more to performance specifications than price 30 . In turn, brighter and more opportunistic prospects<br />

exist for producers with a portfolio mix that includes these performance chemicals.<br />

Next in line is the Polymers SBU, whereby the bulk pertains to polyethylene and polypropylene<br />

production. Although innovative plastics (dominated by polycarbonates) are the smallest<br />

contributors to Sabic’s total output and sales volume, the contribution of this SBU to total sales<br />

revenues should not be underestimated at all. Products such as polycarbonates and innovative<br />

plastics in general are high-value products, thus they enjoy prices equal to a manifold of those of<br />

commodity or traditional chemicals.<br />

Chart 18: Production Breakdown by SBU Chart 19: Sales Output Breakdown by SBU<br />

*Includes Performance Chemicals *Includes Performance Chemicals<br />

Source: Company Reports 2011 Source: Company Reports 2011<br />

30 Bloomberg BusinessWeek<br />

15

SABIC<br />

December 4, 2012<br />

FOOTNOTES<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

Sabic’s exposure to so many industries, with different fundamentals, should largely reduce the<br />

company’s market risk.<br />

A BROAD AND DIVERSIFIED MARKET PRESENCE<br />

Given its global reach of more than 100 countries, Sabic faces limited country risk. In terms of<br />

regions, Asia represents the largest market for Sabic, generating 35% of sales, with the Middle<br />

East making up for the next largest market. Sabic has been continuously seeking new markets and<br />

strengthening its presence in existing home markets, especially in key market China. Its JV in China<br />

with Sinopec, along with its 41 offices, 10 production sites and 5 T&I centers in Asia, has solidified<br />

the company’s foothold in one of the world’s highest growth markets. The geographical proximity<br />

of Asia to Saudi Arabia has given domestic producers a material advantage over European and US<br />

counterparts.<br />

Attractive growth dynamics are also present in the MENA region, as the per capita consumption of<br />

various polymers is significantly below that of North America and Europe 31 . Hence, with ambitious<br />

global growth initiatives set, robust emerging market demand and growth potential in the MENA<br />

region, Sabic’s market share is expected to grow.<br />

Chart 20: Geographical Market Segmentation of Sales Revenues<br />

Source: Company Reports 2011<br />

A STATE-OWNED ASSET CONTRIBUTING TO THE KINGDOM’S WELL-BEING<br />

A stake of 30% was floated to the public in 1984. Since then the Saudi government has retained its<br />

70% of Sabic, through the Public Investment Fund, thus granting Sabic the backing of the world’s<br />

largest holder of oil reserves (KSA’s S&P Credit Rating: AA- for Local and Foreign Currency LT Debt ).<br />

Government support for Sabic has been evident in “feedstock supply, funding and infrastructure”<br />

(Sabic). About 11% of Sabic’s loan book is through funding from government-related agencies.<br />

Moreover, as a state-owned asset, Sabic is leading the country’s industrial diversification program<br />

and developing its downstream industries.<br />

By investing increasingly in the specialty chemicals sector, Sabic is establishing the groundworks<br />

for the government’s drive to add more value to its crude oil. This vision will be realized by taking<br />

the petrochemical industry downstream (key examples are Sabic, Saudi Kayan and Tasnee) and<br />

developing industrial parks at proximity to petrochemical complexes. Such integrated sites should<br />

in turn attract multinational names in prime manufacturing industries such as the automotive and<br />

electronics industries. With these industries developed, and additional jobs created for the young<br />

and unemployed, a large part of the government’s economic program would be implemented.<br />

31 Source: MEED, May 2011<br />

16

SABIC<br />

December 4, 2012<br />

FOOTNOTES<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

Finally, it is worth noting that Sabic is a key employer in the Kingdom, having over 15,000 employees<br />

in the country alone 32 . With job creation a top priority for the government of Saudi Arabia, Sabic’s<br />

move downstream will play a major role in meeting these targets. As such Sabic will remain an<br />

integral asset for the Kingdom and will accordingly continue to leverage on its wide state-support,<br />

leading its country’s largest non-oil sector and contributing to the Kingdom’s overall well-being.<br />

TECHNOLOGY & INNOVATION UNIT 33: CONSTANTLY EVOLVING IN AIM OF 2020 VISION<br />

Research, technology and innovation are among the key determinants of a company’s<br />

competitiveness and in turn success. Sabic is constantly investing in new technologies and innovative<br />

solutions, a practice that has given the company its leading status today. Its growing investment in<br />

T&I, with technological fixed assets representing investments of c$90 billion until today 34 , will allow<br />

Sabic to develop the new products targeted by 2020 and in turn realize its objectives. Sabic has its<br />

12 T&I centers spread globally, with ones in Saudi Arabia, the US, Europe, China, Japan, Korea and<br />

India. These centers are present in such countries to make Sabic closer to its partners and more so<br />

to its clients, to better meet their needs. Furthermore, Sabic’s T&I unit “develops more than 150 new<br />

products every year” and enjoys the backing of over 8000 global patents, with Sabic Innovative<br />

Plastics (SIP) holding the lion share as it is supported by more than 5000 global patents 35 . The highperformance<br />

engineered plastics SIP offers are marketed under well-known brands, especially in<br />

the automotive industry, with names such as Lexan, Xenoy, Noryl and Valox. Out of the c$6 billion<br />

worth of intangibles on Sabic’s books, representing 6.8% of total assets, patents and trademarks<br />

constituted around 24% of total intangibles or $1.4 billion (as of September-end 2012).<br />

Despite, Sabic’s current R&D to sales of 0.4% being below the industry average of 1.6% 36 , the<br />

company is increasingly strengthening its focus on R&D. It has three technology centers under<br />

construction and research programs constantly underway.<br />

UNDER-PERFORMER OVER COURSE OF YEAR<br />

Over the course of the year, Sabic’s shares have under-performed global peers (represented by<br />

the Bloomberg World, Americas and EMEA Chemical indices). This could be partially explained by<br />

the region’s social, economic and political instability. However, the unjustified performance gap<br />

should narrow given Sabic’s inherent competitiveness, margin expansion and earnings/cash flow<br />

generating power. Moreover, Sabic, which is down by 7% YTD, has also underperformed Brent crude<br />

oil on a YTD basis by c11% aggregate.<br />

Chart 21: Price Performance (Rebased) Chart 22: Price Performance (Rebased)<br />

Source: Bloomberg Source: Bloomberg<br />

32 Source: Sabic Capital<br />

33 Sabic has restructured its Research & Technology unit, changing its name to Technology & Innovation unit (T&I)<br />

34 Source: Sabic<br />

35 Source: Sabic<br />

36 Source: Bloomberg<br />

17

SABIC<br />

December 4, 2012<br />

FOOTNOTES<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

TRADING AT A DISCOUNT TO ITS 10-YEAR HISTORICAL AVERAGE AND TO ITS PEERS<br />

Sabic is trading at PE 12E of 10.8x and a PE 13E of 9.0x, reflecting a discount to the weighted peer<br />

average 37 of 11.9 x and 9.8x, respectively. The discount to peers is not justified owing to its various<br />

competitive advantages, most importantly its cost leadership. Moreover, Sabic is trading at relative<br />

historical lows, trading at 40% discount to its 10-year historical average of 17.8x, signaling the extent<br />

to which global macro-economic and industry threats are factored in its current price. In turn, these<br />

levels provide an attractive entry point for investors.<br />

Chart 23: Sabic Historical PE’s<br />

Source: Bloomberg<br />

INITIATING COVERAGE WITH AN ACCUMULATE RATING<br />

Despite reduced growth prospects for domestic petrochemical producers given feedstock<br />

constraints in Saudi Arabia, Sabic is adamant in pursuing its growth objectives. The company is<br />

delving downstream into new product lines and extending its portfolio. With the company’s growth<br />

momentum expected to continue, and given Sabic’s 1/ secured access to low-cost feedstock 2/ widestate<br />

support 3/ strong balance sheet (net debt-to-equity of just 0.23x), we project further profit<br />

gains in the medium term and higher returns for shareholders. Sabic trades at a PE 12E of 10.8x,<br />

a discount to peers (average of 11.9x), which does not reflect the company’s growth momentum<br />

along with its cost competitive assets. The company’s high dividend yield of 5.1% for 2012 also gives<br />

investors a stable income stream amid a low-yield environment. Moreover, Sabic generates a FCF/<br />

share of SAR 10.5, implying a FCF yield of 11.7% which is materially higher than the industry (peer<br />

average of 8.0%). We initiate coverage on the region’s largest cap company, with an Accumulate<br />

rating given its estimated target price of SAR 108.4/share (upside potential of 21%).<br />

37 The peer group, used to calculate the weighted peer average, is comprised of leading names across all<br />

industries Sabic pertains to.<br />

18

SABIC<br />

December 4, 2012<br />

VALUATION<br />

FCFF VALUATION<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

We valued Sabic using the Free Cash Flow to the Firm (FCFF) model, given its strong earnings and<br />

free cash flow power. We accounted for Sabic’s expansions, in addition to the double-edge effect<br />

of crude oil prices on the prices of Sabic’s products together with its impact on the production<br />

cost of mainly its European operations. We ran a regression on petrochemical prices, using oil as<br />

the independent variable given that the marginal cost of petrochemical production is determined<br />

by naphtha-based producers. Furthermore, we included an adjustment factor to account for the<br />

demand/supply imbalances in the various petrochemical markets, and the economic growth outlook<br />

of major end-markets. For the fertilizer and steel SBU, a similar approach was adopted, however we<br />

used the anthracite coal as the independent variable in our regression model for fertilizers and for<br />

the steel SBU we used iron ore as the independent variable for deriving steel prices (both long and<br />

flat). The model was based on a 4-year forecast period, with the below oil prices used and the below<br />

prices for key commodities and products derived.<br />

Table 2: Projected Product Prices<br />

2012E 2013 E 2014 E 2015 E<br />

Brent Crude Oil ($/bbl) 113 109 110 115<br />

Ethylene ($/mt) 1,188 1,124 1,140 1,220<br />

MEG ($/mt) 1,011 992 997 1,021<br />

LDPE ($/mt) 1,330 1,302 1,309 1,344<br />

HDPE ($/mt) 1,355 1,333 1,339 1,365<br />

PP ($/mt) 1,393 1,374 1,378 1,403<br />

Anthracite Coal ($/mt) 207 227 235 236<br />

Urea ($/mt) 489 492 504 506<br />

Ammonia ($/mt) 496 523 529 531<br />

Iron Ore ($/mt) 179 138 130 115<br />

Long Steel ($/mt) 621 512 492 453<br />

Source: Bloomberg Commodity Price Forecasts, ASIB Estimates<br />

Using a long-term expected profitability of 8.9% and a retention rate of 15%, a perpetual growth<br />

rate of 1.3% was derived. The profitability accounted for the premium Sabic retains due to its cost<br />

leadership in the chemical industry, state-of-the-art production plants in addition to its firm statesupport.<br />

For the discount rate, we used a WACC of 10.3%, based on a cost of equity of 14% and a cost<br />

of debt of 2%. The FCFF model resulted in an estimated target price of SAR 112.4/share, implying<br />

upside potential of 26%.<br />

19

SABIC<br />

December 4, 2012<br />

Table 3: FCFF Model<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

SAR mn 2012 E 2013 E 2014 E 2015 E<br />

Net Income 24,933 29,734 29,180 32,233<br />

Change in Working Capital (6,087) (1,095) 1,197 952<br />

Non-Cash Charges 12,459 12,570 12,855 13,200<br />

Capex (10,034) (10,124) (10,353) (10,630)<br />

Interest Expense (2,282) (1,841) (1,504) (1,098)<br />

Free Cash Flow to the Firm 35,728 35,118 31,989 34,948<br />

Present Value of Free Cash Flow to the Firm 35,728 28,885 23,863 23,644<br />

Present Value of Terminal Value 268,426<br />

Intrinsic Value of the Firm 380,546<br />

Net Debt 43,268<br />

Intrinsic Value of Equity 337,278<br />

WACC 10.3%<br />

Terminal Growth Rate 1.3%<br />

Shares Outstanding (mn) 3,000<br />

NAV per share (SAR) 112.4<br />

Source: ASIB Estimates<br />

SENSITIVITY ANALYSIS<br />

The data table below presents a sensitivity analysis to our price target valuation assuming various<br />

growth and discount rates. Our calculated fair value of SAR 112.4 /share, for the base case scenario, was<br />

based on a WACC of 10.3 % and a terminal growth rate of 1.3%.<br />

Table 4: Sensitivity Analysis<br />

WACC<br />

Terminal Growth Rate<br />

1.0% 1.5% 2.0% 2.5% 3.0%<br />

8.0% 145.4 155.5 167.4 181.4 198.2<br />

8.5% 135.0 143.7 153.7 165.4 179.3<br />

9.0% 126.0 133.5 142.1 152.0 163.5<br />

9.5% 118.1 124.6 132.0 140.5 150.2<br />

10.0% 111.1 116.9 123.3 130.6 138.9<br />

10.5% 104.9 110.0 115.6 122.0 129.1<br />

11.0% 99.3 103.8 108.8 114.4 120.6<br />

11.5% 94.3 98.3 102.8 107.7 113.2<br />

12.0% 89.8 93.4 97.4 101.7 106.6<br />

Source: ASIB Estimates<br />

20

SABIC<br />

December 4, 2012<br />

RELATIVE VALUATION<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

We valued Sabic on an equal basis with selected global peers from across the three industries:<br />

chemical, fertilizer and steel. Our peer group included companies such as Dow Chemical, BASF,<br />

DuPont, Total, Yara, CF Industries and Tata Steel. Again, Sabic should be trading at a premium given<br />

that it: 1/ is positioned at the low-end of the production cost curve 2/ enjoys superior profitability<br />

levels in contrast to its counterparts 3/ has very strong government support and 4/ plays a strategic<br />

role in the country’s economic and social development.<br />

Global peers trade at a weighted average of 11.9x estimated 2012 earnings, opposed to Sabic trading<br />

at 10.8x, implying an unjustified discount. In turn, a fair value of SAR 98.8/share is derived, based on<br />

our 2012 earnings per share (EPS) estimate of SAR 8.31.<br />

On an EV/EBITDA 12E basis, Sabic trades at a multiple of 6.5x versus a weighted peer average of 6.2x.<br />

Yet, given Sabic’s trading premium historically to the industry average, we added this premium which<br />

resulted into a weighted peer average EV/EBITDA 12E of 7.3x Accordingly, based on EBITDA 12E of SAR<br />

54,293 million, a fair value of SAR 105.7/share was obtained.<br />

Table 5: EV/EBITDA Valuation<br />

SAR mn<br />

EBITDA 2012E 54,293<br />

Enterprise Value 396,618<br />

Net Debt as of YE12E 25,210<br />

Minority Interest as of YE12E 54,294<br />

Market Capitalization 317,115<br />

Shares Outstanding 3,000<br />

Source: ASIB Estimates<br />

FINAL VALUATION<br />

NAV per Share (SAR) 105.7<br />

Attributing a 60% weight to the FCFF valuation and a 40% weight to the relative valuation, a final fair<br />

value of SAR 108.4/share was derived for Sabic, offering an upside potential of 21%.<br />

Table 6: Final Valuation<br />

Fair Value (SAR) Weight<br />

FCFF Valuation 112.4 60%<br />

Relative Valuation<br />

Source: ASIB Estimates<br />

P/E 98.8 20%<br />

EV/EBITDA 105.7 20%<br />

Final Fair Value per Share (SAR) 108.4<br />

21

SABIC<br />

December 4, 2012<br />

INVESTMENT RISKS<br />

1 Cyclicality of industry<br />

1 Recessionary threats in US and Europe<br />

1 Hard landing in China<br />

1 Reduced import demand from Asia<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

1 Increase of US competitiveness given access to low-cost gas-based feedstocks<br />

1 Dwindling availability of gas feedstock in the Kingdom<br />

1 Upward revision to gas prices in the Kingdom<br />

1 Increasing use of NGL’s (propane, butane and naphtha) in the feedstock mix<br />

1 Rise in costs of feedstocks benzene and propylene (where not entire rise can be passed on to<br />

customers) for US operations<br />

1 Rise in naphtha costs for European operations<br />

1 Price increase in iron ore imports<br />

1 Rise in steel imports from neighboring producers<br />

1 Unannounced plant stoppages<br />

1 Increase in competition from local and neighboring expansions (Borouge, Qatar Petroleum...)<br />

22

SABIC<br />

December 4, 2012<br />

FOOTNOTES<br />

COMPANY PROFILE<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

1 Saudi Basic Industries Corp. (Sabic) was established in September 1976 through a royal decree,<br />

with the first plant beginning production in 1981. The company’s capital has been raised<br />

several times, amounting today to SAR 30,000 million comprised of 3,000 million shares of<br />

SAR 10/share.<br />

1 Sabic is a heavy-weight on several regional market indices. The stock represents c10% of the<br />

Tadawul All Share Index and 40% of the Tadawul All Share Petrochemical Index. Furthermore,<br />

it represents c12% of the Bloomberg EMEA Chemicals Index.<br />

1 The company has five strategic business units, whose combined output amounted to 69.1<br />

million tons for the full year 2011. Although separated into two different SBU’s, polymers and<br />

innovative plastics fall under the same product range of plastics. As such, the product range<br />

of Sabic could be narrowed down to: Chemicals-Plastics-Fertilizers-Metals (for a detailed<br />

summary of Sabic’s products, please refer to Appendix C).<br />

Table 7: Breakdown of Production and Sales Volumes (for FY 2011)<br />

(Million Mt) Chemicals* Polymers Fertilizers Metals Innovative<br />

Plastics<br />

Production 44.5 11.3 6.7 5.4 1.1 69.1<br />

Sales 31.4 11.4 4.5 5.5 1.4 54.2<br />

* Includes Performance Chemicals of 439 thousand tons; Performance Chemicals were introduced to Sabic’s portfolio for first<br />

time in 2010<br />

Source: Company Reports 2011<br />

1 Sabic has over 40,000 employees today (versus 790 employees in 1980). There are more<br />

than 15,000 employees in Saudi Arabia, around 11,000 employees in the US, around 6000<br />

employees in Europe, with the remainder spread across various countries.<br />

1 Sabic has operations across 40 countries. The company operates :<br />

- 2 massive production sites in Saudi Arabia (Al-Jubail and Yanbu) comprising 19 world-scale<br />

complexes<br />

- 10 manufacturing sites in Asia<br />

- 17 manufacturing sites in the US<br />

- 13 manufacturing sites in Europe<br />

Overall, Sabic operates a total of 60 world-scale plants 38 .<br />

1 Most of the subsidiaries consolidated in Sabic’s books pertain to the management and<br />

operations of its Chemicals, Polymers and Innovative Plastics SBUs. Among these subsidiaries<br />

are: Sharq, Ar-Razi, Ibn Zahr, Ibn Sina, Kemya, Yanpet, Sadaf, Yansab and Kayan (for a summary<br />

of the subsidiaries consolidated in Sabic’s consolidated financial statements, please refer to<br />

Appendix D).<br />

1 Out of Sabic’s 24 manufacturing affiliates, 18 affiliates are for the production of petrochemicals,<br />

three affiliates are for the production of fertilizers and the remaining three are for the<br />

production of steel. Moreover, most of Sabic’s manufacturing affiliates are based in Saudi<br />

Arabia (for a summary of Sabic’s manufacturing affiliates, please refer to Appendix F).<br />

38 Source: Sabic<br />

Total<br />

23

SABIC<br />

December 4, 2012<br />

FOOTNOTES<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

Table 8: Geographic Presence of Manufacturing Affiliates<br />

KSA Bahrain Europe USA Asia<br />

# of Manufacturing Affiliates 17 3 1 1 1<br />

Source: Company Reports<br />

The bulk of production takes place in the Kingdom. The output of Sabic Europe approximates 8<br />

million tpa or 11% of total output (for 2011), comprised of almost 5 million tons of basic chemicals<br />

(10% of consolidated basic chemicals output) and 3 million tons of polymers 39 (27% of consolidated<br />

polymers output). US operations account for around 1 million tons of output or c2% of output,<br />

whereas Asian operations account to approx. 5 million tons or c7% of total output 40 .<br />

1 Sabic ‘s hydrocarbon feedstock mix includes ethane, methane, propane, butane and naphtha.<br />

From these feedstocks, Sabic produces its basic chemicals such as olefins and aromatics<br />

which in turn are used to produce polyolefins and other polymers.<br />

1 Sabic’s top-line and bottom-line figures are foremost derived from the sale of chemicals,<br />

polymers and innovative plastics. Below is a comprehensive breakdown, prior to the<br />

consolidation adjustments and eliminations (based on 2011 report).<br />

Table 9: Breakdown of Operations (for FY 2011)<br />

(SAR million) Chemicals* Fertilizers Metals Corporate** Total***<br />

Sales 218,725 8,654 15,532 17,877 260,788<br />

Gross profit 47,038 5,706 2,829 5,104 60,677<br />

Net profit 32,618 5,952 2,036 30,854 71,460<br />

*Chemicals Segment account for basic chemicals, performance chemicals, polymers and innovative plastics.<br />

**Corporate Segment “includes the corporate operations, technology and innovation centers, the investment activities<br />

and Sabic Industrial Investments Co. “ (Sabic)<br />

***Prior to Consolidation Adjustments and Eliminations<br />

Source: Company Reports<br />

39 Sabic Europe produces mainly HDPE, LDPE, LLDPE and Polypropylene<br />

40 Source: Sabic, ASIB Estimates<br />

24

SABIC<br />

December 4, 2012<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

APPENDIX A: PRO-FORMA INCOME STATEMENT<br />

(SAR mn) 2011 2012E 2013E 2014E 2015E<br />

Sales revenues 189,898 184,917 186,565 190,791 195,906<br />

Cost of sales (127,768) (132,350) (126,411) (128,721) (129,342)<br />

Gross profit 62,130 52,567 60,154 62,069 66,565<br />

S,G&A expenses (13,292) (12,954) (13,069) (16,217) (16,652)<br />

Operating income 48,838 39,613 47,085 45,852 49,913<br />

Other income 2,039 2,221 1,629 1,711 1,652<br />

Finance charges (2,993) (2,282) (1,841) (1,504) (1,098)<br />

Income before minority interests and zakat 47,885 39,552 46,873 46,060 50,467<br />

Minority interests (16,043) (12,673) (15,019) (14,759) (16,171)<br />

Income before zakat 31,842 26,878 31,853 31,301 34,296<br />

Zakat (2,600) (1,945) (2,119) (2,121) (2,063)<br />

Net Income 29,242 24,933 29,734 29,180 32,233<br />

APPENDIX B: PRO-FORMA BALANCE SHEET<br />

(SAR mn) 2011 2012E 2013E 2014E 2015E<br />

Cash and cash equivalents 50,389 51,011 53,221 55,907 53,972<br />

Accounts receivables 31,426 29,303 29,564 30,234 31,044<br />

Inventories 31,464 32,718 31,250 31,821 31,974<br />

Other receivables and prepayments 19,122 14,907 14,238 14,498 14,568<br />

Total current assets 132,401 127,939 128,273 132,459 131,559<br />

Investments 9,701 9,013 9,060 9,825 10,444<br />

Property, plant and equipment 165,805 164,590 163,363 162,109 160,822<br />

Intangible assets 21,891 21,529 20,396 19,262 18,129<br />

Other non-current assets 2,986 3,658 3,879 4,113 4,361<br />

Total non-current assets 200,382 198,789 196,697 195,310 193,756<br />

Total Assets 332,784 326,728 324,970 327,769 325,315<br />

Accounts payable 16,388 17,391 16,610 16,914 16,996<br />

Short-term bank facilities 1,333 1,299 1,311 1,627 1,670<br />

Current portion of long-term debt 13,264 14,735 11,600 13,597 13,029<br />

Accrued liabilities and other payables 8,944 13,906 10,176 10,362 10,412<br />

Zakat payable 3,140 2,810 3,797 5,129 6,928<br />

Total current liabilities 43,070 50,142 43,494 47,629 49,035<br />

Long-term debt 87,907 60,187 48,586 34,989 21,960<br />

Employees' service benefits payable 8,555 9,071 9,618 10,199 10,814<br />

Other non-current liabilities 4,046 3,793 3,514 3,257 3,018<br />

Total non-current liabilities 100,508 73,050 61,719 48,445 35,793<br />

Share capital 30,000 30,000 30,000 30,000 30,000<br />

Statutory reserve 15,000 15,000 15,000 15,000 15,000<br />

General reserve 69,781 80,242 92,136 100,890 107,337<br />

Retained earnings 23,242 24,000 24,000 24,000 24,000<br />

Total shareholders' equity 138,022 149,242 161,136 169,890 176,337<br />

Minority interests 51,183 54,294 58,620 61,805 64,150<br />

Total Liabilities and Equity 332,784 326,728 324,970 327,769 325,315<br />

25

SABIC<br />

December 4, 2012<br />

APPENDIX C: SABIC’S PORTFOLIO<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

Chemicals Plastics Fertilizers Steel<br />

Olefins PVC Urea Long Steel<br />

Ethylene Polyester Ammonia Rebars<br />

Propylene Polystyrene DAP Wire Rod<br />

Butadiene Polyolefins MAP Rebar in Coil<br />

Butane-1 HDPE Billets<br />

Oxygenates LDPE Flat Products<br />

Methanol LLDPE Hot Rolled Coil<br />

MTBE PP Cold Rolled Coil<br />

Aromatics Advanced thermoplastic<br />

sheet and film materials<br />

Hot Dip Galvanized Coil<br />

Styrene Monomer Polycarbonates Pre-Painted Coil<br />

Benzene ABS<br />

Pyrolysis Gasoline Resins<br />

PTA Lexan<br />

Chemical Intermediates Noryl<br />

Caustic Acid Ultem<br />

Ethylene Di-chloride Valox<br />

Vinyl Chloride Monomer Xenoy<br />

Glycols Xylex<br />

Mono-ethylene Glycol<br />

Di-ethylene Glycol<br />

Tri-ethylene Glycol<br />

Industrial Gases<br />

Gaseous Nitrogen<br />

Liquid Nitrogen<br />

Liquid Argon<br />

Crude Krypton/Xenon<br />

Gaseous Hydrogen<br />

Linear Alpha Olefins<br />

Performance Chemicals<br />

Ethoxylates<br />

Ethanolamines<br />

Source: Sabic<br />

26

SABIC<br />

December 4, 2012<br />

FOOTNOTES<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

APPENDIX D: SABIC’S CONSOLIDATED SUBSIDIARIES 41<br />

Company Name* Direct and Indirect Shareholding<br />

Sabic Industrial Investments Company (SIIC) and its subsidiaries 100%<br />

Sabic Luxembourg (SLUX) and its subsidiaries 100%<br />

Sabic Asia Pacific Pte. (SAPPL) and its subsidiaries 100%<br />

Arabian Petrochemical Company and its subsidiary (Petrokemya) 100%<br />

Saudi Iron and Steel Company (Hadeed) 100%<br />

Sabic Sukuk Company (SUKUK) 100%<br />

Sabic Industrial Catalyst Co. (Sabcat) 100%<br />

Saudi European Petrochemical Company (Ibn Zahr) 80%<br />

Jubail United Petrochemical Company (United) 75%<br />

National Chemical Fertilizer Company (Ibn Al-Baytar) 72%<br />

National Industrial Gases Company (Gas) 70%<br />

Yanbu National Petrochemical Company (Yansab) 52%<br />

Saudi Methanol Company (Ar-Razi) 50%<br />

Al-Jubail Fertilizer Company (Al-Bayroni) 50%<br />

Saudi Yanbu Petrochemical Company (Yanpet) 50%<br />

National Methanol Company (Ibn Sina) 50%<br />

Saudi Petrochemical Company (Sadaf) 50%<br />

Eastern Petrochemical Company (Sharq) 50%<br />

Al-Jubail Petrochemical Company (Kemya) 50%<br />

Arabian Industrial Fiber Company (Ibn Rushd) 47%<br />

Saudi Arabian Fertilizer Company (Safco) 43%<br />

Saudi Kayan Petrochemical Company (Saudi Kayan) 35%<br />

Source: Sabic Report 2011<br />

*17 companies out of these consolidated subsidiaries are manufacturing subsidiaries<br />

APPENDIX E: SABIC’S INVESTMENTS<br />

Associated Companies Shareholding<br />

Gulf Petrochemical Industries Co. (GPIC) 33%<br />

Gulf Aluminum Rolling Mills Co. (Garmco) 31%<br />

Maaden Phosphate Company 30%<br />

Power and Water Utilities Company 25%<br />

Aluminum Bahrain BSC (Alba) 21%<br />

National Chemical Carrier Company 20%<br />

Source: Sabic Report 2011<br />

41 Tianjin Petrochemical Company, owned by Sabic, SIIC and Sinopec, is proportionately consolidated in Sabic›s<br />

consolidated financial statements.<br />

27

SABIC<br />

December 4, 2012<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

APPENDIX F: SABIC’S MANUFACTURING AFFILIATES<br />

Location Est.<br />

Date<br />

Onstream<br />

Date<br />

SBU Products<br />

Ar-Razi KSA 1979 1983 Chemicals Methanol<br />

Sadaf KSA 1980 1985 Chemicals Ethylene,Styrene,Caustic<br />

Soda,Ethylene Di-chloride, MTBE<br />

Ibn-Sina KSA 1981 1985 Chemicals Methanol, MTBE<br />

Yanpet KSA 1980 1985 Polymers Ethylene, Propylene,MEG,<br />

Polyethylene, Polypropylene<br />

Petrokemya KSA 1981 1985 Chemicals Ethylene,Polystyrene,Butene-1,<br />

Propylene,Butadiene,Benzene,<br />

Polyethylene, PVC,ABS<br />

Kemya KSA 1979 1985 Polymers Ethylene, Polyethylene<br />

Sharq KSA 1981 1985 Chemicals Ethylene,Propylene,MEG,DEG,<br />

TEG,LLDPE,HDPE<br />

Ibn Zahr KSA 1984 1988 Polymers MTBE,Polypropylene<br />

Ibn Rushd KSA 1993 1995 Polymers Aromatics, PTA,PET,Acetic Acid<br />

Al-Bayroni KSA 1979 1983 Fertilizers Ammonia,Urea,DOP<br />

Safco KSA 1965 1969 Fertilizers Ammonia,Urea<br />

Ibn Al-Baytar KSA 1985 1987 Fertilizers Ammonia,Urea,Phosphate<br />

Hadeed KSA 1979 1983 Metals Steel Rebars,HRC,CRC,Wire<br />

Rod,Flat Steel products<br />

Gas KSA 1983 1984 Chemicals Hydrogen,Oxygen,Nitrogen<br />

United KSA 2001 2004 Chemicals Ethylene,Polyethylene,MEG,LAO<br />

Yansab KSA 2004 2008 Polymers Ethylene,Propylene,LLDPE,<br />

HDPE, MEG, MTBE,<br />

Polypropylene, Butene-1,Butane-<br />

2,TolueneXylene<br />

Kayan KSA 2007 2011 Performance<br />

Chemicals<br />

Ethylene,Propylene, LDPE,HDPE,<br />

Polypropylene,MEG,Acetone,PC<br />

and other specialty products<br />

Garmco Bahrain 1981 1985 Metals Aluminum Sheet, Can Stocks<br />

GPIC Bahrain 1979 1985 Chemicals Ammonia,Methanol,Urea<br />