sabic - Search Center - Bank Audi

sabic - Search Center - Bank Audi

sabic - Search Center - Bank Audi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SABIC<br />

December 4, 2012<br />

FOOTNOTES<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

FERTILIZER INDUSTRY FUNDAMENTALS STILL FIRM<br />

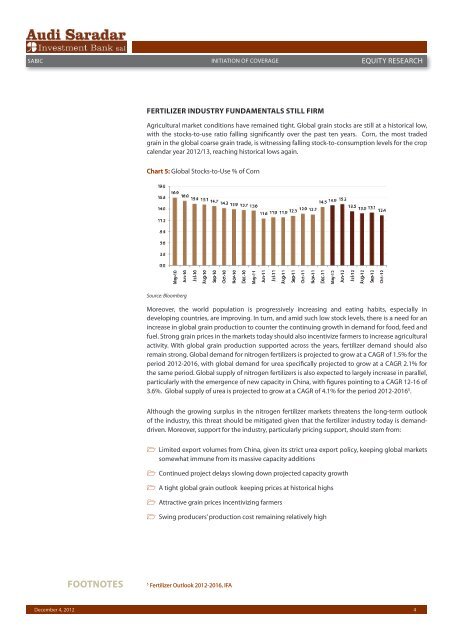

Agricultural market conditions have remained tight. Global grain stocks are still at a historical low,<br />

with the stocks-to-use ratio falling significantly over the past ten years. Corn, the most traded<br />

grain in the global coarse grain trade, is witnessing falling stock-to-consumption levels for the crop<br />

calendar year 2012/13, reaching historical lows again.<br />

Chart 5: Global Stocks-to-Use % of Corn<br />

Source: Bloomberg<br />

Moreover, the world population is progressively increasing and eating habits, especially in<br />

developing countries, are improving. In turn, and amid such low stock levels, there is a need for an<br />

increase in global grain production to counter the continuing growth in demand for food, feed and<br />

fuel. Strong grain prices in the markets today should also incentivize farmers to increase agricultural<br />

activity. With global grain production supported across the years, fertilizer demand should also<br />

remain strong. Global demand for nitrogen fertilizers is projected to grow at a CAGR of 1.5% for the<br />

period 2012-2016, with global demand for urea specifically projected to grow at a CAGR 2.1% for<br />

the same period. Global supply of nitrogen fertilizers is also expected to largely increase in parallel,<br />

particularly with the emergence of new capacity in China, with figures pointing to a CAGR 12-16 of<br />

3.6%. Global supply of urea is projected to grow at a CAGR of 4.1% for the period 2012-2016 5 .<br />

Although the growing surplus in the nitrogen fertilizer markets threatens the long-term outlook<br />

of the industry, this threat should be mitigated given that the fertilizer industry today is demanddriven.<br />

Moreover, support for the industry, particularly pricing support, should stem from:<br />

1 Limited export volumes from China, given its strict urea export policy, keeping global markets<br />

somewhat immune from its massive capacity additions<br />

1 Continued project delays slowing down projected capacity growth<br />

1 A tight global grain outlook keeping prices at historical highs<br />

1 Attractive grain prices incentivizing farmers<br />

1 Swing producers’ production cost remaining relatively high<br />

5 Fertilizer Outlook 2012-2016, IFA<br />

4