swot analysis - Search Center - Bank Audi

swot analysis - Search Center - Bank Audi

swot analysis - Search Center - Bank Audi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

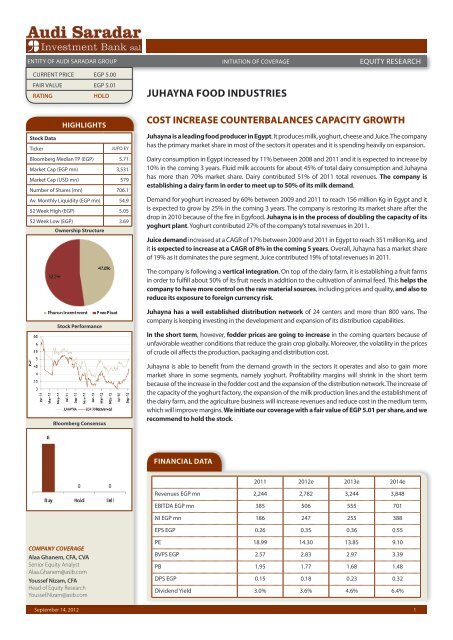

ENTITY OF AUDI SARADAR GROUP<br />

CURRENT PRICE EGP 5.00<br />

FAIR VALUE EGP 5.01<br />

RATING HOLD<br />

Stock Data<br />

Ownership Structure<br />

Stock Performance<br />

Bloomberg Consensus<br />

September 14, 2012<br />

HIGHLIGHTS<br />

Ticker JUFO EY<br />

Bloomberg Median TP (EGP) 5.71<br />

Market Cap (EGP mn) 3,531<br />

Market Cap (USD mn) 579<br />

Number of Shares (mn) 706.1<br />

Av. Monthly Liquidity (EGP mn) 54.9<br />

52 Week High (EGP) 5.05<br />

52 Week Low (EGP) 3.69<br />

COMPANY COVERAGE<br />

Alaa Ghanem, CFA, CVA<br />

Senior Equity Analyst<br />

Alaa.Ghanem@asib.com<br />

Youssef Nizam, CFA<br />

Head of Equity Research<br />

Youssef.Nizam@asib.com<br />

INITIATION OF COVERAGE<br />

JUHAYNA FOOD INDUSTRIES<br />

EQUITY RESEARCH<br />

COST INCREASE COUNTERBALANCES CAPACITY GROWTH<br />

Juhayna is a leading food producer in Egypt. It produces milk, yoghurt, cheese and Juice. The company<br />

has the primary market share in most of the sectors it operates and it is spending heavily on expansion.<br />

Dairy consumption in Egypt increased by 11% between 2008 and 2011 and it is expected to increase by<br />

10% in the coming 3 years. Fluid milk accounts for about 45% of total dairy consumption and Juhayna<br />

has more than 70% market share. Dairy contributed 51% of 2011 total revenues. The company is<br />

establishing a dairy farm in order to meet up to 50% of its milk demand.<br />

Demand for yoghurt increased by 60% between 2009 and 2011 to reach 156 million Kg in Egypt and it<br />

is expected to grow by 25% in the coming 3 years. The company is restoring its market share after the<br />

drop in 2010 because of the fire in Egyfood. Juhayna is in the process of doubling the capacity of its<br />

yoghurt plant. Yoghurt contributed 27% of the company’s total revenues in 2011.<br />

Juice demand increased at a CAGR of 17% between 2009 and 2011 in Egypt to reach 351 million Kg, and<br />

it is expected to increase at a CAGR of 8% in the coming 5 years. Overall, Juhayna has a market share<br />

of 19% as it dominates the pure segment. Juice contributed 19% of total revenues in 2011.<br />

The company is following a vertical integration. On top of the dairy farm, it is establishing a fruit farms<br />

in order to fulfill about 50% of its fruit needs in addition to the cultivation of animal feed. This helps the<br />

company to have more control on the raw material sources, including prices and quality, and also to<br />

reduce its exposure to foreign currency risk.<br />

Juhayna has a well established distribution network of 24 centers and more than 800 vans. The<br />

company is keeping investing in the development and expansion of its distribution capabilities.<br />

In the short term, however, fodder prices are going to increase in the coming quarters because of<br />

unfavorable weather conditions that reduce the grain crop globally. Moreover, the volatility in the prices<br />

of crude oil affects the production, packaging and distribution cost.<br />

Juhayna is able to benefit from the demand growth in the sectors it operates and also to gain more<br />

market share in some segments, namely yoghurt. Profitability margins will shrink in the short term<br />

because of the increase in the fodder cost and the expansion of the distribution network. The increase of<br />

the capacity of the yoghurt factory, the expansion of the milk production lines and the establishment of<br />

the dairy farm, and the agriculture business will increase revenues and reduce cost in the medium term,<br />

which will improve margins. We initiate our coverage with a fair value of EGP 5.01 per share, and we<br />

recommend to hold the stock.<br />

FINANCIAL DATA<br />

2011 2012e 2013e 2014e<br />

Revenues EGP mn 2,244 2,782 3,244 3,848<br />

EBITDA EGP mn 385 506 555 701<br />

NI EGP mn 186 247 255 388<br />

EPS EGP 0.26 0.35 0.36 0.55<br />

PE 18.99 14.30 13.85 9.10<br />

BVPS EGP 2.57 2.83 2.97 3.39<br />

PB 1.95 1.77 1.68 1.48<br />

DPS EGP 0.15 0.18 0.23 0.32<br />

Dividend Yield 3.0% 3.6% 4.6% 6.4%<br />

1

JUHAYNA FOOD INDUSTRIES INITIATION OF COVERAGE<br />

EQUITY RESEARCH<br />

TABLE OF CONTENTS<br />

Company Overview 2<br />

Investment Case 3<br />

Dairy 3<br />

Yoghurt 4<br />

Juice 5<br />

SWOT Analysis 8<br />

Valuation 9<br />

Pro Forma Financials 10<br />

Appendix 11<br />

September 14, 2012<br />

COMPANY OVERVIEW<br />

Established in 1983, Juhayna is a leading food producer in Egypt. The company mainly operates in<br />

producing and packaging various kinds of dairy and juice products. Production began in 1987 with<br />

a capacity of 35 tons/day and total sales of EGP 2.4 million. Currently, Juhayna with a paid up capital<br />

of EGP 706 million, employing a work force of 3,700 employees and having a daily production<br />

capacity of 2,900 tons.<br />

Chart 1: 2011 Sales by Sector<br />

Source: Company Financials<br />

Most of the sales are in the local market and exports accounts for just 5% of total revenues in H1 12.<br />

Juhayna has leading market shares in most of the segments it operates and it is in the process of<br />

increasing its capacity in the milk and yoghurt sectors.<br />

The company is establishing dairy and fruit farms in addition to the cultivation of animal feed in a<br />

step to have more control on the raw material sources, including prices and quality.<br />

Juhayna has also a well established distribution channel with more than 800 vehicles and 24<br />

distribution centers and it is in the process of opening additional distribution centers.<br />

Table 1: Group Legal Structure<br />

Juhayna Food Industries SAE<br />

(Milk & cream)<br />

Subsidiaries Ownership Products<br />

Dawleya Company 99.9% Juice<br />

Egyptian Food Industries<br />

(Egyfood)<br />

99.9% Yoghurt<br />

Masreya Dairy 99.9% Milk & Cheese<br />

El Marwa Food Industries Co. 99.9% Fruit Juice & Concentrates<br />

Modern Concentrate Co. 99.9% Fruit Juice & Concentrates<br />

Al Enmaa For Agricultural<br />

Development<br />

Enmaa For Reclamation &<br />

Agriculture<br />

99.9% Agriculture Land<br />

development<br />

99.9% Agriculture Land<br />

development<br />

Enmaa For Livestock 99.9% Dairy Farm<br />

Milkys Dairy Co. 40.0% Dairy Farm<br />

Tiba For Trading & Distribution 99.9% Sales & Distribution<br />

2

JUHAYNA FOOD INDUSTRIES<br />

Imports are increasing at a decreasing<br />

rate<br />

September 14, 2012<br />

INVESTMENT CASE<br />

DAIRY SEGMENT<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

Demand for milk and dairy products in Egypt is increasing due to two main reasons:<br />

1 Population growth: annual historical rate averaged 1.9% during the last 10 years, according to<br />

IMF, and expected to increase slightly to 2% in the coming 6 years.<br />

1 Rising per capita consumption: from 47.6kg in 2007 to 49.8kg in 2010 and it is expected to reach<br />

53.6kg in 2015, according to Fapri.<br />

Chart 2: Dairy Consumption<br />

Source: Fapri<br />

Fluid milk accounts for about 45% of total dairy consumption. Local production, on the other hand,<br />

depends on 2 main factors:<br />

1 The number of milking cow heads: expected to increase slightly from 1.62 million in 2006 to 1.69<br />

million in 2015.<br />

1 Yield per cow: showing a noticeable improvement from 2.48 kg per day in 2007 to 2.75 in 2010,<br />

and expected to reach 3.48 in 2015 (CAGR of 4.8%), according to Fapri.<br />

Chart 3: Milk Production<br />

Source: Fapri<br />

Despite this increase, local production just covers a portion of total demand. Both local and foreign<br />

companies are eyeing the dairy market in Egypt to benefit from the deficit in the production<br />

capacity. Egyptian Dina Farms, for example, aims to double its 11,000 milking and non-milking cows<br />

herd by 2014. Juhayna is establishing its own dairy farm of 14,000 heads. Saudi Almarai plans to<br />

invest heavily in Egypt in order to gain a large market share. Therefore, imports are expected to keep<br />

increasing in the coming years but at a decreasing rate.<br />

3

JUHAYNA FOOD INDUSTRIES<br />

Conversion rate toward packaged milk<br />

is slow<br />

Emphasizing on cost efficient products<br />

On track to reduce reliance on 3 rd party<br />

suppliers<br />

September 14, 2012<br />

Chart 4: Imports<br />

Source: Fapri<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

Important to note that the drop in production and consumption in 2009 was due to various kinds of<br />

diseases that affected the livestock in Egypt. Disease is a continuous risk that threats animal farms in<br />

Egypt which could lead to death and reproduction failure, and some limited cases were discovered<br />

in small farms in Egypt in 2012.<br />

Around 85% of the market is loose milk and just 15% is packaged milk. Different campaigns are<br />

done in collaboration between the private sector (including Juhayna) and the government in<br />

order to raise awareness among the public of the advantage of using packaged milk. However, the<br />

conversion toward the use of packaged milk is still slow mainly because of the price difference and<br />

it is expected to reach 20% in 2014.<br />

Juhayna is a main player in the plain packaged milk industry in Egypt with a market share of 70%<br />

followed by Beyti, indirectly owned by Almarai (8%). Juhayna is also the main player in the flavored<br />

packaged milk with a market share of 74% in 2011. In addition to milk, which is the largest contributor<br />

to the dairy revenues, Juhayna produces white cheese and cream. The company is increasing its<br />

dairy capacities - new production lines were installed during H1 12 and others will be installed in<br />

the coming quarters - and emphasizing on cost efficient and small size product. The dairy segment<br />

contributed more than 50% of the company’s total revenues in 2011. About 170 thousand tons were<br />

sold in 2011, recognizing revenues of EGP 1.1 billion.<br />

In order to reduce reliance on third parties, Juhayna is in the process of establishing its own dairy<br />

farms of 14,000 cows, allowing it to satisfy up to 50% of its raw milk needs – construction to begin in<br />

2013. This comes after the previous acquisition of 40% of Milkys Dairy, satisfying 10% of milk needs.<br />

In addition, it is in the process of the cultivation of animal feeds in order to have more control on raw<br />

material sources, including prices and quality.<br />

YOGHURT<br />

Demand for yoghurt increased by 60% between 2009 and 2011 to reach 156 million Kg in Egypt and<br />

it is expected to grow by 25% in the coming 3 years. However, per capita consumption remains one of<br />

the lowest in the world.<br />

Chart 5: Yoghurt Per Capita Consumption<br />

Source: Juhayna<br />

4

JUHAYNA FOOD INDUSTRIES<br />

Fast conversion toward packaged<br />

yogurt<br />

Juhayna has the capability to expand<br />

in the juice sector<br />

September 14, 2012<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

Changing lifestyle, increasing health awareness and the entrance of international brands resulted in<br />

aggressive conversion from loose to packaged yoghurt, especially that there is little price difference.<br />

Packaged yoghurt accounted for 66% of total market in 2011 compared to 44% in 2008.<br />

Juhayna produced 61 million Kg of yoghurt in 2011, 39% higher than 2010. The company has a<br />

leading share of 73% in the drinkable market but it ranks second in the spoonable market with a<br />

31% share, after Danone (35%), according to MEMRB.<br />

The company’s share in the yoghurt market dropped from 44% in 2009 to 39% in 2011 due to the<br />

fire in its factory in 2010. In order to restore and also to increase its share, Juhayna is in the process<br />

of establishing a new EGP 330 million yoghurt factory in order to double its capacity. Operations are<br />

expected to start in mid 2013 and the company took a loan of EGP 300 million to finance the project.<br />

Chart 6: Juhayna Market Share in the Yoghurt Segment<br />

Source: Juhayna<br />

JUICE<br />

Juice demand increased at a CAGR of 17% between 2009 and 2011 in Egypt to reach 351 million Kg,<br />

but per capita consumption remains low at about 4 liters/year. Consumption is expected to increase<br />

at a CAGR of 8% in the coming 5 years, according to FAPRI.<br />

Chart 7: Juice Per Capita Consumption<br />

Source: Juhayna<br />

While the pure share remains constant at about 3% of total juice market, the nectar share is increasing<br />

(from 56% in 2009 to 59% in 2011) at the cost of drink. The juice market is fragmented with more<br />

than 300 players. Juhayna produced 67 million kg of juice in 2011 with an overall market share<br />

of 19%. Because the juice market is fragmented, and because Juhayna has the needed expertise<br />

and most importantly a well established distribution network, we believe that the company should<br />

expand in this sector in order to gain more market share in the nectar and drink segments.<br />

5

JUHAYNA FOOD INDUSTRIES<br />

September 14, 2012<br />

Chart 8: Juhayna Market Share in the Juice Sector<br />

Source: Juhayna, ASIB<br />

Table 2: Summary of Financials<br />

Revenues<br />

EGP million<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

2008 2009 2010 2011 H1 12<br />

Dairy 918 907 1,037 1,135 644<br />

Yoghurt 262 364 402 614 346<br />

Juice 264 287 384 421 240<br />

Concentrate 18 20 39 45 17<br />

Agriculture 0 0 0 29 20<br />

Total 1462 1578 1861 2244 1267<br />

% of Total Revenues Dairy 63% 57% 56% 51% 51%<br />

Yoghurt 18% 23% 22% 27% 27%<br />

Juice 18% 18% 21% 19% 19%<br />

Concentrate 1% 1% 2% 2% 1%<br />

Agriculture 0% 0% 0% 1% 2%<br />

Gross Margin Dairy 8.0% 16.4% 16.2% 13.8% 27.0%<br />

Source: Juhayna, ASIB<br />

Yoghurt 22.4% 38.1% 36.8% 34.6% 35.0%<br />

Juice 34.3% 33.7% 32.2% 27.0% 29.0%<br />

Concentrate -5.1% -18.9% -16.3% 14.6% 21.0%<br />

Agriculture NA NA NA 34.6% 8.0%<br />

Total 20.0% 32.5% 31.3% 28.3% 28.2%<br />

Despite that dairy revenues are increasing, its contribution to total revenues is dropping while<br />

yoghurt contribution is increasing for 4 main reasons:<br />

1 Overall demand for yoghurt in Egypt is expected to increase at a faster pace than that of dairy<br />

in the coming few years.<br />

1 The conversion rate to packaged products is higher for the yoghurt than that of milk. As such,<br />

Juhayna has a greater ability to pass the increase in raw material costs to end consumers in the<br />

yoghurt products than that in the dairy products, as the price difference between loose and<br />

packaged products is smaller for yoghurt than that of milk. Average price for dairy products<br />

increased by 4% between Q1 11 and Q1 12, while it increased by 10% for yoghurt products,<br />

despite the higher competition in this sector.<br />

1 Gross margin of the Yoghurt segment is much higher than that of dairy.<br />

6

JUHAYNA FOOD INDUSTRIES<br />

Backward integration reduces the<br />

company’s volatility of earnings<br />

September 14, 2012<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

1 Juhayna has a leading market share in the milk (plain and flavored) which is much higher than<br />

its share in the yoghurt segment.As such, Juhayna is in the process of doubling its yoghurt capacity<br />

in order to gain market share in this segment, which will increase yoghurt contribution to<br />

total revenues. At the same time, the company is working to maintain its leading market share<br />

in other segments.<br />

The volatility of the cost of fruits and animal feeds highly affects the performance of Juhayna. As<br />

such, the company is trying to secure parts of its needs by establishing a fruit farm, allowing it to<br />

secure about half of its fruit needs for concentrate plants, in addition to the cultivation of animal<br />

feeds. In the short term, however, the increase in the price of grains due to bad weather (including<br />

US and India) is expected to be reflected negatively in the company’s performance in the coming<br />

quarters.<br />

Juhayna has also a well established distribution channel with more than 800 vehicles and 24<br />

distribution centers and it is in the process of opening additional distribution centers.<br />

On the other hand, local currency devaluation is a main risk that threatens the company especially<br />

that more than 25% of raw materials are imported.<br />

In addition to local sales, Juhayna exports to neighborhood countries. Exports contributed 7.8%<br />

of total revenues in 2010, but it dropped to 4.1% in 2011, mainly due to the war in Libya, which<br />

accounted for 70% of total exports. In addition, gross margin dropped from 14% in 2010 to 8% in<br />

2011. Exports has started to improve in H1 12, and it contributed 5.2% of total revenues.<br />

Chart 9: Exports<br />

Source: Juhayna<br />

Juhayna was accused of violating of Anti-Monopolistic Law in pricing milk as well as many of<br />

its raw milk competitors such as Beyti and Enjoy. The Egyptian Competition Authority (ECA) has<br />

revealed that the three companies fixed the prices of raw milk bought from farmers. If proven true,<br />

a maximum fine of EGP 300 million will be imposed on Juhayna according to the law of punishment<br />

for any anti-competitive and monopolistic practices.<br />

7

JUHAYNA FOOD INDUSTRIES<br />

September 14, 2012<br />

SWOT ANALYSIS<br />

STRENGTHS<br />

1 Leading market shares<br />

1 Well established distribution channel<br />

1 Establishing of dairy and fruit farms<br />

1 Pricing flexibility<br />

WEAKNESSES<br />

1 High Inflation in Egypt<br />

1 Slow conversion to packaged milk<br />

1 Increase of fodder cost<br />

OPPORTUNITIES<br />

1 Restoring of exports<br />

1 Increasing capacity<br />

1 Fast conversion to packaged yoghurt<br />

THREATS<br />

1 Animal Disease<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

1 High competition in the yoghurt and juice segments<br />

1 Fluctuation of costs of raw materials, including oil<br />

1 Currency devaluation<br />

1 Anti-monopoly case<br />

8

JUHAYNA FOOD INDUSTRIES<br />

September 14, 2012<br />

VALUATION<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

The company has managed to benefit from the demand growth in the sectors it operates and also<br />

to gain more market share in some segments, namely yoghurt. According to our model, profitability<br />

margins will shrink in the short term because of the increase in the fodder cost and the expansion<br />

of the distribution network. The increase of the capacity of the yoghurt factory, the expansion of<br />

the milk production lines and the establishment of the dairy farm, and the agriculture business will<br />

increase revenues and reduce cost in the medium term, which will improve margins. We rely on the<br />

FCFF model to value the company’s share. We initiate our coverage with a fair value of EGP 5.01 per<br />

share, and we recommend to hold the stock.<br />

Table 3: FCFF<br />

EGP million unless otherwise stated 2012e 2013e 2014e<br />

Net Income 247 255 388<br />

Non-Cash Charges 172 203 212<br />

Fixed Capital Investment 500 500 300<br />

Change in Working Capital 70 82 53<br />

After Tax Interest 55 64 57<br />

FCFF (95) (60) 303<br />

PV of Terminal Value 3,613<br />

Net Debt 183<br />

Shares Outstanding (million) 706<br />

WACC 13.5%<br />

Terminal Growth 4.1%<br />

Fair Value (EGP) 5.01<br />

9

JUHAYNA FOOD INDUSTRIES<br />

September 14, 2012<br />

PRO FORMA FINANCIALS<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

EGP million unless otherwise stated 2010 2011 2012e 2013e 2014e<br />

Sales 1,861 2,244 2,782 3,244 3,848<br />

Growth 18% 21% 24% 17% 19%<br />

COGS (1,279) (1,609) (1,973) (2,347) (2,733)<br />

Gross profit 582.7 635.0 809.6 897.3 1,115.1<br />

Growth 14% 9% 28% 11% 24%<br />

Gross margin 31.3% 28.3% 29.1% 27.7% 29.0%<br />

S&D expenses (205) (255) (356) (406) (462)<br />

G&A expenses (82) (98) (121) (141) (169)<br />

Others* 19 (35) 2 2 5<br />

EBITDA 441 385 506 555 701<br />

EBITDA margin 23.7% 17.2% 18.2% 17.1% 18.2%<br />

EBIT 315 246 334 353 489<br />

EBIT margin 16.9% 11.0% 12.0% 10.9% 12.7%<br />

Net finance cost (59) (39) (59) (68) (60)<br />

Taxes (28) (23) (28) (29) (40)<br />

NI to shareholders 228 186 247 255 388<br />

Growth 23% -18% 33% 3% 52%<br />

Net margin 12.2% 8.3% 8.9% 7.9% 10.1%<br />

*2011 figure included EGP 41 million factory fire losses<br />

EGP million unless otherwise stated 2010 2011 2012e 2013e 2014e<br />

PPE 1,151 1,329 1,657 1,954 2,042<br />

Under construction 138 214 300 200 140<br />

Goodwill 97 97 97 97 97<br />

Investments 39 42 44 45 47<br />

Others 1 1 1 1 1<br />

Total non current assets 1,425 1,683 2,099 2,297 2,327<br />

Cash & equivalents 724 691 533 543 666<br />

Inventories 280 397 468 556 629<br />

AR 299 188 231 273 316<br />

Others 1 1 2 2 2<br />

Total current assets 1,303 1,278 1,233 1,373 1,612<br />

Total assets 2,728 2,961 3,332 3,670 3,940<br />

LT loans 384 252 299 320 320<br />

Other Liabilities 77 81 85 93 104<br />

Total non current liabilities 461 334 384 413 424<br />

Short term debt 377 647 739 898 798<br />

Trade balances 217 149 187 235 287<br />

Others 29 20 26 27 37<br />

Total current liabilities 623 816 952 1,160 1,123<br />

Total liabilities 1,084 1,149 1,336 1,573 1,547<br />

Total equity 1,644 1,812 1,996 2,097 2,393<br />

ROAE 20.5% 10.8% 13.0% 12.5% 17.3%<br />

ROAA 9.8% 6.5% 7.8% 7.3% 10.2%<br />

Net debt to equity 0.02 0.11 0.25 0.32 0.19<br />

10

JUHAYNA FOOD INDUSTRIES<br />

September 14, 2012<br />

APPENDIX I<br />

RELATIVE VALUATION<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

Below are some food producers with similar business model in the world. We include these figures<br />

for comparative purposes only. Calculation is based on 2011 numbers, except PE, PB and EV/EBITDA<br />

ratios which are based on trailing figures ending Q1 or Q2 12 (according to the availability of data).<br />

Table 4: Relative valuation<br />

PE PB EV/EBITDA DVD ROE ROA Net Debt<br />

to Equity<br />

Net<br />

Margin<br />

Gross<br />

Margin<br />

Alaska Milk Corp 10.58 3.16 5.47 4.5% 18.0% 11.9% (0.61) 9.4% 28.2%<br />

Nestle Lanka PLC 22.57 12.89 16.09 5.4% 79.0% 29.5% (0.02) 10.2% 33.3%<br />

JM Smucker Co 15.60 1.60 8.54 2.5% 8.9% 5.0% 0.36 8.3% 34.2%<br />

Dean Foods Co 14.94 NA 8.14 0.0% 6.0% 1.1% 2.63 0.8% 24.8%<br />

Agrana AG 7.77 1.14 5.83 4.5% 14.2% 6.5% 0.54 5.9% NA<br />

Oarmalat SpA 11.34 0.74 4.97 3.9% 6.0% 4.7% (0.41) 5.0% 20.6%<br />

Almarai 15.24 3.06 11.87 2.3% 16.8% 7.3% 0.98 14.3% 37.7%<br />

Nadec 28.01 1.51 10.09 5.1% 8.6% 3.9% 0.83 5.9% 35.2%<br />

Halwani Brothers 14.30 1.98 7.59 3.7% 15.0% 11.7% (0.20) 9.9% 29.9%<br />

Average 15.60 3.26 8.73 0.04 19.2% 9.1% 0.45 7.7% 30.5%<br />

Juhayna 17.10 1.85 8.13 3.8% 10.3% 6.3% 0.12 8.3% 28.3%<br />

APPENDIX II<br />

SCENARIO ANALYSIS<br />

We run scenario <strong>analysis</strong> concerning the major economic risks that threaten Juhayna’s operating<br />

environment - the depreciation of the Egyptian Pound and the change in the interest rate – and how<br />

they affect the valuation of Juhayna.<br />

EGP/USD<br />

WACC<br />

12.0% 13.0% 13.5% 14.0% 15.0%<br />

5.5 7.09 6.15 5.76 5.41 4.82<br />

6.1 6.08 5.31 5.01 4.69 4.19<br />

6.7 6.08 5.31 4.98 4.69 4.19<br />

7.3 5.61 4.9 4.61 4.34 3.88<br />

7.9 2.61 2.31 2.17 2.05 1.83<br />

11

JUHAYNA FOOD INDUSTRIES<br />

FAIR VALUE DEFINITION<br />

September 14, 2012<br />

RATING GUIDE<br />

ISSUER<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

It is an unbiased estimate of the 12-month potential market price of the stock<br />

SELL REDUCE HOLD ACCUMULATE BUY<br />

Downside -30% -10% +10% +30% Upside<br />

BUY: Upside potential in share price is more than 30%<br />

ACCUMULATE: Upside potential in share price is between 10 and 30%<br />

HOLD: Upside or downside potential in share price less than 10%<br />

REDUCE: Downside potential in share price is between 10 and 30%<br />

SELL: Downside potential in share price is more than 30%<br />

<strong>Audi</strong> Saradar Investment <strong>Bank</strong><br />

<strong>Audi</strong> Saradar Investment <strong>Bank</strong> SAL • Lebanese joint stock company with a registered capital of<br />

10,000,000,000 Lebanese Pounds • Commercial Registrar in Beirut: 30812 • Holding number 33 on<br />

the Central <strong>Bank</strong>’s <strong>Bank</strong>s List.<br />

<strong>Bank</strong> <strong>Audi</strong> Plaza • Bab Idriss • Beirut 2021 8102 Lebanon • P.O. Box 11-2560 • Beirut 1107 2808 •<br />

Lebanon. Phone: +961 1 964072 • Fax: +961 1 970403 • Email: contactus@asib.com<br />

12

JUHAYNA FOOD INDUSTRIES<br />

September 14, 2012<br />

DISCLAIMER<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

“All rights reserved. This research document (the “Document”) is prepared by <strong>Audi</strong> Saradar Investment <strong>Bank</strong> SAL (“ASIB”),<br />

being an entity of <strong>Audi</strong> Saradar Group, for the use of the clients of ASIB and/or the clients of any entity within the <strong>Audi</strong><br />

Saradar Group.<br />

This Document is disclosed to you on a confidential basis. Receipt and/or review of this Document constitute your agreement<br />

not to copy, modify, redistribute, retransmit, or disclose to others the contents, opinions, conclusion, or information<br />

contained in this Document prior to public disclosure of the same by ASIB or the <strong>Audi</strong> Saradar Group or without the express<br />

prior written consent of ASIB.<br />

This Document is not intended for dissemination, distribution to, or use by, any person or entity in any country or jurisdiction<br />

which would subject ASIB or any entity within the <strong>Audi</strong> Saradar Group, to any registration or licensing requirements within<br />

these jurisdictions or where it might be considered as unlawful. Accordingly, this Document is for distribution solely in<br />

jurisdictions where permitted and to persons who may receive it without breaching any applicable legal or regulatory<br />

requirements. In any case, this Document shall not be distributed in the Republic of Egypt.<br />

Your attention is drawn to the fact that you should not access this Document if the regulations of your country of citizenship<br />

and/or residency or any applicable regulations prohibit it. In any case, persons who are subject to any restrictions in any<br />

country, such as US persons are not permitted to access information contained herein.<br />

Neither the information, nor any opinion expressed herein constitutes an offer or an invitation or a recommendation to<br />

make an offer, to buy or sell any security or other investment product related to such security or investment. This Document<br />

provides general information only, is not intended to provide personal investment advice or recommendation and does not<br />

take into account the specific investment objectives, financial situation and the particular needs of any specific person who<br />

may receive it. You should seek financial, legal or tax advice regarding the appropriateness and suitability in investing in any<br />

security, other investment or investment strategy discussed or forecasted in this Document.<br />

You should carefully read the definitions of the Rating Guide provided in this Document. In addition you should read this<br />

Document in its entirety and not conclude its contents from the ratings solely.<br />

The information herein was obtained from various public sources believed in good faith to be reliable. Neither ASIB nor any<br />

entity within the <strong>Audi</strong> Saradar Group represents that the information contained in this Document is complete, accurate<br />

or free from any error and makes no representations or warranties whatsoever as to the data, information and opinions<br />

provided herein.<br />

This Document and any information, opinion and prospect contained herein reflect a judgment at its original date<br />

of publication by ASIB and are subject to change without notice. ASIB and/or any entity within the <strong>Audi</strong> Saradar Group<br />

may have issued, and may in the future issue, other research documents that are inconsistent with, and reach different<br />

conclusions from, the information, opinions and prospects presented in this Document.<br />

This Document reflects the different assumptions, views and analytical methods of the analysts who prepared them; ASIB,<br />

and the <strong>Audi</strong> Saradar Group are under no obligation to ensure that such other research documents are brought to the<br />

attention of any recipient of this Document.<br />

ASIB, any entity within the <strong>Audi</strong> Saradar Group, one or more of their affiliates and/or their officers (including but not limited<br />

to their strategists, analysts and sales staff) may have a financial interest in securities of the issuer(s) or related investments,<br />

may engage in securities transactions, on a proprietary basis or otherwise, in a manner inconsistent with the view taken in<br />

this Document and may take a view that is inconsistent with that taken herein.<br />

The price, value of and income from any of the securities or financial instruments mentioned in this Document can fall as well<br />

as rise. The value of securities and financial instruments is subject to market conditions, volatility, exchange rate fluctuation<br />

and credit quality of any issuer that may have a positive or adverse effect on the price or income of such securities or<br />

financial instruments. Any forecasts on the economy, stock market, bond market or the economic trends of the markets are<br />

not necessarily a guide to future returns. You should understand that statements regarding future prospects may not be<br />

realized. Past performance should not be taken as an indication or guarantee of future performance, and no representation<br />

or warranty, express or implied, is made regarding future returns. As a result of the preceding, you may lose, as the case may<br />

be, the amount originally invested.<br />

None of ASIB, any entity within the <strong>Audi</strong> Saradar Group, any of their affiliates and/or their officers (including but not limited<br />

to their strategists, analysts and sales staff) shall be held liable for any loss or damage that may arise, directly or indirectly,<br />

from any use of the information contained in this Document nor for any decision or investment made on the basis of<br />

information contained herein.”<br />

13