sabic - Search Center - Bank Audi

sabic - Search Center - Bank Audi

sabic - Search Center - Bank Audi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SABIC<br />

December 4, 2012<br />

FOOTNOTES<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

FINANCIAL FLEXIBILITY PAVES WAY FOR 2020 TARGET<br />

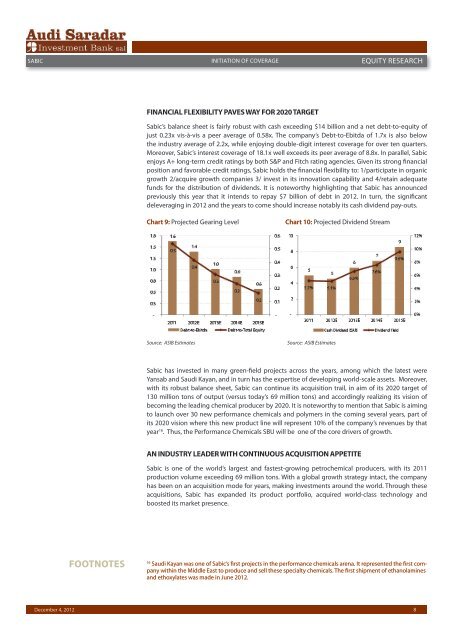

Sabic’s balance sheet is fairly robust with cash exceeding $14 billion and a net debt-to-equity of<br />

just 0.23x vis-à-vis a peer average of 0.58x. The company’s Debt-to-Ebitda of 1.7x is also below<br />

the industry average of 2.2x, while enjoying double-digit interest coverage for over ten quarters.<br />

Moreover, Sabic’s interest coverage of 18.1x well exceeds its peer average of 8.8x. In parallel, Sabic<br />

enjoys A+ long-term credit ratings by both S&P and Fitch rating agencies. Given its strong financial<br />

position and favorable credit ratings, Sabic holds the financial flexibility to: 1/participate in organic<br />

growth 2/acquire growth companies 3/ invest in its innovation capability and 4/retain adequate<br />

funds for the distribution of dividends. It is noteworthy highlighting that Sabic has announced<br />

previously this year that it intends to repay $7 billion of debt in 2012. In turn, the significant<br />

deleveraging in 2012 and the years to come should increase notably its cash dividend pay-outs.<br />

Chart 9: Projected Gearing Level Chart 10: Projected Dividend Stream<br />

Source: ASIB Estimates Source: ASIB Estimates<br />

Sabic has invested in many green-field projects across the years, among which the latest were<br />

Yansab and Saudi Kayan, and in turn has the expertise of developing world-scale assets. Moreover,<br />

with its robust balance sheet, Sabic can continue its acquisition trail, in aim of its 2020 target of<br />

130 million tons of output (versus today’s 69 million tons) and accordingly realizing its vision of<br />

becoming the leading chemical producer by 2020. It is noteworthy to mention that Sabic is aiming<br />

to launch over 30 new performance chemicals and polymers in the coming several years, part of<br />

its 2020 vision where this new product line will represent 10% of the company’s revenues by that<br />

year 16 . Thus, the Performance Chemicals SBU will be one of the core drivers of growth.<br />

AN INDUSTRY LEADER WITH CONTINUOUS ACQUISITION APPETITE<br />

Sabic is one of the world’s largest and fastest-growing petrochemical producers, with its 2011<br />

production volume exceeding 69 million tons. With a global growth strategy intact, the company<br />

has been on an acquisition mode for years, making investments around the world. Through these<br />

acquisitions, Sabic has expanded its product portfolio, acquired world-class technology and<br />

boosted its market presence.<br />

16 Saudi Kayan was one of Sabic’s first projects in the performance chemicals arena. It represented the first company<br />

within the Middle East to produce and sell these specialty chemicals. The first shipment of ethanolamines<br />

and ethoxylates was made in June 2012.<br />

8