adopting a mature growth strategy almarai company - Search Center ...

adopting a mature growth strategy almarai company - Search Center ...

adopting a mature growth strategy almarai company - Search Center ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ALMARAI<br />

March 05, 2012<br />

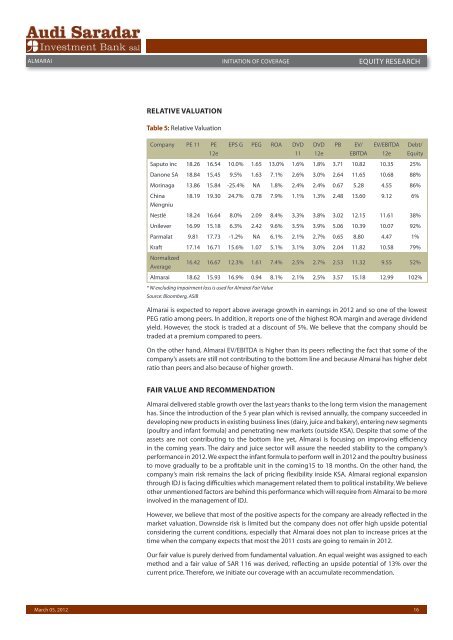

RELATIVE VALUATION<br />

Table 5: Relative Valuation<br />

Company PE 11 PE<br />

12e<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

EPS G PEG ROA DVD<br />

11<br />

DVD<br />

12e<br />

PB EV/<br />

EBITDA<br />

EV/EBITDA<br />

12e<br />

Debt/<br />

Equity<br />

Saputo inc 18.26 16.54 10.0% 1.65 13.0% 1.6% 1.8% 3.71 10.82 10.35 25%<br />

Danone SA 18.84 15.45 9.5% 1.63 7.1% 2.6% 3.0% 2.64 11.65 10.68 88%<br />

Morinaga 13.86 15.84 -25.4% NA 1.8% 2.4% 2.4% 0.67 5.28 4.55 86%<br />

China<br />

Mengniu<br />

18.19 19.30 24.7% 0.78 7.9% 1.1% 1.3% 2.48 13.60 9.12 6%<br />

Nestlé 18.24 16.64 8.0% 2.09 8.4% 3.3% 3.8% 3.02 12.15 11.61 38%<br />

Unilever 16.99 15.18 6.3% 2.42 9.6% 3.5% 3.9% 5.06 10.39 10.07 92%<br />

Parmalat 9.81 17.73 -1.2% NA 6.1% 2.1% 2.7% 0.65 8.80 4.47 1%<br />

Kraft 17.14 16.71 15.6% 1.07 5.1% 3.1% 3.0% 2.04 11.82 10.58 79%<br />

Normalized<br />

Average<br />

16.42 16.67 12.3% 1.61 7.4% 2.5% 2.7% 2.53 11.32 9.55 52%<br />

Almarai 18.62 15.93 16.9% 0.94 8.1% 2.1% 2.5% 3.57 15.18 12.99 102%<br />

* NI excluding impairment loss is used for Almarai Fair Value<br />

Source: Bloomberg, ASIB<br />

Almarai is expected to report above average <strong>growth</strong> in earnings in 2012 and so one of the lowest<br />

PEG ratio among peers. In addition, it reports one of the highest ROA margin and average dividend<br />

yield. However, the stock is traded at a discount of 5%. We believe that the <strong>company</strong> should be<br />

traded at a premium compared to peers.<br />

On the other hand, Almarai EV/EBITDA is higher than its peers reflecting the fact that some of the<br />

<strong>company</strong>’s assets are still not contributing to the bottom line and because Almarai has higher debt<br />

ratio than peers and also because of higher <strong>growth</strong>.<br />

FAIR VALUE AND RECOMMENDATION<br />

Almarai delivered stable <strong>growth</strong> over the last years thanks to the long term vision the management<br />

has. Since the introduction of the 5 year plan which is revised annually, the <strong>company</strong> succeeded in<br />

developing new products in existing business lines (dairy, juice and bakery), entering new segments<br />

(poultry and infant formula) and penetrating new markets (outside KSA). Despite that some of the<br />

assets are not contributing to the bottom line yet, Almarai is focusing on improving efficiency<br />

in the coming years. The dairy and juice sector will assure the needed stability to the <strong>company</strong>’s<br />

performance in 2012. We expect the infant formula to perform well in 2012 and the poultry business<br />

to move gradually to be a profitable unit in the coming15 to 18 months. On the other hand, the<br />

<strong>company</strong>’s main risk remains the lack of pricing flexibility inside KSA. Almarai regional expansion<br />

through IDJ is facing difficulties which management related them to political instability. We believe<br />

other unmentioned factors are behind this performance which will require from Almarai to be more<br />

involved in the management of IDJ.<br />

However, we believe that most of the positive aspects for the <strong>company</strong> are already reflected in the<br />

market valuation. Downside risk is limited but the <strong>company</strong> does not offer high upside potential<br />

considering the current conditions, especially that Almarai does not plan to increase prices at the<br />

time when the <strong>company</strong> expects that most the 2011 costs are going to remain in 2012.<br />

Our fair value is purely derived from fundamental valuation. An equal weight was assigned to each<br />

method and a fair value of SAR 116 was derived, reflecting an upside potential of 13% over the<br />

current price. Therefore, we initiate our coverage with an accumulate recommendation.<br />

16