adopting a mature growth strategy almarai company - Search Center ...

adopting a mature growth strategy almarai company - Search Center ...

adopting a mature growth strategy almarai company - Search Center ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ALMARAI<br />

March 05, 2012<br />

INITIATION OF COVERAGE EQUITY RESEARCH<br />

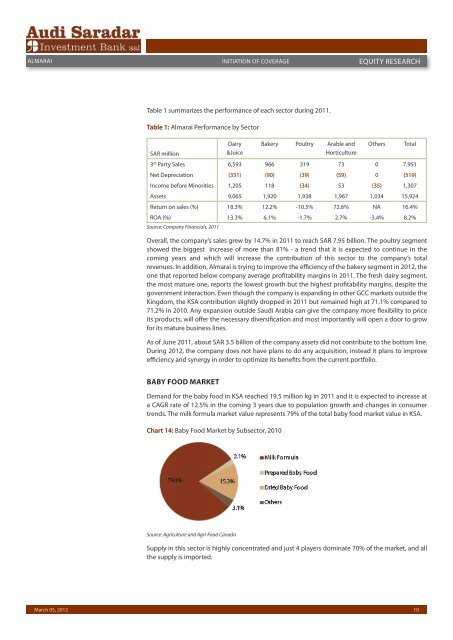

Table 1 summarizes the performance of each sector during 2011.<br />

Table 1: Almarai Performance by Sector<br />

SAR million<br />

Dairy<br />

&Juice<br />

Bakery Poultry Arable and<br />

Horticulture<br />

Others Total<br />

3 rd Party Sales 6,593 966 319 73 0 7,951<br />

Net Depreciation (331) (90) (39) (59) 0 (519)<br />

Income before Minorities 1,205 118 (34) 53 (35) 1,307<br />

Assets 9,065 1,920 1,938 1,967 1,034 15,924<br />

Return on sales (%) 18.3% 12.2% -10.5% 72.6% NA 16.4%<br />

ROA (%) 13.3% 6.1% -1.7% 2.7% -3.4% 8.2%<br />

Source: Company Financials, 2011<br />

Overall, the <strong>company</strong>’s sales grew by 14.7% in 2011 to reach SAR 7.95 billion. The poultry segment<br />

showed the biggest increase of more than 81% - a trend that it is expected to continue in the<br />

coming years and which will increase the contribution of this sector to the <strong>company</strong>’s total<br />

revenues. In addition, Almarai is trying to improve the efficiency of the bakery segment in 2012, the<br />

one that reported below <strong>company</strong> average profitability margins in 2011. The fresh dairy segment,<br />

the most <strong>mature</strong> one, reports the lowest <strong>growth</strong> but the highest profitability margins, despite the<br />

government interaction. Even though the <strong>company</strong> is expanding in other GCC markets outside the<br />

Kingdom, the KSA contribution slightly dropped in 2011 but remained high at 71.1% compared to<br />

71.2% in 2010. Any expansion outside Saudi Arabia can give the <strong>company</strong> more flexibility to price<br />

its products, will offer the necessary diversification and most importantly will open a door to grow<br />

for its <strong>mature</strong> business lines.<br />

As of June 2011, about SAR 3.5 billion of the <strong>company</strong> assets did not contribute to the bottom line.<br />

During 2012, the <strong>company</strong> does not have plans to do any acquisition, instead it plans to improve<br />

efficiency and synergy in order to optimize its benefits from the current portfolio.<br />

BABY FOOD MARKET<br />

Demand for the baby food in KSA reached 19.5 million kg in 2011 and it is expected to increase at<br />

a CAGR rate of 12.5% in the coming 3 years due to population <strong>growth</strong> and changes in consumer<br />

trends. The milk formula market value represents 79% of the total baby food market value in KSA.<br />

Chart 14: Baby Food Market by Subsector, 2010<br />

Source: Agriculture and Agri-Food Canada<br />

Supply in this sector is highly concentrated and just 4 players dominate 70% of the market, and all<br />

the supply is imported.<br />

10