financials - Bank Audi

financials - Bank Audi

financials - Bank Audi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

August 24, 2012<br />

EQUITY RESEARCH<br />

SAUDI BANKS<br />

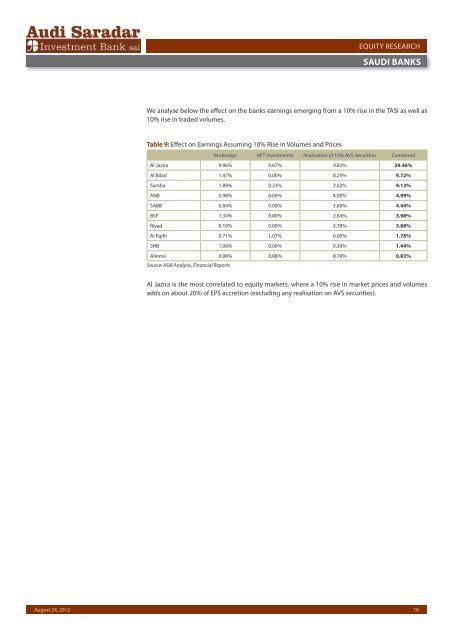

We analyse below the effect on the banks earnings emerging from a 10% rise in the TASI as well as<br />

10% rise in traded volumes.<br />

Table 9: Effect on Earnings Assuming 10% Rise in Volumes and Prices<br />

Brokerage HFT investments Realisation of 10% AVS Securities Combined<br />

Al Jazira 9.96% 9.67% 9.83% 29.46%<br />

Al Bilad 1.47% 0.00% 8.25% 9.72%<br />

Samba 1.89% 0.23% 7.02% 9.13%<br />

ANB 0.98% 0.00% 4.00% 4.99%<br />

SABB 0.84% 0.00% 3.60% 4.44%<br />

BSF 1.34% 0.00% 2.64% 3.98%<br />

Riyad 0.10% 0.00% 3.78% 3.88%<br />

Al Rajhi 0.71% 1.07% 0.00% 1.78%<br />

SHB 1.06% 0.00% 0.39% 1.44%<br />

Alinma 0.00% 0.08% 0.74% 0.83%<br />

Source: ASIB Analysis, Financial Reports<br />

Al Jazira is the most correlated to equity markets, where a 10% rise in market prices and volumes<br />

adds on about 20% of EPS accretion (excluding any realisation on AVS securities).<br />

16