financials - Bank Audi

financials - Bank Audi

financials - Bank Audi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

August 24, 2012<br />

FAVORABLE LIQUIDITY ADDS SUPPORT TO LENDING<br />

MOMENTUM<br />

EQUITY RESEARCH<br />

SAUDI BANKS<br />

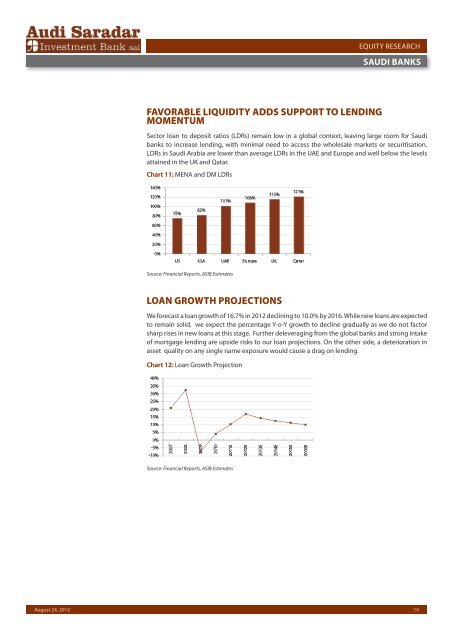

Sector loan to deposit ratios (LDRs) remain low in a global context, leaving large room for Saudi<br />

banks to increase lending, with minimal need to access the wholesale markets or securitisation.<br />

LDRs in Saudi Arabia are lower than average LDRs in the UAE and Europe and well below the levels<br />

attained in the UK and Qatar.<br />

Chart 11: MENA and DM LDRs<br />

Source: Financial Reports, ASIB Estimates<br />

LOAN GROWTH PROJECTIONS<br />

We forecast a loan growth of 16.7% in 2012 declining to 10.0% by 2016. While new loans are expected<br />

to remain solid, we expect the percentage Y-o-Y growth to decline gradually as we do not factor<br />

sharp rises in new loans at this stage. Further deleveraging from the global banks and strong intake<br />

of mortgage lending are upside risks to our loan projections. On the other side, a deterioration in<br />

asset quality on any single name exposure would cause a drag on lending.<br />

Chart 12: Loan Growth Projection<br />

Source: Financial Reports, ASIB Estimates<br />

14