financials - Bank Audi

financials - Bank Audi

financials - Bank Audi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

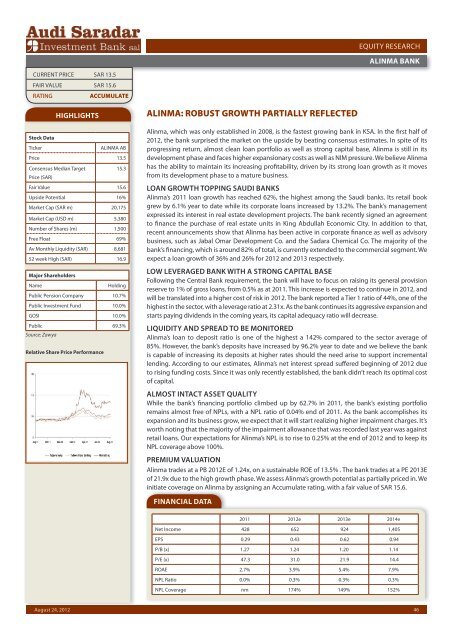

CURRENT PRICE SAR 13.5<br />

FAIR VALUE SAR 15.6<br />

RATING ACCUMULATE<br />

Stock Data<br />

Ticker ALINMA AB<br />

Price 13.5<br />

Consensus Median Target<br />

Price (SAR)<br />

15.3<br />

Fair Value 15.6<br />

Upside Potential 16%<br />

Market Cap (SAR m) 20,175<br />

August 24, 2012<br />

HIGHLIGHTS<br />

Market Cap (USD m) 5,380<br />

Number of Shares (m) 1,500<br />

Free Float 69%<br />

Av Monthly Liquidity (SAR) 8,681<br />

52 week High (SAR) 16.9<br />

Major Shareholders<br />

Name Holding<br />

Public Pension Company 10.7%<br />

Public Investment Fund 10.0%<br />

GOSI 10.0%<br />

Public<br />

Source: Zawya<br />

69.3%<br />

Relative Share Price Performance<br />

ALINMA: ROBUST GROWTH PARTIALLY REFLECTED<br />

EQUITY RESEARCH<br />

Alinma, which was only established in 2008, is the fastest growing bank in KSA. In the first half of<br />

2012, the bank surprised the market on the upside by beating consensus estimates. In spite of its<br />

progressing return, almost clean loan portfolio as well as strong capital base, Alinma is still in its<br />

development phase and faces higher expansionary costs as well as NIM pressure. We believe Alinma<br />

has the ability to maintain its increasing profitability, driven by its strong loan growth as it moves<br />

from its development phase to a mature business.<br />

LOAN GROWTH TOPPING SAUDI BANKS<br />

Alinma’s 2011 loan growth has reached 62%, the highest among the Saudi banks. Its retail book<br />

grew by 6.1% year to date while its corporate loans increased by 13.2%. The bank’s management<br />

expressed its interest in real estate development projects. The bank recently signed an agreement<br />

to finance the purchase of real estate units in King Abdullah Economic City. In addition to that,<br />

recent announcements show that Alinma has been active in corporate finance as well as advisory<br />

business, such as Jabal Omar Development Co. and the Sadara Chemical Co. The majority of the<br />

bank’s financing, which is around 82% of total, is currently extended to the commercial segment. We<br />

expect a loan growth of 36% and 26% for 2012 and 2013 respectively.<br />

LOW LEVERAGED BANK WITH A STRONG CAPITAL BASE<br />

Following the Central <strong>Bank</strong> requirement, the bank will have to focus on raising its general provision<br />

reserve to 1% of gross loans, from 0.5% as at 2011. This increase is expected to continue in 2012, and<br />

will be translated into a higher cost of risk in 2012. The bank reported a Tier 1 ratio of 44%, one of the<br />

highest in the sector, with a leverage ratio at 2.31x. As the bank continues its aggressive expansion and<br />

starts paying dividends in the coming years, its capital adequacy ratio will decrease.<br />

LIQUIDITY AND SPREAD TO BE MONITORED<br />

Alinma’s loan to deposit ratio is one of the highest a 142% compared to the sector average of<br />

85%. However, the bank’s deposits have increased by 96.2% year to date and we believe the bank<br />

is capable of increasing its deposits at higher rates should the need arise to support incremental<br />

lending. According to our estimates, Alinma’s net interest spread suffered beginning of 2012 due<br />

to rising funding costs. Since it was only recently established, the bank didn’t reach its optimal cost<br />

of capital.<br />

ALMOST INTACT ASSET QUALITY<br />

While the bank’s financing portfolio climbed up by 62.7% in 2011, the bank’s existing portfolio<br />

remains almost free of NPLs, with a NPL ratio of 0.04% end of 2011. As the bank accomplishes its<br />

expansion and its business grow, we expect that it will start realizing higher impairment charges. It’s<br />

worth noting that the majority of the impairment allowance that was recorded last year was against<br />

retail loans. Our expectations for Alinma’s NPL is to rise to 0.25% at the end of 2012 and to keep its<br />

NPL coverage above 100%.<br />

PREMIUM VALUATION<br />

Alinma trades at a PB 2012E of 1.24x, on a sustainable ROE of 13.5% . The bank trades at a PE 2013E<br />

of 21.9x due to the high growth phase. We assess Alinma’s growth potential as partially priced in. We<br />

initiate coverage on Alinma by assigning an Accumulate rating, with a fair value of SAR 15.6.<br />

FINANCIAL DATA<br />

ALINMA BANK<br />

2011 2012e 2013e 2014e<br />

Net Income 428 652 924 1,405<br />

EPS 0.29 0.43 0.62 0.94<br />

P/B (x) 1.27 1.24 1.20 1.14<br />

P/E (x) 47.3 31.0 21.9 14.4<br />

ROAE 2.7% 3.9% 5.4% 7.9%<br />

NPL Ratio 0.0% 0.3% 0.3% 0.3%<br />

NPL Coverage nm 174% 149% 152%<br />

46