financials - Bank Audi

financials - Bank Audi

financials - Bank Audi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

August 24, 2012<br />

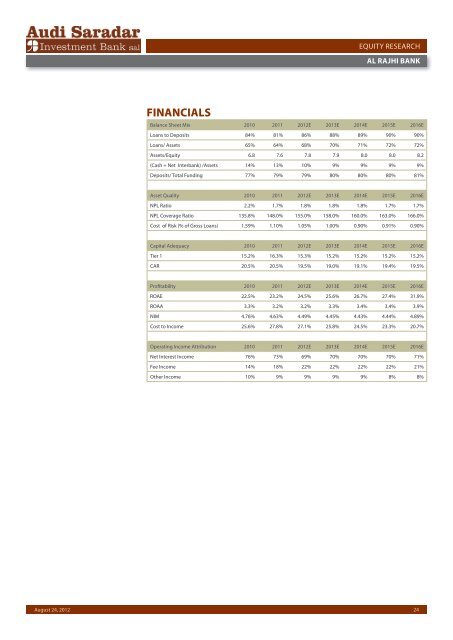

FINANCIALS<br />

EQUITY RESEARCH<br />

AL RAJHI BANK<br />

Balance Sheet Mix 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

Loans to Deposits 84% 81% 86% 88% 89% 90% 90%<br />

Loans/ Assets 65% 64% 68% 70% 71% 72% 72%<br />

Assets/Equity 6.8 7.6 7.8 7.9 8.0 8.0 8.2<br />

(Cash + Net Interbank) /Assets 14% 13% 10% 9% 9% 9% 9%<br />

Deposits/ Total Funding 77% 79% 79% 80% 80% 80% 81%<br />

Asset Quality 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

NPL Ratio 2.2% 1.7% 1.8% 1.8% 1.8% 1.7% 1.7%<br />

NPL Coverage Ratio 135.8% 148.0% 155.0% 158.0% 160.0% 163.0% 166.0%<br />

Cost of Risk (% of Gross Loans) 1.59% 1.10% 1.05% 1.00% 0.90% 0.91% 0.90%<br />

Capital Adequacy 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

Tier 1 15.2% 16.3% 15.3% 15.2% 15.2% 15.2% 15.2%<br />

CAR 20.5% 20.5% 19.5% 19.0% 19.1% 19.4% 19.5%<br />

Profitability 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

ROAE 22.5% 23.2% 24.5% 25.6% 26.7% 27.4% 31.9%<br />

ROAA 3.3% 3.2% 3.2% 3.3% 3.4% 3.4% 3.9%<br />

NIM 4.76% 4.63% 4.49% 4.45% 4.43% 4.44% 4.89%<br />

Cost to Income 25.6% 27.8% 27.1% 25.8% 24.5% 23.3% 20.7%<br />

Operating Income Attribution 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

Net Interest Income 76% 73% 69% 70% 70% 70% 71%<br />

Fee Income 14% 18% 22% 22% 22% 22% 21%<br />

Other Income 10% 9% 9% 9% 9% 8% 8%<br />

24