The national shipping company of saudi arabia - Bank Audi

The national shipping company of saudi arabia - Bank Audi

The national shipping company of saudi arabia - Bank Audi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

THE NATIONAL SHIPPING COMPANY OF SAUDI ARABIA<br />

Stable demand combined with<br />

moderate supply<br />

December 30, 2011<br />

COMPANY UPDATE EQUITY RESEARCH<br />

2011 is a crisis year for the VLCC <strong>shipping</strong> market and according to current figures, 2012 will<br />

continue to be a difficult year. Data from brokers are showing a decreasing trend in the chartering<br />

rates. Some vessels were currently chartered for about USD 20,000 per day for 2-3 years, compared<br />

to about USD 30,000 at the beginning <strong>of</strong> the year. Operating costs are about USD 10,000 – 11,000<br />

per day, excluding financing costs. If we account to the latest, cost could rise to about USD 26,000<br />

per day. Rates in the spot market barely cover operating costs, and during some periods in the year<br />

rates were below costs, putting serious question marks on the ability <strong>of</strong> some tanker owners to<br />

survive. During the last months, some US tanker companies, as Omega Navigation, Marco Polo and<br />

General Maritime, seek protection from their creditors by filing for Chapter 11 bankruptcy. Others<br />

are creating pools to jointly manage their VLCC fleet, a way that could decrease competition, share<br />

cost and increase operational power, which could increase income. Currently, 4 tanker owners,<br />

Mitsui OSK Lines’ Phoenix Tankers, Maersk Tankers, Samco Shipholding and Ocean Tankers, are<br />

forming a pool <strong>of</strong> 50 VLCCs to start operations by the end <strong>of</strong> 2012.<br />

CHEMICAL-OIL SHIPPING MARKET<br />

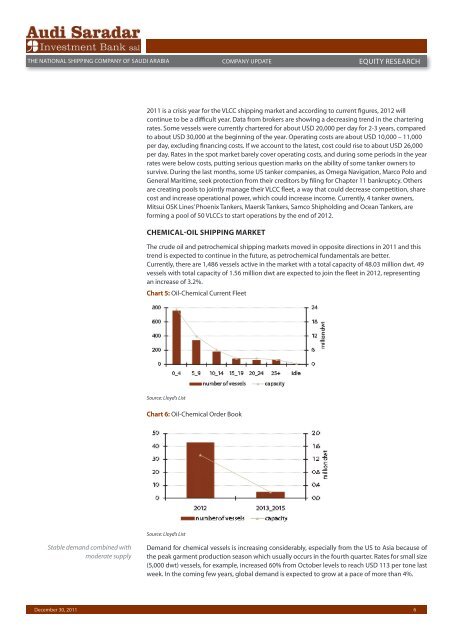

<strong>The</strong> crude oil and petrochemical <strong>shipping</strong> markets moved in opposite directions in 2011 and this<br />

trend is expected to continue in the future, as petrochemical fundamentals are better.<br />

Currently, there are 1,486 vessels active in the market with a total capacity <strong>of</strong> 48.03 million dwt. 49<br />

vessels with total capacity <strong>of</strong> 1.56 million dwt are expected to join the fleet in 2012, representing<br />

an increase <strong>of</strong> 3.2%.<br />

Chart 5: Oil-Chemical Current Fleet<br />

Source: Lloyd’s List<br />

Chart 6: Oil-Chemical Order Book<br />

Source: Lloyd’s List<br />

Demand for chemical vessels is increasing considerably, especially from the US to Asia because <strong>of</strong><br />

the peak garment production season which usually occurs in the fourth quarter. Rates for small size<br />

(5,000 dwt) vessels, for example, increased 60% from October levels to reach USD 113 per tone last<br />

week. In the coming few years, global demand is expected to grow at a pace <strong>of</strong> more than 4%.<br />

6