gÉÉŌ A.]ÉŌ. xÉÉxÉÉ

gÉÉŌ A.]ÉŌ. xÉÉxÉÉ

gÉÉŌ A.]ÉŌ. xÉÉxÉÉ

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

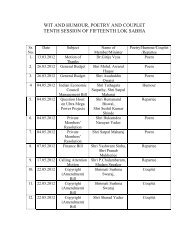

03.08.2010<br />

Today, Shri Mulayam Singh Yadavji was challenging VAT. Today, the<br />

State Governments are financially sound because of VAT. I know that the<br />

Finance Minister of my State was opposing this. But today the State<br />

Government’s income is what it is today. Many of the State Governments are on<br />

sound footing because of the VAT system which was introduced earlier. This kind<br />

of reform process is a continuous process. In that process, probably we wanted to<br />

de-regulate the prices of petroleum products. What happened? An increase of<br />

Rs.3.50 for petrol and Rs.2 for diesel was made. Was it justifiable? Here what is<br />

happening? The State Governments and the Central Government are levying taxes.<br />

Today, a new Bill called Goods and Services Tax Bill is before the House.<br />

Yesterday, I read in the newspapers that the Gujarat Finance Minister and the<br />

Madhya Pradesh Finance Minister have opposed it. All of us know who is ruling<br />

Gujarat and Madhya Pradesh. We have no doubt about it. In Gujarat, there is no<br />

Government but for other kinds of artificial confrontations. But still the Finance<br />

Minister of Gujarat said that they are not going to surrender their right and that<br />

they are not going to allow the Central Government to introduce this new GST.<br />

What does it mean? Today if Rs. 22 is the price of the fuel, then more than Rs. 23<br />

is the tax. The Central Government is levying taxes; the State Government also is<br />

levying tax and these two taxes together is more than the price itself. So, if the<br />

common man is paying Rs. 48 and Rs. 50 for diesel and petrol respectively, then<br />

50 per cent of that amount is tax. If it is liberalised, if the pricing system is de-<br />

controlled, then we can still reduce the price. If the BJP wants to make it a<br />

political issue, then we have nothing to say, but if the GST is introduced, then the<br />

prices will come down, rates will come down. If the Central Government and the<br />

State Governments cut down the prices by Rs. 2 or Rs. 3.50, then even now it is<br />

possible. We have to sit with a determined mind to think as to how this can be<br />

brought down. The impact of the increased prices of petrol and diesel in the whole<br />

price index is very marginal. I come from a consumer State, some 2,000<br />

kilometres away from Delhi, where each and every item is transported either by<br />

202

![gÉÉŌ A.]ÉŌ. xÉÉxÉÉ](https://img.yumpu.com/8015720/202/500x640/geeo-aeo-xeexee.jpg)