- Page 1 and 2:

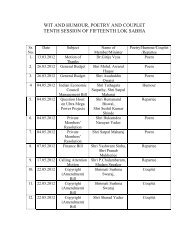

03.08.2010 1 C O N T E N T S Fiftee

- Page 3 and 4:

03.08.2010 (ii) Need to provide com

- Page 5 and 6:

03.08.2010 (xvi) Need to declare Te

- Page 7 and 8:

03.08.2010 Shri C.R. Patil 859-860

- Page 9 and 10:

03.08.2010 LOK SABHA DEBATES ______

- Page 11 and 12:

03.08.2010 MADAM SPEAKER : I will g

- Page 13 and 14:

03.08.2010 11.06 hrs At this stage,

- Page 15 and 16:

03.08.2010 àÉèbàÉ, BÉEÉä

- Page 17 and 18:

03.08.2010 àÉèbàÉ º{ÉÉÒBÉ

- Page 19 and 20:

03.08.2010 12.20 hrs. SUBMISSION BY

- Page 21 and 22:

03.08.2010 11.54 hrs. PAPERS LAID O

- Page 23 and 24:

03.08.2010 (ii) (iii) The Central I

- Page 25 and 26:

03.08.2010 (2) Report of the Comptr

- Page 27 and 28:

03.08.2010 (4) A copy each of the f

- Page 29 and 30:

03.08.2010 (1) A copy of the Annual

- Page 31 and 32:

03.08.2010 (x) S.O. 367(E) publishe

- Page 33 and 34:

03.08.2010 (xxiv) S.O. 104(E) publi

- Page 35 and 36:

03.08.2010 Peripheral Expressway) (

- Page 37 and 38:

03.08.2010 and operation of Nationa

- Page 39 and 40:

03.08.2010 11.56 hrs. DEPARTMENTALL

- Page 41 and 42:

03.08.2010 11.57 hrs. STATEMENT BY

- Page 43 and 44:

03.08.2010 11.58 hrs. DEMANDS FOR S

- Page 45 and 46:

03.08.2010 11.59 hrs MATTERS UNDER

- Page 47 and 48:

03.08.2010 (iii) Need to review the

- Page 49 and 50:

03.08.2010 (v) Need to open a Kendr

- Page 51 and 52:

03.08.2010 (viii) Need to review th

- Page 53 and 54:

03.08.2010 (x) Need to include Raja

- Page 55 and 56:

03.08.2010 foot. There is need to t

- Page 57 and 58:

03.08.2010 (xvii) Need to provide s

- Page 59 and 60:

03.08.2010 12.00 hrs. MOTION RE: CO

- Page 61 and 62:

03.08.2010 àÉé {Éä]ÅÉäÉÊ

- Page 63 and 64:

03.08.2010 nÉä* ®ÉVªÉ BÉEci

- Page 65 and 66:

03.08.2010 ªÉc =kÉ®

- Page 67 and 68:

03.08.2010 ªÉc iÉÉä +ÉÉ{ÉB

- Page 69 and 70:

03.08.2010 |ÉÉÊiÉ ÉÊBÉEãÉ

- Page 71 and 72:

03.08.2010 àÉcÆMÉÉ

- Page 73 and 74:

03.08.2010 BÉDªÉÉ cÉä MɪÉ

- Page 75 and 76:

03.08.2010 =ºÉBÉEä ¤ÉÉn ºÉ

- Page 77 and 78:

03.08.2010 ªÉc cÉäMÉÉ ÉÊBÉ

- Page 79 and 80:

03.08.2010 àÉcÉänªÉ, +ÉÉVÉ

- Page 81 and 82:

03.08.2010 13.07 hrs The Lok Sabha

- Page 83 and 84:

03.08.2010 SHRI V. NARAYANASAMY : T

- Page 85 and 86:

03.08.2010 ={ÉÉvªÉFÉ àÉcÉä

- Page 87 and 88:

03.08.2010 BÉE~Éä® BÉEɮǴ

- Page 89 and 90:

03.08.2010 SHRI LALU PRASAD : He sa

- Page 91 and 92:

03.08.2010 BÉDªÉÉ nÖÉÊxɪ

- Page 93 and 94:

03.08.2010 ÉÊBÉE ÉÊBÉEºÉÉx

- Page 95 and 96:

03.08.2010 gÉÉÒ àÉÖãÉɪÉ

- Page 97 and 98:

03.08.2010 bÉì. ¤ÉãÉÉÒ®É

- Page 99 and 100:

03.08.2010 ={ÉÉvªÉFÉ àÉcÉä

- Page 101 and 102:

03.08.2010 gÉÉÒ ãÉÉãÉÚ |É

- Page 103 and 104:

03.08.2010 ªÉcÉÆ BÉEÉÒ ºÉ

- Page 105 and 106:

03.08.2010 +ÉÉè® ÉʺÉxÉä

- Page 107 and 108:

03.08.2010 SHRI SUDIP BANDYOPADHYAY

- Page 109 and 110:

03.08.2010 Secondly, the Government

- Page 111 and 112:

03.08.2010 position of the common m

- Page 113 and 114:

03.08.2010 gaining something and we

- Page 115 and 116:

03.08.2010 SHRI T.R. BAALU (SRIPERU

- Page 117 and 118:

03.08.2010 of each and every essent

- Page 119 and 120:

03.08.2010 things would have been s

- Page 121 and 122:

03.08.2010 are very less. The pulse

- Page 123 and 124:

03.08.2010 BÉEÉä BÉDªÉÉ VÉ

- Page 125 and 126:

03.08.2010 SÉÉ´ÉãÉ JÉ®ÉÒn

- Page 127 and 128:

03.08.2010 what is happening to the

- Page 129 and 130:

03.08.2010 Sir, 60 per cent of the

- Page 131 and 132:

03.08.2010 gÉÉÒ +ÉÉxÉÆn®É

- Page 133 and 134:

03.08.2010 DR. M. THAMBIDURAI (KARU

- Page 135 and 136:

03.08.2010 I would like to bring to

- Page 137 and 138:

03.08.2010 Now, I come to the godow

- Page 139 and 140:

03.08.2010 SHRI GURUDAS DASGUPTA (G

- Page 141 and 142:

03.08.2010 centres. What are the ex

- Page 143 and 144:

03.08.2010 people’s distress. Ban

- Page 145 and 146:

03.08.2010 gÉÉÒ ®àÉäÉ ®É~

- Page 147 and 148:

03.08.2010 ∗ DR. KIRIT PREMJIBHAI

- Page 149 and 150:

03.08.2010 ∗ gÉÉÒ ´ÉÉÒ®ä

- Page 151 and 152:

03.08.2010 {É®äÉÉxÉ cé ÉÊB

- Page 153 and 154:

03.08.2010 +ÉlÉÇÉɺjÉ BÉEÉ

- Page 155 and 156:

03.08.2010 àÉé BÉEcxÉÉ SÉÉc

- Page 157 and 158:

03.08.2010 nÖMvÉ BÉEä FÉäjÉ

- Page 159 and 160:

03.08.2010 have taken. They talk of

- Page 161 and 162:

03.08.2010 ∗ SHRI D.V. SADANANDA

- Page 163 and 164:

03.08.2010 ∗ gÉÉÒ PÉxɪÉÉ

- Page 165 and 166:

03.08.2010 BÉEÉÒ ºÉ®BÉEÉ®

- Page 167 and 168:

03.08.2010 Sir, we have not been ab

- Page 169 and 170:

03.08.2010 Sir, Hon’ble Prime Min

- Page 171 and 172:

03.08.2010 ∗ DR. THOKCHOM MEINYA(

- Page 173 and 174:

03.08.2010 commodities. Proper secu

- Page 175 and 176:

03.08.2010 ºÉc−ÉÇ º´ÉÉÒB

- Page 177 and 178:

03.08.2010 within four months. The

- Page 179 and 180:

03.08.2010 time when there is a dem

- Page 181 and 182:

03.08.2010 cover 85 per cent people

- Page 183 and 184:

03.08.2010 On the one hand, the ris

- Page 185 and 186:

03.08.2010 MÉèºÉ, ºÉÉÒAxÉV

- Page 187 and 188:

03.08.2010 ∗ gÉÉÒ +ÉÉÉäBÉ

- Page 189 and 190:

03.08.2010 I wonder why the Governm

- Page 191 and 192:

03.08.2010 gÉÉÒ ºÉÆVÉªÉ É

- Page 193 and 194:

03.08.2010 {ÉSÉÉºÉ {ÉèºÉä

- Page 195 and 196:

03.08.2010 They are what kind of ad

- Page 197 and 198:

03.08.2010 SHRI P.C. CHACKO (THRISS

- Page 199 and 200:

03.08.2010 We have to know some bas

- Page 201 and 202:

03.08.2010 but it is given under AA

- Page 203 and 204:

03.08.2010 truck or train and conse

- Page 205 and 206:

03.08.2010 Where from is he coming?

- Page 207 and 208:

03.08.2010 are looking at this Parl

- Page 209 and 210:

03.08.2010 ∗ SHRI P.KUMAR (TIRUCH

- Page 211 and 212:

03.08.2010 In agriculture, the cult

- Page 213 and 214:

03.08.2010 18.47 hrs (Dr. M. Thambi

- Page 215 and 216:

03.08.2010 shell out Rs.32 for a ki

- Page 217 and 218:

03.08.2010 *SHRI P.T. THOMAS (IDUKK

- Page 219 and 220:

03.08.2010 The Central Government i

- Page 221 and 222:

03.08.2010 näÉ BÉEÉÒ 70 |ÉÉ

- Page 223 and 224:

03.08.2010 ¤ÉÉÒiÉä ´É−É

- Page 225 and 226: 03.08.2010 ºÉÉÊàÉÉÊiÉ BÉE

- Page 227 and 228: 03.08.2010 ¤ÉfÃiÉÉÒ àÉcÆM

- Page 229 and 230: 03.08.2010 SHRI MOHAMMED E.T. BASHE

- Page 231 and 232: 03.08.2010 19.00 hrs. FCI will have

- Page 233 and 234: 03.08.2010 gÉÉÒ MÉÉäÉÊ´Éx

- Page 235 and 236: 03.08.2010 ºÉ®BÉEÉ® cÉä, ¤

- Page 237 and 238: 03.08.2010 MR. CHAIRMAN : Nothing w

- Page 239 and 240: 03.08.2010 BÉEä

- Page 241 and 242: 03.08.2010 BÉE® ®cä lÉä, ÉÊ

- Page 243 and 244: 03.08.2010 ºÉƤÉÆvÉ àÉå n

- Page 245 and 246: 03.08.2010 ∗ SHRI HARIBHAU JAWALE

- Page 247 and 248: 03.08.2010 have committed common su

- Page 249 and 250: 03.08.2010 Governments to stop play

- Page 251 and 252: 03.08.2010 {ÉcÖÆSÉÉ nåMÉä +

- Page 253 and 254: 03.08.2010 ∗ gÉÉÒ +ÉVÉÇÖx

- Page 255 and 256: 03.08.2010 iÉ®{ÉE £ÉÖJÉàÉ

- Page 257 and 258: 03.08.2010 ¤ÉcÖiÉ +ÉàÉÉÒ®

- Page 259 and 260: 03.08.2010 àÉcÉänªÉ, +ÉÉVÉ

- Page 261 and 262: 03.08.2010 MR. CHAIRMAN: Madam, you

- Page 263 and 264: 03.08.2010 are required, ãÉäÉÊ

- Page 265 and 266: 03.08.2010 ∗ SHRIMATI BOTCHA JHAN

- Page 267 and 268: 03.08.2010 Coming to the wastage or

- Page 269 and 270: 03.08.2010 ºÉ®BÉEÉ® BÉEÉä

- Page 271 and 272: 03.08.2010 £ÉÉÒ xÉcÉÓ ÉÊà

- Page 273 and 274: 03.08.2010 àÉÉvªÉàÉ ºÉä

- Page 275: 03.08.2010 *SHRI M.I. SHANAVAS (WAY

- Page 279 and 280: 03.08.2010 Essar 1% Shel .6% Total

- Page 281 and 282: 03.08.2010 totally different story

- Page 283 and 284: 03.08.2010 ¤ÉfÃBÉE® +É|Éèã

- Page 285 and 286: 03.08.2010 * ∗ gÉÉÒ cƺɮ

- Page 287 and 288: 03.08.2010 àÉcÆMÉÉ

![gÉÉŌ A.]ÉŌ. xÉÉxÉÉ](https://img.yumpu.com/8015720/277/500x640/geeo-aeo-xeexee.jpg)