Download the report - Vodafone

Download the report - Vodafone

Download the report - Vodafone

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

116 <strong>Vodafone</strong> Group Plc Annual Report 2011<br />

Notes to <strong>the</strong> consolidated financial statements continued<br />

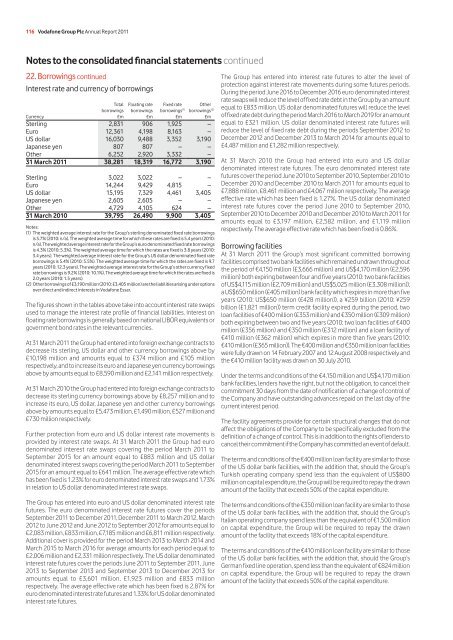

22. Borrowings continued<br />

Interest rate and currency of borrowings<br />

Total Floating rate Fixed rate O<strong>the</strong>r<br />

borrowings borrowings borrowings (1) borrowings (2)<br />

Currency £m £m £m £m<br />

Sterling 2,831 906 1,925 –<br />

Euro 12,361 4,198 8,163 –<br />

US dollar 16,030 9,488 3,352 3,190<br />

Japanese yen 807 807 – –<br />

O<strong>the</strong>r 6,252 2,920 3,332 –<br />

31 March 2011 38,281 18,319 16,772 3,190<br />

Sterling 3,022 3,022 – –<br />

Euro 14,244 9,429 4,815 –<br />

US dollar 15,195 7,329 4,461 3,405<br />

Japanese yen 2,605 2,605 – –<br />

O<strong>the</strong>r 4,729 4,105 624 –<br />

31 March 2010 39,795 26,490 9,900 3,405<br />

Notes:<br />

(1) The weighted average interest rate for <strong>the</strong> Group’s sterling denominated fixed rate borrowings<br />

is 5.7% (2010: n/a). The weighted average time for which <strong>the</strong>se rates are fixed is 5.4 years (2010:<br />

n/a). The weighted average interest rate for <strong>the</strong> Group’s euro denominated fixed rate borrowings<br />

is 4.3% (2010: 5.3%). The weighted average time for which <strong>the</strong> rates are fixed is 3.8 years (2010:<br />

3.4 years). The weighted average interest rate for <strong>the</strong> Group’s US dollar denominated fixed rate<br />

borrowings is 5.4% (2010: 5.5%). The weighted average time for which <strong>the</strong> rates are fixed is 9.7<br />

years (2010: 12.3 years). The weighted average interest rate for <strong>the</strong> Group’s o<strong>the</strong>r currency fixed<br />

rate borrowings is 9.2% (2010: 10.1%). The weighted average time for which <strong>the</strong> rates are fixed is<br />

2.0 years (2010: 1.5 years).<br />

(2) O<strong>the</strong>r borrowings of £3,190 million (2010: £3,405 million) are <strong>the</strong> liabilities arising under options<br />

over direct and indirect interests in <strong>Vodafone</strong> Essar.<br />

The figures shown in <strong>the</strong> tables above take into account interest rate swaps<br />

used to manage <strong>the</strong> interest rate profile of financial liabilities. Interest on<br />

floating rate borrowings is generally based on national LIBOR equivalents or<br />

government bond rates in <strong>the</strong> relevant currencies.<br />

At 31 March 2011 <strong>the</strong> Group had entered into foreign exchange contracts to<br />

decrease its sterling, US dollar and o<strong>the</strong>r currency borrowings above by<br />

£10,198 million and amounts equal to £374 million and £105 million<br />

respectively, and to increase its euro and Japanese yen currency borrowings<br />

above by amounts equal to £8,590 million and £2,141 million respectively.<br />

At 31 March 2010 <strong>the</strong> Group had entered into foreign exchange contracts to<br />

decrease its sterling currency borrowings above by £8,257 million and to<br />

increase its euro, US dollar, Japanese yen and o<strong>the</strong>r currency borrowings<br />

above by amounts equal to £5,473 million, £1,490 million, £527 million and<br />

£730 million respectively.<br />

Fur<strong>the</strong>r protection from euro and US dollar interest rate movements is<br />

provided by interest rate swaps. At 31 March 2011 <strong>the</strong> Group had euro<br />

denominated interest rate swaps covering <strong>the</strong> period March 2011 to<br />

September 2015 for an amount equal to £883 million and US dollar<br />

denominated interest swaps covering <strong>the</strong> period March 2011 to September<br />

2015 for an amount equal to £641 million. The average effective rate which<br />

has been fixed is 1.23% for euro denominated interest rate swaps and 1.73%<br />

in relation to US dollar denominated interest rate swaps.<br />

The Group has entered into euro and US dollar denominated interest rate<br />

futures. The euro denominated interest rate futures cover <strong>the</strong> periods<br />

September 2011 to December 2011, December 2011 to March 2012, March<br />

2012 to June 2012 and June 2012 to September 2012 for amounts equal to<br />

£2,083 million, £833 million, £7,185 million and £6,811 million respectively.<br />

Additional cover is provided for <strong>the</strong> period March 2013 to March 2014 and<br />

March 2015 to March 2016 for average amounts for each period equal to<br />

£2,006 million and £2,331 million respectively. The US dollar denominated<br />

interest rate futures cover <strong>the</strong> periods June 2011 to September 2011, June<br />

2013 to September 2013 and September 2013 to December 2013 for<br />

amounts equal to £3,601 million, £1,923 million and £833 million<br />

respectively. The average effective rate which has been fixed is 2.87% for<br />

euro denominated interest rate futures and 1.33% for US dollar denominated<br />

interest rate futures.<br />

The Group has entered into interest rate futures to alter <strong>the</strong> level of<br />

protection against interest rate movements during some futures periods.<br />

During <strong>the</strong> period June 2016 to December 2016 euro denominated interest<br />

rate swaps will reduce <strong>the</strong> level of fixed rate debt in <strong>the</strong> Group by an amount<br />

equal to £833 million. US dollar denominated futures will reduce <strong>the</strong> level<br />

of fixed rate debt during <strong>the</strong> period March 2016 to March 2019 for an amount<br />

equal to £321 million. US dollar denominated interest rate futures will<br />

reduce <strong>the</strong> level of fixed rate debt during <strong>the</strong> periods September 2012 to<br />

December 2012 and December 2013 to March 2014 for amounts equal to<br />

£4,487 million and £1,282 million respectively.<br />

At 31 March 2010 <strong>the</strong> Group had entered into euro and US dollar<br />

denominated interest rate futures. The euro denominated interest rate<br />

futures cover <strong>the</strong> period June 2010 to September 2010, September 2010 to<br />

December 2010 and December 2010 to March 2011 for amounts equal to<br />

£7,888 million, £8,461 million and £4,067 million respectively. The average<br />

effective rate which has been fixed is 1.27%. The US dollar denominated<br />

interest rate futures cover <strong>the</strong> period June 2010 to September 2010,<br />

September 2010 to December 2010 and December 2010 to March 2011 for<br />

amounts equal to £3,197 million, £2,582 million, and £1,119 million<br />

respectively. The average effective rate which has been fixed is 0.86%.<br />

Borrowing facilities<br />

At 31 March 2011 <strong>the</strong> Group’s most significant committed borrowing<br />

facilities comprised two bank facilities which remained undrawn throughout<br />

<strong>the</strong> period of €4,150 million (£3,666 million) and US$4,170 million (£2,596<br />

million) both expiring between four and five years (2010: two bank facilities<br />

of US$4,115 million (£2,709 million) and US$5,025 million (£3,308 million)),<br />

a US$650 million (£405 million) bank facility which expires in more than five<br />

years (2010: US$650 million (£428 million)), a ¥259 billion (2010: ¥259<br />

billion (£1,821 million)) term credit facility expired during <strong>the</strong> period, two<br />

loan facilities of €400 million (£353 million) and €350 million (£309 million)<br />

both expiring between two and five years (2010: two loan facilities of €400<br />

million (£356 million) and €350 million (£312 million) and a loan facility of<br />

€410 million (£362 million) which expires in more than five years (2010:<br />

€410 million (£365 million)). The €400 million and €350 million loan facilities<br />

were fully drawn on 14 February 2007 and 12 August 2008 respectively and<br />

<strong>the</strong> €410 million facility was drawn on 30 July 2010.<br />

Under <strong>the</strong> terms and conditions of <strong>the</strong> €4,150 million and US$4,170 million<br />

bank facilities, lenders have <strong>the</strong> right, but not <strong>the</strong> obligation, to cancel <strong>the</strong>ir<br />

commitment 30 days from <strong>the</strong> date of notification of a change of control of<br />

<strong>the</strong> Company and have outstanding advances repaid on <strong>the</strong> last day of <strong>the</strong><br />

current interest period.<br />

The facility agreements provide for certain structural changes that do not<br />

affect <strong>the</strong> obligations of <strong>the</strong> Company to be specifically excluded from <strong>the</strong><br />

definition of a change of control. This is in addition to <strong>the</strong> rights of lenders to<br />

cancel <strong>the</strong>ir commitment if <strong>the</strong> Company has committed an event of default.<br />

The terms and conditions of <strong>the</strong> €400 million loan facility are similar to those<br />

of <strong>the</strong> US dollar bank facilities, with <strong>the</strong> addition that, should <strong>the</strong> Group’s<br />

Turkish operating company spend less than <strong>the</strong> equivalent of US$800<br />

million on capital expenditure, <strong>the</strong> Group will be required to repay <strong>the</strong> drawn<br />

amount of <strong>the</strong> facility that exceeds 50% of <strong>the</strong> capital expenditure.<br />

The terms and conditions of <strong>the</strong> €350 million loan facility are similar to those<br />

of <strong>the</strong> US dollar bank facilities, with <strong>the</strong> addition that, should <strong>the</strong> Group’s<br />

Italian operating company spend less than <strong>the</strong> equivalent of €1,500 million<br />

on capital expenditure, <strong>the</strong> Group will be required to repay <strong>the</strong> drawn<br />

amount of <strong>the</strong> facility that exceeds 18% of <strong>the</strong> capital expenditure.<br />

The terms and conditions of <strong>the</strong> €410 million loan facility are similar to those<br />

of <strong>the</strong> US dollar bank facilities, with <strong>the</strong> addition that, should <strong>the</strong> Group’s<br />

German fixed line operation, spend less than <strong>the</strong> equivalent of €824 million<br />

on capital expenditure, <strong>the</strong> Group will be required to repay <strong>the</strong> drawn<br />

amount of <strong>the</strong> facility that exceeds 50% of <strong>the</strong> capital expenditure.