Business Opportunities in - Trade Development Authority Of Pakistan

Business Opportunities in - Trade Development Authority Of Pakistan

Business Opportunities in - Trade Development Authority Of Pakistan

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

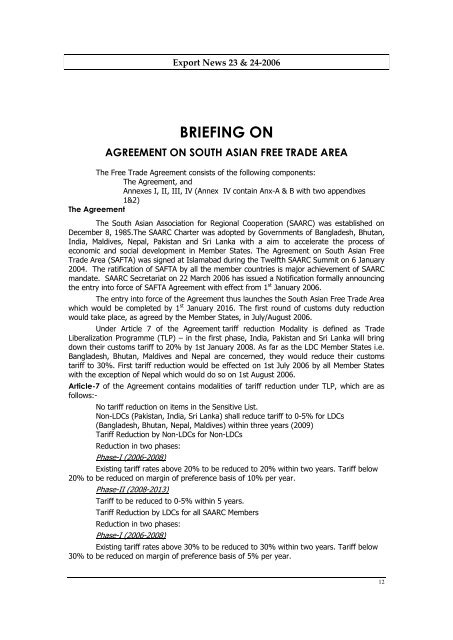

Export News 23 & 24-2006<br />

BRIEFING ON<br />

AGREEMENT ON SOUTH ASIAN FREE TRADE AREA<br />

The Free <strong>Trade</strong> Agreement consists of the follow<strong>in</strong>g components:<br />

� The Agreement, and<br />

� Annexes I, II, III, IV (Annex IV conta<strong>in</strong> Anx-A & B with two appendixes<br />

1&2)<br />

The Agreement<br />

The South Asian Association for Regional Cooperation (SAARC) was established on<br />

December 8, 1985.The SAARC Charter was adopted by Governments of Bangladesh, Bhutan,<br />

India, Maldives, Nepal, <strong>Pakistan</strong> and Sri Lanka with a aim to accelerate the process of<br />

economic and social development <strong>in</strong> Member States. The Agreement on South Asian Free<br />

<strong>Trade</strong> Area (SAFTA) was signed at Islamabad dur<strong>in</strong>g the Twelfth SAARC Summit on 6 January<br />

2004. The ratification of SAFTA by all the member countries is major achievement of SAARC<br />

mandate. SAARC Secretariat on 22 March 2006 has issued a Notification formally announc<strong>in</strong>g<br />

the entry <strong>in</strong>to force of SAFTA Agreement with effect from 1 st January 2006.<br />

The entry <strong>in</strong>to force of the Agreement thus launches the South Asian Free <strong>Trade</strong> Area<br />

which would be completed by 1 st January 2016. The first round of customs duty reduction<br />

would take place, as agreed by the Member States, <strong>in</strong> July/August 2006.<br />

Under Article 7 of the Agreement tariff reduction Modality is def<strong>in</strong>ed as <strong>Trade</strong><br />

Liberalization Programme (TLP) – <strong>in</strong> the first phase, India, <strong>Pakistan</strong> and Sri Lanka will br<strong>in</strong>g<br />

down their customs tariff to 20% by 1st January 2008. As far as the LDC Member States i.e.<br />

Bangladesh, Bhutan, Maldives and Nepal are concerned, they would reduce their customs<br />

tariff to 30%. First tariff reduction would be effected on 1st July 2006 by all Member States<br />

with the exception of Nepal which would do so on 1st August 2006.<br />

Article-7 of the Agreement conta<strong>in</strong>s modalities of tariff reduction under TLP, which are as<br />

follows:-<br />

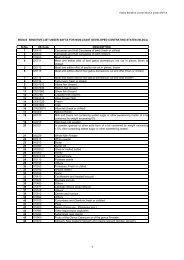

� No tariff reduction on items <strong>in</strong> the Sensitive List.<br />

� Non-LDCs (<strong>Pakistan</strong>, India, Sri Lanka) shall reduce tariff to 0-5% for LDCs<br />

(Bangladesh, Bhutan, Nepal, Maldives) with<strong>in</strong> three years (2009)<br />

� Tariff Reduction by Non-LDCs for Non-LDCs<br />

Reduction <strong>in</strong> two phases:<br />

Phase-I (2006-2008)<br />

Exist<strong>in</strong>g tariff rates above 20% to be reduced to 20% with<strong>in</strong> two years. Tariff below<br />

20% to be reduced on marg<strong>in</strong> of preference basis of 10% per year.<br />

Phase-II (2008-2013)<br />

Tariff to be reduced to 0-5% with<strong>in</strong> 5 years.<br />

� Tariff Reduction by LDCs for all SAARC Members<br />

Reduction <strong>in</strong> two phases:<br />

Phase-I (2006-2008)<br />

Exist<strong>in</strong>g tariff rates above 30% to be reduced to 30% with<strong>in</strong> two years. Tariff below<br />

30% to be reduced on marg<strong>in</strong> of preference basis of 5% per year.<br />

12