Business Opportunities in - Trade Development Authority Of Pakistan

Business Opportunities in - Trade Development Authority Of Pakistan

Business Opportunities in - Trade Development Authority Of Pakistan

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Phase-II (2008-2016)<br />

Export News 23 & 24-2006<br />

Tariff to be reduced to 0-5% with<strong>in</strong> 8 years.<br />

Annexes: (Detailed Annexes/Lists have been publish<strong>in</strong>g <strong>in</strong> Export News Bullet<strong>in</strong>)<br />

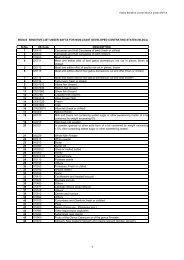

Annex 'I' Sensitive Lists:<br />

Annex I relates to the Sensitive Lists of Member States. No reduction of tariff on<br />

these tariff l<strong>in</strong>es:<br />

Summary of Sensitive Lists<br />

Countries No of tariff l<strong>in</strong>es Percentage of total l<strong>in</strong>es<br />

Bangladesh 1254 24%<br />

Bhutan 157 3%<br />

India 884 16.9%<br />

Maldives 671 12.8%<br />

Nepal 1310 25.5%<br />

<strong>Pakistan</strong> 1183 22.6%<br />

Sri Lanka 1065 20.3%<br />

Annex 'II' Technical Assistance for LDCs:<br />

Annex II relates Technical Assistance for LDCs, Areas of Technical Assistance<br />

<strong>in</strong>clude:-<br />

� Advisory services for identify<strong>in</strong>g export niches for the products of LDCs.<br />

� Capacity build<strong>in</strong>g <strong>in</strong> metallurgy, standards, test<strong>in</strong>g and quality control.<br />

� Tra<strong>in</strong><strong>in</strong>g of <strong>Trade</strong> <strong>Of</strong>ficers.<br />

� Tra<strong>in</strong><strong>in</strong>g <strong>in</strong> sanitary and phyto-sanitary measures; technical barriers to trade and<br />

export proceed on agro based products.<br />

Annex 'III' Mechanism for Compensation of Revenue Loss for LDCs (MCRL):<br />

Annex III def<strong>in</strong>es mechanism and its rules and regulations to compensate the Least<br />

Developed member countries for their loss of customs revenue due to the implementation of<br />

the <strong>Trade</strong> Liberalisation Programme (TLP) under this Agreement. Ma<strong>in</strong> Feature are as under:<br />

� To be enforced one year after implementation of tariff reduction (i.e. after July<br />

2007).<br />

Shall rema<strong>in</strong> operative for 4 years.<br />

� Compensation only on revenue loss on import of products where tariff reduction is<br />

made by LDCs.<br />

The extent of compensation shall be as follows:<br />

o First year and second year<br />

- Not more than 1% of customs duty collected.<br />

o Third year<br />

- Not more than 5% of customs duty collected.<br />

o Fourth year<br />

- Not more than 3% of customs duty collected.<br />

Annex 'IV' - SAFTA Rules of Orig<strong>in</strong>:<br />

Annex IV def<strong>in</strong>es mechanism and its rules and regulations to compensate the Least<br />

Developed member countries for their loss of customs revenue due to the implementation of<br />

the <strong>Trade</strong> Liberalisation Programme (TLP) under this Agreement. Ma<strong>in</strong> Feature are as under:<br />

Annex IV deals with the rules of orig<strong>in</strong> under the SAFTA required to qualify products<br />

for preferential duty benefits. Rules of Orig<strong>in</strong> – to be operative on 01.07.2006. Basic Criteria<br />

is as under:<br />

� For non-LDCs<br />

40% value addition + change <strong>in</strong> tariff head<strong>in</strong>g at 4 digits (CTH).<br />

13