FINAL CLUSTER ANALYSIS - Kohtla-Järve

FINAL CLUSTER ANALYSIS - Kohtla-Järve

FINAL CLUSTER ANALYSIS - Kohtla-Järve

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Project: cluster DeveloPment anD B2B InternatIonalIzatIon In estonIan-russIan BorDer regIons<br />

FInal cluster analYsIs<br />

IDENTIFICATION OF CROSS-BORDER ECONOMIC <strong>CLUSTER</strong>S IN<br />

TRANS-BORDER REGION OF ST. PETERSBURG, LENINGRAD REGION AND IDA-VIRUMAA<br />

This project is funded by<br />

the European Union<br />

2009

This publication has been produced with the assistance of the European Union.<br />

The contents of this publication are the sole responsibility of project “EstRuClusters Development”<br />

experts and can in no way be taken to refl ect the views of the European Union.

Project:<br />

cluster DeveloPment anD B2B InternatIonalIzatIon<br />

In estonIan-russIan BorDer regIons<br />

FInal cluster analYsIs<br />

IDENTIFICATION OF CROSS-BORDER ECONOMIC <strong>CLUSTER</strong>S IN<br />

TRANS-BORDER REGION OF ST. PETERSBURG, LENINGRAD REGION AND IDA-VIRUMAA

Final Cluster Analysis<br />

t a B l e o F c o n t e n t s :<br />

Executive summary ............................................................................................................................. 3<br />

Glossary of terms ................................................................................................................................. 4<br />

1. Introduction ............................................................................................................................. 5<br />

1.1 Purpose of the Investigation ....................................................................................................................................................5<br />

1.2 Survey hypothesis ...........................................................................................................................................................................5<br />

2. Methodology ........................................................................................................................... 6<br />

2.1 Sources ..................................................................................................................................................................................................6<br />

3. Cluster definition ..................................................................................................................... 7<br />

4.Statistical survey results .................................................................................................................. 8<br />

4.1. Key findings in Ida-Virumaa .....................................................................................................................................................8<br />

4.2. Key findings in Leningrad region ......................................................................................................................................14<br />

5.Documentary Survey results ........................................................................................................ 21<br />

5.1. Key findings in Ida-Virumaa ..................................................................................................................................................21<br />

5.2. Key findings in Leningrad region ......................................................................................................................................22<br />

6. Key persons interview analysis .................................................................................................... 24<br />

7. Surveys conclusion ....................................................................................................................... 26<br />

8.Cross-border clusters identification ............................................................................................. 28<br />

8.1. Identified cross-border clusters from Statistical Survey ......................................................................................28<br />

8.2. Identified cross-border clusters from Documentary Survey ............................................................................29<br />

8.3. Identified cross-border clusters from Key Persons’ Interviews ........................................................................30<br />

9. Results of Working seminar for EstRuCluster project partners ................................................ 31<br />

10. Final cross-border clusters identification .................................................................................. 33<br />

11. Foresight on selected clusters, trends and drivers ................................................................... 34<br />

2<br />

11.1. Hospitality sector ......................................................................................................................................................................34<br />

11.2. Chemical sector .........................................................................................................................................................................37<br />

11.3. Woodworking sector ..............................................................................................................................................................41<br />

11.4. Metalworking sector...............................................................................................................................................................43<br />

© Narva Business Advisory Services Foundation, St. Petersburg Information and Analytical Center, Synergy International Ltd. 2008

e x e c u t I v e s u m m a r Y<br />

The overall mandate of the Final cluster analysis was to<br />

generalise the sectors of economic activities that are well<br />

or over-represented in the target areas of Ida-Virumaa region<br />

of Estonia and Leningrad oblast incl. St. Petersburg,<br />

Russia, and have a potential to be developed into clusters.<br />

This document is produced by an international consortium<br />

(here and after referred to as “Expert Group”) that comprises<br />

representatives from the following organisations: Narva<br />

Business Advisory Services Foundation (Estonia), Saint Petersburg<br />

Information and Analytical Center (Russia) and<br />

Synergy International Ltd (Netherlands).<br />

This Cluster Analysis is defining the existing and potential<br />

networks in relation to EstRuCluster Development project<br />

target areas. This document provides synthesised information<br />

from previous studies and research prepared by Expert<br />

Group, including Statistical survey, Documentary survey<br />

and Key Persons’ interviews.<br />

Final Cluster Analysis summarises cluster situation in Ida-<br />

Virumaa and Leningrad oblast and arguing the choice for<br />

the following four potential cross-border clusters:<br />

1. Hospitality cluster<br />

2. Chemical cluster<br />

3. Woodworking cluster<br />

4. Metalworking cluster<br />

Final Cluster Analysis<br />

3

Final Cluster Analysis<br />

g l o s s a r Y o F t e r m s<br />

Cluster – geographic concentrations of interconnected<br />

companies, specialized suppliers, service providers, firms<br />

in related industries, and associated organizations (such<br />

as universities, standard agencies, trade associations) in a<br />

particular field linked by commonalities and complementarities<br />

Cross-border cluster – geographically concentrated network<br />

of cooperating companies in the trans-border region<br />

in complimentary sectors and supporting institutions<br />

Foresight is a term that is used for future-related activities,<br />

trends and drives analysis, uncertainties and challenges.<br />

Foresight is a systematic, participatory, future intelligence<br />

gathering and medium-to-long term vision-building process<br />

aimed at present current decisions and mobilising joint<br />

actions.<br />

Nace code – a pan-European classification system that<br />

groups organisations according to their business activities.<br />

4<br />

Ida-Virumaa region flag<br />

Leningrad region flag<br />

St.Petersburg flag<br />

© Narva Business Advisory Services Foundation, St. Petersburg Information and Analytical Center, Synergy International Ltd. 2008

1.1 PurPose oF the InvestIgatIon<br />

1<br />

Current Final cluster analysis is aimed at identifying potential<br />

trans-border economic clusters in cross border region<br />

of Leningrad oblast and Ida-Virumaa and was carried out<br />

at European and national levels and focused on possible<br />

cross-border company networks.<br />

This survey is intending to assist EstRuCluster Development<br />

project partner consortium to identify and develop<br />

basis for trans-border economic clusters as new business<br />

opportunity for SMEs development and innovation in cross<br />

border Leningrad oblast and Ida-Virumaa territory.<br />

The objective of EstRuClusterDevelopement project is<br />

to raise awareness, identify and prepare development of<br />

trans-border economic clusters in the North-East Estonia<br />

and North-West Russia and to give potential cluster SMEs<br />

Introduction<br />

practical opportunities in developing cross-border contacts,<br />

open new markets and create innovative networks.<br />

It aims to raise awareness on clusters and improve capacity<br />

of local actors in encouraging cross-border activities providing<br />

for long lasting cross-border contacts and interaction<br />

with SMEs in cross-border environment.<br />

1.2 surveY hYPothesIs<br />

Final Cluster Analysis<br />

Experts assume that Russian region of Leningrad oblast, including<br />

Saint Petersburg metropolis, and Estonian region<br />

Ida-Virumaa, with the common border, similar economic<br />

pattern set up already in the former Soviet Union, sufficient<br />

levels of development and related groups of industrial sectors,<br />

have a potential for the development of trans-border<br />

industrial-innovative clusters.<br />

5

Final Cluster Analysis<br />

2<br />

The following analysis is based summary of results of studies<br />

and research conducted by Expert group from April-December<br />

2008: Statistical and Documentary surveys and Key<br />

persons’ interviews. Statistical survey sought all available<br />

statistical information concerning the company groupings<br />

that are well-presented in the target region. Documentary<br />

survey summarised different documents, articles, economic<br />

reports, policies and strategies for economic development.<br />

Key persons’ interviews provided an insight of<br />

obtained in previous surveys’ materials from stakeholders’<br />

point of view.<br />

Moreover, based on the information provided by Experts<br />

during Working seminar, project partners made final decision<br />

concerning the choice of the target sectors to be developed<br />

on their territories.<br />

Current document summarised and analysed all obtained<br />

data and justified agreed final decision to develop perspective<br />

target cluster groupings.<br />

The methodology used in the Final Cluster Analysis is a<br />

desk research method that is based on several EU cluster<br />

methodologies, including Netwin-Methodological Guide<br />

to Networking and Cluster Development and is based on<br />

acquiring direct secondary information sources. The information<br />

obtained through desk research was verified, defined<br />

and is a subject to detalisation by quantitative field<br />

research. Number of major activity sectors for survey was<br />

limited to Industry and Service sectors according to the<br />

common decision made by the Expert Group during Expert<br />

Panel 1 (22.04.2008) and agreed with project partners.<br />

Cluster wise selection is be made inside these sectors of<br />

activity.<br />

1 http://ec.europa.eu/comm/competition/mergers/cases/index/nace_all.html<br />

2 Expert Group will later refer to the short title of the sector<br />

6<br />

Methodology<br />

2.1 sources<br />

The principal contributions to the survey were from the following<br />

documents:<br />

Statistical Survey, Documentary survey, Key Persons’ interview<br />

Sectors that were selected for the survey were taking from<br />

the list of Nace Codes1 , which is the international coding<br />

system for industrial classification used by the EU:<br />

CA.0.00<br />

Mining and quarrying of energy producing<br />

materials<br />

DB.0.00<br />

Manufacture of textiles and textile products<br />

(textile) 2<br />

DC.0.00 Manufacture of leather and leather products<br />

DD.0.00<br />

Manufacture of wood and wood products<br />

(woodworking)<br />

DE.0.00<br />

Manufacture of pulp, paper and paper products;<br />

publishing and printing<br />

DF.0.00<br />

Manufacture of coke, refined petroleum<br />

products and nuclear fuel<br />

DG.0.00<br />

Manufacture of chemicals, chemical products<br />

and man-made fibres<br />

DH.0.00 Manufacture of rubber and plastic products<br />

DJ.0.00<br />

Manufacture of basic metals and fabricated<br />

metal products (metalworking)<br />

DK.0.00 Manufacture of machinery and equipment n.e.c.<br />

DL.0.00 Manufacture of electrical and optical equipment<br />

DN.0.00 Manufacturing n.e.c.<br />

E .0.00 Electricity, gas and water supply<br />

F .0.00 Construction<br />

H .0.00 Hotels and restaurants (hospitality) 2<br />

I .0.00 Transport, storage and communication<br />

K .0.00 Real estate, renting and business activities<br />

O .0.00<br />

Other community, social and personal service<br />

activities<br />

© Narva Business Advisory Services Foundation, St. Petersburg Information and Analytical Center, Synergy International Ltd. 2008

3<br />

Final Cluster Analysis<br />

Cluster definition<br />

Previous studies on clusters did not mention in detail what<br />

term “cross-border cluster” implies. From a classical cluster<br />

definition by Michael Porter “Clusters are geographic<br />

concentrations of interconnected companies, specialised<br />

suppliers, service providers, firms in related<br />

industries, and associated organisations (such as universities,<br />

standard agencies, trade associations) in a<br />

particular field linked by commonalities and complementarities”.<br />

Expert Group concluded its own definition of cluster placing<br />

emphasis on cross-border aspect.<br />

Therefore, in the framework of EstRuCluster Development<br />

project expert services, cross-border cluster is “a geographically<br />

concentrated network of cooperating<br />

companies in the trans-border region in complimentary<br />

sectors and supporting institutions”. This definition<br />

is therefore will be used in this and subsequent documents<br />

to be produced by Expert Group.<br />

7

Final Cluster Analysis<br />

4<br />

4.1. KeY FInDIngs In IDa-vIrumaa<br />

According to the acquired data on the national and regional<br />

levels the most developed economic sectors in terms of<br />

general indicators in Ida-Virumaa until 2008 are:<br />

construction (ranging from companies involved in<br />

building constructions and civil engineering works<br />

to companies involved in installation and finishing<br />

works);<br />

transport (ranging from companies involved in logistics<br />

and warehousing);<br />

Statistical survey<br />

results<br />

tourism sector (is considered as quite important in<br />

terms of domestic tourism).<br />

wood sector (companies that involved in woodworking);<br />

metal sector (companies that involved in metalworking)<br />

chemical sector (although the number of companies<br />

is fairly small in Ida-Virumaa (12), this sector is very well<br />

developed and described in more depth in Documentary<br />

study);<br />

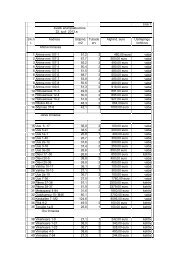

The following table summarises the results obtained in Ida-Virumaa from national and regional sources.<br />

SECTOR<br />

Total number<br />

of companies<br />

2007<br />

Number of<br />

emerged<br />

companies in<br />

2004-2007<br />

Predominant size<br />

of the company (%)<br />

Share of export<br />

from Ida-Virumaa<br />

to Russia 2007 (EUR)<br />

Table 1<br />

Share of import from<br />

Ida-Virumaa to Russia<br />

2007 (EUR)<br />

Construction 440 211 Small/micro (87%) 1 635 506 818 594<br />

Transport, storage and communication 312 128 Small/micro (85%) N/A N/A<br />

Hotels and restaurants 109 43 Small/micro (91%) N/A N/A<br />

Manufacture of basic metals and<br />

fabricated metal products<br />

90 43 Small/micro (90%) N/A N/A<br />

Other community, social and personal<br />

service activities<br />

80 44 Small/micro (80%) N/A 25 909<br />

Manufacture of wood and wood products 71 30 Small/micro (89%) 42 426 130 11 433 784<br />

Manufacture of textiles and textile<br />

products<br />

63 21 Small/micro (75%) 20 194 065 18 496 691<br />

Manufacturing n.e.c. 52 26 Small/micro (87%) 1 164 427 767 506<br />

Manufacture of machinery and equipment<br />

n.e.c.<br />

23 4 Small/micro (78%) 4 244 613 430 964<br />

Electricity, gas and water supply 23 6 Small/micro (57%) N/A N/A<br />

Manufacture of pulp, paper and paper<br />

products; publishing<br />

21 4 Small/micro (95%) 11 162 239 591<br />

Manufacture of electrical and optical<br />

equipment<br />

18 6 Small/micro (83%) 1 895 876 869 693<br />

Manufacture of rubber and plastic<br />

products<br />

15 6 Small/micro (67%) N/A N/A<br />

Manufacture of chemicals, chemical<br />

products and man-made fibers<br />

12 4 Small/micro (42%) 1 658 933 7 854 687<br />

Manufacture of leather and leather<br />

products<br />

6 0 Small/micro (67%) 1 705 869 1 349 001<br />

Manufacture of coke, refined petroleum<br />

products and nuclear fuel<br />

4 1 Medium (50%) 152 494 525 284<br />

Mining and quarrying of energy<br />

producing materials<br />

3 0 Large (67%) N/A 6 690 362<br />

8<br />

© Narva Business Advisory Services Foundation, St. Petersburg Information and Analytical Center, Synergy International Ltd. 2008

In terms of newborn companies, the most rapidly growing<br />

sector on national level is construction, as number of companies<br />

has increased more than twice since 2004. However,<br />

current decline in terms of work force and company<br />

number is evident in 2008.<br />

Number of companies manufacturing coke, refined petroleum<br />

products and nuclear fuel has also increased, however<br />

the total number of these companies is insignificant.<br />

Other sectors with a high number of newborn companies<br />

were transport, storage and communication sector, other<br />

community, social and personal service activities, hotels<br />

Sector Net sales in EUR (ths.)<br />

Transport, storage and communication 4 481 250<br />

Construction 3 552 153<br />

Real estate, renting and business activities 2 490 367<br />

Electricity, gas and water supply 1 198 644<br />

Manufacture of wood and wood products 1 135 463<br />

Manufacture of basic metals and fabricated metal products 850 989<br />

Manufacture of electrical and optical equipment 804 694<br />

Manufacturing n.e.c. 544 852<br />

Manufacture of textiles and textile products 468 826<br />

Manufacture of pulp, paper and paper products 452 885<br />

Hotels and restaurants 434 467<br />

Other community, social and personal service activities 433 767<br />

Manufacture of chemicals, chemical products and man-made fibres 422 557<br />

Manufacture of rubber and plastic products 339 052<br />

Manufacture of machinery and equipment n.e.c. 272 512<br />

Mining and quarrying of energy producing materials 208 790<br />

Manufacture of coke, refined petroleum products and nuclear fuel 90 009<br />

Manufacture of leather and leather products 30 247<br />

Total 18 211 523<br />

Graphical representation is proved below in figure 1.<br />

5000000<br />

4500000<br />

4000000<br />

3500000<br />

3000000<br />

2500000<br />

2000000<br />

1500000<br />

1000000<br />

500000<br />

0<br />

Transport, Transport, storage storage and<br />

communication<br />

and communication<br />

Construction<br />

Real estate, Real renting estate, renting and<br />

business and business activities<br />

Electricity, gas and water<br />

Electricity, gas and water supply<br />

Manufacture Manufacture of wood of wood and<br />

and wood wood products<br />

Manufacture of basic of basic metals<br />

and fabricated and fabricated metal metal products<br />

Manufacture Manufacture of electrical of electrical and<br />

optical and optical equipment<br />

Manufacturing n.e.c.<br />

Manufacture Manufacture of textiles of textiles and<br />

textile and textile products<br />

and restaurants, manufactures of basic metals and fabricated<br />

metal products, manufactures of wood and wood<br />

products and manufacturing n.e.c.<br />

The leading sectors in terms of net sales were transport,<br />

storage and communication, construction, real estate,<br />

renting and business activities, electricity, gas and water<br />

supply, manufacture of wood and wood products. These<br />

sectors altogether constituted over 10 milliards Euro of net<br />

sales in 2007. Graphical representation is provided below.<br />

Turnover data for all examined sectors3 is as following:<br />

3 Turnover figures per sector in Ida-Virumaa are unavailable; therefore, Expert Group concluded that national turnover figures would be used<br />

in order to identify regional most developed sectors..<br />

Manufacture Manufacture of pulp, of pulp, paper<br />

and<br />

and<br />

paper<br />

paper<br />

products<br />

products<br />

Hotels Hotels and and restaurants<br />

Other community, Other community, social social and<br />

personal and personal service activities<br />

Manufacture of chemicals, of chemicals, chemical<br />

chemical products products and man-made and man- �bres<br />

made fibres<br />

Manufacture Manufacture of rubber of rubber and<br />

plastic and plastic products<br />

Manufacture Manufacture of machinery of machinery and<br />

equipment and equipment n.e.c.<br />

Mining and and quarrying quarrying of energy of<br />

energy producing materials<br />

Final Cluster Analysis<br />

Manufacture<br />

Manufacture<br />

of coke,<br />

of<br />

re�ned<br />

coke,<br />

petroleum<br />

refined<br />

petroleum products and<br />

products and nuclear nuclear fuel<br />

Manufacture<br />

Manufacture<br />

of leather<br />

of leather<br />

and<br />

leather products<br />

and leather products<br />

Table 2<br />

Fig.1<br />

9

Final Cluster Analysis<br />

In order to distinguish concentrated sector groupings in Ida-Virumaa, comparison on national scale must be done. This<br />

analysis aims to identify concentration ratio of Estonian sectors that are highly represented in Ida-Virumaa. The following<br />

table #3 reveals these concentration ratios.<br />

Sector<br />

Number of<br />

companies in Estonia<br />

Number of<br />

companies in Ida-<br />

Virumaa<br />

Table 3<br />

Concentration ratio<br />

in Ida-Virumaa (%)<br />

Manufacture of coke, refined petroleum products and nuclear fuel 13 4 30,7<br />

Manufacture of chemicals, chemical products and man-made fibres 108 12 11,1<br />

Manufacture of textiles and textile products 702 63 8,9<br />

Manufacture of basic metals and fabricated metal products 1045 90 8,6<br />

Manufacture of leather and leather products 71 6 8,4<br />

Electricity, gas and water supply 281 23 8,1<br />

Transport, storage and communication 4434 312 7<br />

Manufacture of machinery and equipment n.e.c. 331 23 6,9<br />

Manufacture of rubber and plastic products 223 15 6,7<br />

Mining and quarrying of energy producing materials 45 3 6,6<br />

Manufacturing n.e.c. 784 52 6,6<br />

Manufacture of wood and wood products 1210 71 5,8<br />

Construction 7574 440 5,8<br />

Hotels and restaurants 1946 109 5,6<br />

Manufacture of electrical and optical equipment 407 18 4,4<br />

Other community, social and personal service activities 2065 80 3,8<br />

Manufacture of pulp, paper and paper products 701 21 2,9<br />

Real estate, renting and business activities 18180 501 2,7<br />

Number of companies 21353 620 4,5<br />

Below is the graphical representation of the concentration ratios.<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

10<br />

Производство кокса,<br />

Manufacture рафинированных of coke, нефтепродуктов refined<br />

petroleum products and и ядерного nuclear топлива fuel<br />

Manufacture of chemicals, Производство химикатов,<br />

химических chemical продуктов<br />

products and и искусственных man-made fibres волокон<br />

Manufacture of textiles Производство текстиля<br />

и текстильных<br />

and textile<br />

изделий<br />

products<br />

Производство основных<br />

Manufacture of basic металлов metals и продуктов and<br />

fabricated metal металлообработки<br />

products<br />

Manufacture of leather Производство and leather кожи<br />

и изделий products из кожи<br />

Electricity, gas and water Электро-, supply газои<br />

водоснабжение<br />

Transport, Транспорт, storage логистика and<br />

communication<br />

и коммуникации<br />

Manufacture of Производство machinery and машин<br />

и оборудования equipment (прочее) n.e.c.<br />

Manufacture of rubber Производство and plastic изделий<br />

из резины products и пластика<br />

Mining and quarrying Горная промышленность<br />

of energy<br />

и добыча энергосырья<br />

producing materials<br />

© Narva Business Advisory Services Foundation, St. Petersburg Information and Analytical Center, Synergy International Ltd. 2008<br />

Manufacturing Производство (прочее) n.e.c.<br />

Manufacture Производство of wood and древесины wood<br />

и продуктов деревообработки<br />

products<br />

Construction<br />

Строительство<br />

Hotels Гостиницы and restaurants и рестораны<br />

Manufacture Производство of electrical электротехнического<br />

and optical<br />

и оптического equipment<br />

оборудования<br />

Other Другая community, деятельность social по оказанию and<br />

социальных personal и индивидуальных service activities услуг<br />

Manufacture Производство of pulp, paper целлюлозы, and<br />

бумаги и paper продуктов products из бумаги<br />

Недвижимость, аренда<br />

Real estate, renting и деловая and деятельность business<br />

activities<br />

Fig.2

In terms of labour force the following table revealing concentration ratio of Estonian employees in Ida-Virumaa.<br />

Sector<br />

Number<br />

of employees<br />

in Estonia 2007<br />

Number of employees<br />

in Ida-Virumaa<br />

Concentration ratio<br />

in Ida-Virumaa (%)<br />

Manufacture of coke, refined petroleum products and nuclear fuel 800 800 100<br />

Mining and quarrying of energy producing materials 5700 3700 65<br />

Manufacture of chemicals, chemical products and man-made fibers 2600 1600 62<br />

Electricity, gas and water supply 11400 5200 46<br />

Manufacture of textiles and textile products 21000 5500 26<br />

Manufacture of basic metals and fabricated metal products 15400 3300 21<br />

Manufacture of leather and leather products 2300 300 13<br />

Manufacture of machinery and equipment n.e.c. 3700 900 24<br />

Manufacturing n.e.c. 13000 2100 16<br />

Other community, social and personal service activities 27600 3100 11<br />

Construction 51200 4400 9<br />

Real estate, renting and business activities 39900 3800 10<br />

Transport, storage and communication 52500 4500 9<br />

Hotels and restaurants 19800 1500 8<br />

Manufacture of wood and wood products 20200 1200 6<br />

Manufacture of electrical and optical equipment 11700 700 6<br />

Manufacture of rubber and plastic products 4100 300 7<br />

Manufacture of pulp, paper and paper products 7400 200 3<br />

Total number of employees 310300 43100 13,8%<br />

According to the presented data, the largest share of labour force concentrated in Ida-Virumaa in the following sectors: manufacture<br />

of coke, refined petroleum products and nuclear fuel, mining and quarrying of energy producing materials, manufacture<br />

of chemicals, chemical products and man-made fibers, electricity, gas and water supply, manufacture of textiles and textile<br />

products and also manufacture of basic metals and fabricated metal products.<br />

As statistical data indicated almost 100% of all employees from manufacture of coke, refined petroleum products and nuclear fuel<br />

industry are working in Ida-Virumaa<br />

Graphical representation is proved in figure 3 below.<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

Производство кокса, рафинированных<br />

нефтепродуктов Manufacture и ядерного of coke, топлива refined<br />

petroleum products and nuclear fuel<br />

Mining and Горная quarrying промышленность of energy<br />

и добыча энергосырья<br />

producing materials<br />

Производство химикатов, химических<br />

Manufacture продуктов и of искусственных chemicals, chemical волокон<br />

products and man-made fibers<br />

Электро-, газо- и водоснабжение<br />

Electricity, gas and water supply<br />

Manufacture Производство of textiles and текстиля textile<br />

и текстильных изделий<br />

products<br />

Manufacture Производство of machinery машин and<br />

и оборудования equipment (прочее) n.e.c.<br />

Manufacture Производство основных металлов<br />

и продуктов of металлообработки<br />

basic metals and<br />

fabricated metal products<br />

Производство Manufacturing (прочее) n.e.c.<br />

Manufacture Производство кожи of leather и изделий and из leather кожи<br />

products<br />

Другая деятельность по<br />

Social<br />

оказанию<br />

and personal<br />

общественных, социальных<br />

и индивидуальных service activities услуг<br />

Real estate, Недвижимость, аренда<br />

и renting деловая and деятельность business<br />

activities<br />

Строительство<br />

Construction<br />

Транспорт, логистика Transport, и коммуникации<br />

storage and<br />

communication<br />

Гостиницы и рестораны<br />

Hotels and restaurants<br />

Производство изделий<br />

Manufacture of из rubber резины and и пластика plastic<br />

products<br />

Final Cluster Analysis<br />

Производство древесины<br />

Manufacture и продуктов of wood деревообработки and wood<br />

products<br />

Manufacture Производство of electrical электротехнического and optical<br />

и оптического оборудования<br />

equipment<br />

Table 4<br />

Fig.3<br />

Manufacture Производство of pulp, целлюлозы, paper and<br />

бумаги и продуктов из бумаги<br />

paper- products<br />

11

Final Cluster Analysis<br />

The mapping 4 fi gure provided below reveals that the most developed sectors in Ida-Virumaa in terms of number of companies,<br />

number of employees and net sales (turnover) are transport (incl. logistics and transit) and construction sectors.<br />

Second group of mature sectors in Ida-Virumaa are: textile, metalworking, hotels and restaurants (incl. tourism), social<br />

and personal services and woodworking. Expert group assumes that social and personal services, hotels, and restaurants<br />

could be further considered as tourism sector as such.<br />

-2<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

DH DK<br />

DF<br />

H<br />

DN<br />

O<br />

CA<br />

DB<br />

0 DC<br />

0 2 4 6 8 10 12 14 16 18<br />

-5<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

-5<br />

DE<br />

DH<br />

DE<br />

DN<br />

DD<br />

DL<br />

DL<br />

DG<br />

H<br />

O<br />

I<br />

DD<br />

F<br />

DJ<br />

DB<br />

DK DC<br />

E<br />

-20 0 20 40 60 80 100 120<br />

DJ<br />

The following potential cluster mapping takes into consideration those sectors that are concentrated in Ida-Virumaa from<br />

national perspective. The mapping is represented in the fi gure below.<br />

Precluster sector maturity mapping in Ida-Virumaa<br />

4 Y-axis represents number of companies in Ida-Virumaa, X-axis represents number of employees in Ida-Virumaa,<br />

the diameter of the “bubbles” represents turnover in Estonia.<br />

12<br />

Number of companies (%)<br />

Number of companies (%)<br />

I<br />

F<br />

Number of employees (%)<br />

Number of employees (%)<br />

CA<br />

© Narva Business Advisory Services Foundation, St. Petersburg Information and Analytical Center, Synergy International Ltd. 2008<br />

E<br />

DF<br />

CA<br />

DB<br />

DC<br />

DD<br />

DE<br />

DF<br />

DG<br />

DH<br />

DJ<br />

DK<br />

DL<br />

DN<br />

E<br />

F<br />

H<br />

I<br />

O<br />

CA<br />

DB<br />

DC<br />

DD<br />

DE<br />

DF<br />

DG<br />

DH<br />

DJ<br />

DK<br />

DL<br />

DN<br />

E<br />

F<br />

H<br />

I<br />

O<br />

Fig.4<br />

Fig.5

To conclude, Expert Group have identifi ed following company groupings that may have a tendency to further develop<br />

into clusters:<br />

Manufacture of coke, refi ned petroleum products and nuclear fuel<br />

Mining and quarrying of energy producing materials<br />

Manufacture of textiles and textile products<br />

Electricity, gas and water supply<br />

Manufacture of basic metals and fabricated metal products<br />

Manufacture of machinery and equipment n.e.c.<br />

Manufacture of chemicals, chemical products and man-made fi bers<br />

Transport, storage and communication<br />

Construction<br />

Manufacture of wood and wood products<br />

Hotels and restaurants (the following sector will be later referred to as hospitality sector)<br />

Final Cluster Analysis<br />

The pure statistical evaluation of concentrated sectors in Ida-Virumaa will be compared with Leningrad region and will be<br />

validated together with Documentary survey and key persons’ interviews analysis.<br />

13

Final Cluster Analysis<br />

4.2. KeY FInDIngs In lenIngraD regIon<br />

According to the acquired data on the sub-national and regional levels the most developed economic sectors in Leningrad<br />

region until 2008 are:<br />

The following table summarises the results obtained in Leningrad region:<br />

Sector<br />

Manufacture of machinery and equipment<br />

(traditionally developed sector with engineering<br />

and scientifi c background);<br />

Manufacture of basic metals and fabricated<br />

metal products (as a supplier for a wide range of<br />

industries);<br />

Manufacture of chemicals, chemical products<br />

and man-made fi bers (rather mature and diversifi<br />

ed sector);<br />

Total number of<br />

companies 2007<br />

Average trade<br />

turnover<br />

2005-2007<br />

Average number of<br />

employees per sector<br />

2004-2007<br />

Table 5<br />

Joint Russian-<br />

Estonian ventures<br />

by sector in<br />

Leningrad region,<br />

2006<br />

Transport, storage and communication n/a 547 854 124,10** 526 763 25<br />

Real estate, renting and business activities 94317* 269 445 033,30** 509 681 25<br />

Construction 48 053* 391 972 705,30** 351 433 9<br />

Manufacture of machinery and equipment n.e.c. 2 364 66 222 372,79 281 079 -<br />

Other community, social and personal service<br />

activities<br />

42 523* 53 848 547,70** 202 203 3<br />

Electricity, gas and water supply 4 791 215 363 436,73 200 564 -<br />

Manufacture of basic metals and fabricated metal<br />

products<br />

505 186 738 603,40 115 718 2<br />

Hotels and restaurants 14 364* 31 783 367,23** 90 210 -<br />

Manufacture of wood and wood products 2 529 54 777 047,15 77 752 11<br />

Manufacture of textiles and textile products 1 569 12 461 468,86 44 764 2<br />

Mining and quarrying of energy producing materials 316 115 209 098,10 43 586 2<br />

Manufacturing n.e.c. 2 583 34 918 748,73 42 174 4<br />

Manufacture of chemicals, chemical products and<br />

man-made fi bres<br />

835 77 471 297,14 40 883 1<br />

Manufacture of rubber and plastic products 862 18 012 797,76 16 628 4<br />

Manufacture of coke, refi ned petroleum products<br />

and nuclear fuel<br />

Transport, storage and communication (the<br />

most attractive for the development of Russian-<br />

Estonian companies in the region);<br />

Construction (the most dynamic and large-scale<br />

sector);<br />

Manufacture of wood and wood products<br />

(sector with the experience of joint venturing).<br />

108 38 501 455,92 8 700 -<br />

Manufacture of leather and leather products 199 1 303 124,47 6 988 -<br />

Manufacture of pulp, paper and paper products;<br />

publishing and printing<br />

2837 111 141 390,10 80 616 3<br />

Manufacture of electrical and optical equipment 2309 10 463 817,20 108 667 3<br />

14<br />

* Data of 2006.<br />

** Data of 2007.<br />

© Narva Business Advisory Services Foundation, St. Petersburg Information and Analytical Center, Synergy International Ltd. 2008

According to the statistics, North-west Federal District of Russia has a well-diversifi ed industrial structure with a stable<br />

growth. The greatest activity is observed in service sectors, especially in construction industry (by all four basic criteria),<br />

transportation and storage services and business activities. All that should provide proper networking opportunities<br />

for trans-border clustering, especially in case of rather long distances between cooperating companies.<br />

On the other hand, production industries are also increasing their scale in the region, especially: metalworking, manufacture<br />

of wood products in general and pulp and paper industry. These sectors are very perspective for clustering,<br />

because they provide lots of opportunities for common related and supporting chains of cooperation.<br />

Concerning the rate of growth of the employment during last four years: it shows stability, except diff erent types of<br />

manufacturing, where the number of employees signifi cantly increased, and textile industry with great reduction of<br />

work force. There may be diff erent reasons for such decrease: more sophisticated equipment, which needs less people,<br />

or the pressure of cheap imports. The Expert Group assumes, that mostly it is the second reason, so, there is an<br />

opportunity to co-operate with foreign (Estonian) textile sector also because Estonian products are well accepted in<br />

the Russian North-west.<br />

In terms of export and import activities, the following fi gure provides the most prominent sectors in trade relations<br />

between Russia and Ida-Virumaa.<br />

e x P o r t :<br />

Construction – 17,93%<br />

Textile – 7,27%<br />

Woodworking – 4,29%<br />

Electronics – 4,22%<br />

RUSSIA<br />

IDA-VIRUMAA<br />

Estonian companies have the experience of doing business<br />

in the region and the number of joint ventures is increasing.<br />

Mostly Russian-Estonian companies are involved in the Transport,<br />

storage and communication sector (Expert Group may<br />

assume that logistic companies and sea ports are included<br />

into this category). Besides, Manufacture of wood and wood<br />

products and Construction sector are also the most attractive<br />

for Estonian business in the Russian North-west.<br />

Final Cluster Analysis<br />

Fig.6<br />

I m P o r t :<br />

Woodworking – 18,36%<br />

Manufacture of coke – 11,29%<br />

Mining and quarrying – 10,66%<br />

Textile – 9,77%<br />

15

Final Cluster Analysis<br />

The mapping provided below reveals that the most developed sectors in Leningrad region in terms of number of companies,<br />

number of employees and annual net sales (turnover) are: construction (F) and transportation, storage and<br />

communication (I): they provide the balance between number of companies on the market and great employment<br />

together with signifi cant turnovers.<br />

The sector of electricity, gas and water supply (E) follows the leaders but, having very similar fi gure of the turnover, lags<br />

behind by the number of companies and people employed.<br />

Sector of machinery and equipment manufacturing (DK), despite its modest fi gures of employment and number of<br />

companies, provides the greatest turnover, which is even more important.<br />

Sector of manufacture of pulp, paper and paper products, publishing and printing (DE) also show results, strong<br />

enough for future clustering. Besides it provides opportunities for building up various chains of cooperation.<br />

16<br />

Number of companies from total (%)<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

-5<br />

-10<br />

DH<br />

DN<br />

CA<br />

DK<br />

H<br />

K<br />

DL<br />

DF DG<br />

Pre-cluster sector maturity mapping in Leningrad region<br />

(size of «buubles» = % od sales from total turniver by sector)<br />

DJ<br />

DE<br />

O<br />

0 2 4 6 8 10 12 14 16 18 20<br />

Number of employees from total (%)<br />

© Narva Business Advisory Services Foundation, St. Petersburg Information and Analytical Center, Synergy International Ltd. 2008<br />

E<br />

DD<br />

I<br />

F<br />

CA<br />

DB<br />

DC<br />

DD<br />

DE<br />

DF<br />

DG<br />

DH<br />

DJ<br />

DK<br />

DL<br />

DN<br />

E<br />

F<br />

H<br />

I<br />

K<br />

O<br />

Fig. 7

In order to makethe choice of concentrated sector groupings in Leningrad region more precise, comparison with sub-national<br />

level should be done. This analysis aims to identify sectors of the North-west of Russia, which are highly represented<br />

in Leningrad region. The following table provides a comparison in terms of number of companies.<br />

Sector<br />

Number of<br />

companies in the<br />

North-west.<br />

2007<br />

Number of<br />

companies<br />

in Leningrad<br />

region. 2007<br />

Table 6<br />

Concentration<br />

ratio in Leningrad<br />

region<br />

Manufacture of wood and wood products 2529 549 21,71<br />

Manufacture of coke, refi ned petroleum products and nuclear fuel 108 21 19,44<br />

Manufacture of chemicals, chemical products and man-made fi bres 835 151 18,08<br />

Manufacture of rubber and plastic products 862 113 13,11<br />

Manufacture of basic metals and fabricated metal products 2505 295 11,78<br />

Manufacture of textiles and textile products 1569 178 11,34<br />

Mining and quarrying of energy producing materials 316 35 11,08<br />

Electricity, gas and water supply 4791 464 9,68<br />

Manufacture of machinery and equipment n.e.c. 2364 204 8,63<br />

Manufacture of leather and leather products 199 16 8,04<br />

Manufacturing n.e.c. 2583 200 7,74<br />

Manufacture of electrical and optical equipment 2309 159 6,89<br />

Manufacture of pulp, paper and paper products; publishing and printing 2837 170 5,99<br />

Construction n/a 3649 n/a<br />

Hotels and restaurants n/a 1075 n/a<br />

Transport, storage and communication n/a 2548 n/a<br />

Real estate, renting and business activities n/a 7360 n/a<br />

Other community, social and personal service activities n/a 3597 n/a<br />

As it is evident from the table, Leningrad region is one of the most industrialized in the whole North-west. Average concentration<br />

ratio for Leningrad region is rather signifi cant (app. 10 % of all number of companies of the North-west Federal<br />

District are located in Leningrad region).<br />

Concerning industries of the North-west, the most concentrated sectors in Leningrad region are: manufacture of wood<br />

and wood products, manufacture of coke, refi ned petroleum products and nuclear fuel, manufacture of chemicals, chemical<br />

products and man-made fi bres, manufacture of rubber and plastic products and metalworking. Unfortunately, offi cial<br />

statistics on services in the North west lacks, though Expert Group may assume signifi cant concentration of such companies<br />

in Leningrad region.<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Manufacture of Производство wood and древесины wood<br />

и продуктов деревообработки products<br />

Manufacture of coke, refi ned<br />

Производство кокса, рафинированных<br />

petroleum products and<br />

нефтепродуктов и ядерного топлива<br />

nuclear fuel<br />

Manufacture of chemicals,<br />

Производство химикатов, химических<br />

chemical products and man-<br />

продуктов и искусственных<br />

made<br />

волокон<br />

fi bres<br />

Manufacture Производство of rubber изделий and<br />

plastic из резины products и пластика<br />

Manufacture Производство of basic основных metals металлов and<br />

fabricated и продуктов metal металлообработки products<br />

Manufacture Производство of textiles текстиля and<br />

и textile текстильных products изделий<br />

Mining and quarrying of energy<br />

Горная промышленность<br />

producing materials<br />

и добыча энергосырья<br />

Electricity, Электро-, gas and газо- water и водоснабжение supply<br />

Manufacture of Производство machinery машин and<br />

и оборудования equipment (прочее) n.e.c.<br />

Manufacture Производство of leather and кожи<br />

leather и изделий products из кожи<br />

Производство (прочее)<br />

Manufacturing n.e.c.<br />

Final Cluster Analysis<br />

Manufacture Производство of электротехнического<br />

electrical and<br />

и оптического optical equipment<br />

оборудования<br />

Manufacture Производство of pulp, целлюлозы, paper бумаги and<br />

paper и продуктов products; из бумаги; publishing издательские and<br />

и типографские printing услуги<br />

Fig.8<br />

17

Final Cluster Analysis<br />

In terms of labour force, the following comparison with sub-national level has been made in order to elaborate concentration<br />

ratio.<br />

Sector<br />

Number of<br />

employees in the<br />

North-west.<br />

2007<br />

Number of<br />

employees in<br />

Leningrad region.<br />

2007<br />

Table 7<br />

Concentration ratio<br />

in Leningrad<br />

region, %<br />

Manufacture of coke, refined petroleum products and nuclear fuel 9 289 5 569 59,95<br />

Manufacture of chemicals, chemical products and man-made fibres 40 973 9 686 23,64<br />

Manufacture of rubber and plastic products 17 087 3 695 21,62<br />

Electricity, gas and water supply 194 120 30 204 15,56<br />

Manufacture of pulp, paper and paper products; publishing and printing 81 282 12 581 15,48<br />

Manufacture of leather and leather products 6 658 907 13,62<br />

Construction 354 253 43 514 12,28<br />

Manufacture of textiles and textile products 36 170 4 281 11,84<br />

Manufacture of wood and wood products 72 851 8 266 11,35<br />

Manufacture of basic metals and fabricated metal products 112 881 12 302 10,90<br />

Other community, social and personal service activities 204 428 18 877 9,23<br />

Manufacturing n.e.c. 46 461 3 809 8,20<br />

Transport, storage and communication 515 363 41 465 8,05<br />

Manufacture of machinery and equipment n.e.c. 437 678 34 142 7,80<br />

Real estate, renting and business activities 517 591 37 791 7,30<br />

Hotels and restaurants 107 758 7 379 6,85<br />

Manufacture of electrical and optical equipment 106 563 5 268 4,94<br />

Mining and quarrying of energy producing materials 42 258 1 512 3,58<br />

Total: 2 903 664 281 248 9,69<br />

As it is evident from the table, Leningrad region is one of the most populated and industrialized in the whole North-west.<br />

Average concentration ratio of labour force for Leningrad region is rather significant (app. 10 % of all number of companies<br />

of the North-west Federal District are located in Leningrad region).<br />

Industrial sectors of the North-west Federal District of Russia with the highest representation of labor force in Leningrad<br />

region are: manufacture of coke, refined petroleum products and nuclear fuel, manufacture of chemicals, chemical products<br />

and man-made fibres, manufacture of rubber and plastic products, electricity, gas and water supply and manufacture<br />

of pulp, paper and paper products. The graphical representation is provided in figure 9.<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

18<br />

Manufacture Производство of coke, кокса, refined рафинированных petroleum<br />

нефтепродуктов products и and ядерного nuclear топлива fuel<br />

Manufacture Производство of chemicals, химикатов, химических chemical<br />

products продуктов и and искусственных man-made волокон fibres<br />

Manufacture Производство of rubber изделий and<br />

из резины plastic и products пластика<br />

Electricity, Электро-, gas газо- and и водоснабжение<br />

water supply<br />

Manufacture<br />

Производство<br />

of pulp, paper<br />

целлюлозы,<br />

and<br />

бумаги<br />

paper<br />

products; и продуктов publishing из бумаги; and издательские printing<br />

и типографские услуги<br />

Manufacture Производство of leather кожи and<br />

leather и изделий products из кожи<br />

Construction<br />

Строительство<br />

Manufacture Производство of textiles текстиля and<br />

и текстильных textile products изделий<br />

Manufacture Производство of wood древесины and<br />

и продуктов деревообработки<br />

wood products<br />

Manufacture Производство of основных basic metals металлов and<br />

и<br />

fabricated<br />

продуктов металлообработки<br />

metal products<br />

© Narva Business Advisory Services Foundation, St. Petersburg Information and Analytical Center, Synergy International Ltd. 2008<br />

Other community, social Другая and деятельность personal<br />

по оказанию service общественных activities<br />

и персональных услуг<br />

Manufacturing Производство (прочее) n.e.c.<br />

Транспорт, логистика<br />

Transport, storage and communication<br />

и коммуникации<br />

Manufacture Производство of machinery машин and<br />

и оборудования equipment (прочее) n.e.c.<br />

Недвижимость, Real estate, renting аренда<br />

and и деловая business деятельность activities<br />

Hotels Гостиницы and и restaurants<br />

рестораны<br />

Manufacture Производство of electrical электротехнического and optical<br />

и оптического оборудования equipment<br />

Fig. 9<br />

Mining and Горная quarrying промышленность of energy<br />

producing и добыча энергосырья materials

At the same time, it is important to determine, what part of annual trade turnover of companies in the North-west is<br />

generated in Leningrad region. These data are shown in the neat table.<br />

Sector<br />

Annual trade turnovers<br />

in the North-west.<br />

2007, ths. RUB<br />

Annual trade turnovers in<br />

Leningrad region. 2007,<br />

ths. RUB<br />

Concentration ratio in<br />

Leningrad region, %<br />

Manufacture of coke, refined petroleum products and<br />

nuclear fuel<br />

63 181 506,96 24 917 698,48 39,44<br />

Manufacture of rubber and plastic products 26 220 740,44 8 799 631,44 33,56<br />

Manufacture of chemicals, chemical products and manmade<br />

fibres<br />

79 576 730,56 19 523 101,68 24,53<br />

Manufacture of pulp, paper and paper products; publishing<br />

and printing<br />

132 120 815,20 29 827 556,99 22,58<br />

Electricity, gas and water supply 240 467 331,70 45 147 582,24 18,77<br />

Construction 391 972 705,30 53 602 625,55 13,68<br />

Transport, storage and communication 547 854 124,10 66 580 497,2 12,15<br />

Manufacturing n.e.c. 41 323 677,86 4 493 680,54 10,87<br />

Manufacture of machinery and equipment n.e.c. 81 278 672,30 7 870 465,04 9,68<br />

Manufacture of wood and wood products 72 532 271,34 6 987 730,72 9,63<br />

Manufacture of textiles and textile products 13 931 622,04 991 166,81 7,11<br />

Real estate, renting and business activities 269 445 033,30 17 295 946,26 6,42<br />

Hotels and restaurants 31 783 367,23 1 331 548,96 4,19<br />

Manufacture of basic metals and fabricated metal products 370 200 219,9 15 020 979,09 4,06<br />

Other community, social and personal service activities 53 848 547,70 2 056 186,97 3,82<br />

Manufacture of leather and leather products 1 228 284,01 32 711,81 2,66<br />

Manufacture of electrical and optical equipment 128 174 180,60 2 467 039,52 1,92<br />

Mining and quarrying of energy producing materials 188 008 455,20 57 511,00 0,03<br />

Average share of sales provided by the companies of Leningrad region in the whole North-west is 12,5%. Sales of companies<br />

from the whole North-west, concentrated in Leningrad region, mostly come from: manufacture of coke, refined<br />

petroleum products and nuclear fuel, manufacture of rubber and plastic products, manufacture of chemicals, chemical<br />

products and man-made fibres, manufacture of pulp, paper and paper products; publishing and printing, Electricity, gas<br />

and water supply and construction. The graphical representation is provided in figure 10.<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Производство кокса,<br />

Manufacture of coke, рафинированных refined petroleum нефте-<br />

products продуктов and и ядерного nuclear топлива fuel<br />

Производство изделий<br />

Manufacture of rubber and plastic products<br />

из резины и пластика<br />

Производство химикатов,<br />

Manufacture of chemicals, chemical products<br />

химических продуктов<br />

and man-made fibres<br />

и искусственных волокон<br />

Производство целлюлозы, бумаги<br />

Manufacture of pulp, paper and paper<br />

products;<br />

и продуктов<br />

publishing<br />

из бумаги;<br />

and printing<br />

издательские<br />

и типографские услуги<br />

Electricity, Электро-, gas газо- and и water водоснабжение supply<br />

Construction<br />

Строительство<br />

Транспорт, логистика<br />

Transport, storage and communication<br />

и коммуникации<br />

Manufacturing Производство (прочее) n.e.c.<br />

Manufacture of machinery Производство and equipment машин<br />

и оборудования (прочее) n.e.c.<br />

Производство древесины<br />

Manufacture of wood и продуктов and wood деревообработки products<br />

Manufacture of textiles and Производство textile products текстиля<br />

и текстильных изделий<br />

Недвижимость, аренда<br />

Real estate, renting and business activities<br />

и деловая деятельность<br />

Hotels Гостиницы and restaurants<br />

и рестораны<br />

Manufacture of basic<br />

Производство<br />

metals<br />

основных<br />

and fabricated<br />

металлов<br />

и продуктов metal металлообработки products<br />

Other community, Другая social деятельность and personal по service оказанию<br />

общественных и личных activities услуг<br />

Final Cluster Analysis<br />

Производство кожи<br />

Manufacture of leather and leather<br />

и изделий<br />

products<br />

из кожи<br />

Manufacture of electrical Производство and optical электротехнического<br />

equipment<br />

и оптического<br />

оборудования<br />

Table 8<br />

Fig.10<br />

Mining and quarrying of Горная energy промышленность<br />

producing<br />

и добыча энергосырья materials<br />

19

Final Cluster Analysis<br />

The following potential cluster mapping takes into consideration those sectors that are concentrated in Leningrad region<br />

from the perspective of the North-west Federal District of Russia. The mapping figure is provided below.<br />

Number of companies (%)<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

-5<br />

0<br />

DK<br />

DL<br />

CA<br />

DN<br />

DD<br />

DJ<br />

DB<br />

DH<br />

E<br />

DG<br />

10 20 30 40 50 60 70<br />

Overall, taking into account the following set of factors:<br />

chosen list of industries<br />

concentration of labor and capital resources, necessary<br />

for further cluster formation<br />

growing economic activity in the sectors<br />

Estonian orientation of trade and investment activities<br />

in the sector<br />

To conclude, Expert Group has identified following company<br />

groupings on the regional (Leningrad region) scale<br />

that may have a tendency to further develop into clusters:<br />

20<br />

Manufacture of coke, refined petroleum<br />

products and nuclear fuel<br />

Manufacture of rubber and plastic products<br />

Manufacture of pulp, paper and paper<br />

products<br />

Electricity, gas and water supply<br />

Manufacture of basic metals and fabricated<br />

metal products<br />

Manufacture of machinery and equipment<br />

n.e.c.<br />

Table 9<br />

Manufacture of chemicals, chemical products<br />

and man-made fibers<br />

Transport, storage and communication<br />

Construction<br />

Manufacture of wood and wood products<br />

Number of employees (%)<br />

saInt PetersBurg metroPolIs<br />

DF<br />

DF<br />

DG<br />

DH<br />

E<br />

DB<br />

DD<br />

DJ<br />

DN<br />

DK<br />

DL<br />

CA<br />

Fig.11<br />

Saint Petersburg keeps the role of industrial centre with<br />

concentrated industries, mainly: manufacture of pulp, paper<br />

and paper products; publishing and printing, manufacture<br />

of electrical and optical equipment (including scientific<br />

institutions and construction bureaus), manufacture of<br />

basic metals and fabricated metal products.<br />

Manufacture of electrical and optical equipment, as one of<br />

the most innovative industries with high value added, has<br />

the highest turnover. Also profitable are: electricity, gas and<br />

water supply (as a “common utility” producer) and production<br />

of basic metals and fabricated metal products.<br />

Besides, the figures for these sectors are increasing<br />

(2006-2007)<br />

Number of employees may prove another strong side of<br />

Saint Petersburg, its service-oriented economy. The first<br />

positions have real estate, renting and business activities,<br />

transport, storage and communication, and construction.<br />

Electrical equipment is strong but decreasing, metal and<br />

paper are strong and increase the employment.<br />

© Narva Business Advisory Services Foundation, St. Petersburg Information and Analytical Center, Synergy International Ltd. 2008

5.1. KeY FInDIngs In IDa-vIrumaa<br />

5<br />

The current Estonian policy is mainly based on horizontal<br />

measures, related to entrepreneurship, export promotion,<br />

innovation and R&D support, foreign direct investments<br />

and access to capital. Future development of state measures<br />

partly is planned to be realised through the cluster approach,<br />

as previously revealed by the Estonian R&D Strategy<br />

“Knowledge-based Estonia” (2002-2006). One of the<br />

instruments that can apply here is the creation of so-called<br />

Competence Centres. Sectoral studies have been conducted,<br />

which have shown that the ties between the enterprises<br />

within the clusters, as well as the enterprises’ ties with<br />

research institutions, are weak, using the argument that Estonia’s<br />

case concerns operation within international (North<br />

European) rather than domestic clusters and therefore the<br />

policy of supporting the clusters cannot be efficient. Most<br />

of the EU studies consider Estonia quite undeveloped in<br />

terms of clustering activities. The emergence and development<br />

of clusters that would create competitive advantages<br />

has been restrained by the lack of a critical mass of strong<br />

enterprises acting in one sector, which amplified the need<br />

for Estonian enterprises to find and develop cooperation<br />

with enterprises outside Estonia.<br />

During this structural assistance period, 2007-2013 entrepreneurship<br />

is among supported fields. Key goal is to introduce<br />

the cluster-based approach in less knowledge and<br />

technology-intense sectors and traditional branches of<br />

the economy. For raising the innovation capacity in traditional<br />

economic sectors and building critical mass through<br />

enterprise cooperation (incl. with R&D institutions), it will<br />

be important to implement cluster specific approach. The<br />

development of cooperation networks joining enterprises,<br />

R&D institutions and local municipalities will be supported.<br />

In the clusters that have been activated by the “bottom<br />

up” approach, inter-enterprise cooperation in the fields of<br />

training, product development and export marketing will<br />

be supported.<br />

Support measures to the cluster-specific needs will be ensured,<br />

such as cooperation between enterprises in the foreign<br />

market participation will be supported sharing of orders,<br />

formation of export consortiums and joint marketing.<br />

Documentary<br />

Survey results<br />

Final Cluster Analysis<br />

Estonia has now several good opportunities to improve its<br />

innovation capacity:<br />

The development of a new R&D Strategy for 2007 -2013<br />

and the new round of Structural Funds;<br />

The ongoing development and launching of new innovation<br />

support schemes targeting the existing company<br />

base and its needs to become more competitive;<br />

The launching of a State venture capital fund in 2005<br />

and the increased financial support for national R&D<br />

infrastructures.<br />

The development of Estonian innovation policy is mainly<br />

obstructed by two factors: Insufficient awareness of the<br />

need for an innovation policy among politicians, different<br />

understanding of innovation policy among various ministries<br />

and the lack of resources.<br />

In 2008 Estonia Ministry of Economics & Communication<br />

as a responsible body for implementation Operational Programme<br />

for Development of Economic Environment proposed<br />

that grants for development of innovative clusters<br />

under Capability of innovation and growth of business priority<br />

would be made available in October 2008, as Regulation<br />

of the measure will enter into force. Total amount of<br />

100 million EEK (6,3 million EUR) for 2008-2013 will be allocated<br />

towards cluster initiatives in Estonia.<br />

Documentary survey revealed that the largest economic<br />

spheres in Ida-Virumaa regions are: shale oil refining, electricity<br />

and heating power production, chemical industry,<br />

trade, construction and building of materials, woodworking,<br />

metalworking, food processing, tourism. The backbone<br />

of Ida-Virumaa industry is formed with oil shale production<br />

and power engineering complex, internationally competitive<br />

production, as well as development service sectors: logistics<br />

and tourism. The most essential strategic priorities for<br />

economic development in North-East Estonia according to<br />

Ida-Virumaa County Development Plan (2005-2013) are:<br />

Power production, • Power production – in addition to<br />

generating power based on local raw material - oil-shale,<br />

it is also one of the most rapidly developing regions in<br />

Estonia using wind energy for power production;<br />

21

Final Cluster Analysis<br />

Strengthening of processing industry – including metal<br />

processing, chemical industry, production of building<br />

materials, manufacturing pulp;<br />

Development of transport and logistic systems for supporting<br />

enhancement of transit and local industry;<br />

Enhancement of tourism.<br />

A special natural characteristic trait of Ida-Virumaa is the<br />

availability of oil shale, which is used as raw material in power<br />

stations, chemical industries and in enterprises manufacturing<br />

building materials. However, environmental impact<br />

of oil shale industry is considered as quite signifi cant, as the<br />

oil shale-fi red power plants, which provide the atmospheric<br />

emissions of gaseous products, cause main air pollution.<br />

Metal processing has started to develop to support and<br />

enrich the mentioned big branches of industry. In December<br />

2007, there were more than 70 actively functioning<br />

metal processing enterprises; their volume of investments<br />

and number of people employed is one of the biggest in<br />

the entire region. These are mostly enterprises involved in<br />

export, which invest considerably in development activities<br />

and elaboration of new products.<br />

Wide forested areas have allowed for developing pulp industry<br />

and the seacoast has been a favourite spot for tourists<br />

and holidaymakers for centuries.<br />

The most promising economic sectors of the region according<br />

to regional authorities are:<br />

Chemical industry,<br />

Textile,<br />

Construction and processing industry,<br />

Metalworking,<br />

Hospitality.<br />

Now no clusters are formally functioning in Ida-Virumaa.<br />

However, six industrial (manufacturing) parks (Narva, Sillamäe,<br />

<strong>Kohtla</strong>-<strong>Järve</strong>, Jõhvi, Püssi and Kiviõli) can be identifi<br />

ed in the region.<br />

Cluster approach as a way of developing competitive network<br />

of companies could well be used as way of funding<br />

attainment. Transit and logistics sector currently experienc-<br />

22<br />

ing diffi culties due to the political tensions between Estonia<br />

and Russia. Expert Group agreed that the main challenge<br />

is to convince any potential cluster member company<br />

and regional stakeholders that increased productivity and<br />

competitiveness both of companies and the region can be<br />

streamlined and increased through cluster networking.<br />

Overall, Documentary survey revealed that the following<br />

company groupings that may have a tendency to further<br />

develop into clusters in Ida-Virumaa are:<br />

Mining and quarrying of energy<br />

producing materials<br />

Manufacture of chemicals, chemical<br />

products and man-made fi bers<br />

Hospitality<br />

Transport and communication<br />

Woodworking<br />

Metalworking<br />

5.2. KeY FInDIngs In lenIngraD regIon<br />

Table 10<br />

For several years, Russian Government is paying a great<br />

attention to cluster initiatives as the main engine of international<br />

competitive advantage of the Russian Federation.<br />

Therefore, cluster concepts are incorporated into offi cial<br />

documents, i.e. legislation and documents that are more<br />

informal. Cluster concept was elaborated in Russia due<br />

to recent Potential Competitiveness of Russian industries<br />

study by Michael Porter in 2006.<br />

In 2007 the Ministry for Economic Development of the Russian<br />

Federation has worked out the project of the Concept<br />

of Cluster Policy in Russia and plan of its implementation. Its<br />

realization should stimulate innovations, foreign direct investments<br />

and economic growth of regions of potential clusters.<br />

Concept of Cluster Policy consists of three main blocks:<br />

Institutional assistance in cluster<br />

development,<br />

Measures for competitiveness of cluster participants<br />

Formation of favourable conditions for cluster development<br />

© Narva Business Advisory Services Foundation, St. Petersburg Information and Analytical Center, Synergy International Ltd. 2008

One of the main engines of clusters formation has become<br />

the concept of Special Economic Zones. Cluster initiatives<br />

in Saint Petersburg are implemented in the open dialogue<br />

of authorities, scientifi c circles and business structures:<br />

such cooperation may be described as a triple helix. In January<br />

2008, Saint Petersburg Government has adopted the<br />

Complex Program of Activities for Realization of Innovative<br />

Policy in 2008-2011, consisting of two blocs, both of which<br />

include direct and indirect cluster activities. Cluster policy<br />

of Saint Petersburg includes:<br />

Planning activities of SPb cluster policy realization,<br />

Assistance in development of pilot innovative cluster<br />

Research activities for pointing out industrial and interindustrial<br />

groups, complementary small enterprises of<br />

SPb in prioritized sectors of with export potential or<br />

potential of import-substitution (in the framework of<br />

cluster policy development).<br />

Saint Petersburg as an industrial centre, “engine” for cluster<br />

building, the following sectors are to be mentioned:<br />

Wood-processing industry,<br />

Shipbuilding (such historical large-scale plants, as: “Baltic<br />

Plant”, “Admiralty Dockyards”, now forming Joint<br />

Shipbuilding Corp., partly owned by the state)<br />

Instrument-manufacturing<br />

Defense engineering with traditional high-level scientifi<br />

c school<br />

Energy engineering (“Electrosila”, turbine plant)<br />

Food industry (joint ventures)<br />

In general, app. 480 000 employees are working in manufacturing.<br />

In case of Russian-Estonian, cluster initiative Saint Petersburg<br />

should become the centre of information and new<br />

knowledge production. Saint Petersburg is one of the Russian’s<br />

main information technology centres, playing a signifi<br />

cant role in the world’s ITC exports. Certain domains of<br />

specialization in the IT sector can be identifi ed as follows:<br />

navigation, speech recognition, translation and educational<br />

software. Summarizing advantages of Saint Petersburg<br />

as a centre for trans-border clustering, it is important to put<br />

an accent on diversifi ed structure of production, innovative<br />

potential and role of a transportation hub.<br />

According to the offi cial sources, currently, attracting investment<br />

in the production sector is one of the most important<br />

tasks of the social and economic development of<br />

the Leningrad Region. The Baltic Pipeline System implies<br />

building a new Russian crude oil transhipment terminal<br />

near the city of Primorsk (Vyborg district) – one of the most<br />

perspective projects in the whole of the Russian Federation.<br />

( The structure of gross value added of the Leningrad region<br />

is rather mature: industrial output makes 1/3. In the structure<br />

of production, prevail: food industry, including tobacco<br />

and beverages, pulp & paper, means of transportation, oil<br />

products and chemical products. Total share of these types<br />

of production made in 2007.4 % of the completely industrial<br />

output. Additional investments are also planned for the construction<br />

materials industry engineering and metal processing<br />

and the light and metallurgy sector.<br />

In practice, Saint Petersburg city Administration announced<br />

a tender among diff erent scale companies for a pilot cluster<br />

creation. Recently two main branches of cluster development<br />

are of great attention of the municipals: automobile<br />

industry and electronics.<br />

Overall, Documentary survey revealed that the following<br />

company groupings that may have a tendency to further<br />