Non-parametric estimation of a time varying GARCH model

Non-parametric estimation of a time varying GARCH model

Non-parametric estimation of a time varying GARCH model

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

(1993) and references therein) <strong>model</strong>s are estimated using SAS, while MATLAB is used<br />

for the <strong>estimation</strong> <strong>of</strong> FI<strong>GARCH</strong> (1, d0, 1) <strong>model</strong>, where d0 is the fractional differencing<br />

parameter to be estimated from the data (Baillie (1996)). The definitions <strong>of</strong> these <strong>model</strong>s<br />

are provided in Appendix C. R codes have been written for the <strong>estimation</strong> <strong>of</strong> tv<strong>GARCH</strong><br />

(with d = 3, 1 and p = log n) and tvARCH <strong>model</strong>s using Epanechnikov kernel. All the<br />

codes can be made available on from authors. The choices <strong>of</strong> d = 3, 1 facilitate the optimal<br />

rate <strong>of</strong> convergence <strong>of</strong> the order <strong>of</strong> n −8/9 and n −4/5 respectively and p = log n requires<br />

lesser number <strong>of</strong> parameters to be estimated in Step 1 as compared to other choices <strong>of</strong><br />

p such as √ n. The bandwidth is selected using the cross-validation method as described<br />

in Section 3.1. Estimation <strong>of</strong> the tvARCH <strong>model</strong> has been carried out using Step 1<br />

methodology <strong>of</strong> Section 3 with bandwidth chosen using cross validation, minimizing the<br />

mean-squared prediction error for tvARCH (Hart (1994)). E<strong>GARCH</strong> <strong>model</strong> could not be<br />

estimated for the CNY/USD data due to convergence problems.<br />

Superiority <strong>of</strong> the tv<strong>GARCH</strong> <strong>model</strong> is evident from the Table 2. The non-stationary<br />

<strong>model</strong>s have clearly outperformed stationary as well as long memory <strong>model</strong>s. The AMSEs<br />

<strong>of</strong> tv<strong>GARCH</strong> with d = 3 are smaller than that with d = 1 in most <strong>of</strong> the cases. However,<br />

the difference between the two is not very high. An illustrative comparison <strong>of</strong> tv<strong>GARCH</strong><br />

(d = 3) <strong>model</strong> is also shown in Figure 3 for BRL/EURO data. The faint plot depicts<br />

the squared returns and the dark plot is the predicted volatility with the corresponding<br />

<strong>model</strong>. Clearly, the tv<strong>GARCH</strong> <strong>model</strong> has captured the ups and downs in the volatility<br />

more accurately.<br />

In Figure 4, we plot the the estimators ˆω(u), ˆα(u), ˆ β(u) and ˆα(u) + ˆ β(u) against<br />

u ∈ (0, 1] for the BSE data. Notice that similar to the least squares estimators <strong>of</strong><br />

Fryzlewicz, Sapatinas and Subba Rao (2008), the local polynomial estimators are not<br />

guaranteed to be non-negative. Although, the estimators satisfy ˆα(u) + ˆ β(u) < 1 for this<br />

data, this may not be the case in general depending on the behaviour <strong>of</strong> the data.<br />

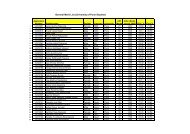

To compare the performance <strong>of</strong> the tv<strong>GARCH</strong> <strong>model</strong> further, in Table 3, we report<br />

the AMSE for the in-sample monthly volatility (<strong>of</strong> 22 trading days) forecasts for the<br />

same data sets, based on the monthly returns. The monthly returns are calculated<br />

as rmt = log(Pt/Pt−1), t = 1, 2,...,T, where Pt denotes the closing price on the last<br />

day <strong>of</strong> t th month and T is the total number <strong>of</strong> complete months in the data. All the<br />

datasets are <strong>of</strong> size around 125 except NSE dataset which has the size 95. This analysis<br />

16