Annual Report 2005 - Walter Meier

Annual Report 2005 - Walter Meier

Annual Report 2005 - Walter Meier

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

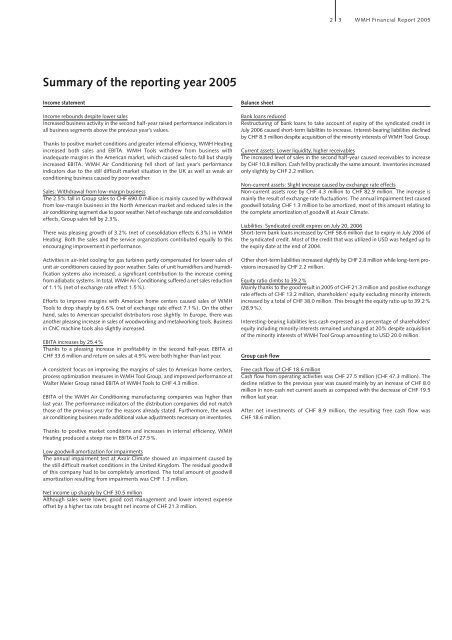

Summary of the reporting year <strong>2005</strong><br />

Income statement<br />

Income rebounds despite lower sales<br />

Increased business activity in the second half-year raised performance indicators in<br />

all business segments above the previous year’s values.<br />

Thanks to positive market conditions and greater internal efficiency, WMH Heating<br />

increased both sales and EBITA. WMH Tools withdrew from business with<br />

inadequate margins in the American market, which caused sales to fall but sharply<br />

increased EBITA. WMH Air Conditioning fell short of last year’s performance<br />

indicators due to the still difficult market situation in the UK as well as weak air<br />

conditioning business caused by poor weather.<br />

Sales: Withdrawal from low-margin business<br />

The 2.5% fall in Group sales to CHF 690.0 million is mainly caused by withdrawal<br />

from low-margin business in the North American market and reduced sales in the<br />

air conditioning segment due to poor weather. Net of exchange rate and consolidation<br />

effects, Group sales fell by 2.3%.<br />

There was pleasing growth of 3.2% (net of consolidation effects 6.3%) in WMH<br />

Heating. Both the sales and the service organizations contributed equally to this<br />

encouraging improvement in performance.<br />

Activities in air-inlet cooling for gas turbines partly compensated for lower sales of<br />

unit air conditioners caused by poor weather. Sales of unit humidifiers and humidification<br />

systems also increased, a significant contribution to the increase coming<br />

from adiabatic systems. In total, WMH Air Conditioning suffered a net sales reduction<br />

of 1.1% (net of exchange rate effect 1.5%).<br />

Efforts to improve margins with American home centers caused sales of WMH<br />

Tools to drop sharply by 6.6% (net of exchange rate effect 7.1%). On the other<br />

hand, sales to American specialist distributors rose slightly. In Europe, there was<br />

another pleasing increase in sales of woodworking and metalworking tools. Business<br />

in CNC machine tools also slightly increased.<br />

EBITA increases by 25.4%<br />

Thanks to a pleasing increase in profitability in the second half-year, EBITA at<br />

CHF 33.6 million and return on sales at 4.9% were both higher than last year.<br />

A consistent focus on improving the margins of sales to American home centers,<br />

process optimization measures in WMH Tool Group, and improved performance at<br />

<strong>Walter</strong> <strong>Meier</strong> Group raised EBITA of WMH Tools to CHF 4.3 million.<br />

EBITA of the WMH Air Conditioning manufacturing companies was higher than<br />

last year. The performance indicators of the distribution companies did not match<br />

those of the previous year for the reasons already stated. Furthermore, the weak<br />

air conditioning business made additional value adjustments necessary on inventories.<br />

Thanks to positive market conditions and increases in internal efficiency, WMH<br />

Heating produced a steep rise in EBITA of 27.5%.<br />

Low goodwill amortization for impairments<br />

The annual impairment test at Axair Climate showed an impairment caused by<br />

the still difficult market conditions in the United Kingdom. The residual goodwill<br />

of this company had to be completely amortized. The total amount of goodwill<br />

amortization resulting from impairments was CHF 1.3 million.<br />

Net income up sharply by CHF 30.5 million<br />

Although sales were lower, good cost management and lower interest expense<br />

offset by a higher tax rate brought net income of CHF 21.3 million.<br />

Balance sheet<br />

Bank loans reduced<br />

Restructuring of bank loans to take account of expiry of the syndicated credit in<br />

July 2006 caused short-term liabilities to increase. Interest-bearing liabilities declined<br />

by CHF 8.3 million despite acquisition of the minority interests of WMH Tool Group.<br />

Current assets: Lower liquidity, higher receivables<br />

The increased level of sales in the second half-year caused receivables to increase<br />

by CHF 10.8 million. Cash fell by practically the same amount. Inventories increased<br />

only slightly by CHF 2.2 million.<br />

Non-current assets: Slight increase caused by exchange rate effects<br />

Non-current assets rose by CHF 4.3 million to CHF 82.9 million. The increase is<br />

mainly the result of exchange rate fluctuations. The annual impairment test caused<br />

goodwill totaling CHF 1.3 million to be amortized, most of this amount relating to<br />

the complete amortization of goodwill at Axair Climate.<br />

Liabilities: Syndicated credit expires on July 20, 2006<br />

Short-term bank loans increased by CHF 58.6 million due to expiry in July 2006 of<br />

the syndicated credit. Most of the credit that was utilized in USD was hedged up to<br />

the expiry date at the end of 2004.<br />

Other short-term liabilities increased slightly by CHF 2.8 million while long-term provisions<br />

increased by CHF 2.2 million.<br />

Equity ratio climbs to 39.2%<br />

Mainly thanks to the good result in <strong>2005</strong> of CHF 21.3 million and positive exchange<br />

rate effects of CHF 13.2 million, shareholders’ equity excluding minority interests<br />

increased by a total of CHF 38.0 million. This brought the equity ratio up to 39.2%<br />

(28.9%).<br />

Interesting-bearing liabilities less cash expressed as a percentage of shareholders’<br />

equity including minority interests remained unchanged at 20% despite acquisition<br />

of the minority interests of WMH Tool Group amounting to USD 20.0 million.<br />

Group cash flow<br />

2<br />

WMH Financial <strong>Report</strong> <strong>2005</strong><br />

Free cash flow of CHF 18.6 million<br />

Cash flow from operating activities was CHF 27.5 million (CHF 47.3 million). The<br />

decline relative to the previous year was caused mainly by an increase of CHF 8.0<br />

million in non-cash net current assets as compared with the decrease of CHF 19.5<br />

million last year.<br />

After net investments of CHF 8.9 million, the resulting free cash flow was<br />

CHF 18.6 million.<br />

3