Annual Report 2005 - Walter Meier

Annual Report 2005 - Walter Meier

Annual Report 2005 - Walter Meier

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

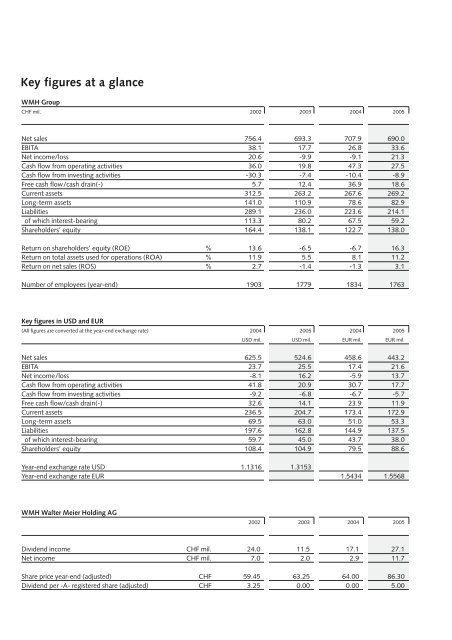

Key figures at a glance<br />

WMH Group<br />

CHF mil. 2002 2003 2004 <strong>2005</strong><br />

Net sales 756.4 693.3 707.9 690.0<br />

EBITA 38.1 17.7 26.8 33.6<br />

Net income/loss 20.6 -9.9 -9.1 21.3<br />

Cash flow from operating activities 36.0 19.8 47.3 27.5<br />

Cash flow from investing activities -30.3 -7.4 -10.4 -8.9<br />

Free cash flow/cash drain(-) 5.7 12.4 36.9 18.6<br />

Current assets 312.5 263.2 267.6 269.2<br />

Long-term assets 141.0 110.9 78.6 82.9<br />

Liabilities 289.1 236.0 223.6 214.1<br />

of which interest-bearing 113.3 80.2 67.5 59.2<br />

Shareholders’ equity 164.4 138.1 122.7 138.0<br />

Return on shareholders’ equity (ROE) % 13.6 -6.5 -6.7 16.3<br />

Return on total assets used for operations (ROA) % 11.9 5.5 8.1 11.2<br />

Return on net sales (ROS) % 2.7 -1.4 -1.3 3.1<br />

Number of employees (year-end) 1903 1779 1834 1763<br />

Key figures in USD and EUR<br />

(All figures are converted at the year-end exchange rate) 2004 <strong>2005</strong> 2004 <strong>2005</strong><br />

USD mil. USD mil. EUR mil. EUR mil.<br />

Net sales 625.5 524.6 458.6 443.2<br />

EBITA 23.7 25.5 17.4 21.6<br />

Net income/loss -8.1 16.2 -5.9 13.7<br />

Cash flow from operating activities 41.8 20.9 30.7 17.7<br />

Cash flow from investing activities -9.2 -6.8 -6.7 -5.7<br />

Free cash flow/cash drain(-) 32.6 14.1 23.9 11.9<br />

Current assets 236.5 204.7 173.4 172.9<br />

Long-term assets 69.5 63.0 51.0 53.3<br />

Liabilities 197.6 162.8 144.9 137.5<br />

of which interest-bearing 59.7 45.0 43.7 38.0<br />

Shareholders’ equity 108.4 104.9 79.5 88.6<br />

Year-end exchange rate USD 1.1316 1.3153<br />

Year-end exchange rate EUR 1.5434 1.5568<br />

WMH <strong>Walter</strong> <strong>Meier</strong> Holding AG<br />

2002 2003 2004 <strong>2005</strong><br />

Dividend income CHF mil. 24.0 11.5 17.1 27.1<br />

Net income CHF mil. 7.0 2.0 2.9 11.7<br />

Share price year-end (adjusted) CHF 59.45 63.25 64.00 86.30<br />

Dividend per -A- registered share (adjusted) CHF 3.25 0.00 0.00 5.00