Annual Report 2005 - Walter Meier

Annual Report 2005 - Walter Meier

Annual Report 2005 - Walter Meier

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

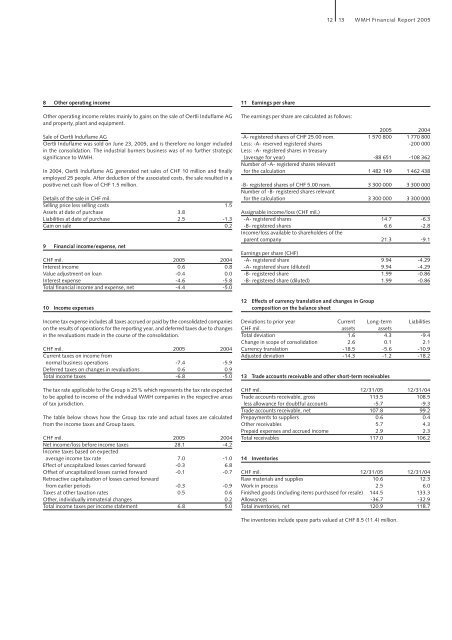

8 Other operating income<br />

Other operating income relates mainly to gains on the sale of Oertli Induflame AG<br />

and property, plant and equipment.<br />

Sale of Oertli Induflame AG<br />

Oertli Induflame was sold on June 23, <strong>2005</strong>, and is therefore no longer included<br />

in the consolidation. The industrial burners business was of no further strategic<br />

significance to WMH.<br />

In 2004, Oertli Induflame AG generated net sales of CHF 10 million and finally<br />

employed 25 people. After deduction of the associated costs, the sale resulted in a<br />

positive net cash flow of CHF 1.5 million.<br />

Details of the sale in CHF mil.<br />

Selling price less selling costs 1.5<br />

Assets at date of purchase 3.8<br />

Liabilities at date of purchase 2.5 -1.3<br />

Gain on sale 0.2<br />

9 Financial income/expense, net<br />

CHF mil. <strong>2005</strong> 2004<br />

Interest income 0.6 0.8<br />

Value adjustment on loan -0.4 0.0<br />

Interest expense -4.6 -5.8<br />

Total financial income and expense, net -4.4 -5.0<br />

10 Income expenses<br />

Income tax expense includes all taxes accrued or paid by the consolidated companies<br />

on the results of operations for the reporting year, and deferred taxes due to changes<br />

in the revaluations made in the course of the consolidation.<br />

CHF mil. <strong>2005</strong> 2004<br />

Current taxes on income from<br />

normal business operations -7.4 -5.9<br />

Deferred taxes on changes in revaluations 0.6 0.9<br />

Total income taxes -6.8 -5.0<br />

The tax rate applicable to the Group is 25% which represents the tax rate expected<br />

to be applied to income of the individual WMH companies in the respective areas<br />

of tax jurisdiction.<br />

The table below shows how the Group tax rate and actual taxes are calculated<br />

from the income taxes and Group taxes.<br />

CHF mil. <strong>2005</strong> 2004<br />

Net income/loss before income taxes 28.1 -4.2<br />

Income taxes based on expected<br />

average income tax rate 7.0 -1.0<br />

Effect of uncapitalized losses carried forward -0.3 6.8<br />

Offset of uncapitalized losses carried forward -0.1 -0.7<br />

Retroactive capitalization of losses carried forward<br />

from earlier periods -0.3 -0.9<br />

Taxes at other taxation rates 0.5 0.6<br />

Other, individually immaterial changes 0.2<br />

Total income taxes per income statement 6.8 5.0<br />

11 Earnings per share<br />

12<br />

13<br />

The earnings per share are calculated as follows:<br />

WMH Financial <strong>Report</strong> <strong>2005</strong><br />

<strong>2005</strong> 2004<br />

-A- registered shares of CHF 25.00 nom. 1 570 800 1 770 800<br />

Less: -A- reserved registered shares -200 000<br />

Less: -A- registered shares in treasury<br />

(average for year) -88 651 -108 362<br />

Number of -A- registered shares relevant<br />

for the calculation 1 482 149 1 462 438<br />

-B- registered shares of CHF 5.00 nom. 3 300 000 3 300 000<br />

Number of -B- registered shares relevant<br />

for the calculation 3 300 000 3 300 000<br />

Assignable income/loss (CHF mil.)<br />

-A- registered shares 14.7 -6.3<br />

-B- registered shares 6.6 -2.8<br />

Income/loss available to shareholders of the<br />

parent company 21.3 -9.1<br />

Earnings per share (CHF)<br />

-A- registered share 9.94 -4.29<br />

-A- registered share (diluted) 9.94 -4.29<br />

-B- registered share 1.99 -0.86<br />

-B- registered share (diluted) 1.99 -0.86<br />

12 Effects of currency translation and changes in Group<br />

composition on the balance sheet<br />

Deviations to prior year Current Long-term Liabilities<br />

CHF mil. assets assets<br />

Total deviation 1.6 4.3 -9.4<br />

Change in scope of consolidation 2.6 0.1 2.1<br />

Currency translation -18.5 -5.6 -10.9<br />

Adjusted deviation -14.3 -1.2 -18.2<br />

13 Trade accounts receivable and other short-term receivables<br />

CHF mil. 12/31/05 12/31/04<br />

Trade accounts receivable, gross 113.5 108.5<br />

less allowance for doubtful accounts -5.7 -9.3<br />

Trade accounts receivable, net 107.8 99.2<br />

Prepayments to suppliers 0.6 0.4<br />

Other receivables 5.7 4.3<br />

Prepaid expenses and accrued income 2.9 2.3<br />

Total receivables 117.0 106.2<br />

14 Inventories<br />

CHF mil. 12/31/05 12/31/04<br />

Raw materials and supplies 10.6 12.3<br />

Work in process 2.5 6.0<br />

Finished goods (including items purchased for resale) 144.5 133.3<br />

Allowances -36.7 -32.9<br />

Total inventories, net 120.9 118.7<br />

The inventories include spare parts valued at CHF 8.5 (11.4) million.