Novo-Nordisk-AR-2012-en

Novo-Nordisk-AR-2012-en

Novo-Nordisk-AR-2012-en

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

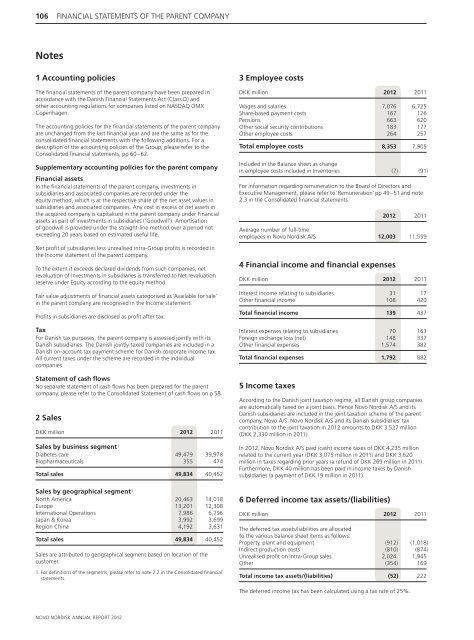

106 FINANCIAL STATEMENTS OF THE P<strong>AR</strong>ENT COMPANY<br />

Notes<br />

1 Accounting policies<br />

The fi nancial statem<strong>en</strong>ts of the par<strong>en</strong>t company have be<strong>en</strong> prepared in<br />

accordance with the Danish Financial Statem<strong>en</strong>ts Act (Class D) and<br />

other accounting regulations for companies listed on NASDAQ OMX<br />

Cop<strong>en</strong>hag<strong>en</strong>.<br />

The accounting policies for the fi nancial statem<strong>en</strong>ts of the par<strong>en</strong>t company<br />

are unchanged from the last fi nancial year and are the same as for the<br />

consolid ated fi nancial statem<strong>en</strong>ts with the following additions. For a<br />

description of the accounting policies of the Group, please refer to the<br />

Consolidated fi nancial statem<strong>en</strong>ts, pp 60–62.<br />

Supplem<strong>en</strong>tary accounting policies for the par<strong>en</strong>t company<br />

Financial assets<br />

In the fi nancial statem<strong>en</strong>ts of the par<strong>en</strong>t company, investm<strong>en</strong>ts in<br />

sub sidiaries and associated companies are recorded under the<br />

equity method, which is at the respective share of the net asset values in<br />

subsidiaries and associated companies. Any cost in excess of net assets in<br />

the acquired company is capitalised in the par<strong>en</strong>t company under Financial<br />

assets as part of investm<strong>en</strong>ts in subsidiaries (‘Goodwill’). Amortisation<br />

of goodwill is provided under the straight-line method over a period not<br />

exceeding 20 years based on estimated useful life.<br />

Net profi t of subsidiaries less unrealised intra-Group profi ts is recorded in<br />

the Income statem<strong>en</strong>t of the par<strong>en</strong>t company.<br />

To the ext<strong>en</strong>t it exceeds declared divid<strong>en</strong>ds from such companies, net<br />

revaluation of investm<strong>en</strong>ts in subsidiaries is transferred to Net revaluation<br />

reserve under Equity according to the equity method.<br />

Fair value adjustm<strong>en</strong>ts of fi nancial assets categorised as ‘Available for sale’<br />

in the par<strong>en</strong>t company are recognised in the Income statem<strong>en</strong>t.<br />

Profi ts in subsidiaries are disclosed as profi t after tax.<br />

Tax<br />

For Danish tax purposes, the par<strong>en</strong>t company is assessed jointly with its<br />

Danish subsidiaries. The Danish jointly taxed companies are included in a<br />

Danish on-account tax paym<strong>en</strong>t scheme for Danish corporate income tax.<br />

All curr<strong>en</strong>t taxes under the scheme are recorded in the individual<br />

com panies.<br />

Statem<strong>en</strong>t of cash fl ows<br />

No separate statem<strong>en</strong>t of cash fl ows has be<strong>en</strong> prepared for the par<strong>en</strong>t<br />

company; please refer to the Consolidated Statem<strong>en</strong>t of cash fl ows on p 58.<br />

2 Sales<br />

DKK million <strong>2012</strong> 2011<br />

Sales by business segm<strong>en</strong>t 1<br />

Diabetes care 49,479 39,978<br />

Biopharmaceuticals 355 474<br />

Total sales 49,834 40,452<br />

Sales by geographical segm<strong>en</strong>t 1<br />

North America 20,463 14,018<br />

Europe 13,201 12,308<br />

International Operations 7,986 6,796<br />

Japan & Korea 3,992 3,699<br />

Region China 4,192 3,631<br />

Total sales 49,834 40,452<br />

Sales are attributed to geographical segm<strong>en</strong>t based on location of the<br />

customer.<br />

1. For defi nitions of the segm<strong>en</strong>ts, please refer to note 2.2 in the Consolidated fi nancial<br />

statem<strong>en</strong>ts.<br />

NOVO NORDISK ANNUAL REPORT <strong>2012</strong><br />

3 Employee costs<br />

DKK million <strong>2012</strong> 2011<br />

Wages and salaries 7,076 6,725<br />

Share-based paym<strong>en</strong>t costs 167 126<br />

P<strong>en</strong>sions 663 620<br />

Other social security contributions 183 177<br />

Other employee costs 264 257<br />

Total employee costs 8,353 7,905<br />

Included in the Balance sheet as change<br />

in employee costs included in Inv<strong>en</strong>tories (7) (91)<br />

For information regarding remuneration to the Board of Directors and<br />

Executive Managem<strong>en</strong>t, please refer to ‘Remuneration’ pp 49–51 and note<br />

2.3 in the Consolidated fi nancial statem<strong>en</strong>ts.<br />

<strong>2012</strong> 2011<br />

Average number of full-time<br />

employees in <strong>Novo</strong> <strong>Nordisk</strong> A/S 12,003 11,559<br />

4 Financial income and fi nancial exp<strong>en</strong>ses<br />

DKK million <strong>2012</strong> 2011<br />

Interest income relating to subsidiaries 31 17<br />

Other fi nancial income 108 420<br />

Total fi nancial income 139 437<br />

Interest exp<strong>en</strong>ses relating to subsidiaries 70 163<br />

Foreign exchange loss (net) 148 337<br />

Other fi nancial exp<strong>en</strong>ses 1,574 382<br />

Total fi nancial exp<strong>en</strong>ses 1,792 882<br />

5 Income taxes<br />

According to the Danish joint taxation regime, all Danish group companies<br />

are automatically taxed on a joint basis. H<strong>en</strong>ce <strong>Novo</strong> <strong>Nordisk</strong> A/S and its<br />

Danish subsidiaries are included in the joint taxation scheme of the par<strong>en</strong>t<br />

company, <strong>Novo</strong> A/S. <strong>Novo</strong> <strong>Nordisk</strong> A/S and its Danish subsidiaries’ tax<br />

contribution to the joint taxation in <strong>2012</strong> amounts to DKK 3,527 million<br />

(DKK 2,330 million in 2011).<br />

In <strong>2012</strong>, <strong>Novo</strong> <strong>Nordisk</strong> A/S paid (cash) income taxes of DKK 4,235 million<br />

related to the curr<strong>en</strong>t year (DKK 3,075 million in 2011) and DKK 3,620<br />

million in taxes regarding prior years (a refund of DKK 269 million in 2011).<br />

Furthermore, DKK 40 million has be<strong>en</strong> paid in income taxes by Danish<br />

subsidiaries (a paym<strong>en</strong>t of DKK 19 million in 2011).<br />

6 Deferred income tax assets/(liabilities)<br />

DKK million <strong>2012</strong> 2011<br />

The deferred tax assets/liabilities are allocated<br />

to the various balance sheet items as follows:<br />

Property, plant and equipm<strong>en</strong>t (912) (1,018)<br />

Indirect production costs (810) (874)<br />

Unrealised profi t on intra-Group sales 2,024 1,945<br />

Other (354) 169<br />

Total income tax assets/(liabilities) (52) 222<br />

The deferred income tax has be<strong>en</strong> calculated using a tax rate of 25%.