Novo-Nordisk-AR-2012-en

Novo-Nordisk-AR-2012-en

Novo-Nordisk-AR-2012-en

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Section 5<br />

Other disclosures<br />

CONSOLIDATED FINANCIAL STATEMENTS 85<br />

This section includes other statutory notes or notes that are of secondary importance for understanding the fi nancial<br />

performance of <strong>Novo</strong> <strong>Nordisk</strong>. A list of subsidiaries in the <strong>Novo</strong> <strong>Nordisk</strong> Group is also included here.<br />

5.1 Share-based paym<strong>en</strong>t schemes<br />

Accounting policies<br />

Share-based comp<strong>en</strong>sation<br />

<strong>Novo</strong> <strong>Nordisk</strong> operates equity-settled, share-based comp<strong>en</strong>sation plans.<br />

The fair value of the employee services received in exchange for the grant<br />

of the options or shares is recognised as an exp<strong>en</strong>se and allocated over the<br />

vesting period.<br />

The total amount to be exp<strong>en</strong>sed over the vesting period is determined by<br />

refer<strong>en</strong>ce to the fair value of the options or shares granted, excluding<br />

the impact of any non-market vesting conditions. The fair value is fi xed at<br />

the grant date. Non-market vesting conditions are included in assumptions<br />

about the number of options or shares that are expected to vest. At the <strong>en</strong>d<br />

of each reporting period, <strong>Novo</strong> <strong>Nordisk</strong> revises its estimates of the number<br />

of options or shares that are expected to vest. <strong>Novo</strong> <strong>Nordisk</strong> recognises the<br />

impact of the revision of the original estimates, if any, in the Income<br />

statem<strong>en</strong>t and in a corresponding adjustm<strong>en</strong>t to Equity (change in<br />

proceeds) over the remaining vesting period. Adjustm<strong>en</strong>ts relating to prior<br />

years are included in the Income statem<strong>en</strong>t in the year of adjustm<strong>en</strong>t.<br />

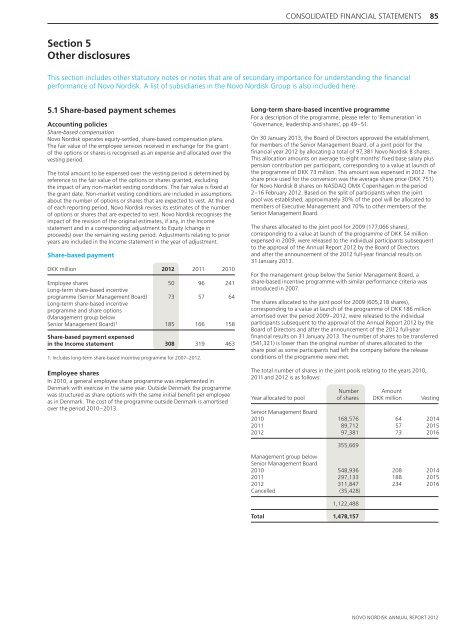

Share-based paym<strong>en</strong>t<br />

DKK million <strong>2012</strong> 2011 2010<br />

Employee shares 50 96 241<br />

Long-term share-based inc<strong>en</strong>tive<br />

programme (S<strong>en</strong>ior Managem<strong>en</strong>t Board) 73 57 64<br />

Long-term share-based inc<strong>en</strong>tive<br />

programme and share options<br />

(Managem<strong>en</strong>t group below<br />

S<strong>en</strong>ior Managem<strong>en</strong>t Board) 1 185 166 158<br />

Share-based paym<strong>en</strong>t exp<strong>en</strong>sed<br />

in the Income statem<strong>en</strong>t 308 319 463<br />

1. Includes long-term share-based inc<strong>en</strong>tive programme for 2007–<strong>2012</strong>.<br />

Employee shares<br />

In 2010, a g<strong>en</strong>eral employee share programme was implem<strong>en</strong>ted in<br />

D<strong>en</strong>mark with exercise in the same year. Outside D<strong>en</strong>mark the programme<br />

was structured as share options with the same initial b<strong>en</strong>efi t per employee<br />

as in D<strong>en</strong>mark. The cost of the programme outside D<strong>en</strong>mark is amortised<br />

over the period 2010–2013.<br />

Long-term share-based inc<strong>en</strong>tive programme<br />

For a description of the programme, please refer to ‘Remuneration’ in<br />

‘Governance, leadership and shares’, pp 49–51.<br />

On 30 January 2013, the Board of Directors approved the establishm<strong>en</strong>t,<br />

for members of the S<strong>en</strong>ior Managem<strong>en</strong>t Board, of a joint pool for the<br />

fi nancial year <strong>2012</strong> by allocating a total of 97,381 <strong>Novo</strong> <strong>Nordisk</strong> B shares.<br />

This allocation amounts on average to eight months’ fi xed base salary plus<br />

p<strong>en</strong>sion contribution per participant, corresponding to a value at launch of<br />

the programme of DKK 73 million. This amount was exp<strong>en</strong>sed in <strong>2012</strong>. The<br />

share price used for the conversion was the average share price (DKK 751)<br />

for <strong>Novo</strong> <strong>Nordisk</strong> B shares on NASDAQ OMX Cop<strong>en</strong>hag<strong>en</strong> in the period<br />

2–16 February <strong>2012</strong>. Based on the split of participants wh<strong>en</strong> the joint<br />

pool was established, approximately 30% of the pool will be allocated to<br />

members of Executive Managem<strong>en</strong>t and 70% to other members of the<br />

S<strong>en</strong>ior Managem<strong>en</strong>t Board.<br />

The shares allocated to the joint pool for 2009 (177,066 shares),<br />

corresponding to a value at launch of the programme of DKK 54 million<br />

exp<strong>en</strong>sed in 2009, were released to the individual participants subsequ<strong>en</strong>t<br />

to the approval of the Annual Report <strong>2012</strong> by the Board of Directors<br />

and after the announcem<strong>en</strong>t of the <strong>2012</strong> full-year fi nancial results on<br />

31 January 2013.<br />

For the managem<strong>en</strong>t group below the S<strong>en</strong>ior Managem<strong>en</strong>t Board, a<br />

share-based inc<strong>en</strong>tive programme with similar performance criteria was<br />

introduced in 2007.<br />

The shares allocated to the joint pool for 2009 (605,218 shares),<br />

corresponding to a value at launch of the programme of DKK 186 million<br />

amortised over the period 2009–<strong>2012</strong>, were released to the individual<br />

participants subsequ<strong>en</strong>t to the approval of the Annual Report <strong>2012</strong> by the<br />

Board of Directors and after the announcem<strong>en</strong>t of the <strong>2012</strong> full-year<br />

fi nancial results on 31 January 2013. The number of shares to be transferred<br />

(541,321) is lower than the original number of shares allocated to the<br />

share pool as some participants had left the company before the release<br />

conditions of the programme were met.<br />

The total number of shares in the joint pools relating to the years 2010,<br />

2011 and <strong>2012</strong> is as follows:<br />

Number Amount<br />

Year allocated to pool of shares DKK million Vesting<br />

S<strong>en</strong>ior Managem<strong>en</strong>t Board<br />

2010 168,576 64 2014<br />

2011 89,712 57 2015<br />

<strong>2012</strong> 97,381 73 2016<br />

355,669<br />

Managem<strong>en</strong>t group below<br />

S<strong>en</strong>ior Managem<strong>en</strong>t Board<br />

2010 548,936 208 2014<br />

2011 297,133 188 2015<br />

<strong>2012</strong> 311,847 234 2016<br />

Cancelled (35,428)<br />

1,122,488<br />

Total 1,478,157<br />

NOVO NORDISK ANNUAL REPORT <strong>2012</strong>