Novo-Nordisk-AR-2012-en

Novo-Nordisk-AR-2012-en

Novo-Nordisk-AR-2012-en

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

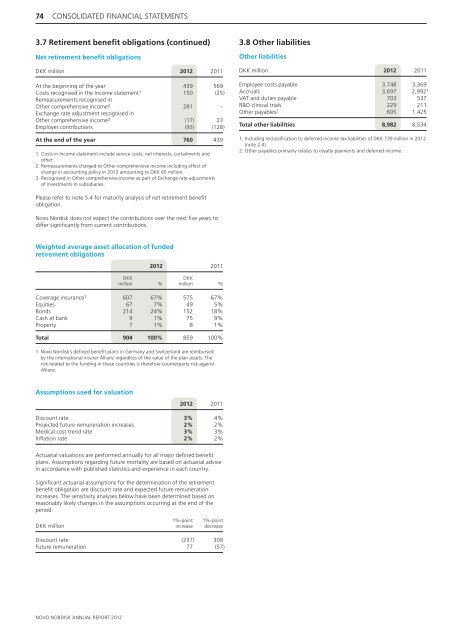

74 CONSOLIDATED FINANCIAL STATEMENTS<br />

3.7 Retirem<strong>en</strong>t b<strong>en</strong>efi t obligations (continued)<br />

Net retirem<strong>en</strong>t b<strong>en</strong>efi t obligations<br />

DKK million <strong>2012</strong> 2011<br />

At the beginning of the year 439 569<br />

Costs recognised in the Income statem<strong>en</strong>t 1 150 (25)<br />

Remeasurem<strong>en</strong>ts recognised in<br />

Other compreh<strong>en</strong>sive income 2 281 –<br />

Exchange rate adjustm<strong>en</strong>t recognised in<br />

Other compreh<strong>en</strong>sive income 3 (17) 23<br />

Employer contributions (93) (128)<br />

At the <strong>en</strong>d of the year 760 439<br />

1. Costs in Income statem<strong>en</strong>t include service costs, net interests, curtailm<strong>en</strong>ts and<br />

other.<br />

2. Remeasurem<strong>en</strong>ts charged to Other compreh<strong>en</strong>sive income including effect of<br />

change in accounting policy in <strong>2012</strong> amounting to DKK 65 million.<br />

3. Recognised in Other compreh<strong>en</strong>sive income as part of Exchange rate adjustm<strong>en</strong>ts<br />

of investm<strong>en</strong>ts in subsidiaries.<br />

Please refer to note 5.4 for maturity analysis of net retirem<strong>en</strong>t b<strong>en</strong>efi t<br />

obligation.<br />

<strong>Novo</strong> <strong>Nordisk</strong> does not expect the contributions over the next fi ve years to<br />

differ signifi cantly from curr<strong>en</strong>t contributions.<br />

Weighted average asset allocation of funded<br />

retirem<strong>en</strong>t obligations<br />

NOVO NORDISK ANNUAL REPORT <strong>2012</strong><br />

<strong>2012</strong> 2011<br />

DKK DKK<br />

million % million %<br />

Coverage insurance 1 607 67% 575 67%<br />

Equities 67 7% 49 5%<br />

Bonds 214 24% 152 18%<br />

Cash at bank 9 1% 75 9%<br />

Property 7 1% 8 1%<br />

Total 904 100% 859 100%<br />

1. <strong>Novo</strong> <strong>Nordisk</strong>’s defi ned b<strong>en</strong>efi t plans in Germany and Switzerland are reimbursed<br />

by the international insurer Allianz regardless of the value of the plan assets. The<br />

risk related to the funding in these countries is therefore counterparty risk against<br />

Allianz.<br />

Assumptions used for valuation<br />

<strong>2012</strong> 2011<br />

Discount rate 3% 4%<br />

Projected future remuneration increases 2% 2%<br />

Medical cost tr<strong>en</strong>d rate 3% 3%<br />

Infl ation rate 2% 2%<br />

Actuarial valuations are performed annually for all major defi ned b<strong>en</strong>efi t<br />

plans. Assumptions regarding future mortality are based on actuarial advice<br />

in accordance with published statistics and experi<strong>en</strong>ce in each country.<br />

Signifi cant actuarial assumptions for the determination of the retirem<strong>en</strong>t<br />

b<strong>en</strong>efi t obligation are discount rate and expected future remuneration<br />

increases. The s<strong>en</strong>sitivity analyses below have be<strong>en</strong> determined based on<br />

reasonably likely changes in the assumptions occurring at the <strong>en</strong>d of the<br />

period.<br />

1%-point 1%-point<br />

DKK million increase decrease<br />

Discount rate (237) 309<br />

Future remuneration 77 (57)<br />

3.8 Other liabilities<br />

Other liabilities<br />

DKK million <strong>2012</strong> 2011<br />

Employee costs payable 3,748 3,369<br />

Accruals 3,697 2,992 1<br />

VAT and duties payable 703 537<br />

R&D clinical trials 229 211<br />

Other payables 2 605 1,425<br />

Total other liabilities 8,982 8,534<br />

1. Including reclassifi cation to deferred income tax liabilities of DKK 739 million in <strong>2012</strong><br />

(note 2.4).<br />

2. Other payables primarily relates to royalty paym<strong>en</strong>ts and deferred income.