Novo-Nordisk-AR-2012-en

Novo-Nordisk-AR-2012-en

Novo-Nordisk-AR-2012-en

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

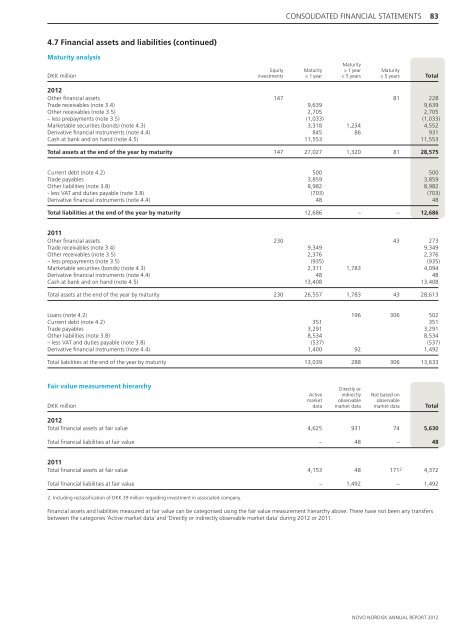

4.7 Financial assets and liabilities (continued)<br />

CONSOLIDATED FINANCIAL STATEMENTS 83<br />

Maturity analysis<br />

Equity Maturity<br />

Maturity<br />

> 1 year Maturity<br />

DKK million investm<strong>en</strong>ts < 1 year < 5 years > 5 years Total<br />

<strong>2012</strong><br />

Other fi nancial assets 147 81 228<br />

Trade receivables (note 3.4) 9,639 9,639<br />

Other receivables (note 3.5) 2,705 2,705<br />

– less prepaym<strong>en</strong>ts (note 3.5) (1,033) (1,033)<br />

Marketable securities (bonds) (note 4.3) 3,318 1,234 4,552<br />

Derivative fi nancial instrum<strong>en</strong>ts (note 4.4) 845 86 931<br />

Cash at bank and on hand (note 4.5) 11,553 11,553<br />

Total assets at the <strong>en</strong>d of the year by maturity 147 27,027 1,320 81 28,575<br />

Curr<strong>en</strong>t debt (note 4.2) 500 500<br />

Trade payables 3,859 3,859<br />

Other liabilities (note 3.8) 8,982 8,982<br />

- less VAT and duties payable (note 3.8) (703) (703)<br />

Derivative fi nancial instrum<strong>en</strong>ts (note 4.4) 48 48<br />

Total liabilities at the <strong>en</strong>d of the year by maturity 12,686 – – 12,686<br />

2011<br />

Other fi nancial assets 230 43 273<br />

Trade receivables (note 3.4) 9,349 9,349<br />

Other receivables (note 3.5) 2,376 2,376<br />

– less prepaym<strong>en</strong>ts (note 3.5) (935) (935)<br />

Marketable securities (bonds) (note 4.3) 2,311 1,783 4,094<br />

Derivative fi nancial instrum<strong>en</strong>ts (note 4.4) 48 48<br />

Cash at bank and on hand (note 4.5) 13,408 13,408<br />

Total assets at the <strong>en</strong>d of the year by maturity 230 26,557 1,783 43 28,613<br />

Loans (note 4.2) 196 306 502<br />

Curr<strong>en</strong>t debt (note 4.2) 351 351<br />

Trade payables 3,291 3,291<br />

Other liabilities (note 3.8) 8,534 8,534<br />

– less VAT and duties payable (note 3.8) (537) (537)<br />

Derivative fi nancial instrum<strong>en</strong>ts (note 4.4) 1,400 92 1,492<br />

Total liabilities at the <strong>en</strong>d of the year by maturity 13,039 288 306 13,633<br />

Fair value measurem<strong>en</strong>t hierarchy<br />

Directly or<br />

Active indirectly Not based on<br />

market observable observable<br />

DKK million data market data market data Total<br />

<strong>2012</strong><br />

Total fi nancial assets at fair value 4,625 931 74 5,630<br />

Total fi nancial liabilities at fair value – 48 – 48<br />

2011<br />

Total fi nancial assets at fair value 4,153 48 171 2 4,372<br />

Total fi nancial liabilities at fair value – 1,492 – 1,492<br />

2. Including reclassifi cation of DKK 39 million regarding investm<strong>en</strong>t in associated company.<br />

Financial assets and liabilities measured at fair value can be categorised using the fair value measurem<strong>en</strong>t hierarchy above. There have not be<strong>en</strong> any transfers<br />

betwe<strong>en</strong> the categories ’Active market data’ and ’Directly or indirectly observable market data’ during <strong>2012</strong> or 2011.<br />

NOVO NORDISK ANNUAL REPORT <strong>2012</strong>