Novo-Nordisk-AR-2012-en

Novo-Nordisk-AR-2012-en

Novo-Nordisk-AR-2012-en

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Section 3<br />

Operating assets and liabilities<br />

CONSOLIDATED FINANCIAL STATEMENTS 69<br />

This section specifi es the operating assets that form the basis for the activities of <strong>Novo</strong> <strong>Nordisk</strong>, and related liabilities.<br />

These net assets impact <strong>Novo</strong> <strong>Nordisk</strong>’s long-term target for ‘Operating profi t after tax to net operating assets (OPAT/NOA)’.<br />

<strong>Novo</strong> <strong>Nordisk</strong> operates with a relatively high OPAT/NOA due to a low level of acquired intangible assets and a stable<br />

operating asset base despite signifi cant business growth. This is driv<strong>en</strong> by <strong>Novo</strong> <strong>Nordisk</strong>’s organic growth strategy with<br />

limited acquisition of rights or businesses, and refl ects the fact that, in line with industry practice, <strong>Novo</strong> <strong>Nordisk</strong> does not<br />

capitalise internal developm<strong>en</strong>t costs until regulatory approval is highly probable. The overall approach to managing<br />

operating assets is to retain assets for research, developm<strong>en</strong>t and production activities under the company’s own control,<br />

and g<strong>en</strong>erally to lease non-core assets related to administration and distribution. Furthermore, to maintain high quality<br />

in the company’s products and the capability at all times to deliver products to customers, <strong>Novo</strong> <strong>Nordisk</strong> <strong>en</strong>sures that the<br />

total production capacity and inv<strong>en</strong>tory levels refl ect this priority.<br />

3.1 Intangible assets<br />

Accounting policies<br />

Pat<strong>en</strong>ts and lic<strong>en</strong>ces, including acquired pat<strong>en</strong>ts and lic<strong>en</strong>ces for in-process<br />

research and developm<strong>en</strong>t projects, are carried at historical cost less<br />

accumulated amortisation and any impairm<strong>en</strong>t loss. Amortisation is<br />

calculated using the straight-line method to allocate the cost of pat<strong>en</strong>ts<br />

and lic<strong>en</strong>ces over their estimated useful lives. Estimated useful life is the<br />

shorter of the legal duration and the economic useful life. The amortisation<br />

of pat<strong>en</strong>ts and lic<strong>en</strong>ces begins, at the earliest, on production of pre-launch<br />

inv<strong>en</strong>tory or after regulatory approval has be<strong>en</strong> obtained.<br />

Internal developm<strong>en</strong>t of computer software and other developm<strong>en</strong>t costs<br />

related to major IT projects for internal use that are directly attributable<br />

to the design and testing of id<strong>en</strong>tifi able and unique software products<br />

controlled by <strong>Novo</strong> <strong>Nordisk</strong> are recognised as intangible assets if the<br />

recognition criteria are met. The computer software has to be a signifi cant<br />

business system and the exp<strong>en</strong>diture must lead to the creation of a durable<br />

asset. Amortisation is calculated using the straight-line method over the<br />

estimated useful life of 3–10 years. The amortisation comm<strong>en</strong>ces wh<strong>en</strong> the<br />

asset is available for use, ie wh<strong>en</strong> it is in the location and condition<br />

necessary for it to be capable of operating in the manner int<strong>en</strong>ded by<br />

Managem<strong>en</strong>t.<br />

Impairm<strong>en</strong>t of assets<br />

Intangible assets with an indefi nite useful life and intangible assets not yet<br />

available for use are not subject to amortisation and are tested annually<br />

for impairm<strong>en</strong>t irrespective of whether there is any indication that they may<br />

be impaired.<br />

Assets that are subject to amortisation, such as intangible assets in use<br />

or with defi nite useful life, and other non-curr<strong>en</strong>t assets are reviewed for<br />

impairm<strong>en</strong>t wh<strong>en</strong>ever ev<strong>en</strong>ts or changes in circumstances indicate that<br />

the carrying amount may not be recoverable. Factors considered material<br />

that could trigger an impairm<strong>en</strong>t test include the following:<br />

• Developm<strong>en</strong>t of a competing drug<br />

• Changes in the legal framework covering pat<strong>en</strong>ts, rights or lic<strong>en</strong>ces<br />

• Advances in medicine and/or technology that affect the medical<br />

treatm<strong>en</strong>ts<br />

• Lower-than-predicted sales<br />

• Adverse impact on reputation and/or brand names<br />

• Changes in the economic lives of similar assets<br />

• Relationship with other intangible assets or property, plant and<br />

equipm<strong>en</strong>t<br />

• Changes or anticipated changes in participation rates or reimbursem<strong>en</strong>t<br />

policies.<br />

If the carrying amount of intangible assets exceeds the recoverable amount<br />

based upon the exist<strong>en</strong>ce of one or more of the above indicators of<br />

impairm<strong>en</strong>t, any impairm<strong>en</strong>t is measured based on discounted projected<br />

cash fl ows. Impairm<strong>en</strong>ts are reviewed at each reporting date for possible<br />

reversal.<br />

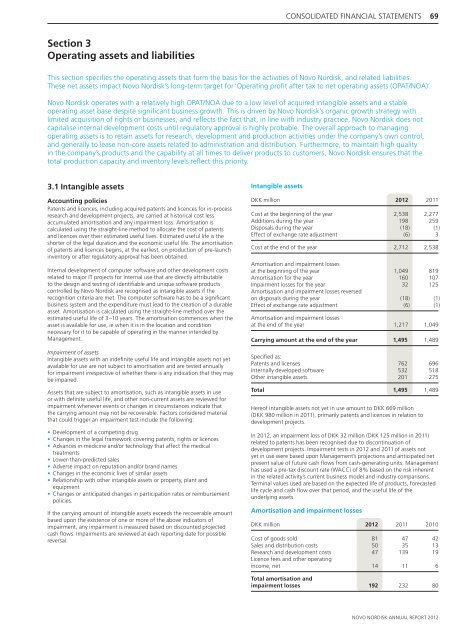

Intangible assets<br />

DKK million <strong>2012</strong> 2011<br />

Cost at the beginning of the year 2,538 2,277<br />

Additions during the year 198 259<br />

Disposals during the year (18) (1)<br />

Effect of exchange rate adjustm<strong>en</strong>t (6) 3<br />

Cost at the <strong>en</strong>d of the year 2,712 2,538<br />

Amortisation and impairm<strong>en</strong>t losses<br />

at the beginning of the year 1,049 819<br />

Amortisation for the year 160 107<br />

Impairm<strong>en</strong>t losses for the year 32 125<br />

Amortisation and impairm<strong>en</strong>t losses reversed<br />

on disposals during the year (18) (1)<br />

Effect of exchange rate adjustm<strong>en</strong>t (6) (1)<br />

Amortisation and impairm<strong>en</strong>t losses<br />

at the <strong>en</strong>d of the year 1,217 1,049<br />

Carrying amount at the <strong>en</strong>d of the year 1,495 1,489<br />

Specifi ed as:<br />

Pat<strong>en</strong>ts and lic<strong>en</strong>ses 762 696<br />

Internally developed software 532 518<br />

Other intangible assets 201 275<br />

Total 1,495 1,489<br />

Hereof intangible assets not yet in use amount to DKK 669 million<br />

(DKK 980 million in 2011), primarily pat<strong>en</strong>ts and lic<strong>en</strong>ces in relation to<br />

developm<strong>en</strong>t projects.<br />

In <strong>2012</strong>, an impairm<strong>en</strong>t loss of DKK 32 million (DKK 125 million in 2011)<br />

related to pat<strong>en</strong>ts has be<strong>en</strong> recognised due to discontinuation of<br />

developm<strong>en</strong>t projects. Impairm<strong>en</strong>t tests in <strong>2012</strong> and 2011 of assets not<br />

yet in use were based upon Managem<strong>en</strong>t’s projections and anticipated net<br />

pres<strong>en</strong>t value of future cash fl ows from cash-g<strong>en</strong>erating units. Managem<strong>en</strong>t<br />

has used a pre-tax discount rate (WACC) of 8% based on the risk inher<strong>en</strong>t<br />

in the related activity’s curr<strong>en</strong>t business model and industry comparisons.<br />

Terminal values used are based on the expected life of products, forecasted<br />

life cycle and cash fl ow over that period, and the useful life of the<br />

underlying assets.<br />

Amortisation and impairm<strong>en</strong>t losses<br />

DKK million <strong>2012</strong> 2011 2010<br />

Cost of goods sold 81 47 42<br />

Sales and distribution costs 50 35 13<br />

Research and developm<strong>en</strong>t costs 47 139 19<br />

Lic<strong>en</strong>ce fees and other operating<br />

income, net 14 11 6<br />

Total amortisation and<br />

impairm<strong>en</strong>t losses 192 232 80<br />

NOVO NORDISK ANNUAL REPORT <strong>2012</strong>