Greece in Figures 2008 - Icap

Greece in Figures 2008 - Icap

Greece in Figures 2008 - Icap

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

www.f<strong>in</strong>dbiz.gr Η Ελλάδα σε Αριθµούς 2010<br />

Total assets and turnover of manufactur<strong>in</strong>g recorded s<strong>in</strong>gle-digit growth rates, but profitability decreased sharply. In<br />

more detail, the total assets of the 5,167 firms <strong>in</strong> the <strong>in</strong>dustry <strong>in</strong>creased by 7.5% to €70.3 billion, while sales reached<br />

€60.5 billion, 9.9% higher than a year earlier. However, costs <strong>in</strong>creased faster and profits dropped sharply. Pre-tax <strong>in</strong>come<br />

decreased by a dramatic 46.1% to €1.6 billion. As a result, all f<strong>in</strong>ancial <strong>in</strong>dices worsened; ROE dropped from 11.0% <strong>in</strong><br />

2007 to 5.5% <strong>in</strong> <strong>2008</strong>. However, this decrease <strong>in</strong> profitability may prove to be mostly due to cyclical reasons and may not<br />

reflect structural weaknesses. To a large extend it was due to companies, which were <strong>in</strong> the black <strong>in</strong> 2007, but plunged<br />

<strong>in</strong>to the red <strong>in</strong> <strong>2008</strong>. At the same time, the losses of the companies which were <strong>in</strong> the red <strong>in</strong> both years did not <strong>in</strong>crease<br />

substantially. Therefore, an improvement <strong>in</strong> profitability is imm<strong>in</strong>ent when the economy recovers.<br />

The energy-water sector comprises 218 bus<strong>in</strong>esses, but the <strong>in</strong>dustry totals reflect the presence of the Public Power Corporation<br />

(PPC) and other large public-sector entities. Total sales grew impressively, from €8.5 billion to €14.8 billion. However,<br />

to a large extend this was due to the <strong>in</strong>creased turnover of HTSO, the public power grid manager. Gross profits<br />

dropped sharply, by almost 30% and the gross marg<strong>in</strong> fell from 16.0% to 6.4%. Pre-tax <strong>in</strong>come decreased dramatically<br />

from €382 million <strong>in</strong> 2007 to €74 million <strong>in</strong> <strong>2008</strong>, mostly because PPC moved <strong>in</strong>to the red.<br />

Despite the economy’s slowdown and a sharp drop <strong>in</strong> private construction activity, the f<strong>in</strong>ancial situation of the construction<br />

<strong>in</strong>dustry improved <strong>in</strong> <strong>2008</strong>. Turnover of the 2,292 companies <strong>in</strong> the sector <strong>in</strong>creased by an impressive 21.8% and<br />

reached €8.4 billion. Gross profits <strong>in</strong>creased at an almost equal rate, but the faster rise <strong>in</strong> adm<strong>in</strong>istration, market<strong>in</strong>g and<br />

f<strong>in</strong>ancial expenses, as well as worse non-operational <strong>in</strong>come, reduced pre-tax profits sharply, to €80 million <strong>in</strong> <strong>2008</strong> from<br />

€371 million a year earlier. This, however, was largely due to the worse performance of several large bus<strong>in</strong>esses, which<br />

suffered a decrease <strong>in</strong> profits or even plunged <strong>in</strong>to the red. It is <strong>in</strong>dicative that the group of the very large companies<br />

(250+ employees) suffered losses. Most f<strong>in</strong>ancial <strong>in</strong>dicators worsened especially liquidity and debt to equity.<br />

After years of solid growth, commerce stalled <strong>in</strong> <strong>2008</strong>. Turnover growth was slow, pre-tax profits decreased and total<br />

assets <strong>in</strong>creased only modestly. In more detail, total sales <strong>in</strong> the largest sector <strong>in</strong>creased by 5.1% to €80.9 billion. Gross<br />

profits <strong>in</strong>creased slightly less and the large rise <strong>in</strong> adm<strong>in</strong>istration, market<strong>in</strong>g and f<strong>in</strong>ancial costs cut net <strong>in</strong>come by 29.4%<br />

to €1.9 billion. Total assets <strong>in</strong>creased by 10.7% and reached €58.8 billion. Most f<strong>in</strong>ancial <strong>in</strong>dices worsened. A case <strong>in</strong> po<strong>in</strong>t<br />

is ROE, which fell to 13.5%, from 20.5%. It rema<strong>in</strong>ed, however, the highest among all <strong>in</strong>dustries.<br />

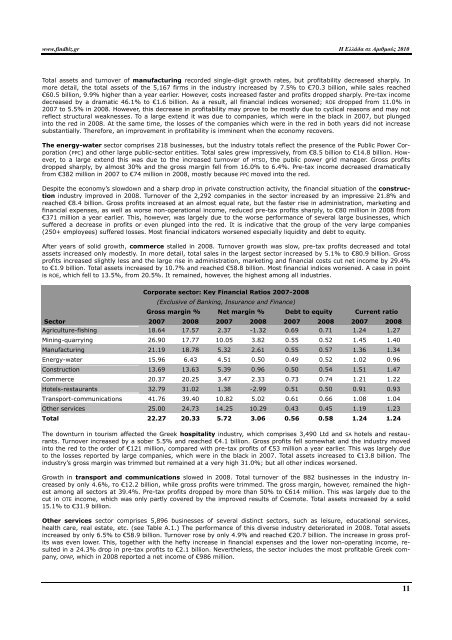

Corporate sector: Key F<strong>in</strong>ancial Ratios 2007-<strong>2008</strong><br />

(Exclusive of Bank<strong>in</strong>g, Insurance and F<strong>in</strong>ance)<br />

Gross marg<strong>in</strong> % Net marg<strong>in</strong> % Debt to equity Current ratio<br />

Sector 2007 <strong>2008</strong> 2007 <strong>2008</strong> 2007 <strong>2008</strong> 2007 <strong>2008</strong><br />

Agriculture-fish<strong>in</strong>g 18.64 17.57 2.37 -1.32 0.69 0.71 1.24 1.27<br />

M<strong>in</strong><strong>in</strong>g-quarry<strong>in</strong>g 26.90 17.77 10.05 3.82 0.55 0.52 1.45 1.40<br />

Manufactur<strong>in</strong>g 21.19 18.78 5.32 2.61 0.55 0.57 1.36 1.34<br />

Energy-water 15.96 6.43 4.51 0.50 0.49 0.52 1.02 0.96<br />

Construction 13.69 13.63 5.39 0.96 0.50 0.54 1.51 1.47<br />

Commerce 20.37 20.25 3.47 2.33 0.73 0.74 1.21 1.22<br />

Hotels-restaurants 32.79 31.02 1.38 -2.99 0.51 0.50 0.91 0.93<br />

Transport-communications 41.76 39.40 10.82 5.02 0.61 0.66 1.08 1.04<br />

Other services 25.00 24.73 14.25 10.29 0.43 0.45 1.19 1.23<br />

Total 22.27 20.33 5.72 3.06 0.56 0.58 1.24 1.24<br />

The downturn <strong>in</strong> tourism affected the Greek hospitality <strong>in</strong>dustry, which comprises 3,490 Ltd and SA hotels and restaurants.<br />

Turnover <strong>in</strong>creased by a sober 5.5% and reached €4.1 billion. Gross profits fell somewhat and the <strong>in</strong>dustry moved<br />

<strong>in</strong>to the red to the order of €121 million, compared with pre-tax profits of €53 million a year earlier. This was largely due<br />

to the losses reported by large companies, which were <strong>in</strong> the black <strong>in</strong> 2007. Total assets <strong>in</strong>creased to €13.8 billion. The<br />

<strong>in</strong>dustry’s gross marg<strong>in</strong> was trimmed but rema<strong>in</strong>ed at a very high 31.0%; but all other <strong>in</strong>dices worsened.<br />

Growth <strong>in</strong> transport and communications slowed <strong>in</strong> <strong>2008</strong>. Total turnover of the 882 bus<strong>in</strong>esses <strong>in</strong> the <strong>in</strong>dustry <strong>in</strong>creased<br />

by only 4.6%, το €12.2 billion, while gross profits were trimmed. The gross marg<strong>in</strong>, however, rema<strong>in</strong>ed the highest<br />

among all sectors at 39.4%. Pre-tax profits dropped by more than 50% to €614 million. This was largely due to the<br />

cut <strong>in</strong> OTE <strong>in</strong>come, which was only partly covered by the improved results of Cosmote. Total assets <strong>in</strong>creased by a solid<br />

15.1% to €31.9 billion.<br />

Other services sector comprises 5,896 bus<strong>in</strong>esses of several dist<strong>in</strong>ct sectors, such as leisure, educational services,<br />

health care, real estate, etc. (see Table A.1.) The performance of this diverse <strong>in</strong>dustry deteriorated <strong>in</strong> <strong>2008</strong>. Total assets<br />

<strong>in</strong>creased by only 6.5% to €58.9 billion. Turnover rose by only 4.9% and reached €20.7 billion. The <strong>in</strong>crease <strong>in</strong> gross profits<br />

was even lower. This, together with the hefty <strong>in</strong>crease <strong>in</strong> f<strong>in</strong>ancial expenses and the lower non-operat<strong>in</strong>g <strong>in</strong>come, resulted<br />

<strong>in</strong> a 24.3% drop <strong>in</strong> pre-tax profits to €2.1 billion. Nevertheless, the sector <strong>in</strong>cludes the most profitable Greek company,<br />

OPAP, which <strong>in</strong> <strong>2008</strong> reported a net <strong>in</strong>come of €986 million.<br />

11