Business Report 2005 - Interseroh

Business Report 2005 - Interseroh

Business Report 2005 - Interseroh

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>2005</strong> BUSINESS REPORT<br />

INTERSEROH AG – Stollwerckstraße 9a – 51149 Cologne – Tel.: +49(2203)9147-0 – Fax: +49(2203)9147-1394<br />

eMail: info@interseroh.de – internet: www.interseroh.de<br />

1

INTERSEROH is a leading European supplier of organisational solutions for materials<br />

management.<br />

With the help of around 1,100 waste disposal partners, INTERSEROH collects raw materials,<br />

has them recycled and then returns them to the production cycle.<br />

INTERSEROH generated a raw material volume of about 5.2 million tons in <strong>2005</strong>, making it one<br />

of the biggest suppliers of secondary raw materials in Europe.<br />

2

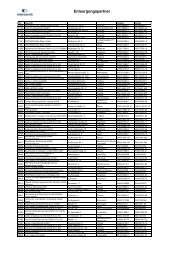

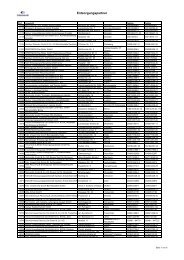

KEY GROUP FIGURES<br />

Group<br />

<strong>2005</strong> * 2004 2003 2002 2001<br />

Consolidated turnover in million euros<br />

• Services and raw materials 248.7 229.7 226.2 235.6 211.1<br />

• Steel and metal recycling 698.2 810.5 510.5 418.6 158.4<br />

946.9 1,040.2 736.7 654.2 369.5<br />

Earnings before taxes in million euros 29.9 44.7 19.0 20.4 24.6<br />

Net income in million euros 19.0 29.6 8.9 11.4 14.1<br />

Total assets in million euros 317.7 311.5 253.9 249.7 258.3<br />

Equity ratio (1) in % 37.3 34.4 31.0 31.3 29.0<br />

Return on equity (2) in % 16.0 27.6 11.3 14.4 18.7<br />

Total return on capital (3) in % 10.7 16.0 8.7 9.7 10.6<br />

Workforce (average) 1,301 1,254 1,285 1,360 893<br />

Number of shares 9,840,000 9,840,000 9,840,000 9,840,000 9,840,000<br />

Dividend per share in euros 0.86 0.86 0.86 0.86 0.86<br />

(1) Equity according to balance sheet x 100/total assets<br />

(2) Earnings after tax according to income statement x 100/equity according to balance sheet<br />

(3) Earnings before interest and taxes according to income statement x 100/total assets<br />

* 2001–2003 Financial statements according to HGB; 2004–<strong>2005</strong> Financial statements according to IFRS<br />

3

THE MANAGEMENT BOARD<br />

Johannes-Jürgen Albus<br />

has been Chairman of the Management Board since April 2006 and Chief Financial Officer since April<br />

2003. Following various management positions in Germany and abroad, the graduate in business<br />

administration was appointed to the management board of GAH Anlagentechnik AG in 1997, initially<br />

as chief financial officer and later as chairman from mid-2000 on.<br />

Christian Rubach<br />

is responsible for the field of steel and metal recycling and has been a member of the Management<br />

Board since August 2000. From 1995 to July 2000 the qualified economist was managing director of<br />

Krupp Hoesch-Rohstoff und Recycling GmbH (from 1998: Hansa Recycling GmbH).<br />

Roland Stroese<br />

has been responsible for sales and services since October <strong>2005</strong>. Prior to joining INTERSEROH the<br />

graduate business economist worked for REWE Großverbraucher Service in Cologne and was<br />

managing director of various associated companies at Coca Cola, Essen, before moving to the<br />

Cologne-based confectionery manufacturers Intersnack as sales director and member of the board of<br />

directors.<br />

4

CONTENTS<br />

Key Figures 3<br />

The Management Board 4<br />

Letter from the Management Board 6<br />

<strong>Report</strong> of the Supervisory Board 8<br />

Management <strong>Report</strong> A. Framework Conditions 10<br />

1. General Economic Development 10<br />

2. New Laws from Brussels and Berlin 10<br />

B. <strong>Business</strong> Development 12<br />

1. Consolidated Turnover 12<br />

2. Services 13<br />

3. Raw Materials Trading 15<br />

4. Steel and Metal Recycling 16<br />

5. Investments 17<br />

6. Financing Measures 18<br />

7. Human Resources and Social Security 18<br />

8. Environmental Protection 19<br />

9. Marketing and Advertising 19<br />

10. Public Relations 20<br />

11. Investor Relations 20<br />

12. Dividend Yield 21<br />

13. Corporate Governance 21<br />

14. Major Transactions in the Financial Year 22<br />

15. Total Return on Capital Employed as<br />

Management Instrument 23<br />

C. Presentation and Explanation of the Earnings and Financial<br />

Position and Key Consolidated Ratios 24<br />

1. Earnings Position 24<br />

2. Financial Position 25<br />

3. Key Consolidated Ratios 27<br />

D. Other Information 28<br />

1. Transaction of Special Importance After the Close<br />

of the Financial Year 28<br />

2. Risk Management 28<br />

3. Foreseeable Development, Possible Chances and<br />

Potential Risks 30<br />

4. Research and Development 31<br />

5. Branch Offices 32<br />

Financial Statements Consolidated Balance Sheet 33<br />

Consolidated Income Statement 34<br />

Consolidated Notes 35<br />

Explanation of the Principles and Methods Applied<br />

for the Consolidated Financial Statements 35<br />

Notes on the Income Statement 41<br />

Notes on the Balance Sheet 45<br />

Other Notes and Information 58<br />

Separate Notes and Information According to § 315 a<br />

of the German Commercial Code 72<br />

Consolidated Equity Capital Statement 75<br />

Consolidated Cash Flow Statement 77<br />

List of Major Shareholdings 78<br />

Imprint 79<br />

5

LETTER FROM THE MANAGEMENT BOARD<br />

Dear Shareholders,<br />

Your company, INTERSEROH AG, was founded 15 years ago. The German Packaging Ordinance<br />

also came into effect 15 years ago. Both these dates in 1991 are inextricably linked with each other: in<br />

order to organise the return and recycling of used packaging, new business concepts capable of<br />

mastering this challenge across the whole of Germany had to be found. Concepts like that of<br />

INTERSEROH.<br />

The solution involved nothing less than organising a complex logistical structure beginning<br />

with the collection of secondary raw materials – tin, paper, cardboard, pasteboard, plastic, glass and<br />

wood – and ending in their return to the production cycle.<br />

The much-regulated markets in which INTERSEROH moves have changed immensely since<br />

1991. New markets have been added, partly due to growing demand and new production methods<br />

and partly due to liberalisation. The international demand for raw materials and the ability to serve this<br />

demand are moving more and more to the fore of these markets.<br />

Herein lie, on the one hand, numerous opportunities for ongoing positive development in<br />

INTERSEROH’s fields of business – while on the other, we must remain vigilant of the permanent risk<br />

of volatile raw material prices and their growing influence on the services sector at all times.<br />

On top of this, the various market levels of the INTERSEROH supply chain are increasingly<br />

becoming characterised by internationalisation of the closed loop economy and concentration – be it in<br />

the waste disposal sector or the structure of the clientele of our raw materials.<br />

INTERSEROH has also changed in the last 15 years. Apart from many new services, the steel<br />

and metal recycling segment has developed into an essential component of the INTERSEROH Group,<br />

contributing a substantial share to the group’s overall results.<br />

How, against this background, did the economic environment and our segments develop in<br />

<strong>2005</strong>? Although the German economy was again marked by restrained development last year, the<br />

services sector did grow satisfactorily. Whereas the volumes of raw materials registered with<br />

INTERSEROH for recycling grew, the services sector experienced considerable losses in the recycling<br />

of transport packaging and declines in the overall volume of secondary raw materials marketed.<br />

Following an exceptional year in 2004 due to volatility and record prices, the scrap steel sector<br />

was marked more by weak demand and lower prices in <strong>2005</strong>.<br />

In spite of the relatively difficult environment for both segments, we are satisfied with the result<br />

of the overall group in fiscal <strong>2005</strong>.<br />

The coming years will see stronger competition in some of our main fields of business and<br />

therefore also a further decline in our profit margins. At the same time, however, we intend to use the<br />

chances open to us to enter liberalised markets, to grow there and also to develop new fields of<br />

business at home and abroad.<br />

Regardless of whether we are talking about the recycling of packaging, reuse of old products<br />

or trade with secondary raw materials – we can only create value if through excellent organisation and<br />

careful quality management we produce high-quality raw materials and market them worldwide.<br />

Because in contrast to mineral resources, these modern sources of raw materials require less<br />

technology and more organisation and coordination of services to tap.<br />

With its activities, INTERSEROH closes economic material cycles for the lasting benefit of<br />

trade and industry, business, waste disposal companies, consumers, and thus also the environment –<br />

directly from end to start.<br />

That these raw materials can find a new beginning not only in the production of classical<br />

economic goods, but also in art is shown by various works by the Cologne-based artist Joachim<br />

Röderer that illustrate this annual report. All these sculptures have been made from recycled metals.<br />

Why not take some time off while reading this report to view the closed loop economy from another<br />

angle?<br />

The success of INTERSEROH can be attributed to the competence, commitment and<br />

determination of all its employees. For that I would like to thank them all in the name of the<br />

INTERSEROH Management Board. They will continue to be the motor for the dynamic development<br />

of the company in the future as well.<br />

We thank you, our shareholders, for your loyalty and interest, and our customers and business<br />

partners for their confidence in us. You may rest assured we will face the challenges before us with<br />

6

undiminished resolve and work with all our might to implement our ambitious aims for the ongoing<br />

success of INTERSEROH.<br />

Yours sincerely,<br />

Johannes-Jürgen Albus<br />

Chairman of the Management Board<br />

7

REPORT OF THE SUPERVISORY BOARD<br />

In the year under review the Supervisory Board discharged all the duties incumbent upon it according<br />

to law and the company’s bylaws, advised the Management Board on the management of the<br />

company and supervised its conduct of business. The Supervisory Board was directly involved in all<br />

important decisions.<br />

The Management Board informed the Supervisory Board in detail, due time, comprehensively<br />

and in full accordance with legal requirements about the course of business, the financial position of<br />

the company and the strategy and plans of the company in a total of four ordinary and one<br />

extraordinary meeting. The deliberations of the Supervisory Board were based on regular,<br />

comprehensive and timely written and oral reports by the Management Board, especially regarding<br />

business policy, corporate planning, the financial position of the group including the strategic further<br />

development of the group and its sites as well as the profitability of the company and the course of<br />

business. The Chairman of the Supervisory Board maintained constant contact with the Management<br />

Board and was informed of all significant developments and pending decisions. Decisions of<br />

fundamental importance were submitted to the Supervisory Board for approval. This approval was<br />

also granted after review and assessment of the particular matter in hand. The Supervisory Board<br />

supervised the conduct of business by the Management Board and advised it in same in keeping with<br />

the duties placed upon it by law and the company’s bylaws on the basis of the Management Board’s<br />

reports. In its supervision of the conduct of business the Supervisory Board examined especially its<br />

legality, compliance with regulations, expedience and profitability. The Supervisory Board not only<br />

reviewed the activities already initiated by the Management Board, but also discussed business<br />

decisions and planning calculations for the future intensively with the Management Board on the basis<br />

of its reports and the concrete business documents of each particular case.<br />

All the members of the Supervisory Board regularly attended the meetings of the Supervisory<br />

Board that took place in the time of their membership.<br />

Main Aspects<br />

The meetings focused primarily on the strategic alignment of the INTERSEROH Group. The<br />

Supervisory Board concerned itself with the new fields of business, particularly the Dual System<br />

INTERSEROH, as well as with the voluntary offer extended to the shareholders of INTERSEROH AG<br />

by the firm Isabell Finance Vermögensverwaltungs GmbH. A major subject of discussion was the<br />

development of a joint position with the Management Board, and especially in the financial year under<br />

review its preparation by selecting a financial consultant to compile a fairness opinion, and the<br />

question of its fundamental attitude to the offer, also with regards to the strategic development of the<br />

company. Another recurring item on the agenda of every ordinary meeting of the Supervisory Board<br />

was the report by the Chief Financial Officer, who reported on the development in turnover and<br />

income in the group and segments, on current developments on the raw material markets and on<br />

other relevant business data. The Supervisory Board also conducted a self-evaluation of its work.<br />

Committees<br />

In keeping with the recommendations of the German Corporate Governance Code on the formation of<br />

committees, the Supervisory Board set up a Chairman’s Committee, an Audit Committee and a<br />

Personnel Committee. The Chairman’s Committee has a total of four members and met 10 times. It<br />

was mainly occupied with the offer extended by Isabell Finance Vermögensverwaltungs GmbH and<br />

preparation of the Supervisory Board’s position towards this offer. The committee member Dr. Axel<br />

Schweitzer did not take part in the meetings of the Chairman's Committee concerning this offer in<br />

order to avert any conflict of interests.<br />

The Audit Committee is made up of three members of the Supervisory Board. The committee<br />

met three times in the year under review. Its activities were directed at questions concerning the<br />

annual financial statements, stipulation of the main points of focus for the audit, further development of<br />

risk management, investor protection and insider regulations.<br />

The Personnel Committee consists of the Chairman of the Supervisory Board, his two<br />

deputies and a further member of the Supervisory Board. Its work focuses on remuneration and other<br />

personnel matters concerning the Management Board.<br />

The committees report on their work regularly in the next meetings of the full Supervisory<br />

Board.<br />

8

Corporate Governance<br />

The Supervisory Board regards the German Corporate Governance Code drafted by a government<br />

commission as an important step towards improving management practice and corporate control. The<br />

Supervisory Board pronounced INTERSEROH AG’s compliance for the year <strong>2005</strong> together with the<br />

Management Board on 8 December <strong>2005</strong>. This declaration is published on the company’s website.<br />

Further information on the subject of corporate governance is to be found in section B.13 of the<br />

management report.<br />

In keeping with the principles of good corporate governance and to avoid conflicts of interest,<br />

the Supervisory Board members Dr. Axel Schweitzer, Dr. Eric Schweitzer, Mr. Friedrich Merz and Dr.<br />

Wolfgang Bosch did not participate in meetings and resolutions concerning the offer extended to all<br />

the shareholders of INTERSEROH AG by Isabell Finance Vermögensverwaltungs GmbH. Dr. Axel<br />

Schweitzer and Dr. Eric Schweitzer have an indirect interest in Isabell Finance Vermögensverwaltungs<br />

GmbH. Mr. Friedrich Merz and Dr. Wolfgang Bosch are lawyers and partners in law firms that have<br />

advised Isabell Finance Vermögensverwaltungs GmbH. Further information on how the conflict of<br />

interests was dealt with in the Supervisory Board in connection with the acquisition offer by Isabell<br />

Finance Vermögensverwaltungs GmbH can be found in the joint statement by the Management Board<br />

and Supervisory Board pursuant to Article 27, Par. 1 of the Securities Acquisition Act on this<br />

acquisition offer dated 17 January 2006. The statement is published at www.interseroh.de in the<br />

category Investor Relations, Acquisition Offer.<br />

Financial Statements<br />

The <strong>2005</strong> general shareholders’ meeting elected to appoint the company KPMG Deutsche Treuhand-<br />

Gesellschaft Aktiengesellschaft Wirtschaftsprüfungsgesellschaft, Berlin and Frankfurt am Main, as<br />

auditors. KPMG audited the accounting, the annual financial statements and the management report<br />

of INTERSEROH AG as well as the consolidated financial statements and consolidated management<br />

report. The auditor issued an unqualified auditor's opinion for all.<br />

The closing records and reports of KPMG were presented to the Supervisory Board for<br />

inspection in due time. The auditor took part in both the relevant meeting of the Audit Committee and<br />

the balance sheet meeting of the Supervisory Board. He reported on the main results of his audit,<br />

explained the situation with regards to the assets, financial position and earnings of the company and<br />

group and answered the questions of the Supervisory Board.<br />

Based on its own examination of the annual financial statements, the consolidated financial<br />

statements, the management report and the consolidated management report, the Supervisory Board<br />

endorsed the results of the audit by the external auditor. They gave no cause for objection. The<br />

Supervisory Board endorsed the annual financial statements and consolidated financial statements, by<br />

way of which the annual financial statements of INTERSEROH AG were adopted.<br />

The Supervisory Board approves the distribution of retained earnings proposed by the<br />

Management Board.<br />

Changes<br />

There were personnel changes to the Management Board of the company in the period under review.<br />

Mr. Michael Mevissen left the Management Board of INTERSEROH AG on 30 June <strong>2005</strong> and Mr.<br />

Roland Stroese was appointed to the Management Board of INTERSEROH AG with effect on 8<br />

October <strong>2005</strong>.<br />

There were also changes to the Supervisory Board. Mr. Norbert Rethmann, Dr. Walter Aden,<br />

Mr. Gotthard Graß, Mr. Christian Jeschonek, Mr. Andreas Seibert and Mr. Jürgen Tönsmeier all left<br />

the Supervisory Board in the course of <strong>2005</strong>.<br />

New members of the Supervisory Board are Dr. Wolfgang Bosch and Messrs. Joachim<br />

Edmund Hunold and Friedrich Merz. Dr. Axel Schweitzer was elected new chairman in the<br />

Supervisory Board meeting on 31 March <strong>2005</strong>. Messrs. Friedrich Carl Janssen and Hans-Jörg Vetter<br />

were elected his deputies. Dr. Eric Schweitzer resigned as Vice Chairman of the Supervisory Board.<br />

The Supervisory Board would like to thank the members who have left for their valuable work<br />

and constructive support of the company and Management Board. The Supervisory Board would also<br />

like to thank the Management Board and all staff for their work in the year under review.<br />

Cologne, March 2006<br />

Dr. Axel Schweitzer<br />

Chairman of the Supervisory Board<br />

9

MANAGEMENT REPORT<br />

OF THE INTERSEROH GROUP FOR FISCAL <strong>2005</strong><br />

The INTERSEROH Group is one of the leading service providers and raw material companies in<br />

Europe. It organises recycling processes and supplies the paper, steel, plastics and derived timber<br />

product industries as well as biomass power stations with more than five million tons of secondary raw<br />

materials a year. The business activities of the group are divided into two segments – services and<br />

raw materials trading as well as steel and metal recycling.<br />

A. FRAMEWORK CONDITIONS<br />

1. General Economic Development:<br />

Export World Champion with Weak Consumption<br />

The upswing in the Germany economy in <strong>2005</strong> was moderate and borne as in the previous year by<br />

rising exports. Investment in equipment and machinery also grew.<br />

Following a strong start to the year under review, the economy stagnated in the second<br />

quarter, before regaining some speed in the third and fourth quarters. Although the high oil price<br />

slowed the economy less strongly than many feared, it did dampen private consumption. The ongoing<br />

reticence of private households even led to a slight drop in spending in the first half of the year. In<br />

contrast, the monetary assets of Germans rose to a record high of four trillion euros. The rise in the<br />

propensity to save is a result of the fear of not having sufficient income in old age and of becoming<br />

unemployed.<br />

The situation on the German labour market did not improve last year. The decline in registered<br />

unemployment was mainly the result of “one-euro jobs” and more critical examination of the<br />

entitlement of recipients to unemployment benefits.<br />

Experts expect the moderate economic upturn to continue this financial year, again driven<br />

primarily by exports. The development in many growth markets such as Russia and trade with the<br />

candidate states of Eastern Europe remain positive for the German export economy. Growth in<br />

investments in equipment and machinery will boost domestic demand slightly. The reasons for this are<br />

the positive sales expectations on the export markets and a continuation in favourable financing<br />

conditions. Private consumption is also expected to stimulate growth. The reason: spending brought<br />

forward to 2006 due to the planned increase in value added tax of three percentage points in 2007.<br />

Economists fear that even relatively small disruptions from outside could throw the German economy<br />

back to a state close to stagnation. If energy prices were to rise strongly, this would represent a<br />

danger for the world economy.<br />

In spite of slack consumption and increased competition, the development in INTERSEROH’s<br />

services business was satisfactory. The volumes of packaging registered with ISD INTERSEROH<br />

Dienstleistungs GmbH grew as a result of an expansion in sales activities and introduction of new<br />

services. However, we had to accept significant losses in net income in the extension of contracts<br />

from 2006 in transport packaging recycling. The development in INTERSEROH’s services business in<br />

<strong>2005</strong> is described in section B.2.<br />

We were able to keep the quantities of paper marketed by INTERSEROH at the previous<br />

year’s level at largely stable prices. The volumes of plastic traded were increased significantly with<br />

price increases of around 20 percent. The quantities of old wood marketed rose slightly over 2004.<br />

The Technical Instructions for Domestic Waste (TASi), which came into effect on 1 June <strong>2005</strong>,<br />

influenced the prices for materials suitable solely for thermal utilisation. Further details on the situation<br />

on the raw material markets are to be found in section B.3.<br />

The quantities of scrap steel marketed fell well below the previous year’s level. Many<br />

European steelworks reduced their production in the first half of <strong>2005</strong> to help prop up steel prices. The<br />

demand for steel was weak and stocks still well-filled. The prices for scrap steel dropped continuously<br />

from November 2004 to June <strong>2005</strong>, but then rose in July and August. Thereafter the prices fell again<br />

slightly until the end of <strong>2005</strong>. The prices for non-ferrous metals dropped slightly to the middle of the<br />

year, but then rose again from July. INTERSEROH was able to increase the quantity of old metals it<br />

marketed. The development in the steel and metal recycling segment is described in section B.4.<br />

2. New Laws from Brussels and Berlin<br />

INTERSEROH is subject to numerous legal requirements from Brussels and Berlin in the execution of<br />

its business activities. There were several important new developments and changes in the past<br />

10

financial year and years before whose influences INTERSEROH integrated into its business strategy<br />

early on.<br />

Packaging Ordinance<br />

Pursuant to the Packaging Ordinance, a deposit has been charged on certain disposable drink<br />

packages since 1 January 2003. According to the amendment to this ordinance that came into effect<br />

on 28 May <strong>2005</strong>, the so-called stand-alone solutions set up by the large discount stores must be<br />

eliminated by May 2006. Practically this means that whoever sells, for example, disposable PET<br />

packaging must also take back disposable PET packaging regardless of whether it was bought at his<br />

store or not. INTERSEROH has set up a countrywide collection system and offers its customers,<br />

depending on their needs, a full range of necessary service modules, beginning with transportation<br />

and extending through counting, clearing and inter-clearing up to recycling.<br />

The amendment also clarified the future of compostable packaging: it is largely exempt from<br />

the normal take-back and recycling obligations until 31 December 2012.<br />

The fourth amendment to the Packaging Ordinance came into force on 7 January 2006. It<br />

makes the disposal of sales packaging through self-disposal systems more transparent. The obligation<br />

imposed on manufacturers and distributors to “set up suitable collection and recycling structures” is an<br />

important step to ending virtual systems, which INTERSEROH categorically rejects. INTERSEROH<br />

has used corresponding collection points since the start of its self-disposal solutions. It also calls for a<br />

definition and monitoring of guaranteed quality in self-disposal systems by way of a quality seal and<br />

strict action against abuse of the systems by copycats.<br />

The essential legal basis for the establishment of alternative dual systems in Germany was<br />

created in 2001: the EU Commission ruled that collection containers and other collection and sorting<br />

equipment for household sales packaging must be open to competitors of Duales System Deutschland<br />

AG (DSD). DSD was also prohibited from exclusivity agreements with disposal companies.<br />

Section B.2 describes the activities of INTERSEROH regarding disposable deposit drink<br />

packs, the return of sales packaging and compostable packaging.<br />

Electrical and Electronic Equipment Act<br />

Manufacturers have been obligated to take back old electrical and electronic equipment as of 24<br />

March 2006. The manufacturers and importers of electrical and electronic equipment had to register<br />

with the Stiftung Elektro-Altgeräte-Register (EAR) by 23 November <strong>2005</strong> if they wanted to sell their<br />

equipment on the market in the future. Consumers are now obligated to hand over their old equipment<br />

to their municipalities for separate collection. The manufacturers and importers are responsible for the<br />

logistics, sorting, dismantling and recycling of the old equipment. They can assign these<br />

responsibilities to a third party – such as INTERSEROH.<br />

INTERSEROH’s activities in this field are described in section B.2.<br />

Technical Instructions for Domestic Waste (TASi)<br />

The TASi, which came into force on 1 June <strong>2005</strong>, and the resultant ban on dumping untreated,<br />

biodegradable domestic waste have firstly raised the requirements for the processing of the shredder<br />

light fraction at INTERSEROH’s scrap yards. Secondly, the volume of old wood designated for thermal<br />

utilisation has increased in some regions of Germany.<br />

The development in INTERSEROH’s business activities in the old wood market in <strong>2005</strong> is<br />

described in section B.3. INTERSEROH’s activities in the steel and metal recycling segment are<br />

described in section B.4.<br />

Old Auto Act<br />

The Old Auto Act, which took effect on 1 July 2002, gives the last owners of cars and light commercial<br />

vehicles the right to give back these vehicles to the manufacturer or importer free of charge. However,<br />

the related obligation to take back these vehicles is practically meaningless since a large part of the<br />

vehicles deregistered in Germany are exported. There are two main factors for this development: the<br />

large demand in the new EU member states of Eastern Europe for very old used vehicles on the one<br />

hand, and the for Germany negative distortion of competition due to unharmonised dumping<br />

legislation in Europe on the other. For example, it is attractive for a Dutch steel recycling company to<br />

buy up old car bodies in Germany because it is still possible for him to dump the shredder light fraction<br />

inexpensively in the Netherlands, whereas the German TASi (see above) prohibits this.<br />

11

B. BUSINESS DEVELOPMENT<br />

1. Satisfied with Turnover and Earnings<br />

In spite of a sluggish economy and declining demand for scrap steel, INTERSEROH posted<br />

satisfactory figures in fiscal <strong>2005</strong>. The consolidated group turnover amounted to EUR 946.91 million<br />

(previous year: EUR 1,040.15 million). The EBT amounted to EUR 29.85 million (previous year: EUR<br />

44.73 million) and the EBIT to EUR 32.73 million (previous year: EUR 49.06 million).<br />

The steel and metal recycling segment once again contributed the largest share to<br />

consolidated turnover, accounting for EUR 698.16 million (previous year: EUR 810.49 million). Its<br />

share of consolidated turnover: 73.73 percent. The EBT amounted to EUR 11.88 million (previous<br />

year: EUR 25.00 million) and the EBIT to EUR 16.01 million (previous year: EUR 29.93 million).<br />

The consolidated turnover in the services and raw materials trading segment rose from EUR<br />

229.66 million to EUR 248.75 million, accounting for a share of turnover of 26.27 percent. The EBT<br />

amounted to EUR 20.92 million (previous year: EUR 27.81 million) and the EBIT to EUR 19.93 million<br />

(previous year: EUR 27.37 million).<br />

The net income of the group for the year amounted to EUR 18.97 million (previous year: EUR<br />

29.6 million).<br />

The consolidated financial statements were prepared in the year under review according to the<br />

International Financial <strong>Report</strong>ing Standards (IFRS) for the first time. The comparative figures for the<br />

previous year were also calculated according to IFRS.<br />

Development in turnover in<br />

the INTERSEROH Group in million euros<br />

Turnover Change relative to<br />

previous year<br />

2000 394.7 39.2%<br />

2001 369.5 -6.4%<br />

2002 654.2 77.0%<br />

2003 736.7 12.6%<br />

2004 1,040.2 41.2%<br />

<strong>2005</strong> 946.9 -9.0%<br />

Development in turnover<br />

in services and raw materials trading in million euros<br />

Turnover Change relative to<br />

previous year<br />

2000 269.2 44.2%<br />

2001 211.1 -21.6%<br />

2002 235.6 11.6%<br />

2003 226.2 -4.0%<br />

2004 229.7 1.5%<br />

<strong>2005</strong> 248.7 8.3%<br />

Development in turnover<br />

in steel and metal recycling in million euros<br />

Turnover Change relative to<br />

previous year<br />

2000 125.5 29.5%<br />

2001 158.4 26.2%<br />

2002 418.6 164.3%<br />

2003 510.5 22.0%<br />

2004 810.5 58.8%<br />

<strong>2005</strong> 698.2 -13.9%<br />

12

2. <strong>Business</strong> in Services Expanded; Packaging Volume Up<br />

INTERSEROH’s service business developed satisfactorily overall.<br />

Transport Packaging<br />

INTERSEROH organises and coordinates the recycling of transport packaging for its industrial<br />

contracting partners, including collection, transport, sorting and recycling. The volume of transport<br />

packaging registered for recycling was increased. The reasons for this are the acquisition of new<br />

customers in the traditional sectors and services that have been especially developed and<br />

successfully marketed in the last few years for new customer groups, such as the sport and fitness<br />

industry, the pet industry, the toy industry as well as the manufacturers of products for babies and<br />

children. The turnovers were maintained at a steady level in spite of increased competition and<br />

ongoing economic problems in some industries for which INTERSEROH has performed these<br />

services for years. However, we had to accept significant losses in net income in the extension of<br />

contracts from 2006 due to the strong competition in the services sector.<br />

Commercial Sales Packaging<br />

The INTERSEROH self-disposal solution can be used wherever empty sales packaging accrues in the<br />

commercial sector. It is a cost-effective and legally safe solution for the collection and recycling of<br />

sales packaging subject to quotas. All members of the INTERSEROH self-disposal community receive<br />

all legally required documentation verifying their packaging has been recycled in conformity with<br />

regulations. The mass flow verification documentation required in this regard is certified by an<br />

independent, publicly appointed expert in accordance with the criteria of the State Working Group for<br />

Waste Management (LAGA) and deposited with the German Chamber of Commerce and Industry<br />

(DIHK). The INTERSEROH self-disposal community is based on a system in which packaging material<br />

is collected from corresponding (branch-specific) collection points. These materials are sorted and<br />

recycled in certified plants in accordance with official specifications. The INTERSEROH self-disposal<br />

system for the collection and recycling of commercial sales packaging again enjoyed increasing<br />

popularity in the year under review, both in traditional industries and among new customer groups –<br />

for example from the food industry – for which INTERSEROH has developed and successfully<br />

marketed customised solutions in the last few years.<br />

Household Sales Packaging<br />

Rulings allowing the Dual System INTERSEROH for the collection of household sales packaging were<br />

passed in the year under review by the relevant environment ministries in Saarland, Berlin, North<br />

Rhine-Westphalia, Lower Saxony, Bremen, Schleswig-Holstein and Saxony-Anhalt. Together with the<br />

permits already granted in Hamburg and Bavaria in 2004, the Dual System INTERSEROH reached 61<br />

percent of the German population as of 31 December <strong>2005</strong>. All applications still outstanding were<br />

submitted by the end of <strong>2005</strong>. The new INTERSEROH service has met with a great deal of interest<br />

from the distributors of sales packaging. The first contracts were still signed in <strong>2005</strong>. Strong<br />

competition is exerting pressure on profit margins especially in this sector.<br />

Recycling Management<br />

The field of recycling management underwent stable development with moderate growth. In this field<br />

we conclude full-service contracts for nationwide or regional services with commercial and food<br />

companies, petroleum companies, leisure parks, hospitals and railway stations. INTERSEROH<br />

organises the recycling of all their waste and prepares the data on volumes and costs on a sitespecific<br />

basis. Within the framework of this service INTERSEROH has assumed logistical and<br />

recycling services for the stand-alone solutions in the retail sector since introduction of the mandatory<br />

deposit system, for example the collection of disposable PET packaging and the associated<br />

documentation.<br />

Deposits on Disposable Drink Packaging<br />

INTERSEROH has taken over the Westpfand deposit system, i.e. Westpfand Clearing GmbH and<br />

Deutsche Pfand-Konzept GmbH, completely. Following complete acquisition, the deposit system now<br />

operates as “INTERSEROH Pfand-System GmbH” and is a subsidiary of ISD INTERSEROH<br />

Dienstleistungs GmbH. As a provider of a full range of services, INTERSEROH wants to offer all the<br />

13

modules needed to cover the services necessary following the abolition of the so-called stand-alone<br />

solutions as from May 2006.<br />

Old Electrical and Electronic Equipment<br />

Based on its experience in organising the collection and recycling of waste products for companies<br />

from various industries, INTERSEROH has developed services for the collection and recycling of old<br />

electrical and electronic equipment and regularly invited manufacturers to information events through<br />

to February <strong>2005</strong>. The participants had the opportunity to discuss topics with renowned speakers from<br />

politics, industry and trade. INTERSEROH also presented its comprehensive package of solutions for<br />

the take-back and disposal of old equipment, which may be used as needed by the customers:<br />

documentation, logistics, processing and marketing. With its individualised advice, INTERSEROH has<br />

demonstrated its competence in all questions concerning the recycling of old electrical and electronic<br />

equipment and has convinced a number of manufacturers of such equipment to register their<br />

equipment with INTERSEROH. The “INTERSEROH Guarantee Model for Old Electrical and Electronic<br />

Equipment” is the first independent guarantee model for the take-back and recycling of old electrical<br />

and electronic equipment to be approved by the Stiftung Elektro-Altgeräte-Register (EAR). The system<br />

offers manufacturers and importers from all branches of the electrical and electronics industry an<br />

uncomplicated solution whereby to fulfil their legal obligations and ensure the take-back and disposal<br />

of their equipment far into the future as well. INTERSEROH assumes the statutorily required<br />

trusteeship, thus providing guarantee and full-service in disposal and recycling by one and the same<br />

company.<br />

With its proven recycling of transport packaging, self-disposal system, Dual System<br />

INTERSEROH and services for product recycling, INTERSEROH offers a complete portfolio of<br />

services for manufacturers, importers and traders subject to legal waste disposal obligations.<br />

Niche <strong>Business</strong>es and Low-Volume Logistics<br />

The Repasack System for the return and recycling of used kraft paper bags registered declines in<br />

licensed volumes compared to the previous year due to the sluggish domestic economy. The licensed<br />

volumes of ISD INTERSEROH Dienstleistungs GmbH for kraft paper bags also fell.<br />

The school and kindergarten project “Meike – der Sammeldrache” of the ISD branch office<br />

“Grüne Umwelt-Box” continued its success in <strong>2005</strong> as well. The number of participating schools<br />

amounts to more than 11,300 (previous year: 10,000) and kindergartens to more than 2,800 (previous<br />

year: 3,000). The number of sponsoring partners rose to above 5,000 (previous year: 3,300).<br />

The amendment to the Packaging Ordinance of 28 May <strong>2005</strong> removed the obstacles to the<br />

introduction of compostable packaging on to the market in Germany. Until 31 December 2012 the<br />

manufacturers and distributors of this innovative form of packaging merely need to show that “as much<br />

of the packaging as possible is passed on for utilisation”. Experts now expect strong growth in this<br />

form of packaging in Germany as well. Growth of 30 to 50 percent has been recorded in neighbouring<br />

European countries in the past two years. The manufacturers and users of compostable packaging<br />

established an advisory board at INTERSEROH at the end of August to help in the further<br />

development and implementation of a utilisation system. Several large German supermarket chains<br />

have been selling fruit and vegetables in compostable packaging since the summer of <strong>2005</strong>. Contracts<br />

have been signed between the users and INTERSEROH for the qualified support of the market launch<br />

and communication on utilisation.<br />

14

3. Raw Materials Trading Under One Roof<br />

Due to the changes on the market, primarily the strong growth in the demand for raw materials<br />

internationally and increasing tendencies for concentration on the recycler side, INTERSEROH is<br />

orientating itself more and more with its traditional competencies on trading in raw materials. The<br />

coordination and management of group-wide trading activities in wastepaper, old wood and plastics,<br />

excluding steel and metal, have therefore been united under the umbrella of ISR INTERSEROH<br />

Rohstoffe GmbH since 1 July <strong>2005</strong>.<br />

The situation on the raw material markets is as follows:<br />

Wastepaper<br />

The development of new production capacities in Southeast Asia and ongoing high demand in<br />

Germany resulted in stable wastepaper prices overall. In detail: the prices for wastepaper in Germany<br />

rose strongly from February to May <strong>2005</strong>, dropped in the summer months of June and July and then<br />

moved sideways from August to November. They dropped again in December. Wastepaper prices in<br />

Southeast Asia developed similarly, albeit at a level well above German prices due to the<br />

establishment of new production capacities there. In France the paper prices tended to be relatively<br />

weak because of the intense competition in the country.<br />

In spite of increased competition for free wastepaper volumes, the tonnage marketed by ISR<br />

rose to 504,300 tons (previous year: 446,650 tons).<br />

The French subsidiary INTERSEROH CDI S.A.S. was renamed to INTERSEROH France<br />

S.A.S. Its situation improved further thanks to the restructuring measures carried out in fiscal 2004. In<br />

spite of the intense competition, especially for higher-quality old printer paper volumes, INTERSEROH<br />

France was able to protect its market shares and even expand them in some regions. This enabled<br />

the successful acquisition of new big customers. INTERSEROH France erected a new site in<br />

Strasbourg. The total tonnage traded amounted to close on 507,000 tons (previous year: 560,000<br />

tons). The decline in tonnage can be attributed mainly to the sale of the Pierrefitte site.<br />

INTERSEROH has given up its paper activities in Belgium. Padec S.A. was closed down and<br />

s.a. Emile Sanglier was sold. A part of the business activities of Padec S.A. were transferred to<br />

INTERSEROH France. The changes made to management and sales did not produce the lasting<br />

earnings power wanted.<br />

INTERSEROH is the market leader in the collection and recycling of used kraft paper bags.<br />

Repasack GmbH managed to keep the tonnage of used kraft paper bags marketed at the previous<br />

year’s level. ISD INTERSEROH Dienstleistungs GmbH enjoyed the same development.<br />

Old and Residual Wood<br />

Following a slight decline in the purchase prices for old wood, partly also attributable to the weather,<br />

prices rose again significantly after 1 June <strong>2005</strong>. The selling prices for old wood for thermal utilisation<br />

dropped. The reason for this development is the prohibition on dumping of untreated organic materials<br />

contained in the TASi. There were only minor adjustments in the prices for grades suitable for material<br />

recycling.<br />

INTERSEROH managed to increase both its trading volumes and the volumes accrued at its<br />

wood sites slightly in the year under review compared to 2004. The trade in old wood and other types<br />

of biomass was expanded to Denmark and Poland.<br />

Due to the continued growth in the importance of old wood, INTERSEROH made several<br />

important investments in <strong>2005</strong>.<br />

The processing capacity at the INTERSEROH wood site in Bückeburg was raised<br />

considerably with a new preliminary fragmentising plant. INTERSEROH also expanded the wood site<br />

NRW to supply the biomass-fuelled combined heating and power station in Lünen. Supplies to the<br />

power station are due to start in the second quarter of 2006. A rail logistics system for old wood with<br />

wagon sets between France and Germany was installed.<br />

Plastics<br />

Rising prices with a plus of 20 percent overall characterised the past financial year. Prices slumped at<br />

the end of the year. We were able to increase the volumes of plastic marketed significantly and<br />

consolidate our position on the market. International trading activities were expanded.<br />

15

The domestic economy did not have any serious effects on the volumes of EPS (polystyrene)<br />

marketed. They were kept at the previous year’s level. The prices for this raw material developed like<br />

those for plastic. Increased expenditure on transport due to toll payments was offset completely.<br />

INTERSEROH Kunststoffaufbereitung GmbH in Aschersleben has fulfilled the expectations<br />

placed in it and is on a growth course. It manufactures and then markets regranulates from EPS.<br />

Aschersleben is located at the intersection of the important industrial regions of Halle/Leipzig,<br />

Magdeburg, Bitterfeld and Berlin and therefore offers substantial logistical advantages.<br />

4. Steel and Metal Recycling: Declining Crude Steel Production Reduces Volumes<br />

The year <strong>2005</strong> was again characterised by extreme volatility in scrap steel prices. Following true<br />

booms in prices to October 2004, the decline in scrap steel prices continued from the end of 2004 to<br />

June <strong>2005</strong>. Many European steelworks cut back their production in order to prop up steel prices. The<br />

demand for steel weakened, stocks were still well-filled. This decline in demand coincided with still<br />

relatively high scrap steel supply, especially from Russia and the Ukraine. Scrap steel prices rose in<br />

July and August. In the months thereafter they dropped slightly to the end of <strong>2005</strong>.<br />

The reduction in the demand for scrap steel also diminished the tonnage marketed by<br />

INTERSEROH. Due to the declines in prices, activities in direct sale business, where margins are<br />

comparatively weak, were reduced in favour of warehouse business, where margins are higher. Direct<br />

sale business where margins were too low were given up completely.<br />

Due to the strong demand for also older used vehicles and the lack of harmonisation in<br />

dumping legislation in Europe (see also section 1. B), the number of car bodies in Germany dropped.<br />

Nevertheless, INTERSEROH’s processing capacities are largely being used to the full. The sites were<br />

modernised with extensive investments in shredder technology to meet the requirements of the<br />

Technical Instructions for Domestic Waste. For example, INTERSEROH Jade-Stahl in Wilhelmshaven<br />

and INTERSEROH MAB Rostock invested in a new non-ferrous metal and shredder light fraction<br />

separation plant respectively. A new fine dust filter plant was installed at INTERSEROH Evert Heeren<br />

in Leer.<br />

The tonnage of non-ferrous metals was increased.<br />

In keeping with the concentration tendencies on the buyer side, the INTERSEROH Group<br />

expanded its market position and therefore competitiveness in the steel and metal recycling segment<br />

further.<br />

The company “Franz Jungnickel” in Marktredwitz / Bavaria was bought in an asset deal. Apart<br />

from steel and metal scrap, it also recycles paper and plastics. It has been merged into INTERSEROH<br />

Franken Rohstoff GmbH, Sennfeld.<br />

The activities of the company “Serog H. Suhrbier GmbH” in Bous / Saarland were also bought<br />

in an asset deal. It will operate in future under the name of INTERSEROH Serog GmbH.<br />

The two acquisitions have further improved INTERSEROH’s coverage for the collection and<br />

processing of these materials. INTERSEROH is now ranked second among German scrap<br />

processors.<br />

On 1 July <strong>2005</strong> INTERSEROH also acquired a 70-percent interest in RHS Rohstoff Handel<br />

GmbH in Stuttgart. This has strengthened activities in the trading of non-ferrous metals even further.<br />

These three acquisitions brought a total of almost 150,000 annual tons of steel and metal<br />

scrap into the group.<br />

The subsidiary INTERSEROH Hetzel GmbH began moving from Heidelberg to the harbour in<br />

Mannheim towards the end of the year under review. The move should be complete in autumn 2006.<br />

Hetzel will then operate one of the most modern recycling plants in Germany.<br />

Due to the strong demand in Eastern Europe for old cars and relocation of labour-intensive<br />

production to these countries, the amount of scrap steel being generated there is also rising. It is<br />

therefore INTERSEROH’s strategy to increase its presence in these countries. Our associated<br />

company in Szczecin in Poland, TOM, increased its presence with four additional sites. With 10 sites,<br />

TOM is now the market leader in Western Poland. A new company was established in St. Petersburg,<br />

Russia, at the end of <strong>2005</strong>.<br />

16

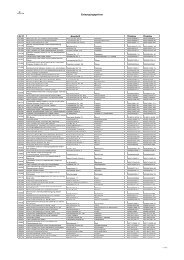

Secondary raw materials 2004/<strong>2005</strong> including steel and<br />

metal recycling<br />

2004 <strong>2005</strong><br />

Total volume in t Total volume in t<br />

Wastepaper 1,119,400 1,104,900<br />

Old wood 635,400 649,700<br />

Plastics 106,100 123,900<br />

Kraft paper bags 14,800 15,800<br />

Scrap metal 109,400 134,600<br />

Scrap steel 3,650,700 3,127,600<br />

Composites 49,600 27,900<br />

Other secondary raw materials 16,700 14,100<br />

5. Investments Up<br />

The current investments for the financial year totalled EUR 28.07 million (previous year: EUR 13.64<br />

million), consisting mostly of accruals to property, plants and equipment at EUR 21.91 million<br />

(previous year: EUR 12.29 million), especially land and buildings at EUR 4.34 million, technical<br />

equipment and machinery at EUR 4.95 million and other facilities, fittings and equipment at EUR 4.66<br />

million. Advances to suppliers and investments in construction amounted to EUR 7.97 million,<br />

primarily for alterations to various sites and the construction of large mechanical plants.<br />

The accruals to intangible assets totalled EUR 3.84 million, mainly for the costs of EUR 1.57<br />

million incurred by the closing date for software that is to be introduced group-wide and goodwill of<br />

EUR 1.55 million.<br />

The accruals to at-equity participations of EUR 0.2 million resulted from the transformation of a<br />

shareholder’s loan to equity.<br />

Investments in the field of long-term financial assets mounted to EUR 2.12 million in the year<br />

under review. Contained in this amount are EUR 0.95 million as the share of a group company not yet<br />

consolidated as of 31 December <strong>2005</strong>. Also included are accruals in the field of long-term loans to<br />

affiliated and associated companies not yet consolidated and to external third parties totalling EUR<br />

1.01 million.<br />

The services and raw materials segment accounted for EUR 14.19 million of the current<br />

investments. The investments in intangible assets of EUR 1.94 million went primarily on the<br />

implementation of new software, for which advances of EUR 1.36 million were paid in <strong>2005</strong>. A total of<br />

EUR 10.44 million was invested in fixed assets. The accruals in the field of fixed assets fell mainly on<br />

advances to suppliers and investments in construction of EUR 5.47 million, of which EUR 4.89 million<br />

were spent on alterations to a site belonging to INTERSEROH Holzkontor NRW and on technical<br />

equipment and machinery as well as other facilities, fittings and equipment at EUR 3.08 million and<br />

EUR 1.84 million respectively.<br />

The accruals in the field of long-term financial assets of EUR 1.80 million comprised mainly<br />

the purchase of the shares of a subsidiary company not consolidated in <strong>2005</strong> (EUR 0.95 million), longterm<br />

loans to unconsolidated affiliated companies (EUR 0.40 million) and long-term loans to external<br />

third parties (EUR 0.38 million).<br />

The steel and metal recycling segment accounted for EUR 13.88 million. The accruals in<br />

intangible assets of EUR 1.81 million comprised mainly goodwill of EUR 1.47 million resulting from the<br />

acquisition of three metal recycling plants and the costs of EUR 0.21 million for the implementation of<br />

new software. A total of EUR 11.47 million was invested in property, plants and equipment, EUR 4.29<br />

million of which in land and buildings, EUR 1.86 million in technical equipment and machinery as well<br />

as EUR 2.82 million in other facilities, fittings and equipment. The advances to suppliers and<br />

investments in construction totalling EUR 2.50 million were spent primarily on two scrap cutters and a<br />

recycling plant.<br />

The accruals in the field of long-term financial assets of EUR 0.40 million comprised mainly<br />

long-term loans to associated companies at EUR 0.23 million.<br />

17

6. Financing Measures: Net Debt Reduced<br />

The overwhelming majority of current payment transactions and current account balances for major<br />

domestic INTERSEROH companies are concentrated in three banks operating throughout Europe.<br />

The relevant accounts are included in a cash pooling arrangement. The former Hansa companies<br />

have a separate cash pooling arrangement with the same banks as with INTERSEROH AG. The<br />

security for the cash pooling credit line is provided by INTERSEROH AG.<br />

Bank liabilities dropped in the year under review by EUR 8.26 million to EUR 33.85 million and<br />

liquid funds from EUR 31.23 million to EUR 29.48 million. The net debt of the group to banks therefore<br />

dropped by EUR 6.51 million.<br />

With equity of EUR 118.44 million, the group’s equity ratio is 37.28 percent. This capitalisation<br />

represents a very solid foundation for the further development of INTERSEROH. Future investments<br />

will be financed – as far as possible – from own funds.<br />

7. Human Resources and Social Security: Qualification Measures Improved<br />

Workforce Grows<br />

The average size of the group’s workforce over the year amounted to 1,301 (previous year: 1,254).<br />

The services and raw materials trading segment employed an average staff of 593 (previous<br />

year: 572). The number of employees was 400 (previous year: 370) and the number of industrial<br />

workers 193 (previous year: 202).<br />

An average of 707 people were employed in the steel and metal recycling segment in the<br />

financial year (previous year: 682), comprising 246 employees (previous year: 246) and 461 industrial<br />

workers (previous year: 436).<br />

Carefully Tailored Qualification Measures<br />

INTERSEROH introduced a new personnel development concept in the year under review. The<br />

concept is based on a model, with whose help necessary skills are defined and existing skills<br />

identified. In this connection INTERSEROH also subjected its evaluation system to a thorough review.<br />

This was followed by the development of further education and training plans. The purpose of these<br />

plans is to support the individual development of senior and junior management personnel so that<br />

existing and future tasks can be solved even more competently than in the past. The qualification<br />

programs of the individual subsidiaries of the INTERSEROH Group have been adapted accordingly.<br />

INTERSEROH again offered IT and other specialised seminars as well as interdisciplinary<br />

training course on subjects such as personality development and behavioural training in <strong>2005</strong>. Internal<br />

job vacancies are advertised throughout the group. With this policy INTERSEROH offers an additional<br />

opportunity for the further development of its employees.<br />

New Employee Performance System Developed<br />

To help improve the personal performance of INTERSEROH employees, interviews are held with<br />

employees in the fourth quarter of every year to agree individual objectives for the following year with<br />

the employees. In a pilot project the group developed a simplified performance system that is now<br />

available to all group companies.<br />

Clear Information for Newcomers<br />

To give new employees a quick idea of the overall group and its growth, INTERSEROH has<br />

developed a group information system, which presents the activities of the individual subsidiary<br />

companies clearly and efficiently. Its purpose is to promote transparency and inter-company<br />

cooperation. Due to the growing fields of business, the group information system is not a static<br />

instrument, but is updated regularly.<br />

Company Pension Scheme Supported<br />

Analysis of one’s own personal income and life situation is an important building block in the search<br />

for suitable retirement pension possibilities. The INTERSEROH Group has made arrangements so<br />

that its employees can have such an analysis performed by qualified consultants. INTERSEROH<br />

supports the selected insurance products with an employer contribution of 10 percent. Around 20<br />

percent of the workforce have already made use of this opportunity.<br />

18

INTERSEROH Wins Top Job Third Time Running<br />

ISD INTERSEROH Dienstleistungs GmbH took part in the project Top Job for the third time. This<br />

competition looks for the best employers in Germany once a year. INTERSEROH was counted among<br />

these employers for the third time in succession.<br />

Social Commitment Continued<br />

During the First Cologne Volunteer Day in September 2003 INTERSEROH committed itself to a<br />

lifelong partnership with a Cologne orphanage, which involves regular participation by INTERSEROH<br />

employees and was continued in the year under review. INTERSEROH again also supported the<br />

activities of the association Diagnose Leukämie e.V., which works to promote the healing of children<br />

suffering from leukaemia.<br />

8. Environmental Protection is an Integral Part of Our <strong>Business</strong><br />

The term “closed loop economy” conveys a concrete promise for sustainable use of natural resources<br />

in production and consumption and has become a guiding principle. Sustainability is an integral<br />

component of INTERSEROH’s philosophy. By closing recycling loops, the group generates streams of<br />

raw materials to supply industry. In this way INTERSEROH makes a valuable contribution to the<br />

creation and development of demand for recycled raw materials and thus to the protection of natural<br />

resources. For INTERSEROH, therefore, environmental protection is not a side issue, but the object of<br />

its business activities.<br />

Like all companies, INTERSEROH is subject to international, national and regional<br />

environmental laws, ordinances and guidelines. To ensure compliance, the group’s operations are<br />

continually inspection by certification companies because almost all INTERSEROH plants are certified<br />

as specialist waste disposal companies and 95 percent already have a certified quality management<br />

system in place.<br />

To meet the requirements of the Old Auto Ordinance and Technical Instructions for Domestic<br />

Waste and its implicit ban on dumping of untreated organic wastes, numerous plants have been<br />

installed at the group’s scrap yards for further separation of the so-called shredder light fraction (e.g.<br />

plastics, foamed materials, rubber). As a result of this, even greater proportions of old cars are<br />

returned to the material cycle – protecting scarce raw material resources and minimising the amount<br />

of waste that has to be disposed of.<br />

9. Marketing and Advertising: New Marketing Campaign Launched<br />

INTERSEROH launched a selective marketing campaign to support the sales activities for the Dual<br />

System INTERSEROH (DSI). Advertisements were placed in various publications, whose target<br />

readership are potential DSI customers, since late summer <strong>2005</strong>. At the centre of the campaign, which<br />

was supported by multi-stage mailing campaigns and the work of a call centre, stood the world’s<br />

largest food and beverage fair “anuga” in Cologne. INTERSEROH also participated in the anuga from<br />

8 to 12 October <strong>2005</strong> with its own exhibition booth, which also covered the INTERSEROH deposit<br />

system and INTERSEROH self-disposal system. In this way a few hundred promising talks with<br />

representatives from the target group in the food industry were held.<br />

INTERSEROH also exhibited at other important trade fairs in <strong>2005</strong>. At the Paperworld in<br />

Frankfurt in January INTERSEROH presented not only the traditional service of recycling of transport<br />

packaging, but also the modus operandi for the collection of empty ink and toner cartridges and its<br />

know-how in all questions concerning the recycling of old electrical and electronic equipment. At the<br />

Interpack in Düsseldorf in April INTERSEROH demonstrated its services for the recycling of<br />

packaging. Also in April, INTERSEROH was present with a large exhibit at the International Trade Fair<br />

for Water, Sewage, Refuse, Recycling (IFAT), one of the leading environment fairs worldwide.<br />

Numerous talks were held with private and municipal waste management companies at this industry<br />

meeting. In addition to these trade fairs, INTERSEROH was also present at important branch fairs of<br />

its individual business segments.<br />

The third, and for the time being last, INTERSEROH information event on implementation of<br />

the European WEEE directive and German law on old electrical and electronic equipment took place<br />

on 28 February <strong>2005</strong>. The conference focussed on concretisation of the future recycling of old<br />

equipment as a result of the law in Germany, implementation of the directive in the other member<br />

states of the European Union and the resultant organisational possibilities. INTERSEROH also<br />

presented its organisational solutions especially for the national sector.<br />

19

INTERSEROH also launched the fourth generation of its group website at the address<br />

www.interseroh.de in the past financial year. The complete redesign has made the website clearer<br />

and more user-friendly. The websites of the group and subsidiary companies were adapted to the<br />

corporate design.<br />

The information brochures and flyers for existing and potential customers were updated and<br />

new flyers produced in German and English due to the expansion in services offered by the group.<br />

10. Public Relations: Resonance in the Media Grows Further<br />

INTERSEROH held four large press conferences in the year under review. In addition to the press<br />

conference on its annual financial statements and its autumn press conference, INTERSEROH also<br />

presented itself and its new services to media representatives at the IFAT in Munich in April and its<br />

new marketing campaign for the Dual System INTERSEROH in September.<br />

Contacts to general-interest and trade media were intensified through visits to editorial offices<br />

and individual talks. They were followed by interviews and guest commentaries in the print media,<br />

radio and television. INTERSEROH also regularly issued press releases to provide up-to-date<br />

information on all important business activities. The press releases were published simultaneously on<br />

the Internet at the INTERSEROH website. INTERSEROH was mentioned in numerous articles and<br />

programs throughout the year. The regionalisation of public relations introduced in <strong>2005</strong> because of<br />

the approximately 70 INTERSEROH sites broadened the company’s presence in the media.<br />

INTERSEROH again distributed its newsletter FaxFacts to its partners in <strong>2005</strong>. The newsletter<br />

focuses on developments in environmental policy and related INTERSEROH services. Four issues of<br />

the customer magazine CIRCLE were published, each with a circulation of at least 17,000 copies.<br />

11. Investor Relations: Interest in INTERSEROH Share Grows Further<br />

The INTERSEROH AG stock was again viewed by the financial community as an attractive alternative<br />

in the year under review. Investor relations work was intensified accordingly. The INTERSEROH<br />

Management Board and IR officer held numerous one-to-one talks with analysts and institutional and<br />

potential investors from Germany, Austria, Great Britain, France and the USA in the company’s<br />

headquarters. Investor conferences and numerous road shows with the Management Board in<br />

Frankfurt, Munich and Zurich met with great interest. INTERSEROH is now regularly observed and<br />

analysed by various German financial analysts.<br />

In <strong>2005</strong> private investors also increasingly made use of the possibility of approaching the IR<br />

officer directly with their questions.<br />

In November INTERSEROH participated in the Cologne Stock Forum organised by the<br />

German investor protection association Schutzvereinigung für Wertpaperbesitz e.V. (DSW) and<br />

Cologne-based Börsenverein e.V. In this event German and international public stock corporations<br />

give private investors an opportunity to inform themselves from sources otherwise open only to<br />

institutional investors and analysts. INTERSEROH AG invited the private shareholders known to it to<br />

this event.<br />

INTERSEROH authorised a new designated sponsor with effect from 1 May <strong>2005</strong>.<br />

All the items on the agenda for the ordinary general shareholders’ meeting in June <strong>2005</strong> were<br />

adopted with a large majority. The ordinary general shareholders’ meeting for 2006 will be held in<br />

Cologne on 22 June.<br />

The press conference convened to present the annual financial statements reported on the<br />

economic development of the INTERSEROH Group. INTERSEROH informed the public about the<br />

economic development of the company in the individual quarters of the year in press releases.<br />

Analysts, institutional and private investors also received this information in the form of shareholder<br />

letters. The information was also published simultaneously on the Internet at the INTERSEROH<br />

website.<br />

In the course of the website facelift the category “Investor Relations” was revised completely<br />

and expanded to include further information.<br />

On 25 November <strong>2005</strong> the Management Board of INTERSEROH AG was notified that the<br />

company Praetorium 61. VV GmbH had decided to offer to buy the ordinary bearer shares of<br />

INTERSEROH Aktiengesellschaft zur Verwertung von Sekundärrohstoffen without par value from the<br />

shareholders of INTERSEROH Aktiengesellschaft zur Verwertung von Sekundärrohstoffen in a public<br />

takeover bid against payment of a purchase price of EUR 26.60 per ordinary share. Praetorium 61. VV<br />

GmbH, in future Isabell Finance Vermögensverwaltungs GmbH, is a company in the ALBA Group.<br />

20

Praetorium 61. VV GmbH currently holds 25.75 percent of the shares in INTERSEROH<br />

Aktiengesellschaft zur Verwertung von Sekundärrohstoffen.<br />

Security type: Domestic share, bearer share<br />

Quoted: Regulated markets in Frankfurt, Düsseldorf and XETRA trading; regulated unofficial markets<br />

in Stuttgart, Munich, Hamburg and Berlin-Bremen<br />

Financial year: 31.12.<br />

Notifiable shareholders: Praetorium 61. VV GmbH (25.75%)<br />

Float: 74.25%<br />

Par value: EUR 2.60<br />

Shares: 9.84 million<br />

Bloomberg code: ITS.ETR<br />

Reuters code: INSG.de<br />

ISIN: DE0006209901<br />

German securities identification number: 620990<br />

PRICE AND TURNOVER STATISTICS<br />

IN EUROS<br />

XETRA<br />

FRANKFURT<br />

Highest variable price 29.32 31.00<br />

Lowest variable price 17.10 16.60<br />

Spread 52.64 % 60.50 %<br />

Opening price 1 st day of trading 17.10 17.25<br />

Closing price 27.60 27.41<br />

Performance 61.40 % 58.90 %<br />

12. Dividend Yield 3.14 Percent<br />

Based on INTERSEROH AG’s retained earnings of EUR 8,462,400, the Management Board is able to<br />

propose a dividend of EUR 0.86 per individual share certificate for the past financial year to the<br />

Supervisory Board and general shareholders’ meeting (previous year: EUR 0.86). Related to the<br />

closing price of EUR 27.41 at the Frankfurt Stock Exchange at the end of December <strong>2005</strong>, the<br />

dividend yield amounted to 3.14 percent.<br />

13. INTERSEROH Identifies with Corporate Governance<br />

Good corporate governance comprises all the principles for responsible and best-possible<br />

management practice and corporate control by generally accepted values. It pursues the object of<br />

communicating reliability, securing the confidence of shareholders, business partners, staff and<br />

general public and influencing the intrinsic value of the company positively over the long term by way<br />

of exemplary conduct.<br />

Shareholder rights, the quality of the Supervisory Board and the guarantee of reasonable<br />

transparency are all important components of a value-orientated corporate philosophy. In addition to<br />

them and the complete internal organisational structure, including the company’s risk management,<br />

the German Corporate Governance Code (DCGK) was adopted on 26 February 2002, with whose<br />

recommendations and ideas the Management Board and Supervisory Board overwhelmingly identify.<br />

The aims of keeping the company in good shape, to which the Supervisory Board and<br />

Management Board of INTERSEROH AG are committed, were pursued vigorously by the boards in<br />

the past. They are codified to a large part in applicable laws, the company’s bylaws and in the rules of<br />

procedure of the INTERSEROH Group.<br />

Within the INTERSEROH Group, only INTERSEROH AG writes a governance report. There is<br />

no such obligation for other companies in the group. INTERSEROH AG has not set up any own<br />

corporate governance principles.<br />

Shareholders and the General Shareholders’ Meeting<br />

For INTERSEROH, guaranteeing shareholder rights and holding a shareholders’ meeting that is<br />

orientated towards the shareholders, with the possibility of permanent voting by proxy, as an annual<br />

21

forum for direct contact with the Management Board and Supervisory Board are enduring components<br />

of business management.<br />

Due to a lack of interest, broadcasting of the general shareholders’ meeting via the Internet is<br />

currently not planned.<br />

Management Board and Supervisory Board<br />

The Management Board and Supervisory Board continuously work together closely for the well-being<br />

of INTERSEROH. The full Supervisory Board, the Chairman’s Committee, the Personnel Committee<br />

and the Audit Committee meet regularly or when required. Regarding the frequency of meetings,<br />

reference is made to the <strong>Report</strong> of the Supervisory Board. The Audit Committee is chaired by neither<br />

the Chairman of the Supervisory Board nor a former member of the Management Board of the<br />

company. The Supervisory Board also deliberates when necessary without the Management Board.<br />

Following the voluntary public takeover bid by Isabell Finance Vermögensverwaltung GmbH<br />

on 5 January 2006, the Management Board did not convene an extraordinary general shareholders’<br />

meeting for discussion or resolution on legal measures. According to the joint statement of the<br />

Management Board and Supervisory Board on 17 January 2006 pursuant to § 27 of the German<br />

Securities Acquisition and Takeover Act, there is no additional need for information or resolutions by<br />

the general shareholders’ meeting.<br />

INTERSEROH AG does not use stock option programmes or similar securities-orientated<br />

incentive systems. The variable compensation of the Management Board does not contain stock<br />

options or comparable arrangements.<br />

Transparency, Submission of Accounts and Auditing<br />

In addition to the possibility of direct contact with the company at any time, INTERSEROH also<br />

continually publishes information on important developments in the group on the Internet at the<br />

address www.interseroh.de.<br />

A portrait of the company as well as its annual reports, quarterly reports and information on<br />

certain services are also available there in English.<br />

The annual financial statements are prepared both in accordance with the German<br />

Commercial Code and the consolidated financial statements also in accordance with the International<br />

Financial <strong>Report</strong>ing Standards (IFRS). The external audit including priority audits are conducted by<br />

KPMG Deutsche Treuhand-Gesellschaft Wirtschaftsprüfungsgesellschaft in Cologne.<br />