Business Report 2005 - Interseroh

Business Report 2005 - Interseroh

Business Report 2005 - Interseroh

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

forum for direct contact with the Management Board and Supervisory Board are enduring components<br />

of business management.<br />

Due to a lack of interest, broadcasting of the general shareholders’ meeting via the Internet is<br />

currently not planned.<br />

Management Board and Supervisory Board<br />

The Management Board and Supervisory Board continuously work together closely for the well-being<br />

of INTERSEROH. The full Supervisory Board, the Chairman’s Committee, the Personnel Committee<br />

and the Audit Committee meet regularly or when required. Regarding the frequency of meetings,<br />

reference is made to the <strong>Report</strong> of the Supervisory Board. The Audit Committee is chaired by neither<br />

the Chairman of the Supervisory Board nor a former member of the Management Board of the<br />

company. The Supervisory Board also deliberates when necessary without the Management Board.<br />

Following the voluntary public takeover bid by Isabell Finance Vermögensverwaltung GmbH<br />

on 5 January 2006, the Management Board did not convene an extraordinary general shareholders’<br />

meeting for discussion or resolution on legal measures. According to the joint statement of the<br />

Management Board and Supervisory Board on 17 January 2006 pursuant to § 27 of the German<br />

Securities Acquisition and Takeover Act, there is no additional need for information or resolutions by<br />

the general shareholders’ meeting.<br />

INTERSEROH AG does not use stock option programmes or similar securities-orientated<br />

incentive systems. The variable compensation of the Management Board does not contain stock<br />

options or comparable arrangements.<br />

Transparency, Submission of Accounts and Auditing<br />

In addition to the possibility of direct contact with the company at any time, INTERSEROH also<br />

continually publishes information on important developments in the group on the Internet at the<br />

address www.interseroh.de.<br />

A portrait of the company as well as its annual reports, quarterly reports and information on<br />

certain services are also available there in English.<br />

The annual financial statements are prepared both in accordance with the German<br />

Commercial Code and the consolidated financial statements also in accordance with the International<br />

Financial <strong>Report</strong>ing Standards (IFRS). The external audit including priority audits are conducted by<br />

KPMG Deutsche Treuhand-Gesellschaft Wirtschaftsprüfungsgesellschaft in Cologne.<br />

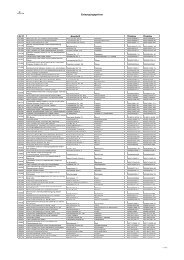

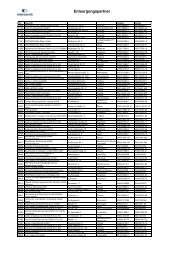

The shares in the company and related financial instruments owned by the members of the<br />

Management and Supervisory Boards are listed in the annex. According to this list, the Supervisory<br />

Board Chairman Dr. Axel Schweitzer and the Supervisory Board member Dr. Eric Schweitzer together<br />

hold a voting share of 25.75 percent in INTERSEROH AG. The voting rights are attributable to both<br />

gentlemen according to § 22, Par. 1, No. 1 Securities Trading Act.<br />

Deviations<br />

Where the group deviated or deviates from the recommendations of the DCGK in isolated cases, this<br />

is stated in the declarations of compliance by the Management Board and Supervisory Board of<br />

INTERSEROH AG. They can be called up on the Internet at http://www.interseroh.de/Investor-<br />

Relations.<br />

14. Major Transactions in the Financial Year<br />

Apart from the business development in the services and raw materials trading and steel and metal<br />

recycling segments already described, the following transactions in the year under review must also<br />

be mentioned.<br />

Acquisition of Companies<br />

ISD INTERSEROH Dienstleistungs GmbH acquired the companies DPK Deutsche Pfandkonzept,<br />

Cologne, and Westpfand Clearing GmbH, Cologne, completely with economic effect from 1 January<br />

<strong>2005</strong>. DPK was merged into Westpfand. The company operates as INTERSEROH Pfand-System<br />

GmbH, Cologne.<br />

INTERSEROH RSH Recycling-Stahl-Handel acquired INTERSEROH RSH Sweden, Göteborg<br />

/ Sweden, effective from 30 November <strong>2005</strong>.<br />

Sale of Companies<br />

INTERSEROH France S.A.S., Paris / France, sold SUD Papier International S.A., Mello / France, with<br />

effect from 22 December <strong>2005</strong>.<br />

22