Business Report 2005 - Interseroh

Business Report 2005 - Interseroh

Business Report 2005 - Interseroh

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

linked in contrast to HGB to very strict requirements and provisions for restructuring formed according<br />

to HGB may not be applied under IFRS.<br />

Overall the provisions dropped by EUR 4.11 million per 1 January 2004 and by EUR 2.98<br />

million per 31 December 2004. In the income statement for 2004 other operating expenses of EUR<br />

1.13 million and an increase in the (deferred) income tax expenditure by EUR 0.2 million resulted from<br />

the adjustment of the corresponding provisions.<br />

h) Further, some obligations that are to be shown as provisions according to HGB, e.g. provisions for<br />

outstanding incoming invoices or vacation remuneration, must be shown as short-term liabilities<br />

according to IFRS.<br />

The corresponding neutral reorganisations led to a reduction in the long and short-term other<br />

provisions by a total of EUR 49.87 million per 31 December 2004 (EUR 47.94 million per 1 January<br />

2004) and an increase in trade accounts payable by EUR 34.51 million per 31 December 2004 (EUR<br />

31.73 million per 1 January 2004) as well as the long and short-term other liabilities by a total of EUR<br />

15.36 million per 31 December 2004 (EUR 16.21 million per 1 January 2004).<br />

i) Deviations not resulting from the change to IFRS<br />

Due to information acquired after preparation of the HGB consolidated balance sheet, the value rate<br />

for a long-term receivable of EUR 0.94 million was already increased in the IFRS opening balance<br />

sheet per 1 January 2004 by EUR 0.84 million to EUR 1.78 million and discounted to EUR 1.48 million<br />

per 31 December 2004.<br />

In addition to this – also as of 1 January 2004 – an individual value adjustment was formed in<br />

full amount. In the IFRS consolidated financial statements for 2004 the increase in the receivable<br />

(EUR 0.84 million from the other operating income) and the discounting (EUR 0.30 million from the<br />

interest expense) were consequently eliminated. Instead a mark-up to the receivable of EUR 0.08<br />

million to EUR 1.48 million was entered (against interest earnings), which has also been value-<br />

adjusted in full (other operating expenses).<br />

In the IFRS consolidated income statement it was also necessary to move receiving and<br />

freight costs from the other operating expenses to cost of materials (total EUR 4.79 million). This did<br />

not result in any effects on the balance sheet or the net income.<br />

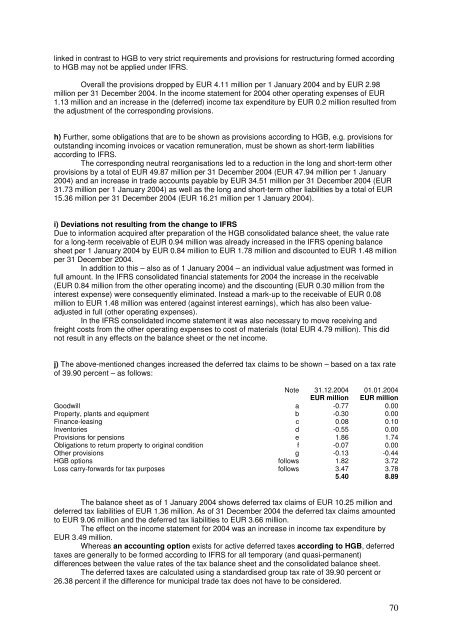

j) The above-mentioned changes increased the deferred tax claims to be shown – based on a tax rate<br />

of 39.90 percent – as follows:<br />

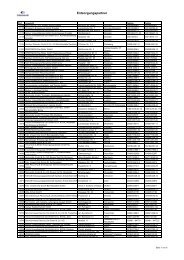

Note 31.12.2004 01.01.2004<br />

EUR million EUR million<br />

Goodwill a -0.77 0.00<br />

Property, plants and equipment b -0.30 0.00<br />

Finance-leasing c 0.08 0.10<br />

Inventories d -0.55 0.00<br />

Provisions for pensions e 1.86 1.74<br />

Obligations to return property to original condition f -0.07 0.00<br />

Other provisions g -0.13 -0.44<br />

HGB options follows 1.82 3.72<br />

Loss carry-forwards for tax purposes follows 3.47 3.78<br />

5.40 8.89<br />

The balance sheet as of 1 January 2004 shows deferred tax claims of EUR 10.25 million and<br />

deferred tax liabilities of EUR 1.36 million. As of 31 December 2004 the deferred tax claims amounted<br />

to EUR 9.06 million and the deferred tax liabilities to EUR 3.66 million.<br />

The effect on the income statement for 2004 was an increase in income tax expenditure by<br />

EUR 3.49 million.<br />

Whereas an accounting option exists for active deferred taxes according to HGB, deferred<br />

taxes are generally to be formed according to IFRS for all temporary (and quasi-permanent)<br />

differences between the value rates of the tax balance sheet and the consolidated balance sheet.<br />

The deferred taxes are calculated using a standardised group tax rate of 39.90 percent or<br />

26.38 percent if the difference for municipal trade tax does not have to be considered.<br />

70