Business Report 2005 - Interseroh

Business Report 2005 - Interseroh

Business Report 2005 - Interseroh

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

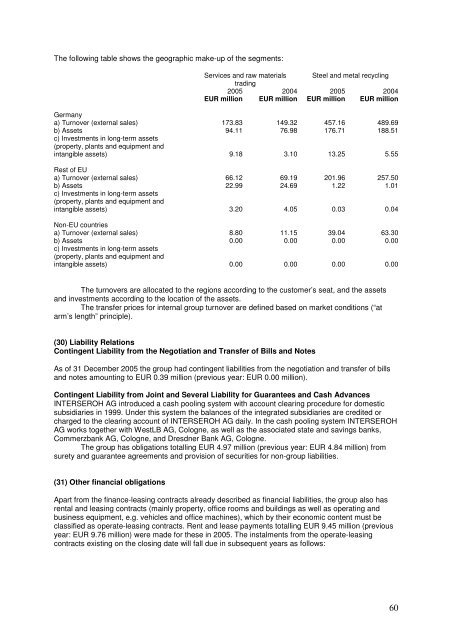

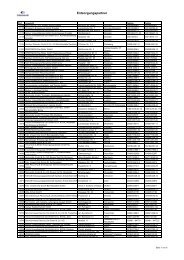

The following table shows the geographic make-up of the segments:<br />

Services and raw materials<br />

trading<br />

<strong>2005</strong><br />

2004<br />

EUR million EUR million<br />

Steel and metal recycling<br />

<strong>2005</strong><br />

EUR million<br />

2004<br />

EUR million<br />

Germany<br />

a) Turnover (external sales) 173.83 149.32 457.16 489.69<br />

b) Assets 94.11 76.98 176.71 188.51<br />

c) Investments in long-term assets<br />

(property, plants and equipment and<br />

intangible assets) 9.18 3.10 13.25 5.55<br />

Rest of EU<br />

a) Turnover (external sales) 66.12 69.19 201.96 257.50<br />

b) Assets 22.99 24.69 1.22 1.01<br />

c) Investments in long-term assets<br />

(property, plants and equipment and<br />

intangible assets) 3.20 4.05 0.03 0.04<br />

Non-EU countries<br />

a) Turnover (external sales) 8.80 11.15 39.04 63.30<br />

b) Assets 0.00 0.00 0.00 0.00<br />

c) Investments in long-term assets<br />

(property, plants and equipment and<br />

intangible assets) 0.00 0.00 0.00 0.00<br />

The turnovers are allocated to the regions according to the customer’s seat, and the assets<br />

and investments according to the location of the assets.<br />

The transfer prices for internal group turnover are defined based on market conditions (“at<br />

arm’s length” principle).<br />

(30) Liability Relations<br />

Contingent Liability from the Negotiation and Transfer of Bills and Notes<br />

As of 31 December <strong>2005</strong> the group had contingent liabilities from the negotiation and transfer of bills<br />

and notes amounting to EUR 0.39 million (previous year: EUR 0.00 million).<br />

Contingent Liability from Joint and Several Liability for Guarantees and Cash Advances<br />

INTERSEROH AG introduced a cash pooling system with account clearing procedure for domestic<br />

subsidiaries in 1999. Under this system the balances of the integrated subsidiaries are credited or<br />

charged to the clearing account of INTERSEROH AG daily. In the cash pooling system INTERSEROH<br />

AG works together with WestLB AG, Cologne, as well as the associated state and savings banks,<br />

Commerzbank AG, Cologne, and Dresdner Bank AG, Cologne.<br />

The group has obligations totalling EUR 4.97 million (previous year: EUR 4.84 million) from<br />

surety and guarantee agreements and provision of securities for non-group liabilities.<br />

(31) Other financial obligations<br />

Apart from the finance-leasing contracts already described as financial liabilities, the group also has<br />

rental and leasing contracts (mainly property, office rooms and buildings as well as operating and<br />

business equipment, e.g. vehicles and office machines), which by their economic content must be<br />

classified as operate-leasing contracts. Rent and lease payments totalling EUR 9.45 million (previous<br />

year: EUR 9.76 million) were made for these in <strong>2005</strong>. The instalments from the operate-leasing<br />

contracts existing on the closing date will fall due in subsequent years as follows:<br />

60