Business Report 2005 - Interseroh

Business Report 2005 - Interseroh

Business Report 2005 - Interseroh

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Praetorium 61. VV GmbH currently holds 25.75 percent of the shares in INTERSEROH<br />

Aktiengesellschaft zur Verwertung von Sekundärrohstoffen.<br />

Security type: Domestic share, bearer share<br />

Quoted: Regulated markets in Frankfurt, Düsseldorf and XETRA trading; regulated unofficial markets<br />

in Stuttgart, Munich, Hamburg and Berlin-Bremen<br />

Financial year: 31.12.<br />

Notifiable shareholders: Praetorium 61. VV GmbH (25.75%)<br />

Float: 74.25%<br />

Par value: EUR 2.60<br />

Shares: 9.84 million<br />

Bloomberg code: ITS.ETR<br />

Reuters code: INSG.de<br />

ISIN: DE0006209901<br />

German securities identification number: 620990<br />

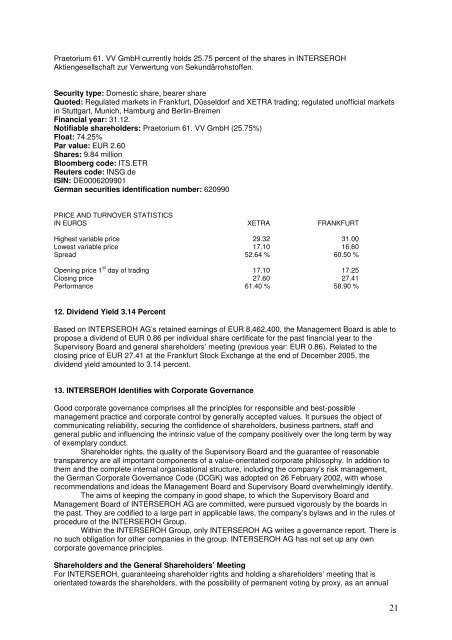

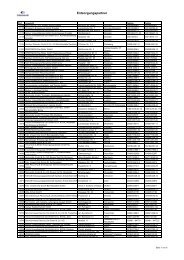

PRICE AND TURNOVER STATISTICS<br />

IN EUROS<br />

XETRA<br />

FRANKFURT<br />

Highest variable price 29.32 31.00<br />

Lowest variable price 17.10 16.60<br />

Spread 52.64 % 60.50 %<br />

Opening price 1 st day of trading 17.10 17.25<br />

Closing price 27.60 27.41<br />

Performance 61.40 % 58.90 %<br />

12. Dividend Yield 3.14 Percent<br />

Based on INTERSEROH AG’s retained earnings of EUR 8,462,400, the Management Board is able to<br />

propose a dividend of EUR 0.86 per individual share certificate for the past financial year to the<br />

Supervisory Board and general shareholders’ meeting (previous year: EUR 0.86). Related to the<br />

closing price of EUR 27.41 at the Frankfurt Stock Exchange at the end of December <strong>2005</strong>, the<br />

dividend yield amounted to 3.14 percent.<br />

13. INTERSEROH Identifies with Corporate Governance<br />

Good corporate governance comprises all the principles for responsible and best-possible<br />

management practice and corporate control by generally accepted values. It pursues the object of<br />

communicating reliability, securing the confidence of shareholders, business partners, staff and<br />

general public and influencing the intrinsic value of the company positively over the long term by way<br />

of exemplary conduct.<br />

Shareholder rights, the quality of the Supervisory Board and the guarantee of reasonable<br />

transparency are all important components of a value-orientated corporate philosophy. In addition to<br />

them and the complete internal organisational structure, including the company’s risk management,<br />

the German Corporate Governance Code (DCGK) was adopted on 26 February 2002, with whose<br />

recommendations and ideas the Management Board and Supervisory Board overwhelmingly identify.<br />

The aims of keeping the company in good shape, to which the Supervisory Board and<br />

Management Board of INTERSEROH AG are committed, were pursued vigorously by the boards in<br />

the past. They are codified to a large part in applicable laws, the company’s bylaws and in the rules of<br />

procedure of the INTERSEROH Group.<br />

Within the INTERSEROH Group, only INTERSEROH AG writes a governance report. There is<br />

no such obligation for other companies in the group. INTERSEROH AG has not set up any own<br />

corporate governance principles.<br />

Shareholders and the General Shareholders’ Meeting<br />

For INTERSEROH, guaranteeing shareholder rights and holding a shareholders’ meeting that is<br />

orientated towards the shareholders, with the possibility of permanent voting by proxy, as an annual<br />

21