Business Report 2005 - Interseroh

Business Report 2005 - Interseroh

Business Report 2005 - Interseroh

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Of the other financial liabilities, EUR 0.20 million (previous year: EUR 0.25 million) were due<br />

to affiliated companies.<br />

The book values reported for all financial liabilities correspond to their current values.<br />

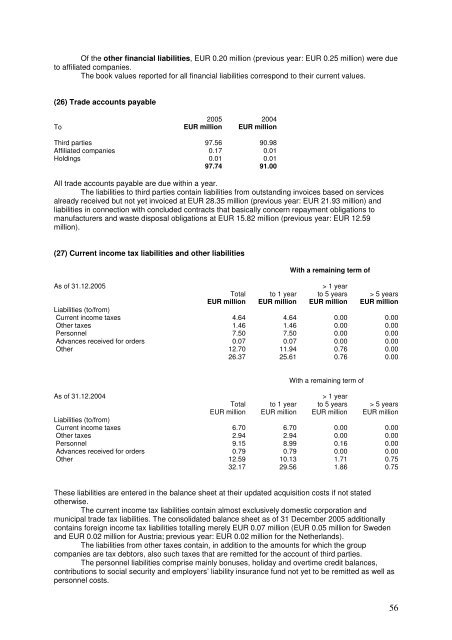

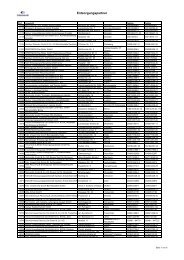

(26) Trade accounts payable<br />

To<br />

<strong>2005</strong><br />

EUR million<br />

2004<br />

EUR million<br />

Third parties 97.56 90.98<br />

Affiliated companies 0.17 0.01<br />

Holdings 0.01 0.01<br />

97.74 91.00<br />

All trade accounts payable are due within a year.<br />

The liabilities to third parties contain liabilities from outstanding invoices based on services<br />

already received but not yet invoiced at EUR 28.35 million (previous year: EUR 21.93 million) and<br />

liabilities in connection with concluded contracts that basically concern repayment obligations to<br />

manufacturers and waste disposal obligations at EUR 15.82 million (previous year: EUR 12.59<br />

million).<br />

(27) Current income tax liabilities and other liabilities<br />

As of 31.12.<strong>2005</strong><br />

Total<br />

EUR million<br />

to 1 year<br />

EUR million<br />

With a remaining term of<br />

> 1 year<br />

to 5 years<br />

EUR million<br />

> 5 years<br />

EUR million<br />

Liabilities (to/from)<br />

Current income taxes 4.64 4.64 0.00 0.00<br />

Other taxes 1.46 1.46 0.00 0.00<br />

Personnel 7.50 7.50 0.00 0.00<br />

Advances received for orders<br />

0.07 0.07 0.00 0.00<br />

Other<br />

12.70 11.94 0.76 0.00<br />

26.37 25.61 0.76 0.00<br />

As of 31.12.2004<br />

Total<br />

EUR million<br />

to 1 year<br />

EUR million<br />

With a remaining term of<br />

> 1 year<br />

to 5 years<br />

EUR million<br />

> 5 years<br />

EUR million<br />

Liabilities (to/from)<br />

Current income taxes 6.70 6.70 0.00 0.00<br />

Other taxes 2.94 2.94 0.00 0.00<br />

Personnel 9.15 8.99 0.16 0.00<br />

Advances received for orders 0.79 0.79 0.00 0.00<br />

Other 12.59 10.13 1.71 0.75<br />

32.17 29.56 1.86 0.75<br />

These liabilities are entered in the balance sheet at their updated acquisition costs if not stated<br />

otherwise.<br />

The current income tax liabilities contain almost exclusively domestic corporation and<br />

municipal trade tax liabilities. The consolidated balance sheet as of 31 December <strong>2005</strong> additionally<br />

contains foreign income tax liabilities totalling merely EUR 0.07 million (EUR 0.05 million for Sweden<br />

and EUR 0.02 million for Austria; previous year: EUR 0.02 million for the Netherlands).<br />

The liabilities from other taxes contain, in addition to the amounts for which the group<br />

companies are tax debtors, also such taxes that are remitted for the account of third parties.<br />

The personnel liabilities comprise mainly bonuses, holiday and overtime credit balances,<br />

contributions to social security and employers’ liability insurance fund not yet to be remitted as well as<br />

personnel costs.<br />

56