Business Report 2005 - Interseroh

Business Report 2005 - Interseroh

Business Report 2005 - Interseroh

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

In addition to this – and in contrast to HGB – deferred tax claims on expected future tax<br />

reductions from the crediting of loss carry-forwards for tax purposes are capitalised according to IFRS<br />

if it is adequately probable that the loss carry-forwards can be used in the future.<br />

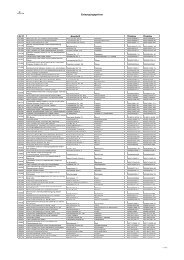

k) The effect of the above-mentioned conversions on the retained earnings are shown in the following<br />

table:<br />

Note 01.01.2004 31.12.2004<br />

EUR million EUR million<br />

Goodwill a 0.00 4.61<br />

Property, plants and equipment b 0.00 0.75<br />

Finance-leasing c 0.09 0.12<br />

Inventories e 0.00 1.40<br />

Provisions for pensions f -4.32 -4.68<br />

Obligations to return property to original condition d 0.00 0.19<br />

Other provisions g 4.11 2.98<br />

Deferred taxes j 7.70 3.95<br />

Other i -0.58 -1.48<br />

6.99 7.84<br />

These effects are to be allocated to:<br />

Shareholders of the parent company 6.99 7.88<br />

Minority interests 0.00 -0.04<br />

6.99 7.84<br />

l) The conversion of the income statement for 2004 to IFRS is shown in the following table:<br />

Note HGB Transition IFRS<br />

EUR million EUR million EUR million<br />

Turnover 1,040.15 0.00 1,040.15<br />

Increase in inventories of finished goods and<br />

work in progress e 12.86 7.82 20.68<br />

Other operating income f, i 13.75 -1.30 12.45<br />

Cost of materials e, i -865.11 -11.21 -876.32<br />

Personnel expenses f -65.51 0.85 -64.66<br />

Depreciations a, b, c, d -15.73 3.94 -11.79<br />

Other operating expenses c, d, g, i -79.17 5.43 -73.74<br />

Other taxes -1.51 0.00 -1.51<br />

Financial earnings i 3.49 0.07 3.56<br />

Financial expenses c, d, f -4.54 -1.06 -5.60<br />

Earnings before taxes 40.19 4.54 44.73<br />

Taxes on income and earnings g, j -11.39 -3.74 -15.13<br />

Consolidated net income 28.80 0.80 29.60<br />

Profit/Loss for other shareholders -0.25 0.04 -0.21<br />

Consolidated unappropriated net income 28.55 0.84 29.39<br />

Earnings per share 2.90 0.09 2.99<br />

71