Business Report 2005 - Interseroh

Business Report 2005 - Interseroh

Business Report 2005 - Interseroh

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

(39) Events after the closing date<br />

No events that would be of importance to the assessment of the financial, earnings and liquidity<br />

position and the payment flows of INTERSEROH AG occurred by 20 February 2006 (date of release<br />

of the consolidated financial statements by the Management Board for handover to the Supervisory<br />

Board).<br />

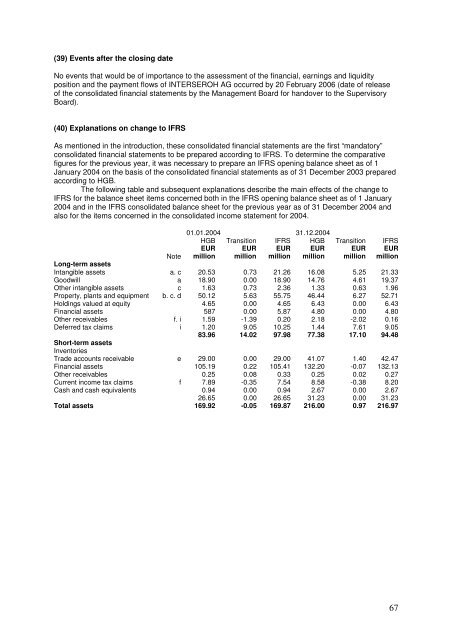

(40) Explanations on change to IFRS<br />

As mentioned in the introduction, these consolidated financial statements are the first “mandatory”<br />

consolidated financial statements to be prepared according to IFRS. To determine the comparative<br />

figures for the previous year, it was necessary to prepare an IFRS opening balance sheet as of 1<br />

January 2004 on the basis of the consolidated financial statements as of 31 December 2003 prepared<br />

according to HGB.<br />

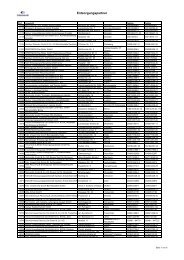

The following table and subsequent explanations describe the main effects of the change to<br />

IFRS for the balance sheet items concerned both in the IFRS opening balance sheet as of 1 January<br />

2004 and in the IFRS consolidated balance sheet for the previous year as of 31 December 2004 and<br />

also for the items concerned in the consolidated income statement for 2004.<br />

01.01.2004 31.12.2004<br />

HGB Transition IFRS HGB Transition IFRS<br />

EUR EUR EUR EUR EUR EUR<br />

Note million million million million million million<br />

Long-term assets<br />

Intangible assets a. c 20.53 0.73 21.26 16.08 5.25 21.33<br />

Goodwill a 18.90 0.00 18.90 14.76 4.61 19.37<br />

Other intangible assets c 1.63 0.73 2.36 1.33 0.63 1.96<br />

Property, plants and equipment b. c. d 50.12 5.63 55.75 46.44 6.27 52.71<br />

Holdings valued at equity 4.65 0.00 4.65 6.43 0.00 6.43<br />

Financial assets 587 0.00 5.87 4.80 0.00 4.80<br />

Other receivables f. i 1.59 -1.39 0.20 2.18 -2.02 0.16<br />

Deferred tax claims i 1.20 9.05 10.25 1.44 7.61 9.05<br />

Short-term assets<br />

Inventories<br />

83.96 14.02 97.98 77.38 17.10 94.48<br />

Trade accounts receivable e 29.00 0.00 29.00 41.07 1.40 42.47<br />

Financial assets 105.19 0.22 105.41 132.20 -0.07 132.13<br />

Other receivables 0.25 0.08 0.33 0.25 0.02 0.27<br />

Current income tax claims f 7.89 -0.35 7.54 8.58 -0.38 8.20<br />

Cash and cash equivalents 0.94 0.00 0.94 2.67 0.00 2.67<br />

26.65 0.00 26.65 31.23 0.00 31.23<br />

Total assets 169.92 -0.05 169.87 216.00 0.97 216.97<br />

67