Business Report 2005 - Interseroh

Business Report 2005 - Interseroh

Business Report 2005 - Interseroh

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Deferred tax liabilities are balanced against corresponding claims insofar as the same tax<br />

subject and same fiscal authority are concerned.<br />

All loss carry-forwards for tax purposes can be used for an unlimited period of time.<br />

Deferred tax receivables due to temporary differences and existing loss carry-forwards for tax<br />

purposes totalling EUR 1.89 million (previous year: EUR 2.65 million) were not capitalised. They<br />

concern mainly foreign companies where realisation of the deferred tax claims can be seen as<br />

uncertain today.<br />

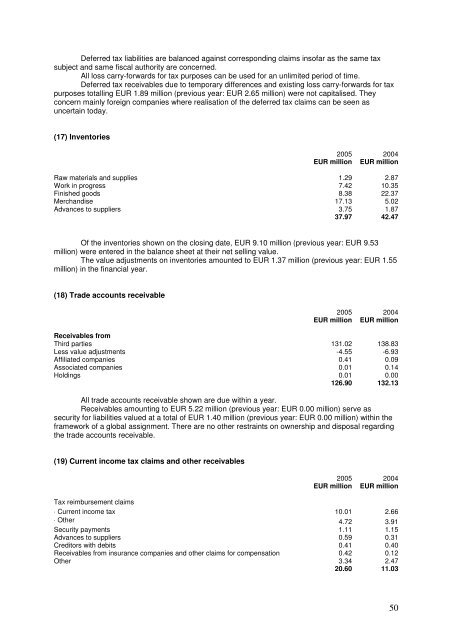

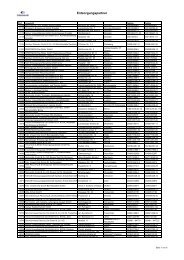

(17) Inventories<br />

<strong>2005</strong><br />

EUR million<br />

2004<br />

EUR million<br />

Raw materials and supplies 1.29 2.87<br />

Work in progress 7.42 10.35<br />

Finished goods 8.38 22.37<br />

Merchandise 17.13 5.02<br />

Advances to suppliers 3.75 1.87<br />

37.97 42.47<br />

Of the inventories shown on the closing date, EUR 9.10 million (previous year: EUR 9.53<br />

million) were entered in the balance sheet at their net selling value.<br />

The value adjustments on inventories amounted to EUR 1.37 million (previous year: EUR 1.55<br />

million) in the financial year.<br />

(18) Trade accounts receivable<br />

<strong>2005</strong><br />

EUR million<br />

2004<br />

EUR million<br />

Receivables from<br />

Third parties 131.02 138.83<br />

Less value adjustments -4.55 -6.93<br />

Affiliated companies 0.41 0.09<br />

Associated companies 0.01 0.14<br />

Holdings 0.01 0.00<br />

126.90 132.13<br />

All trade accounts receivable shown are due within a year.<br />

Receivables amounting to EUR 5.22 million (previous year: EUR 0.00 million) serve as<br />

security for liabilities valued at a total of EUR 1.40 million (previous year: EUR 0.00 million) within the<br />

framework of a global assignment. There are no other restraints on ownership and disposal regarding<br />

the trade accounts receivable.<br />

(19) Current income tax claims and other receivables<br />

<strong>2005</strong><br />

EUR million<br />

2004<br />

EUR million<br />

Tax reimbursement claims<br />

⋅ Current income tax 10.01 2.66<br />

⋅ Other 4.72 3.91<br />

Security payments 1.11 1.15<br />

Advances to suppliers 0.59 0.31<br />

Creditors with debits 0.41 0.40<br />

Receivables from insurance companies and other claims for compensation 0.42 0.12<br />

Other 3.34 2.47<br />

20.60 11.03<br />

50