Business Report 2005 - Interseroh

Business Report 2005 - Interseroh

Business Report 2005 - Interseroh

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

the contract at the cash values of the minimum leasing payments taking one-off payments into<br />

consideration or at the lower fair values. They are written off by scheduled depreciation over their<br />

normal period of economic use. If later transfer of ownership of the leased object is uncertain, the term<br />

of the leasing contract is used as basis insofar as it is shorter. The payment obligations resulting from<br />

the future leasing instalments are stated as financial liabilities.<br />

The obligations to return the property to its original condition are included in the acquisition or<br />

production costs of the asset concerned at the amount of the discounted performance sum and written<br />

off linearly as scheduled depreciation over the normal period of use of the asset. The expected<br />

liabilities are shown as provisions.<br />

The costs for the repair of property, plants and equipment are generally netted out with effect<br />

on net income. They are only capitalised if the costs result in an addition or significant improvement to<br />

the respective asset.<br />

The immovable property, plants and equipment (buildings and structures) are depreciated<br />

linearly over the expected period of economic use. This also applies to movable property, plants and<br />

equipment. When determining the depreciation sums, significant residual values remaining at the end<br />

of the normal period of use are taken into consideration.<br />

The retirement of minor fixed assets in the financial year is assumed.<br />

When selling or closing down property, plants and equipment, the profit or loss from the<br />

difference between the sales proceeds and residual book value are stated under other operating<br />

income or expenses as the case may be.<br />

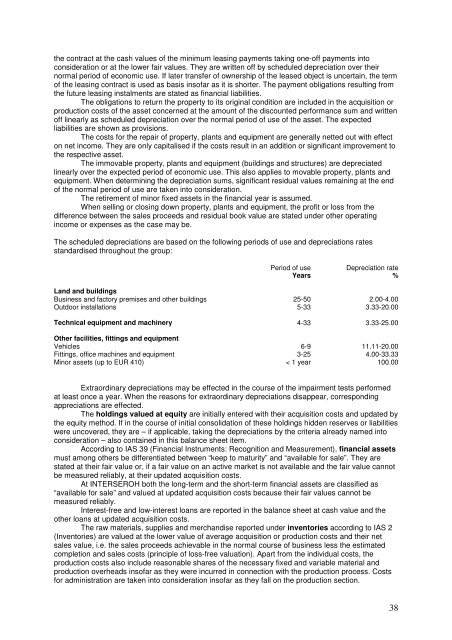

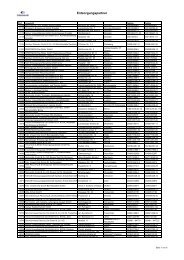

The scheduled depreciations are based on the following periods of use and depreciations rates<br />

standardised throughout the group:<br />

Period of use Depreciation rate<br />

Years %<br />

Land and buildings<br />

<strong>Business</strong> and factory premises and other buildings 25-50 2.00-4.00<br />

Outdoor installations 5-33 3.33-20.00<br />

Technical equipment and machinery 4-33 3.33-25.00<br />

Other facilities, fittings and equipment<br />

Vehicles 6-9 11.11-20.00<br />

Fittings, office machines and equipment 3-25 4.00-33.33<br />

Minor assets (up to EUR 410) < 1 year 100.00<br />

Extraordinary depreciations may be effected in the course of the impairment tests performed<br />

at least once a year. When the reasons for extraordinary depreciations disappear, corresponding<br />

appreciations are effected.<br />

The holdings valued at equity are initially entered with their acquisition costs and updated by<br />

the equity method. If in the course of initial consolidation of these holdings hidden reserves or liabilities<br />

were uncovered, they are – if applicable, taking the depreciations by the criteria already named into<br />

consideration – also contained in this balance sheet item.<br />

According to IAS 39 (Financial Instruments: Recognition and Measurement), financial assets<br />

must among others be differentiated between “keep to maturity” and “available for sale”. They are<br />

stated at their fair value or, if a fair value on an active market is not available and the fair value cannot<br />

be measured reliably, at their updated acquisition costs.<br />

At INTERSEROH both the long-term and the short-term financial assets are classified as<br />

“available for sale” and valued at updated acquisition costs because their fair values cannot be<br />

measured reliably.<br />

Interest-free and low-interest loans are reported in the balance sheet at cash value and the<br />

other loans at updated acquisition costs.<br />

The raw materials, supplies and merchandise reported under inventories according to IAS 2<br />

(Inventories) are valued at the lower value of average acquisition or production costs and their net<br />

sales value, i.e. the sales proceeds achievable in the normal course of business less the estimated<br />

completion and sales costs (principle of loss-free valuation). Apart from the individual costs, the<br />

production costs also include reasonable shares of the necessary fixed and variable material and<br />

production overheads insofar as they were incurred in connection with the production process. Costs<br />

for administration are taken into consideration insofar as they fall on the production section.<br />

38