Business Report 2005 - Interseroh

Business Report 2005 - Interseroh

Business Report 2005 - Interseroh

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

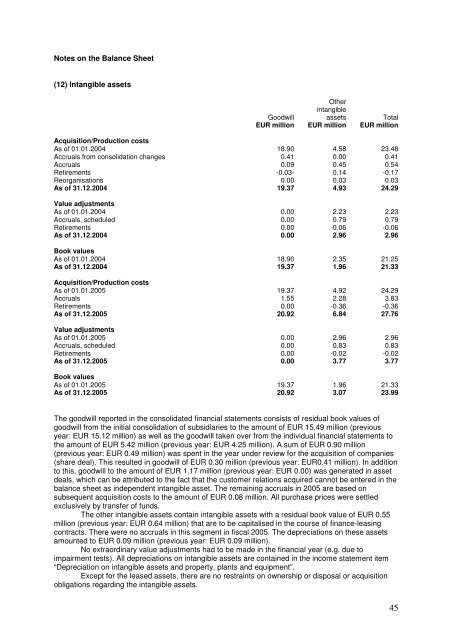

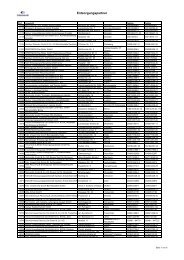

Notes on the Balance Sheet<br />

(12) Intangible assets<br />

Goodwill<br />

EUR million<br />

Other<br />

intangible<br />

assets<br />

EUR million<br />

Total<br />

EUR million<br />

Acquisition/Production costs<br />

As of 01.01.2004 18.90 4.58 23.48<br />

Accruals from consolidation changes 0.41 0.00 0.41<br />

Accruals 0.09 0.45 0.54<br />

Retirements -0.03- 0.14 -0.17<br />

Reorganisations 0.00 0.03 0.03<br />

As of 31.12.2004 19.37 4.93 24.29<br />

Value adjustments<br />

As of 01.01.2004 0.00 2.23 2.23<br />

Accruals, scheduled 0.00 0.79 0.79<br />

Retirements 0.00 -0.06 -0.06<br />

As of 31.12.2004 0.00 2.96 2.96<br />

Book values<br />

As of 01.01.2004 18.90 2.35 21.25<br />

As of 31.12.2004 19.37 1.96 21.33<br />

Acquisition/Production costs<br />

As of 01.01.<strong>2005</strong> 19.37 4.92 24.29<br />

Accruals 1.55 2.28 3.83<br />

Retirements 0.00 -0.36 -0.36<br />

As of 31.12.<strong>2005</strong> 20.92 6.84 27.76<br />

Value adjustments<br />

As of 01.01.<strong>2005</strong> 0.00 2.96 2.96<br />

Accruals, scheduled 0.00 0.83 0.83<br />

Retirements 0.00 -0.02 -0.02<br />

As of 31.12.<strong>2005</strong> 0.00 3.77 3.77<br />

Book values<br />

As of 01.01.<strong>2005</strong> 19.37 1.96 21.33<br />

As of 31.12.<strong>2005</strong> 20.92 3.07 23.99<br />

The goodwill reported in the consolidated financial statements consists of residual book values of<br />

goodwill from the initial consolidation of subsidiaries to the amount of EUR 15.49 million (previous<br />

year: EUR 15.12 million) as well as the goodwill taken over from the individual financial statements to<br />

the amount of EUR 5.42 million (previous year: EUR 4.25 million). A sum of EUR 0.90 million<br />

(previous year: EUR 0.49 million) was spent in the year under review for the acquisition of companies<br />

(share deal). This resulted in goodwill of EUR 0.30 million (previous year: EUR0.41 million). In addition<br />

to this, goodwill to the amount of EUR 1.17 million (previous year: EUR 0.00) was generated in asset<br />

deals, which can be attributed to the fact that the customer relations acquired cannot be entered in the<br />

balance sheet as independent intangible asset. The remaining accruals in <strong>2005</strong> are based on<br />

subsequent acquisition costs to the amount of EUR 0.08 million. All purchase prices were settled<br />

exclusively by transfer of funds.<br />

The other intangible assets contain intangible assets with a residual book value of EUR 0.55<br />

million (previous year: EUR 0.64 million) that are to be capitalised in the course of finance-leasing<br />

contracts. There were no accruals in this segment in fiscal <strong>2005</strong>. The depreciations on these assets<br />

amounted to EUR 0.09 million (previous year: EUR 0.09 million).<br />

No extraordinary value adjustments had to be made in the financial year (e.g. due to<br />

impairment tests). All depreciations on intangible assets are contained in the income statement item<br />

“Depreciation on intangible assets and property, plants and equipment”.<br />

Except for the leased assets, there are no restraints on ownership or disposal or acquisition<br />

obligations regarding the intangible assets.<br />

45