Business Report 2005 - Interseroh

Business Report 2005 - Interseroh

Business Report 2005 - Interseroh

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Current cash in banks or bank liabilities are converted with the buying exchange rate on the<br />

closing date and other foreign currency sums with the rate on the transaction date. Insofar as the<br />

exchange rate on the closing date is lower for receivables or higher for liabilities, the foreign currency<br />

value is shown converted with the rate on the closing date. Resultant currency conversion differences<br />

are included in the group income statement with effect on net income.<br />

The consolidated financial statements are prepared in euros. The sums are – with the<br />

exception of the consolidated balance sheet and consolidated income statement – shown in million<br />

euros rounded up to two decimal places. Rounding differences to the unrounded sums occurred in<br />

individual cases.<br />

The balance sheets and income statements of all foreign subsidiaries included in the<br />

consolidated financial statements by way of full consolidation are also prepared in euros.<br />

Only one associated company prepares its annual financial statements in Polish zloty. The<br />

sums incorporated in the consolidated financial statements are converted pursuant to IAS 21 (The<br />

Effects of Changes in Foreign Exchange Rates) to euros by the functional currency concept.<br />

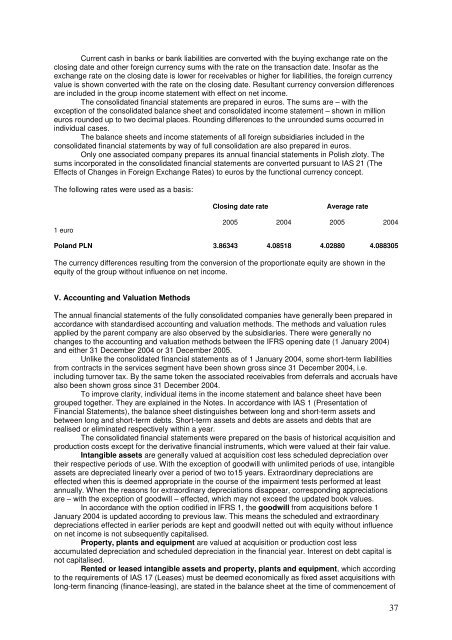

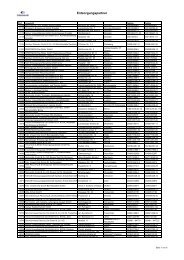

The following rates were used as a basis:<br />

1 euro<br />

Closing date rate Average rate<br />

<strong>2005</strong> 2004 <strong>2005</strong> 2004<br />

Poland PLN 3.86343 4.08518 4.02880 4.088305<br />

The currency differences resulting from the conversion of the proportionate equity are shown in the<br />

equity of the group without influence on net income.<br />

V. Accounting and Valuation Methods<br />

The annual financial statements of the fully consolidated companies have generally been prepared in<br />

accordance with standardised accounting and valuation methods. The methods and valuation rules<br />

applied by the parent company are also observed by the subsidiaries. There were generally no<br />

changes to the accounting and valuation methods between the IFRS opening date (1 January 2004)<br />

and either 31 December 2004 or 31 December <strong>2005</strong>.<br />

Unlike the consolidated financial statements as of 1 January 2004, some short-term liabilities<br />

from contracts in the services segment have been shown gross since 31 December 2004, i.e.<br />

including turnover tax. By the same token the associated receivables from deferrals and accruals have<br />

also been shown gross since 31 December 2004.<br />

To improve clarity, individual items in the income statement and balance sheet have been<br />

grouped together. They are explained in the Notes. In accordance with IAS 1 (Presentation of<br />

Financial Statements), the balance sheet distinguishes between long and short-term assets and<br />

between long and short-term debts. Short-term assets and debts are assets and debts that are<br />

realised or eliminated respectively within a year.<br />

The consolidated financial statements were prepared on the basis of historical acquisition and<br />

production costs except for the derivative financial instruments, which were valued at their fair value.<br />

Intangible assets are generally valued at acquisition cost less scheduled depreciation over<br />

their respective periods of use. With the exception of goodwill with unlimited periods of use, intangible<br />

assets are depreciated linearly over a period of two to15 years. Extraordinary depreciations are<br />

effected when this is deemed appropriate in the course of the impairment tests performed at least<br />

annually. When the reasons for extraordinary depreciations disappear, corresponding appreciations<br />

are – with the exception of goodwill – effected, which may not exceed the updated book values.<br />

In accordance with the option codified in IFRS 1, the goodwill from acquisitions before 1<br />

January 2004 is updated according to previous law. This means the scheduled and extraordinary<br />

depreciations effected in earlier periods are kept and goodwill netted out with equity without influence<br />

on net income is not subsequently capitalised.<br />

Property, plants and equipment are valued at acquisition or production cost less<br />

accumulated depreciation and scheduled depreciation in the financial year. Interest on debt capital is<br />

not capitalised.<br />

Rented or leased intangible assets and property, plants and equipment, which according<br />

to the requirements of IAS 17 (Leases) must be deemed economically as fixed asset acquisitions with<br />

long-term financing (finance-leasing), are stated in the balance sheet at the time of commencement of<br />

37